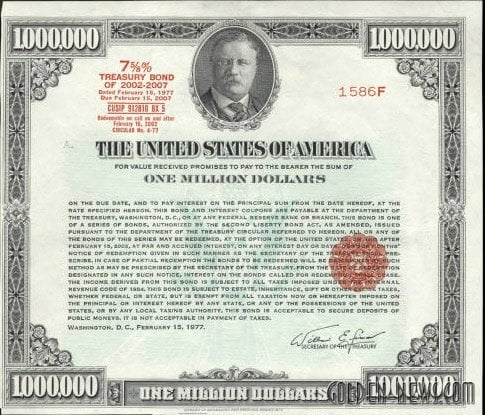

Bonds- one of many tools, used in the securities market, who has a fixed income. Speaking in a more accessible language, then a bond can be defined as a certain obligation of a party, issuing bonds, (issuer) before those, who bought them (Lenders, investors) on payment within the prescribed time frame a certain amount.

Investing free cash in bonds is currently one of the most reliable ways to make a profit.. Especially if such indicators are important to the owner, as an absolute safety of investments, with profitability, exceeding bank interest on deposits. The most reliable among other securities are US bonds. Many investors attribute this quality to them., as absolute reliability. It means the fact, that there are no adequate risks, due to which payments on bonds may not take place, ie. under any circumstances, the state apparatus will find a source of debt repayment on bonds.

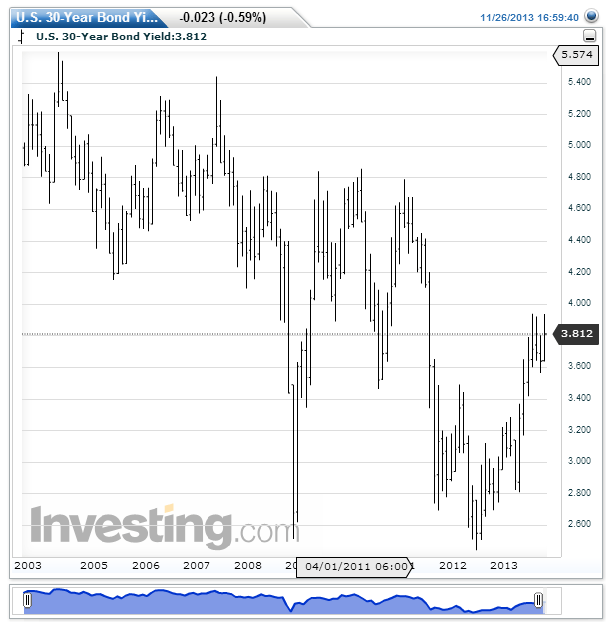

US bonds in recent years have brought their owners a profit in the amount of about 7% per annum. Agree, considering the fact that there are almost no risks, then this figure is "a good increase in pension". Many of the residents of Russia would not mind having such additional passive income., saving your savings in US bonds. but, before we start looking for ways to enter the market in order to purchase American bonds, we will try to consider these securities more closely.

US government bonds are a direct obligation of the US government to investors to provide maximum safety of entrusted capital. In addition to the advantages already listed, American bonds have another advantage - high liquidity, since the exchange and over-the-counter markets are fairly well developed. Worth noticing, that you shouldn't count on sky-high profitability, she will not be high, but you practically do not risk anything either, but profit from bonds is not taxed.

By the way, bonds may differ in maturity, par value, types of bonds. If we consider the maturity, then here the division takes place in a short, medium- and long-term, but if you name the numbers more specific, то получатся следующее:

- 13-those weekly

- 5-you are summer

- 10-you are summer

- 30-you are summer

The par value directly depends on the maturity of the bond, its type and many other indicators and can vary from 50$ to 10 000$.

Let's dwell on the types of American bonds and consider them in a little more detail.. There are currently three main types of bonds, which you can use to save your money:

- EE Series - you can buy them for half of the face value, and in just six months you can sell them back, without risking an early repayment penalty. Interest is accrued on the first day of each month. The nominal value reaches a value of 10 000$. Interest is accrued within 30 years.

- LV series - they can be purchased by exchanging bonds of the previous series (серия ЕЕ) at the end of maturity. The face value ranges from 500$ to 10 000$, and they are sold exclusively at par. Interest is accrued every six months for 20 years, First 10 years there is one interest rate, а вторые 10 years - another.

- Series I - bonds are sold exclusively at par, but with the condition, that an individual cannot purchase these bonds in the amount, exceeding 30 000$ in year. Interest is accrued, as in the previous series, semiannually, and the term of their accrual is 30 a year. This series is characterized by, that the interest rate is fixed for the entire circulation period. By the way, if you try to sell them within the first five years, then you will be deducted a fine, equal to three months interest.

To man, who does not know the principles of the financial market, don't even think about, to try to buy US bonds on your own. Дело здесь не только в том, what, most likely you will not succeed, but in knowledge, which you need to have, to be able to calculate the level of investment attractiveness of a bond, and thus choose the best moment to buy, and then for sale, previously acquired securities.

However, people who are inexperienced in such matters can also invest in US bonds.. Идеальным вариантом для них является взаимный фонд облигаций, because the portfolio is managed by a professional, but it is formed just at the expense of several investors at once.

A source