New York Stock Exchange (English. New York Stock Exchange, NYSE ) - the main US stock exchange, the world's largest. A symbol of the financial power of the United States and the financial industry in general. The world-famous Dow Jones index for industrial stocks is determined on the exchange (English. Dow Jones Industrial Average), as well as the Composite index.

History

Exchange founded 17 May 1792 of the year, when 24 new york broker, who worked with financial instruments and concluded transactions, like their London colleagues, in coffee shops (the most famous coffee house "Tontin"), signed the "Sycamore Agreement" (Buttonwood Agreement) on the creation of the New York Stock Exchange.

With 1975 of the year became a non-profit corporation, owned by their 1366 individual members (this number is unchanged since 1953 of the year). Members' seats may be for sale, the cost of one seat now comes to 3 million US dollars.

In the beginning of March 2006 completed a merger with the Archipelago Holdings electronic exchange and offered shares to investors for the first time in its history, pond, thus, commercial organization. NYSE Group shares are traded on the exchange itself; capitalization as of 5 December 2007 was $22,6 billion.

At the beginning of June 2006 of the year, the upcoming merger of the New York Stock Exchange with the European stock exchange Euronext was announced. This merger took place 4 April 2007 of the year

The main difference between the New York Stock Exchange and other similar platforms is the huge trading tools., namely, more 8 thousand shares at the disposal of brokers. The main condition for the activity is absolute transparency.. Everyone sees everyone. That is, at any time, using special applications, specially designed for users (LEVEL-2, Arca book, open book), you can track the actions of traders, thus forming an overall picture of the market.

Activity

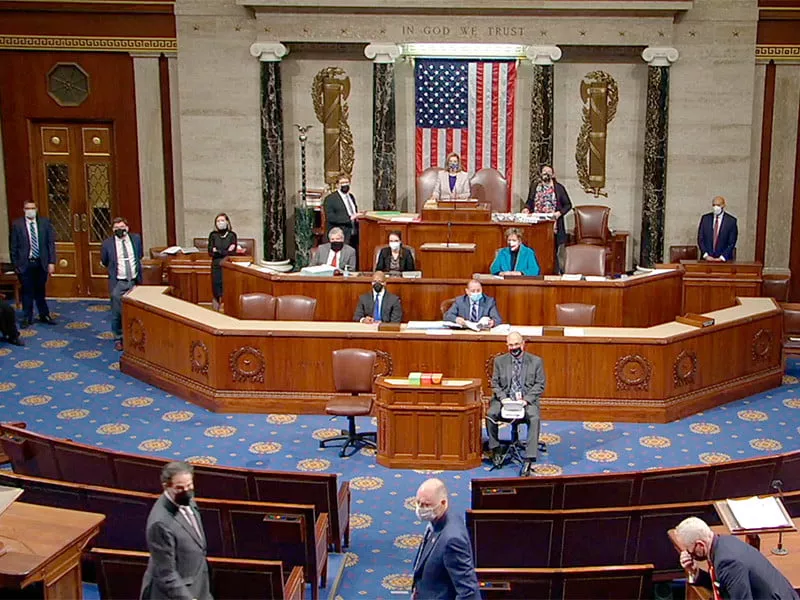

"Traders on the Floor" at the New York Stock Exchange. Each of the thousands of traded securities has its own separate shopping center, your "pit".

Operations with stocks and other securities are performed on the exchange. Securities listed on the stock exchange are more than 3 thousand (2008) companies. Total capitalization of companies, traded on the stock exchange, by the end 2006 G. amounted to $26,5 trillion.

The board of directors includes a chairman, the president, ten members of the exchange and ten representatives of the business community.

The exchange building is located on the famous Wall Street at Wall Street, 11.

Listing on the stock exchange

The main criteria of companies:

- presence of interest in the security on the part of the state (where does the issuer work);

- position of the issuer in the industry (his popularity);

- stability of the company and its prospects for the future.

For admission to the exchange, company – the issuer must have the following indicators:

- Income before taxes for the last year - 2,7 mln USD.

- Profit for 2 previous year - 3,0 mln USD.

- Net tangible assets - 18,0 mln USD.

- Number of shares in public ownership - per 1,1 mln USD.

- Market value of shares - 19,0 mln USD.

- Minimum number of shareholders, owning 100 shares and more, - not less 2 thousand.

- The average monthly volume of trading in shares of this issuer must be at least 100 thousand. Doll. during the last 6 months.

Exchange members Nice

On the exchange there is 1366 members of:

- Brokers – commission agents - 700 human;

- specialists - 400 human;

- brokers in the hall - 225 human;

- stock brokers - 41 human.

- Brokers-Commissioners work for one of the brokerage firms. The main task is to collect orders from clients and deliver them to the exchange hall. The broker-commissioner is responsible for the execution of orders.

- Stock brokers - are engaged in the execution of orders of other brokers, are assistants to brokers-commissioners (when, when they do not have time to cope with a large volume of applications). Receive a portion of the commission, which clients pay to the broker. To work on the exchange, you must pass an exam, get a license and be registered on the exchange.

- Traders - make transactions on the exchange for their own money. They are forbidden to carry out orders of clients.. The income of a stock trader is due to the difference in market rates (speculation). Exchange traders are often referred to as "competitive traders".

- Specialists - professional market workers, collect orders from brokers to buy (sales) Shares. Functions are similar to brokers. If the commission broker does not have time to implement the order, it is passed on to a specialist. The latter undertakes to fulfill it. If the deal burns out, specialist receives commission broker interest. All orders of the latter are recorded in the book of limited orders..

Specialists play a key role in the exchange (specialists).

Their number is slightly less 400 and they work for seven companies (specialists firms):

- Bear Wagner Specialist LLC.

- Fleet Specialist, Inc.

- LaBranche & Co., LLC.

- Performance Specialist Group, LLC.

- Spear, Leeds & Kellog Specialists LLC.

- SIG Specialists, Inc.

- Van der Moolen Specialists, LLC.

Exchange specialists perform four main functions:

- Auctioneer. At the beginning of the trading session, the specialist announces the market prices for shares of several issuers, for which he is responsible on the basis of orders, received by him before the opening of the exchange session. Algorithm for determining the opening price - oncall auction (salvo auction), which is used in many exchanges around the world to determine the opening price.

- Agent. The specialist executes all limited orders, which are passed to him by other members of the exchange. Implementing these applications, the specialist acts as a broker or agent and receives a portion of the commission, due to commission broker.

- Observer. The specialist monitors that, so that stock trading runs smoothly, without sharp price fluctuations.

- Dealer. If there are significantly more buy orders, than sell orders, or vice versa, the specialist is obliged to enter the auction, using the money or shares he has. The specialist buys or sells against the trend until then, as long as supply and demand are not balanced with. The specialist has the right to suspend trading (usually for a few minutes) if there is an imbalance in the market between supply and demand.

Management and regulation of work

1. Management

New York Stock Exchange - Joint Stock Company, features of work, rules and instructions are spelled out in the charter.

In management 26 human, out of which:

– 12 people - independent representatives, "External leaders";

– 12 people - direct members of the exchange;

– 2 people - permanent employees of the exchange - chairman and deputy chairman.

2. Regulation

Four organizations are involved in protecting the interests of the exchange and maintaining its performance:

1) USA congress. Main functions:

- nomination to the Securities and Exchange Commission;

- ensuring the normal operation of the exchange;

- control over compliance with the legality of transactions during the operation of the exchange;

- tracking and adjusting the appearance of new structures in the stock market.

2) Securities and Exchange Commission:

In case of violation of standards and rules, the Commission has the right to punish market participants - to withdraw a license, impose a fine or revoke membership.

3) Exchange is a self-regulatory platform.

More 70% employees are involved in regulation and standardization. More printed in the charter 1000 pages of standards and regulations, mandatory.

4) Independent brokerage companies.

The structure includes several hundred brokerage firms. All of them guarantee high quality work and compliance with all standards.

Working hours

The exchange is open every day, Monday through Friday, with 9.30 to 16.00 по IS, Eastern Standard Time. Translated into Moscow time, this is from 17.30 to 00.00(in winter)

and in the summer an hour earlier.

The largest companies on the stock exchange

- 3M Co. (Ticker: MMM) (industrial conglomerate)

- American Express Co. (AXP) (credit services)

- AT&T (: T) (telecommunications)

- Boeing Co., The (BA) (aircraft construction and defense)

- Caterpillar, Inc. ( CAT) (agricultural and construction machinery)

- Cisco Systems ( CSCO) (telecommunications)

- Chevron Corp.( CVX) (oil and gas company)

- Coca-Cola Co. ( KO) (Drinks)

- E.I. from the Pont de Nemours & Co. ( DD) (chemistry)

- Exxon Mobil Corp. (XOM) (oil and gas company)

- General Electric Co.

- The Goldman Sachs Group, Inc.

- Home Depot, Inc.

- International Business Machines Corp.

- JPMorgan Chase and Co.

- Johnson & Johnson Inc.

- McDonald’s Corp.

- Merck & Co., Inc.

- Nike Inc.

- Procter & Gamble Co.

- Travelers

- UnitedHealth Group Inc

- United Technologies Corp.

- Verizon Communications

- Visa, Inc.

- Wal-Mart Stores, Inc.

- Walt Disney Co., The

Exchange platform Arch

Arca - fully electronic exchange platform, trading stocks of growing companies. After the issuer meets the requirements, its securities can be smoothly transferred to the "senior" platform. Besides, Arca is a leader in the placement and trading of public ETF.

The merger of the American stock exchange NYSE and the European Euronext formed the Euronext group of companies. Under their control, the stock exchanges of many cities of the world - Lisbon, Brussels, Amsterdam, London (LIFFE) and others. The transaction amount is estimated at 8,2 billion dollars.

(with) Official site

Comments are closed.