Nizhnekamskneftekhim (MCX: NKNC, NKNCP) — a large Russian petrochemical holding in Tatarstan. The company is considered one of the leaders in the market of synthetic rubbers and plastics., supplying its products to European countries, Of America, Southeast Asia and the Middle East.

29 In March, the company issued its consolidated FINANCIAL STATEMENTS under IFRS for 2020 year.

Business financial results look weak: net debt increased, and revenue fell to a minimum in recent years, while net profit collapsed in 2,6 times compared to 2019 year. As a result, the board of directors recommended a reduction in dividends in more than 12 once.

Key financial indicators

Revenue NKNK decreased by 14% year to year - before 154 billion rubles - mainly due to falling prices and demand for petrochemical products in 1 Half 2020 years amid the coronavirus pandemic.

The company has two key products, which accounted for 75% of all proceeds in 2020 year: synthetic rubber — 41% and plastic — 34% of total revenue.

Synthetic rubber company mainly sells abroad, in Russia sold less 9% products. Reverse situation with plastic: the Russian market accounted for about 84% of all sales, and a little more came to foreign markets 16% products.

In the overall structure of sales, NKNK has almost parity between domestic and foreign markets: Russia accounts for 52,1%, and for export — 47,9% of total revenue.

Cost of realization decreased by 13% year to year - before 117,9 billion rubles - due to lower costs for the purchase of raw materials, consumables and hydrocarbons are the main raw materials in the creation of petrochemical products.

Commercial, general and administrative expenses decreased by 5% year to year - before 14,1 billion rubles. This is due to a decrease in the cost of transporting goods against the background of a drop in export volumes.. At the same time, the cost of paying employees increased by 7% - to 5,3 billion rubles.

Operating profit NKNK decreased by 19% year to year - before 22,7 billion rubles. I will note, that the fall in operating profit is observed during 5 of recent years and this can be considered a stable trend. Based on this, mistakenly believe, that all the company's problems were due to the coronavirus.

Interest income companies have declined in 2,2 times — up to 0,5 billion rubles, which is due to a decrease in the amount of money, placed on ruble deposits, and a reduction in the rate of return on deposits.

And because of the devaluation of the ruble in 2020 The company was forced to record a loss on exchange rate differences in the amount of 11,8 billion rubles - against profit in the amount of 1,6 billion rubles last year.

Net profit as a result of everything that happened, it fell on 62% year to year - before 9,1 billion rubles — and broke the anti-record of the latter 6 years.

Dynamics of financial indicators of NKNK, billion rubles

| Revenue | Operating profit | Net profit | |

|---|---|---|---|

| 2016 | 158,8 | 30,9 | 24,3 |

| 2017 | 167,6 | 30,7 | 24,9 |

| 2018 | 193,9 | 29,6 | 24,8 |

| 2019 | 179,0 | 28,1 | 24,0 |

| 2020 | 154,0 | 22,7 | 9,1 |

Debts and investments

Over the past few years, NKNK has been conducting a large-scale investment program. The company is building a new olefin complex with a capacity 0,6 million tons of ethylene per year. The complex will double the volume of ethylene production and increase them to 1,2 million tons per year. Besides, existing capacities are being modernized and it is planned to launch its own power plant with a capacity 495 Mw, which will reduce the dependence of production on third-party energy sources.

All upgrades require money.. Based on the results of 2020 year of capital expenditures of the business increased by 38% - to 51,2 billion rubles. To implement the investment program, the company attracts loans from a consortium of German banks. The amount of long-term loans and loans in euros for 12 months increased with 34,7 to 82,3 billion rubles. This led to an increase in net debt in more than 5 once, to 81 billion rubles, — a record figure for NKNK. Taking into account the drop in EBITDA by almost 15% year-on-year level of debt burden, calculated by the net debt ratio / EBITDA», grew from 0,5 to 2,8.

Dynamics of net debt on 31 December, billion rubles

| 2016 | −6,11 |

| 2017 | −23,9 |

| 2018 | 2,6 |

| 2019 | 15,6 |

| 2020 | 81 |

Dynamics of the ratio "net debt / EBITDA»

| 2016 | −0,2 |

| 2017 | −0,7 |

| 2018 | 0,1 |

| 2019 | 0,5 |

| 2020 | 2,8 |

Dividends

The last update of the dividend policy was in 2007 year. According to it, dividends should be directed at least 15% of net profit at the end of the reporting period.

The company has two types of shares traded on the stock exchange: privileged and ordinary. There are special conditions for preferred shares, prescribed in the company's charter and dividend policy.

Annual minimum fixed dividend amount — 6 kopecks per preferred share. At the same time, the amount of dividends per ordinary share cannot be more than, than on the privileged.

Besides, if dividends on preferred shares are not paid or are not paid in full, the missing amount must be paid in the future, but no more than three consecutive years.

That's kind of what happened in 2019 year, when the company declared a huge dividend after two years of abandoning payments due to the implementation of its investment program. Unexpected recommendation of the Board of Directors of NKNK led to a jump in quotations, and no wonder: At the time of the news release, the dividend yield on preferred shares was about 50%.

Since then, there has been no more such generous dividends.. Based on the results of 2020 the recommendation was only 0,73 P per share of each type, what in 12 times less, than paid at the end 2019 of the year.

Dividends per NKNKH share

| 2016 | 4,34 R |

| 2017 | 0 R |

| 2018 | 0 R |

| 2019 | 19,94 R |

| 2020 | 9,07 R |

| 2021 | 0,73 R |

What's the bottom line?

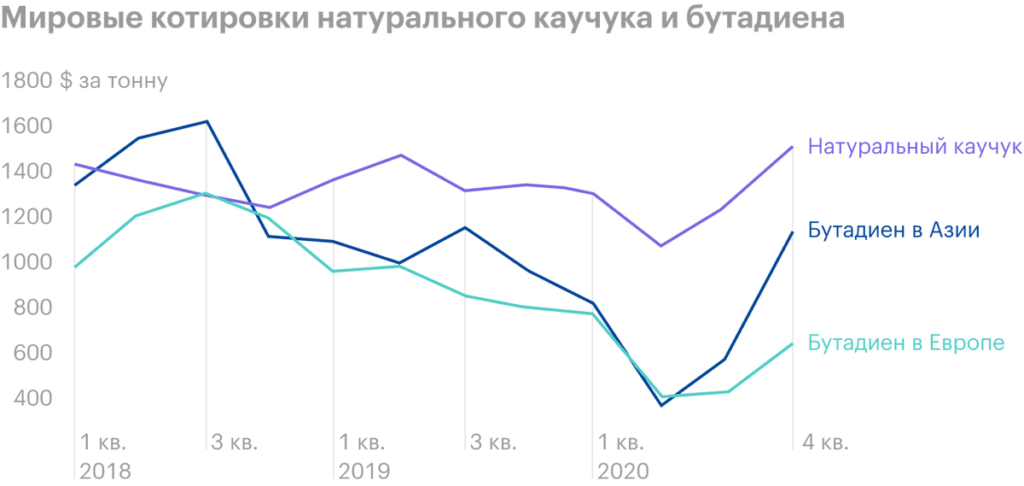

According to the financial statements, the crisis hit the business of NKNK hard. On the example of a company, we can observe the domino effect: due to coronavirus restrictions, the automotive market collapsed - this led to a drop in tire production and reduced the consumption of synthetic rubbers, which are used as raw materials. The plastics market experienced similar problems, especially during 2 last year's quarter, against the backdrop of a sharp drop in business activity and the introduction of strict restrictions.

Beginning with 3 quarter 2020 The situation began to return to normal against the background of the relaxation of quarantine measures. This led to a gradual recovery in demand and prices for rubbers and plastics.. Furthermore, in 1 quarter 2021 World plastic prices soar to historic highs amid power problems for major U.S. producers due to harsh winters. This allows you to count, that the financial results of NKNK in the current year will be much better, especially given the effect of the low base of the crisis 2020 of the year.

Besides, business continues to implement its investment program, the results of which should be particularly noticeable in 2025 year, when a large olefin complex is launched. If everything goes according to plan, then production volumes will grow, and the investment program will be significantly reduced, which will allow the company to increase free cash flow, some of which may be sent, for example, to pay dividends to shareholders.