When investing in , old-timers will definitely point out to you, that the correct entry is equally important, than the right way out.

The calculation is usually made for, what is better to enter on a drawdown, but go out at the peak of profitability, then wait again for a correction for a new entry.

I, for example, I am skeptical about this approach, because we are talking about the trade of the so-called. канала.

For example, the H4 channel on the eurodollar, which some traders have traded from the borders inward. Investors in PAMM accounts also think about the same, but instead of the Eurodollar chart, they try to draw a channel on the PAMM account profitability chart..

In my opinion, channels are clearly visible on history, but identifying them in the future is not so easy. The same is true for PAMM managers..

But in general, this is an interesting topic. — when to enter pamm.

For example, on Friday I tried to catch the movement on gold and euro, turning over after those signals, which I considered worthy of attention, as a result, the account dropped significantly. Earlier, I topped up free funds 250 dollars to your investment account to the main 300 start-up capital, which cannot be withdrawn in any other way, except for closing a PAMM account or draining )))

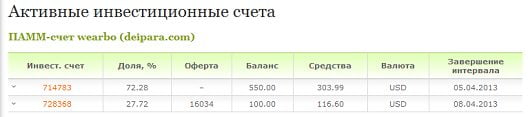

DEM decided to join the experiment and asked to open an offer, to be able to participate with your money. I opened an offer — minimal input 100 ye, manager's remuneration — 25%. The order was executed in the next rollover, that is, at the beginning of the hour (usually, requests for input are not processed in the next hour, and at the beginning of the next. That is, if you threw an application into 17-45, then the money will arrive at 19-00…19-10) Soon the positions went into plus, so for now, although the account is in drawdown, we have the following picture:

Balance — this is how much was entered on the pamm. Of my funds — 550ye, DEM's — 100ye.

Given that, that the account is in drawdown — looking at the graph «Funds». It shows. how much money is actually available at the moment, if you close all open positions.

My funds are left 303 dollar, that is, account for 55% in drawdown, which is reflected in the banner informer and in the graph , but DEM's account shows profit in 16%, since he entered with a larger drawdown and profit, formed after the entrance began to be distributed already between mine and his account in the ratio 72 to 28 (since at the time of the execution of his application, it was in this proportion that our real funds were correlated).

That is, in fact, DEM has the opportunity at the time of the market close to send a request for withdrawal of funds and get its profit, secured against loss. well, for him a hundred is not critical, I understand so, that he does not want to withdraw them yet, but dare to hold his account with me, if we catch a reversal, we can make a good profit.

It should be remembered, what from 16% when withdrawing, that part will be subtracted, which is defined by the manager as his remuneration — that is, in my memory it is 25%, so DEM will really get it 12 Dollars.

And here we are just returning to the beginning of the conversation about, that some investors just invest a small amount in the PAMM accounts of aggressive traders precisely in order to, to independently exit the PAMM in a timely manner and save profit.

That is, if in an aggressive PAMM account your profit was suddenly 100% and more — you can withdraw money, fixing your profit, and then fill them again at the right time.

Generally. this is again close to that, what is he doing trader, only investors trade on PAMMA, how we trade currencies )))

Who likes what.

I'm interested in looking at that, what happens at the opening of the market and if I was right about the forecast for the euro and gold, when the invoice comes out in 0 by profitability, how much money will be on the pamm account. Understandably, what the facility graph will have to show 550 dollars in my account, but DEM's account will probably already show about 200 Dollars, so you end up with a somewhat strange picture, when in terms of balance we will exceed the initial investment of 550 + 100 = 650 dollars by about a hundred, and the profitability of the PAMM account will be 0%.

Поживем, We'll see. Good luck to us =)

By the way,, Robert Kiyosaki versus stock markets in general. Financial games are not for him. Не знаю почему, is he, seem to be, considers, that the fund and forex are created to cheat investors and prefers to work with other forms of investment. In real estate, business, etc.. Although I don't quite agree with him, for example, if you choose not DC, a forex bank, then the situation is not so terrible.