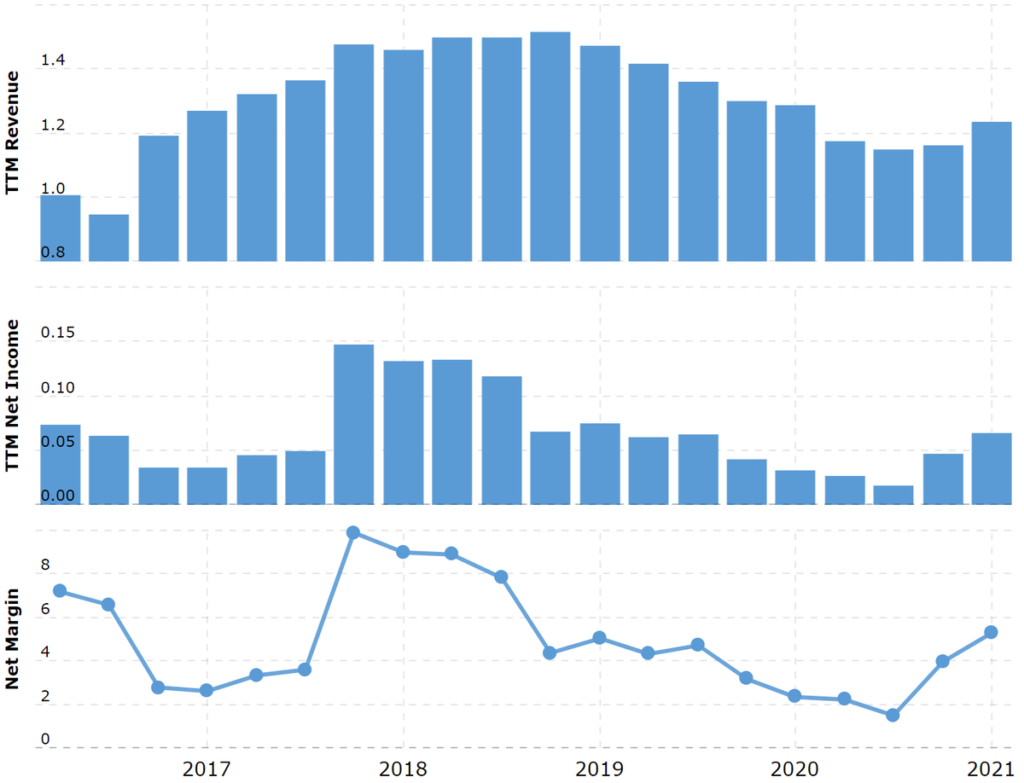

The largest company in the healthcare sector Johnson & Johnson (NYSE: JNJ) published a report for the second quarter of 2021: revenue increased by 27,1%, up to $23.3 billion; operating sales excluding exchange rates increased by 23%; net profit increased by 73,1%, up to 6.3 billion; net margin increased from 19.8 to 26,9%; adjusted net income increased by 49%, up to 6.6 billion; adjusted net margin increased from 24.2 to 28,4%. By regions The company divides sales by two regions: U.S. and other countries. USA (U. S.) — 51%. Revenue increased by 24,9%, up to 11.9 billion. Other countries (International) — 49%. Revenue increased by 29,5%, up to 11.4 billion. Of them 20,9% — operating sales, 8,6% - the influence of the exchange rate. By segment The company has three operating segments: consumer goods, pharmaceuticals and medical devices. Consumer goods (Consumer Health) — 16%. Revenue increased by 13,3%, up to 3.7 billion. Consumer Healthcare Market Continues to Recover After COVID-19 Negative Impact. Increased sales of skin care products, cosmetics and over-the-counter drugs. Pharmaceutics (Pharmaceutical) — 54%. Revenue increased by 17,2%, up to 12.6 billion. Sales of drugs for the treatment of psoriasis increased, myeloma and cancer. Medical devices (Medical Devices) — 30%. Revenue increased by 62,7%, up to 7 billion. Sales in this segment grew the most. A year ago, in the midst of a pandemic, Medical centers refurbished to deal with coronavirus. Non-urgent operations postponed, so the demand for equipment fell. Now, when the number of new cases of COVID-19 infections decreased, medical facilities are returning to their daily operations. Прогноз Компания повысила свои ожидания по росту выручки и скорректированной чистой прибыли на акцию в 2021 году. Revenue: It was: 9,7—10,9%, up to 90.6-91.6 billion; Became: 10,5—11,5%, up to 91.3-92.1 billion; including vaccine: 13,5—14,5%, up to 93.8-94.6 billion. Adjusted net earnings per share: …

Johnson & Johnson reported revenue and profit growth and raised its forecast for the year Read more