so, consider some popular types of investments and then, what taxes are they taxed for Russian tax residents. Recall, a person is considered a tax resident of the Russian Federation, which conducts at least 183 days a year.

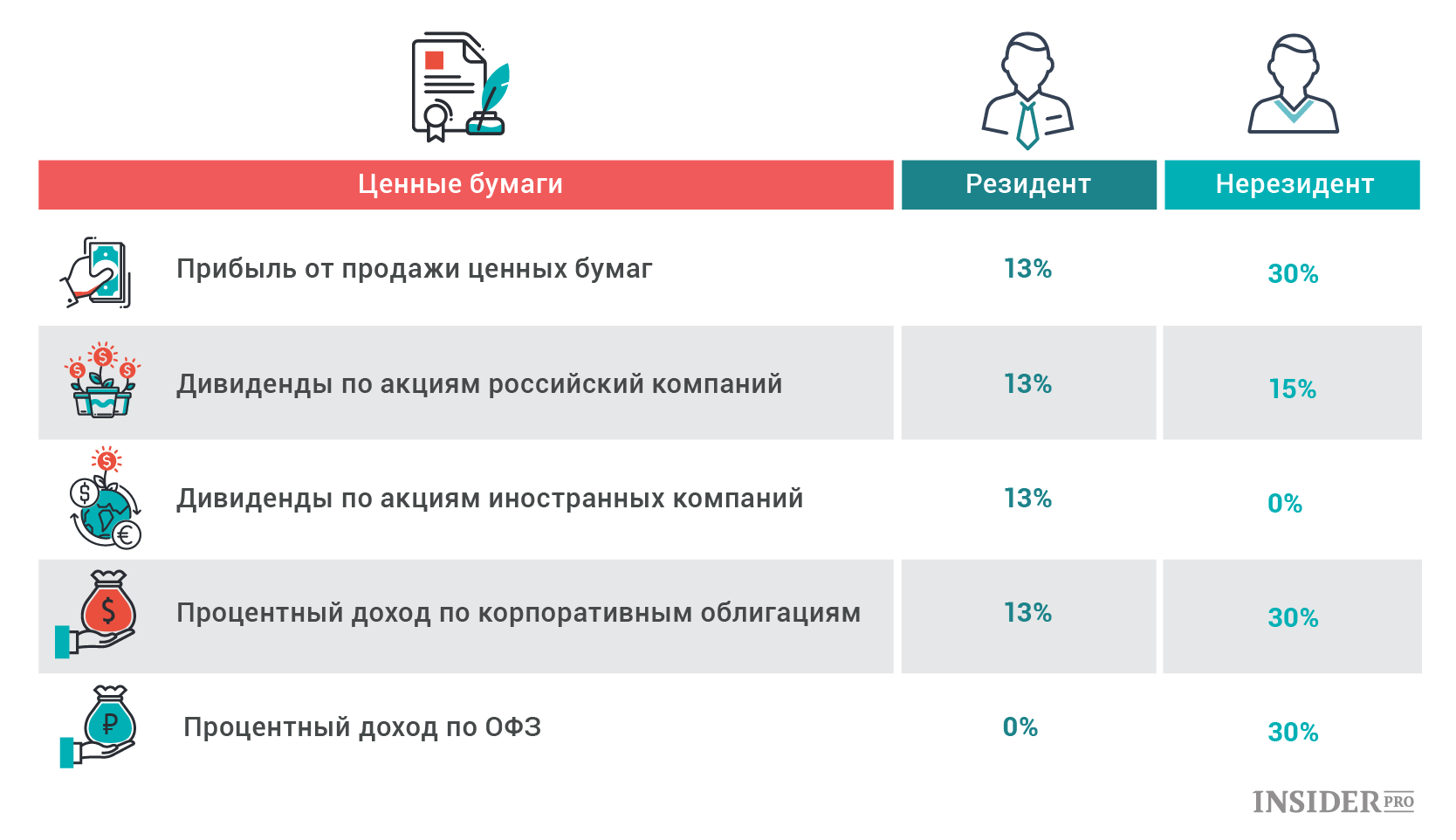

Securities

Income from investments in stocks and bonds, that is, profit, received upon their sale, as well as dividend payments and interest income, - this is one of the types of income of an individual, which means, it is taxed accordingly (NDFL).

At the lowest rate - 9% - now only dividends of Russian companies and interest income on mortgage-backed bonds are taxed, released before 1 January 2007 of the year.

Income from the sale of securities and the dividends you receive from Russian companies are subject to personal income tax at the rate 13%.

Interest income on federal loan bonds, as well as income, received when using a special taxation regime on individual investment accounts, there is no need to share with the state.

Who submits the declaration

If you trade stocks on the stock exchange through a Russian broker, you do not need to calculate the tax amount yourself and submit a tax return. Your broker is your tax agent. This means, that at the beginning of the year he is obliged to calculate the amount of tax for the previous year, debit it from your brokerage account and pay the government. This also applies to trading in shares of foreign companies through a Russian broker..

If you trade stocks on a foreign exchange through a foreign broker, Russian tax law deals with your gains from the sale of shares and dividends, that foreign companies pay you, as “income, sourced, outside the Russian Federation ", the tax rate in this case is 13%, you need to declare it and pay yourself.

At the same time, according to the law, income and expenses in foreign currency are converted into rubles at the exchange rate of the Central Bank on the date of the transaction, and the tax is calculated in rubles. From this, in particular, should, that even if you sold shares at a loss, but at this time the ruble fell, you have to pay tax, since you will receive income in rubles.

If you bought shares or units of a mutual fund after 1 January 2014 of the year, owned them for at least three years and during this time did not perform any operations with securities, except for lending them to a broker or concluding REPO transactions, and then sold, you do not have to pay tax on the income received. Maximum income from the sale of shares, from which you can receive a tax deduction, is 3 million rubles per year or 9 million for all three years.

Bank deposits

Bad news: Income from bank deposits in Russia is taxed at the highest rate: 35% for tax residents and 30% - for non-residents.

Good news: this only happens if, if the rate on the ruble deposit exceeds the key rate of the Central Bank by five percentage points or more. Then the tax is charged only on income, over-earned. With 16 June, the key rate in Russia is 9% per annum, which means that income on deposits in excess of 14% per annum. For foreign currency deposits, the marginal rate is 9% per annum. At the same time, the maximum profitability on ruble deposits of large banks has recently been kept close to historical lows. Simply put, you have very little chance of paying income tax on bank deposits.

But even if it happens, to you, as in the case, with a Russian broker, no need to calculate the tax amount and submit a tax return. Your tax agent will be a bank, he will withhold the amount of tax when paying you income on the deposit.

Currency market, cryptocurrencies and more

So far, the forex market is not described in detail in Russian legislation., and therefore, the features of taxation of income from transactions for the difference in exchange rates have not been thought out. As long as your income exists as a record in the trading terminal, it is not subject to taxation. The tax base (ie. then, where the tax is taken from) appears at that moment, when you withdraw money to your account. Rate - 13% for tax residents and 30% - for non-residents.

How to tax bitcoins (Bitcoin: Bitcoin), the Russian authorities have not yet come up with. So far, the management of the Bank of Russia proposes to count cryptocurrencies, including bitcoin, digital goods. Following the general spirit of the Tax Code, the tax base arises at that moment, when you sold bitcoins and received rubles or dollars for them to your account. The rate is the same 13% And 30%.

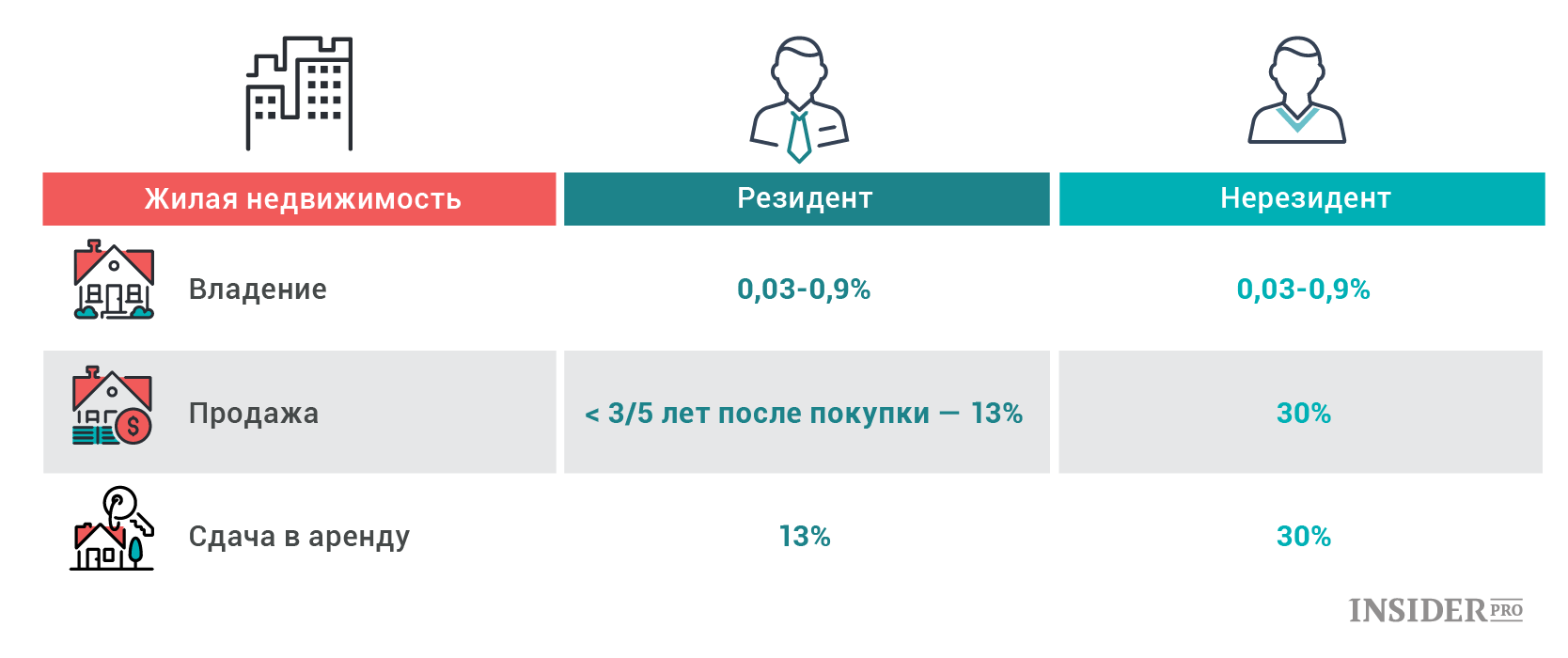

The property

If you have several million rubles, you can buy an apartment or a house, maybe, rent them out, and then sell, when their value rises.

If you just own real estate, you will have to pay property tax. IN 2017 year, the tax rate on real estate of individuals is from 0,1% to 0,3% from the cadastral value of the property. At the same time, local authorities can reduce or increase these rates., but not more, than three times.

If at the same time you rent out the property, you will have to independently declare the income received and pay tax on the income of an individual (hereinafter - personal income tax) at rate 13%. If you decide to sell your property, which belonged to you for less than three years (for real estate, purchased in 2016 year and later, - less than five years), from the amount received, you will also have to pay personal income tax at the rate 13%.

If you have owned a home longer, this tax is not charged. note: the countdown is carried out from the moment of registration of ownership. For example, if you bought an apartment in a building under construction in 2013 year, and the house was leased in 2015, then you can sell an apartment without paying tax in 2018 year.

Tax deduction

If you are buying an apartment or house, you can take advantage of the tax deduction. Maximum purchase cost, from which a deduction is granted, is 2 million rubles. In this way, the state will return you to 260 thousand. rubles (if a, certainly, in the year you bought the apartment or after that you paid income tax on this amount).

If you purchased a home on a mortgage, you can apply for a deduction and interest. Maximum payout amount, from which a deduction is granted, is 3 million rubles, accordingly, the maximum refund amount is 390 thousand. rubles.

It is worth noting, that buying an apartment using borrowed funds should be considered an investment only if, if you are sure, that your profit from renting it and / or subsequent sale will exceed your expenses on loan payments.

Other tax rates

If you are not a tax resident of Russia (for example, you have just obtained investor citizenship in Malta and are now spending more there 184 days a year), the tax rate on your income in Russia will be different. So, Dividends, which you will receive from Russian companies, for example, from Gazprom (MICEX: GAZP), will be subject to personal income tax at the rate 15%. All other income of non-resident individuals (for example, income from the sale of shares or an apartment) are subject to personal income tax at the rate 30%.

If you are not a tax resident of Russia and receive income outside of Russia, this income is not taxed.

More details at https://ru.insider.pro/investment/2017-07-10/vsyo-chto-nuzhno-znat-o-nalogah-na-investicii/