Москвич, stock trader, Told, how he earns and what he spends his high income on

The Village keeps on finding out, how much people of different professions earn and spend. In the new release, the exchange told about his income and expenses. trader. There are different participants in the securities market: stock exchanges, trading systems, banks, brokerage and dealer companies, analytical agencies, as well as private traders. The profession of the latter is surrounded by romantic myths: they are supported by advertising services for working with securities and training courses, promising huge profits with minimal effort. We learned from a private trader from Moscow, is it really so easy to make money in this area, why he does not consider the word "speculator" offensive and what he spends his income on.

| Income | 500 000p | ||

| Expenses: | |||

| 100 000 globetrotting |

100 000 accumulation |

50 000 entertainment |

100 000 investment |

| 25 000 charity |

5 000 animals |

30 000 transport |

20 000 health |

| 15 000 alcohol |

How to become a trader

to me 38 years, My education is in the humanities., but in his student years he helped to write diplomas in economic specialties for money, that was interesting. In the late 90s, people had a huge amount of securities in their hands, with whom they did not know, what to do. The company could issue shares instead of wages, and people needed money, and they were selling them. Even on the poles one could see the announcements "Buy Gazprom shares". My friends and I bought these shares from the population and then sold them to customers - investors, who formed large packages for dividend earnings. Now, certainly, technology has changed, Everything has gone electronic., but the very principles of trading in securities remained the same.

There are a lot of ads now, in which they offer to learn how to work with securities and get rich very quickly. Here's some young man who dreams of easy money, he comes across such an advertisement, he goes to stock market and loses everything very quickly. The fact, that the financial sector is a significant cost of maintaining the exchange, brokers, analytical companies, it's a whole industry, which feeds on the money of traders, most of which are newbies. Novice traders are called “young money”.

I believe, that it is necessary to somehow legislatively regulate advertising, so that there are no such videos, where the plumber invested a thousand dollars, and a month later he is already driving a Mercedes. Certainly, it seems very attractive, no one will tell in the ad, what, according to official exchange statistics, within nine months, half of the newcomers leave the market, having lost their funds. Nobody will explain, what to earn more than 10-20 % a year is a huge success, even large western companies, having received 30 %, consider this a very good indicator.

And it's one thing, when a corporation operates in the market, and the other is a person, who has nothing, except for the last few thousand dollars and the desire to make a quick buck. Nobody speaks, that risk is always proportional to profit. They, who plans to earn 100 % for the year, must be ready to lose everything. If people used this information, they would be better prepared, rather than come to the stock market, after watching a couple of videos on YouTube. But then there would be few beginners, and they would have acted very carefully.

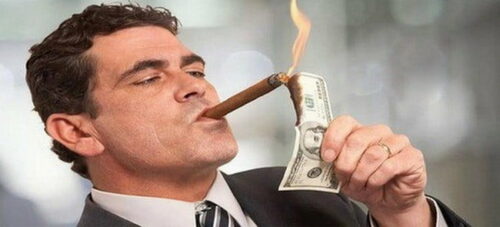

All this information is in the public domain., but it's very boring, and people want to earn a lot of money and have fun, Like in The Wolf of Wall Street. Only everyone forgets, that there actually are shown illegal schemes of earnings. Certainly, there are also successful traders, but here it's like at the olympic games. We only see the athlete, who stands on a pedestal, he has a medal, he wrote his name in history, got the car in gift, but we know nothing about hundreds and thousands of athletes, who did not achieve anything or were seriously injured. Maybe, 90 % financial market participants are people, who lose their money within three to five years, and in ten years less 1 % the most cunning and possessing the necessary levers. This is a kind of social Darwinism.

Features of work

They call me a private trader, but that's not quite right, I prefer to talk about myself as an investor. An investment is the receipt of income from the activity of an asset.. An asset can be stock, and a plant is any thing, which brings money, its value does not change, but makes it possible to earn. I call myself a speculator. This word does not seem offensive to me at all.. He got a negative connotation in the Soviet era, but in fact, speculation is earnings on the price difference of assets. That is, the security itself may not be profitable., but I buy it at the same price, and I'm selling for more.

I work from home, so I don't need to hurry, I usually get up around nine in the morning. The trading day on the stock exchange starts at ten, already at half past ten I try to be at the computer, to see all the news. Necessary to find out, How did trading close in the US?, as the American market influences all others. By this time, trades are already in full swing on the Asian stock exchange., need to study the situation there.

Be sure to follow the news, and it is better to do it on the websites of the companies themselves. Certainly, news is provided by specialized information portals, but they themselves receive data from the source, and then process them, it takes some time. On the same RBC, some news appears in prime time, i.e. in the lunch area, I need this information in the morning. In general, all news instantly appear in trading communities and chats.. Although in the trading environment those, who earns well, prefer to be silent. No wonder they say, that money loves silence. We have our own closed platforms and local chats, but there they can share the news at most, and so they usually just talk about abstract topics - women, soccer, who has been where. No advice, how to earn, no one gives, only beginners do this in their chats.

Even in the morning you need to think about all the ideas., who visited you the night before. Sometimes they seem insane at first glance, but if you look at it from a different angle, then they can be worthwhile. Trading runs five days a week and closes at 19:00, but you don’t need to sit at the computer all this time and follow everything that happens on the market, it's boring and just dangerous - the brain is very overloaded, the person begins to act inappropriately. There is a great practice in the more advanced US market: busy two hours since opening, then a big lunch, two hours before closing again active trading, and the rest of the time very few transactions are made. I work pretty much the same way., I monitor the market for an hour and a half in the morning, then I take a break and in the evening I also do business for about an hour. If any situations occur within the day, to which you need to respond immediately, have a laptop and a phone at hand. Again, newbies don't understand this.. They often think, the longer you sit at the computer, the more you earn.

Successes and failures

All auctions are now held electronically., you do not need to have any physical shares. The exchange has a special system, where depositaries store data on all assets, in the same place in electronic form we receive dividends. It costs some pennies - 170 rubles per month. All transactions in the securities market are carried out by investors through brokers., they are attached to banks or merged into independent financial institutions, for example the same "Finam". Broker is the tax agent of the investor, therefore all deductions occur automatically, it's not even mentioned. Brokers deduct themselves 13 % and generate profit reporting, if necessary.

Certainly, I remember, how did you make your first million, but it was not the most memorable event. Much more important, when i realized, how the financial market works. Whether you succeed or not depends on many factors.. Someone relies on luck, but she likes prepared people. Like in that joke about Izya, who needed at least a lottery ticket to buy, to win. It is much more important to have information, especially insiders. For example, Company A is being sued by Company B, and the stock price of company A drops sharply. This is force majeure, but there are those, who could have foreseen it.

Situations, when i could lose everything, I did not have, because the amount, that I bring to the stock market, always diversifies. As known, all the eggs are stored in one basket only by those same beginners. Yes, and there are no such situations., so that once - and everything is gone. A series of events leads to monetary losses.

Recently one retailer, whose shares I had, issued a report, where reported, that they are incurring losses, outlets are closing. I understand, how do all retail chains work: open a bunch of stores increase turnover, then they close their unprofitable points and open new ones. It's just that this retailer has accumulated a lot of negativity in one period., and investors reacted to it. I understood, that stocks drain those, who thinks, that the company is about to close. They acted inadequately, but there were a lot of them, and thus they greatly brought down the price. I misbehaved, and this mistake cost me 6 % Capital, and this is about two months of free work.

Income

Profit depends on, how many investments do you have under management. Not even necessary, to be your own funds, they can be borrowed or provided. For example, many investors, who have money, don't want to bother, find a manager and do not even give the funds, just listen to recommendations.. If a positive result is achieved, part of the proceeds from earnings as a fee goes to that, who gives recommendations. Sometimes funds are transferred not even on a contractual basis., but on a friendly basis. Working with other people's assets is even easier, because you don't risk anything, the lower the risk, the less worries and experiences and a colder head.

I don't make a profit every month. When money is needed, I just decide, that you need to withdraw part of the funds. Sometimes it is inconvenient., and my wife and I use overdraft cards. Since we have a large turnover, we can use the money without interest for up to three months. And if we take the average, then a month I get about 500 thousand rubles.

Expenses

In our family, my wife is engaged in home bookkeeping.. There is a map, which we use together, and she keeps track, how much and what do we spend. To be honest, I don't feel like doing this. The wife runs the business, she has her own income. We have an equal relationship, but we decided, that big expenses are still my responsibility.

The most precious thing is travel, they spend about 100 thousand rubles. The climate in Moscow is terrible, so I try to go somewhere every two months. At one time there was money, but there wasn't enough time, now i have the opportunity to travel, so at least four times a year we have a rest. We try to get closer to the sea - to Asia or to the south of Europe. Now my wife has gone to Thailand., I'm going to Indonesia in a couple of months, I want to windsurf. Besides abroad, there are still trips around Russia for the weekend - Peter, Yaroslavl, Kostroma.

We are planning to buy land and build a house, for this we also postpone about 100 thousand rubles monthly. Again, due to the climate, the Moscow region does not suit us. We considered Spain or Italy, but it’s been restless there lately and many of our acquaintances from there, vice versa, leaves. Definitely do not want to buy property in Asia. There we will always be strangers for the locals, and they will treat us as an object, to whom you can sell something. Same with Arab countries. We are looking for something closer to the sea and not very far, so that two or three hours - and at home. Because for now we stopped on the Black Sea coast, We plan to start buying and furnishing a house next year..

We spend quite a lot on leisure - restaurants, bars, Exhibitions, films, Cafe. Only about 50 thousand rubles. Buying groceries for home also lies with the wife., I think, it costs 40 thousand rubles. There are also expenses for alcohol - 15 thousand. We buy many good drinks home, give, we go to taste different types of whiskey. We have not yet become serious connoisseurs, but on the way to it. Yet 20 I spend thousands of rubles on health - fitness, pool, massage. Wife still goes to the beautician, so her expenses are much higher here.

Part of the money goes to investments in the real sector, because earnings in the securities market are unstable and there is always a risk of losing. You need to have a different income from investing other assets, like a safety cushion. I invest in construction and a beauty salon. It takes somewhere 100 thousand rubles. I'd still spend it on some bullshit, so let them work better.

On average, cars spend about 30 thousand rubles, it's gas and service. We have two cars, but i can take the subway or taxi, although very rarely. When you get used to the car, understand, what is better to stay in a traffic jam, but with comfort. I don’t spend much on clothes, don't buy all those suits and ties, I wear casual clothes. How to walk all my life in sneakers, so I go. I don't need to prove my worth to anyone, go to the office and make an impression there, especially since everyone knows now, that real businessmen can wear t-shirts and shorts.

My wife and I are doing charity work, trying to send 25 thousand rubles every month. It was originally her idea., but then i got hooked too. I'm bad at presenting, what exactly happens to money, which we translate, but I know for sure, that they go to care for animals, which are kept in shelters. We have two cats ourselves, ordinary yard. For their food, filler for trays, on average we spend visits to the veterinarian per month 5 thousand rubles. One has been living for a long time, and we recently picked up another in the Krasnodar Territory. She fell down the drain, and we went out and after that did not give it to someone.

A source: