MICEX (MCX: MOEX) — diversified exchange holding, one of the largest in the Russian Federation.

About company

MICEX is a financial company, whose main work is the organization of exchange trading. The history of the company began in 1992 with the formation of the Moscow Interbank Money Exchange (MICEX), continued in 1995 with the creation of the RTS exchange and their merger in 2011. In 2013, the combined company went public with an IPO.

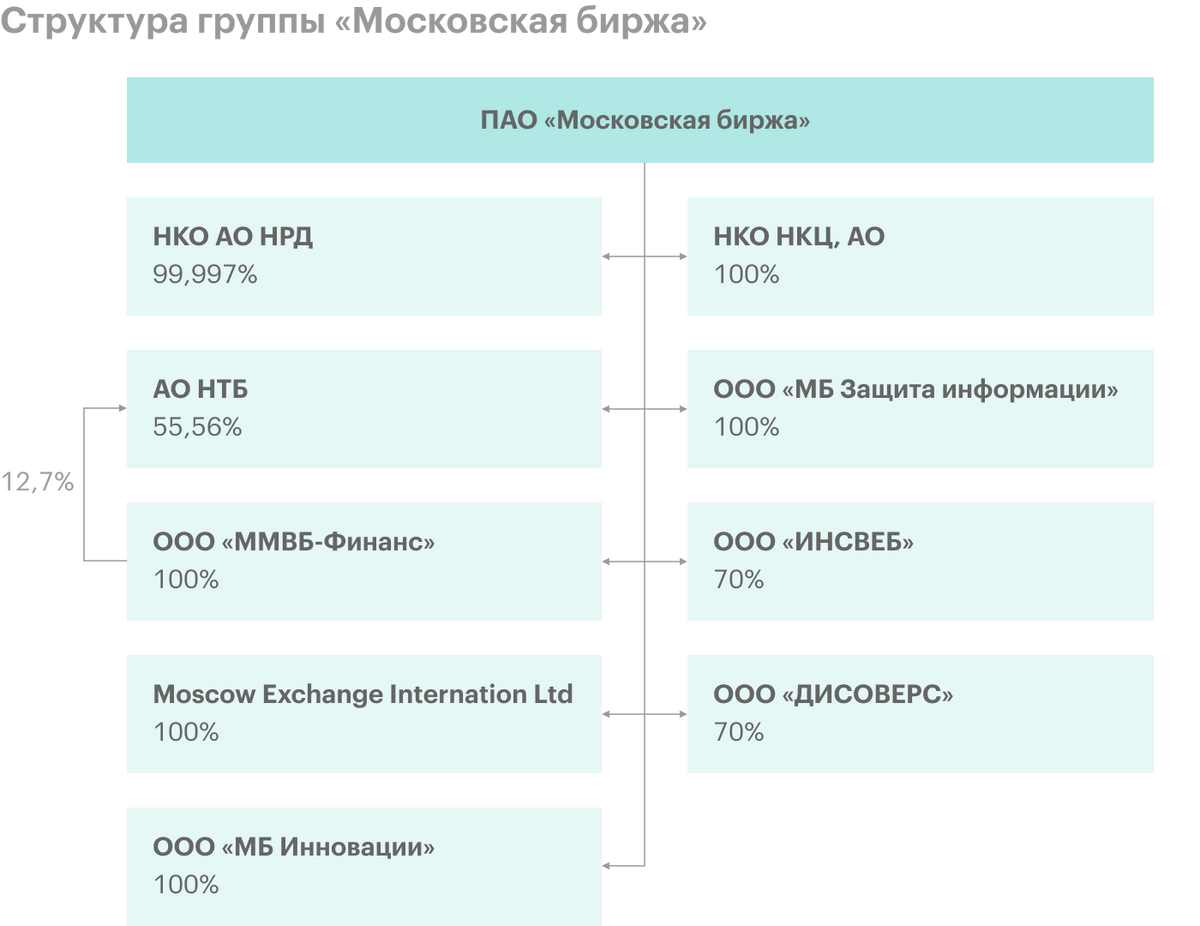

According to the results of 2020, it has 8.8 million individuals, 44,8 thousands of legal and 1460 professional participating tenders. The holding contains several companies, allowing?? provide clients with a full range of services for the organization of exchange trading:

- "MICEX MICEX-RTS" - specifically the organizer of exchange trading;

- "State Settlement Depository" - the central depository;

- "State Clearing Center" - a clearing organization and a central counterparty;

- "State Commodity Exchange" - the organizer of trading in commodity markets;

- MB Innovations is a company, engaged in the development of innovations and interaction with fintech startups.

The company provides access to trading on 5 market sections:

- Stocks and bods market. Securities trading: shares and depositary receipts, bonds of the Central Bank of the Russian Federation, national loan, corporate and eurobonds, ETF, shares of conventional and exchange-traded mutual investment funds, mortgage participation certificates.

- Derivatives market. Trading in derivative financial instruments - futures and options - for shares, bonds, indicators, money pairs, interest rates, oil, gas, alloys, agricultural products.

- Money market. Currency exchange trades.

- Currency market. REPO operations with a central counterparty, with the Central Bank, with clearing participation certificates, deposit and credit operations.

- Commodity Markets. Trade in products: gold, silver, agricultural products.

The main markets in terms of trading volume are foreign exchange, cash and urgent. At the same time, the trading volumes for them have slightly decreased over the past few years., But in 2020 everything has changed: the fall in oil prices and the coronavirus epidemic have become a prerequisite for significant volatility in the markets. As a result, trading volumes in all markets, not counting the market for grain and sugar, increased significantly.

The global trend of a large-scale arrival of individuals on the exchange also contributed to the increase in trading volumes., which is also relevant in the Russian Federation: this number has more than doubled in 2020. However, the trend does not stop.: according to the results of April 2021, the number of individuals on the exchange increased to 11.7 million people.

The company itself is also taking steps, which should help to increase trading volumes even more: in 2020, trading in foreign shares was launched and an evening session was introduced on the stock market, and in 2021 - the morning session on the money and derivatives markets and the precious metals market.

MICEX not only organizes trading, and provides information services: calculates indicators, sells information and analytical products.

In 2019, the company approved a development strategy until 2024, one of the strategic tasks of which was named development in related areas. As part of this initiative, the company is intensively developing the Financial Services money marketplace. This is an electric playground, where you can compare offers and receive various monetary services in one place: open a deposit, apply for a loan, purchase an insurance product, for example, digital car liability insurance policy. In mid-May 2021, the company reported, that it bought an electronic platform for the selection of insurance and banking goods INGURU and plans to integrate it into the Financial Services platform.

In addition, it is necessary to inform, that in 2020 the company became the second one of the largest shareholder of the Kazakhstan Stock Exchange (BECAUSE), - may be, this is the beginning of the creation of an international exchange group based on the MICEX.

Trading volume in different markets of the company by years in billions of rubles

| Shares | Bonds | Urgent | Currency | Monetary | Precious metals | Grains and sugar | |

|---|---|---|---|---|---|---|---|

| 2016 | 9277 | 14 616 | 115 271 | 329 954 | 333 883 | 125 | 12 |

| 2017 | 9185 | 26 228 | 84 497 | 347 671 | 377 141 | 122 | 6 |

| 2018 | 10 830 | 29 841 | 89 263 | 348 368 | 364 216 | 102 | 50 |

| 2019 | 12 443 | 28 219 | 82 370 | 308 274 | 346 347 | 35 | 50 |

| 2020 | 23 905 | 30 617 | 129 864 | 328 946 | 426 781 | 53 | 25 |

Shares

2016

9277

2017

9185

2018

10 830

2019

12 443

2020

23 905

Bonds

2016

14 616

2017

26 228

2018

29 841

2019

28 219

2020

30 617

Urgent

2016

115 271

2017

84 497

2018

89 263

2019

82 370

2020

129 864

Currency

2016

329 954

2017

347 671

2018

348 368

2019

308 274

2020

328 946

Monetary

2016

333 883

2017

377 141

2018

364 216

2019

346 347

2020

426 781

Precious metals

2016

125

2017

122

2018

102

2019

35

2020

53

Grains and sugar

2016

12

2017

6

2018

50

2019

50

2020

25

Number of individuals, who have brokerage accounts, by years in millions of people

| 2016 | 1,1 |

| 2017 | 1,3 |

| 2018 | 2,0 |

| 2019 | 3,9 |

| 2020 | 8,8 |

| 2021, 4 months | 11,7 |

2016

1,1

2017

1,3

2018

2,0

2019

3,9

2020

8,8

2021, 4 months

11,7

Financial indicators

In general, the Moscow Exchange is a fairly understandable business.: the company mainly earns on commissions for transactions and on interest income from investing client balances.

The company's revenue and net profit are growing steadily. Net debt also rises in nominal terms, being constantly negative: the company has more money.

Fee and commission income is constantly growing, the largest contribution is made by the money market and settlement and depository services. Interest income is consistently less than commission and is somewhat volatile - largely due to the fact, that depend on interest rates in the economy. Investment portfolio of the company, interest bearing, more than half consists of deposits and accounts in foreign currencies.

Revenue, net profit and net debt by years in billions of rubles

| Revenue | Net profit | net debt | |

|---|---|---|---|

| 2017 | 38,5 | 20,3 | −82,7 |

| 2018 | 39,9 | 20,8 | −89,7 |

| 2019 | 43,2 | 22,1 | −93,0 |

| 2020 | 48,6 | 25,2 | −103,9 |

| 2021, 1 neighborhood | 12,9 | 6,7 | −102,5 |

Revenue

2017

38,5

2018

39,9

2019

43,2

2020

48,6

2021, 1 neighborhood

12,9

Net profit

2017

20,3

2018

20,8

2019

22,1

2020

25,2

2021, 1 neighborhood

6,7

net debt

2017

−82,7

2018

−89,7

2019

−93,0

2020

−103,9

2021, 1 neighborhood

−102,5

Fee and interest income by years in billions of rubles

| Commission | Interest | |

|---|---|---|

| 2017 | 21,2 | 16,0 |

| 2018 | 23,6 | 17,9 |

| 2019 | 26,2 | 13,6 |

| 2020 | 34,3 | 15,3 |

| 2021, 1 neighborhood | 9,3 | 3,2 |

Commission

2017

21,2

2018

23,6

2019

26,2

2020

34,3

2021, 1 neighborhood

9,3

Interest

2017

16,0

2018

17,9

2019

13,6

2020

15,3

2021, 1 neighborhood

3,2

Structure of commission income for the 1st quarter of 2021 in percent

| Money market | 26 |

| Settlement and depository operations | 21 |

| Stock Market | 14 |

| Derivatives market | 13 |

| Currency market | 12 |

| Bond market | 6 |

| Other | 9 |

Money market

26

Settlement and depository operations

21

Stock Market

14

Derivatives market

13

Currency market

12

Bond market

6

Other

9

The structure of the investment portfolio by asset types for the 1st quarter of 2021 in percent

| Deposits and accounts in foreign currencies | 61 |

| Ruble securities | 13 |

| Foreign securities | 10 |

| Deposits and accounts in rubles | 10 |

| REPO transactions | 5 |

Deposits and accounts in foreign currencies

61

Ruble securities

13

Foreign securities

10

Deposits and accounts in rubles

10

REPO transactions

5

Share capital

The Moscow Exchange has a rather atypical situation for the Russian stock market: there is no majority shareholder with a controlling stake. At the same time, banks appear among the largest shareholders., state-related, including the Bank of Russia.

Share capital structure in percent

| Shareholder | share |

|---|---|

| Bank of Russia | 11,8 |

| Sber | 10,0 |

| ВЭБ.РФ | 8,4 |

| EBRD | 6,1 |

| Capital Research and Management Company | 5,7 |

| Subsidiary LLC "MICEX-Finance" | 0,8 |

| In free circulation (включая Capital Research and Management Company, excluding MICEX-Finance) | 62,9 |

Shareholder

share

Bank of Russia

11,8

Sber

10,0

ВЭБ.РФ

8,4

EBRD

6,1

Capital Research and Management Company

5,7

Subsidiary LLC "MICEX-Finance"

0,8

In free circulation (включая Capital Research and Management Company, excluding MICEX-Finance)

62,9

Why stocks can go up

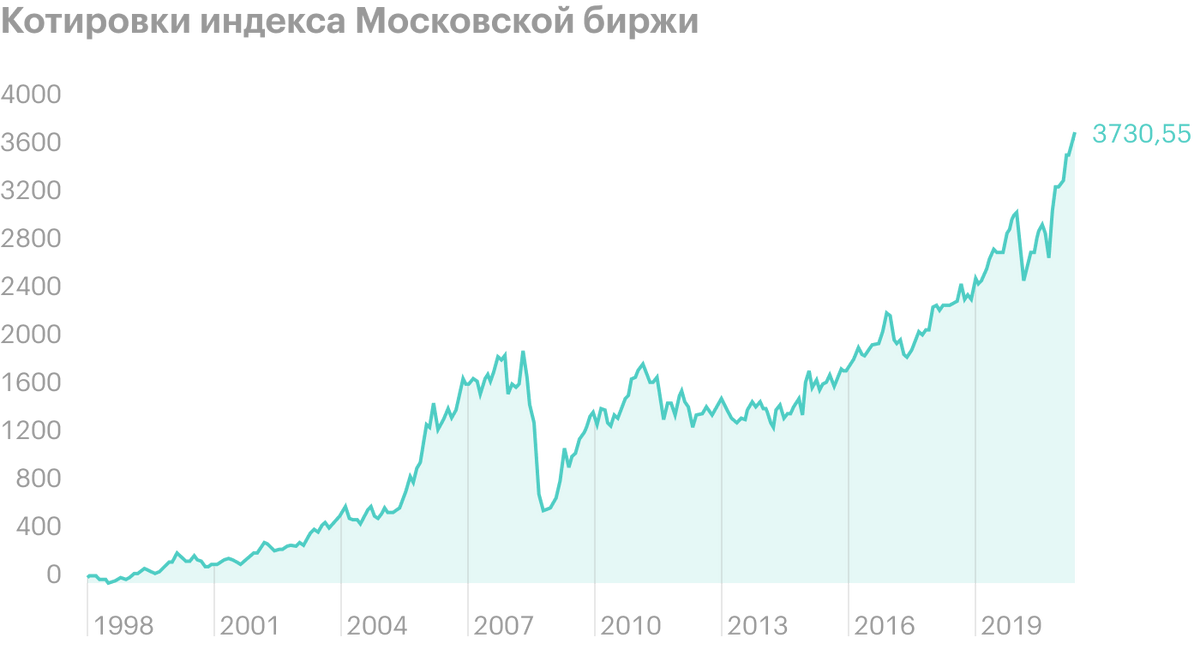

Protective asset with a growing business. The company's business is quite stable, is non-cyclical — and may well be considered a protective asset. After all, the trades are taking place during both economic growth, as well as recessions. And even if in times of stock market turmoil the company's shares fall, due to increased volatility, trading volumes will increase, which will bring more commission income to the Moscow Exchange.

It is also worth considering, that although the company has competitors, such as St. Petersburg Stock Exchange, NYSE, NASDAQ, LSE, CME, you can safely say, that it is the main Russian exchange - and it is unlikely that in the foreseeable future someone will be able to move it out of this niche. Wherein, as we discussed above, in recent years, the company's financial performance has been steadily growing.

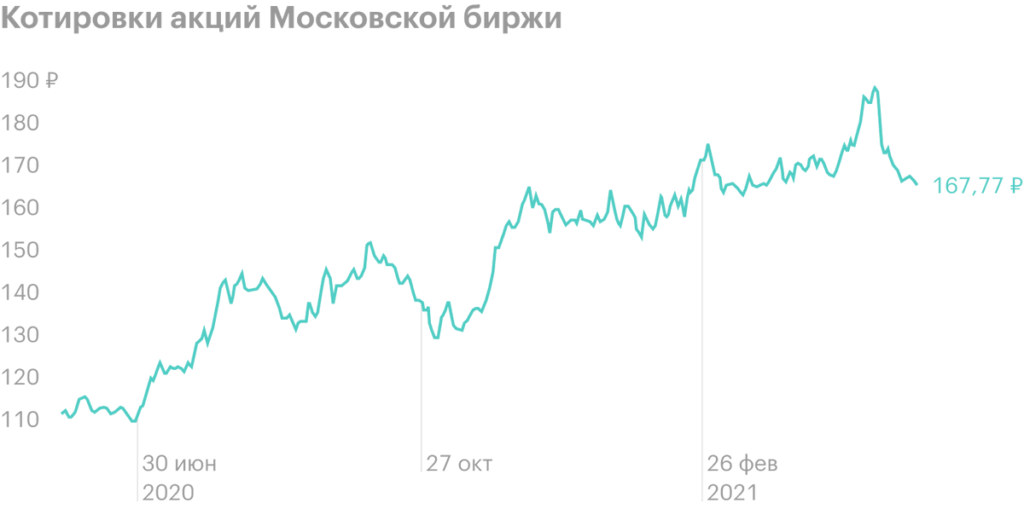

Improper multipliers. The company has a decent return on equity (ROE), no debt problems, according to the P / E multiplier, the company is worth more, than in recent years, as stock prices are at historical highs, but given the historically low interest rates in the economy and the stock market boom among private investors, this is logical.

Dividends and dividend policy. According to dividend policy, The Moscow Exchange pays dividends once a year in the amount of at least 60% net profit for the period. In reality, in recent years, the company pays much more - almost 90% of net profit, at the same time, due to the growth of net profit, dividends are also growing. As a result, dividend policy is pleasant for shareholders, and the dividend yield, although not amazing, but consistently exceeds bank deposit rates.

Company multipliers by years

| P / E | ROE | Net Debt / EBITDA | |

|---|---|---|---|

| 2017 | 12,2 | 16,7% | −2,95 |

| 2018 | 8,9 | 16,5% | −3,24 |

| 2019 | 11,1 | 16,8% | −3,24 |

| 2020 | 15,2 | 18,1% | −2,95 |

| 2021, 1 neighborhood | 15,1 | 17,6% | −2,90 |

P / E

2017

12,2

2018

8,9

2019

11,1

2020

15,2

2021, 1 neighborhood

15,1

ROE

2017

16,7%

2018

16,5%

2019

16,8%

2020

18,1%

2021, 1 neighborhood

17,6%

Net Debt / EBITDA

2017

−2,95

2018

−3,24

2019

−3,24

2020

−2,95

2021, 1 neighborhood

−2,90

Dividends, dividend yield and share of net income, paid out as dividends

| Dividend per share | Dividend yield | Share of net profit, paid out as dividends | |

|---|---|---|---|

| 2016 | 7,68 R | 6,1% | 69% |

| 2017 | 7,96 R | 7,3% | 89% |

| 2018 | 7,70 R | 9,5% | 89% |

| 2019 | 7,93 R | 7,4% | 89% |

| 2020 | 9,45 R | 5,6% | 85% |

Dividend per share

2016

7,68 R

2017

7,96 R

2018

7,70 R

2019

7,93 R

2020

9,45 R

Dividend yield

2016

6,1%

2017

7,3%

2018

9,5%

2019

7,4%

2020

5,6%

Share of net profit, paid out as dividends

2016

69%

2017

89%

2018

89%

2019

89%

2020

85%

Why stocks might fall

Raising rates in the economy. From mid-2019 to mid-2020, the key rate of the Bank of Russia was reduced from 7,75 to 4,25, what, including, led to lower interest rates on bank deposits. This was one of the reasons for the flow of money from banks to the exchange. In the spring of 2021, the Bank of Russia began to raise the rate - and although this should have a positive impact on the interest income of the Moscow Exchange, strategically, this can lead to several consequences.

Firstly, any increase in rates makes conservative instruments - bank deposits and bonds of reliable issuers - more attractive, which in general should cause an outflow of money from risky instruments, such as shares, in particular, of this issuer.

Secondly, potential outflow of money back to bank deposits may cause a decrease in trading volume, due to which the company's fee and commission income may decrease.

Thirdly, shares of companies value, which include the Moscow Exchange, allow you to earn through dividends, and the dividend yield should be higher, to be attractive, - this can happen due to a decrease in the price of the issuer's shares.

Possible end of the stock market boom. Maybe, that now we are at the peak of the stock market boom, which arose due to a combination of several factors: digitization, greatly simplifies access to the exchange, rate cuts in the economy, long-term growing market, grown up new generation, who no longer remembers any bear markets during the 2008 crisis, let alone the financial cataclysms of the 1990s. Potential future losses due to collapses may reduce the attractiveness of the exchange among investors, which will cause an outflow of existing customers and a decrease in the arrival of new ones and may subsequently adversely affect trading volumes and, Consequently, company commission income.

Financial risks. Don't forget, that the exchange does not just take a commission for organizing trading: it not only provides the technical possibility of transactions, but also takes financial risks. And the realized risks may entail the need to spend money on compensation for damage.. For example, in 2019, the company was forced to reserve 2.4 billion rubles due to grain theft, which greatly reduced the profit in reporting. And in 2020, following the results of the story with the suspension of trading in futures for WTI crude oil, the price of which has become negative, investors filed a class action lawsuit against the Moscow Exchange.

Eventually

Moscow Exchange is a large stable business, de facto defensive asset. Growing trading volumes and the stock market boom in the Russian market have allowed the company to increase its financial performance in recent years, which had a positive impact on share prices and dividends.

Worth considering, what, maybe, factors have accumulated to reduce trading volumes in the future, which may adversely affect quotes and dividends. But even if it happens, it is unlikely that something will fundamentally change: probably, the company will continue to be profitable, with negative net debt and will be able to provide its shareholders with a decent dividend income above the yield on bank deposits.

In this way, Moscow Exchange is a typical value company, which may be of interest to be included in the conservative part of the investor's portfolio.