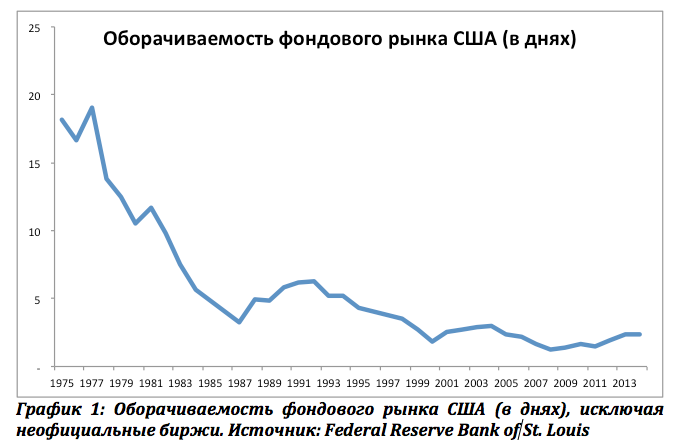

Robots brought on stock market unprecedented speeds. They buy and sell stocks several thousand times in one second.. As a result, if in 1975 year, the average holding period of one share in the United States was about 18 days, then in 2014 year it shrank to 2 days. Considering unofficial exchanges (so called dark pools), which account for most of the turnover of high-speed robots and at the same time whose data are not disclosed, the actual average holding time today is almost certainly already measured in hours.

In this article, we will look at, в чем заключаются стратегии роботов и почему они так быстро захватили фондовый рынок. Who will win the battle of artificial intelligences? Will there be a place for a person in the investment market??

Let's define the terminology. The two main participants in the stock market are traders and Brokers. Traders buy, sell and own shares. Brokers are intermediaries, actually helping traders to exchange shares. Using an analogy with the real estate market, traders are buyers / sellers of apartments, while brokers are realtors.

Usually the dominance of robots in trading is due to speed.. Really, всего за тысячную долю секунды роботы совершают огромное количество транзакций — stock за это время может поменять владельца десятки раз. The person does not even have time to blink.

The fight for speed has come to that, that traders and brokers began to place their servers directly next to the exchanges, laying a cable to the servers directly through the wall of the exchange. Это позволяет сохранить драгоценные микросекунды, which the light spends on reflections in the fiber optic cable. In this environment, the one wins, who is able to obtain information the fastest, make a decision and complete a transaction. Technological progress has left no room for man on the stock exchange.

Однако у такого быстрого проникновения роботов есть еще одно, less obvious, explanation. One of the main market participants, brokers, is directly interested in robots..

Understanding the role of brokers will help us answer the question, who will win the robot fight. To do this, you first need to consider, how robots work. We'll see, that this is not much different from, What did human traders do in the past?.

Robot strategies

Robots use thousands of different individual algorithms and strategies, however, almost all of them can be divided into three main groups: arbitration, trend and pending transactions.

In the case of arbitration, there is a search for shares, priced differently on different exchanges. A difference of only one cent and only a hundredth of a second means arbitrage for the robot.

In trending strategies, the computer tries to provoke an avalanche trend in any stock.. For example, if a critical amount of stop-loss has accumulated (sales orders in case, if the stock price falls), then even a slight decline in the exchange rate can cause an avalanche of sales. Или же если robot was able to convince other robots, that there is a trend in some stock, then this can also cause an avalanche-like change in the stock price. According to a number of experts, this strategy was the reason for the famous Flash Crash, which in 14:32 6 May 2010 year by several minutes dropped the capitalization of the entire American stock market by more than a trillion dollars.

Transaction waiting strategies are based on trying to anticipate large transactions, prepared by big investors, например пенсионными фондами. A typical example of this strategy is buying shares a fraction of a second before., how any large investor will do it with the subsequent sale of these shares to the investor at a higher price. Computer algorithms use various indirect indicators to detect similar pending transactions.. For example, if an investor has placed an order on several exchanges, then even a split second difference in the time of placing these orders may be sufficient, so that the robot sees the order on the first exchange and has time to buy shares on the second exchange before, how will they rise in price.

Do these strategies have any fundamental differences from, what human traders did before? Hardly ever. Arbitration has always been popular. Trending strategies are also nothing new - people have an innate tendency to find and create trends.. Waiting for transactions is also a traditional tool - classic front-running is one of the varieties of this strategy..

In this way, robotic trading is not something fundamentally new - it uses the same short-term speculative strategies, which people-traders have resorted to for many years.

What has followed these strategies in the past?? Widespread belief, what speculation and Trading extremely profitable and that it is short-term speculation that underlies many large fortunes. Is it so?

В текущем списке ста крупнейших миллиардеров Forbes есть лишь четыре человека, made a fortune in short-term speculation: George Soros, Karl Icahn, Steve Coen, and James Simmons. And of them only James Simons, head of Renaissance Technologies, can be called a trader. Other 96 billionaires made their fortunes on long-term investments: как через фондовый рынок, and with the help of direct investments. In other words, less 4% modern big capital was earned through short-term speculation, and of which less 1% - using trading.

In the past, a largely similar picture was observed - over the past century, there were practically no large fortunes., created by trading. From time to time, stories of individual successful big deals appeared on the newspaper pages., but any kind of continuation they, usually, did not have.

Such a blatant absence of traders among successful businessmen indicates that, that trading is not a profitable dominant strategy. Why did traders lose capital in the past??

Of course, many reasons. For example, traders for the most part do not overcome economic crises. The use of debt capital is a characteristic feature of trading. Однако каждый раз в момент наступления кризиса требования вернуть долги (margin calls) instantly wash out their capital. Each economic cycle, the previous generation is forced to leave and a new one comes, optimistic shift. That is why young energetic faces always prevail among traders..

But still, the main reason for the loss of capital by traders is brokerage fees.. In a year, brokers can take away from 3% to 15% of the total trader's capital, and even more. To understand the scale of this phenomenon, can remember, that the average return on the American stock market since 1950 year was only about 9%. In this way, most of the market returns are ultimately distributed in favor of brokers.

Considering, that most of the time traders trade with each other and are a closed community, то можно прибегнуть к аналогии из физики. Фактически трейдеры, taken together, are a classical closed system with internal friction. The role of friction is played by brokers. Most of the energy of this system is ultimately spent on friction and dissipated.. That is why we do not see traders on the Forbes list..

If trading has historically resulted in a loss of capital, can robots change the situation and make trading profitable? Really, the success story of the same James Simons of Renaissance Technologies might suggest such a thought. Однако мы видим, that robots use almost identical strategies. The phenomenal performance of some of the first robotic traders is primarily due to their enormous speed advantage over humans.. Однако по мере исчезновения человека ситуация вернется в привычное русло — соревнование роботов между собой на равных приведет к обнулению прибыли.

Brokers will continue to be the sole beneficiary of this system.. Brokers' commissions from each robotic transaction have decreased and now amount to only hundredths of a percent. but, since the turnover has increased hundreds of times, the total amount of commissions did not decrease as a result, but grew up. Returning to the closed-system analogy, increasing speed only increases friction and energy loss.

What does this mean? What recommendations can be given to market participants? First of all, you need to refrain from frequent trading.. If the fight against robots cannot be won, then it should be avoided. At the same time, it also allows you to practically zero the costs of brokers..

Original: http://www.forbes.ru/finansy-i-investicii/337239-uspet-za-dolyu-sekundy-kto-pobedit-v-voyne-robotov-na-fondovom-rynke