Public Storage (NYSE: PSA) — fund, nesting in storage rooms. This is a measured and well-developed business. The only inconsistency for him may be an increase in rates in the United States..

What happens here

Readers have been asking us for a long time to start sorting out the financial statements and business foundations of foreign issuers.. The idea to review Public Storage was suggested by our reader Ingvar Pchelyakov in the comments to the Hologic review.. Offer in the comments of the company, analysis of which you would like to read.

The overview contains many screenshots with tables from reports. To make it more convenient to use them, we transferred them to google-sheets and translated into Russian. Direct your attention: there are several sheets. And keep in mind, that companies round off certain numbers in documents, therefore, the totals in graphs and tables may not converge.

Download the table from the report

What do they earn

The company belongs to REIT funds, managing?? real estate and a huge part of the income should be distributed among the owners of shares.

The company manages a complex of storage facilities. If you have watched Breaking Bad, you understand, how does such a room look.

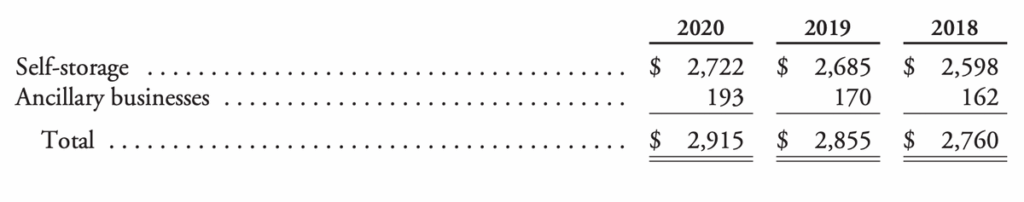

The company's revenue is divided into two unequal parts.

Storage — 93,37 %. This, actually, rent for the introduction of company premises by clients to store their own belongings. The sector's operating margin is 70,31 % from its proceeds.

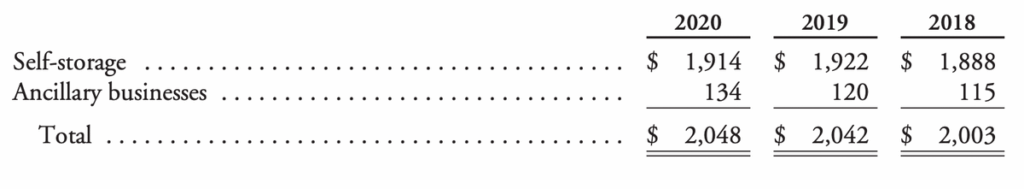

Accompanying services — 6,63 %. The sector's operating margin is 69,43 % from its proceeds. Here, the company's revenue is divided into subsequent segments.:

- Reinsurance services — 77,17 % subsegment revenue. Here, customers pay the company payments for the insurance of things stored by it.. The insurer is another company, Public Storage acts as an intermediary. Subsegment operating margin — 80,91 % from its proceeds.

- Selling products - 15,35 % subsegment revenue. These are implementations of pieces, which are necessary for the owners of things stored in the premises: locks, boxes and all, what is needed for packing. Subsegment operating margin — 40,71 % from its proceeds.

- Management of real estate objects of other companies — 7,48 % subsegment revenue. Subsegment operating margin — 4,33 % from its proceeds.

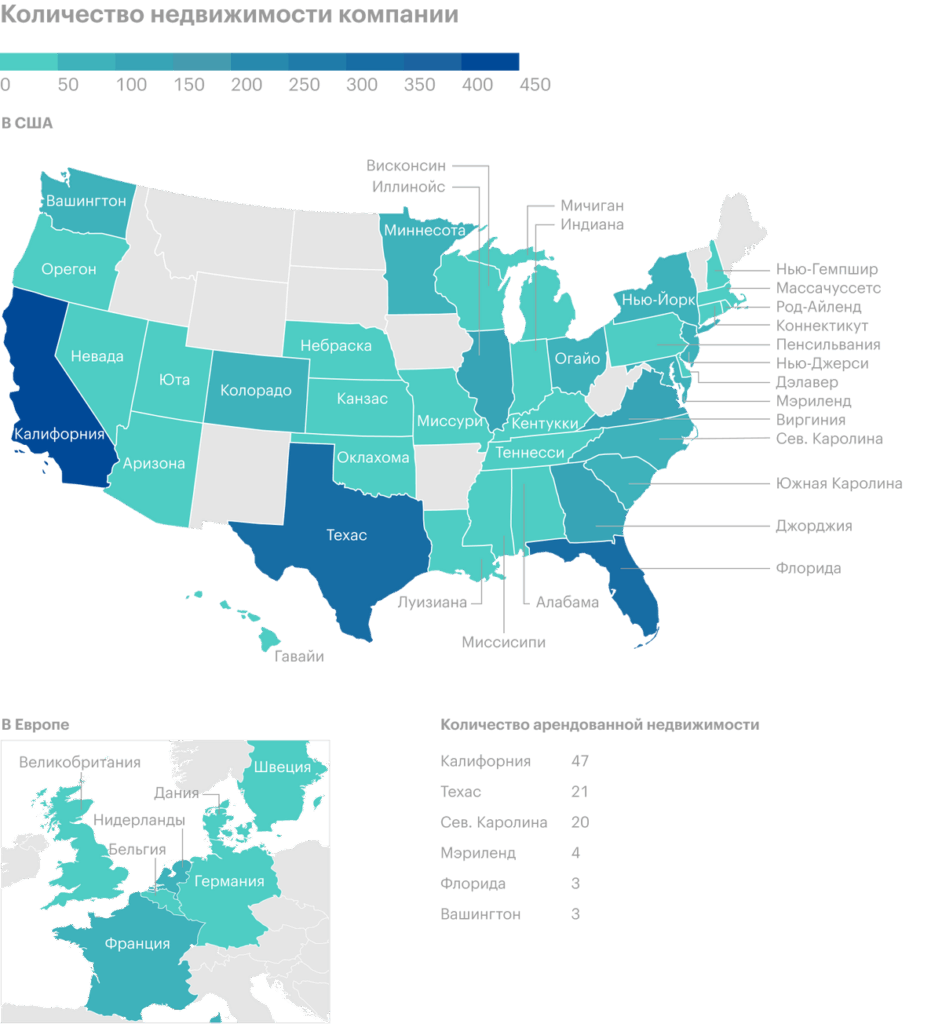

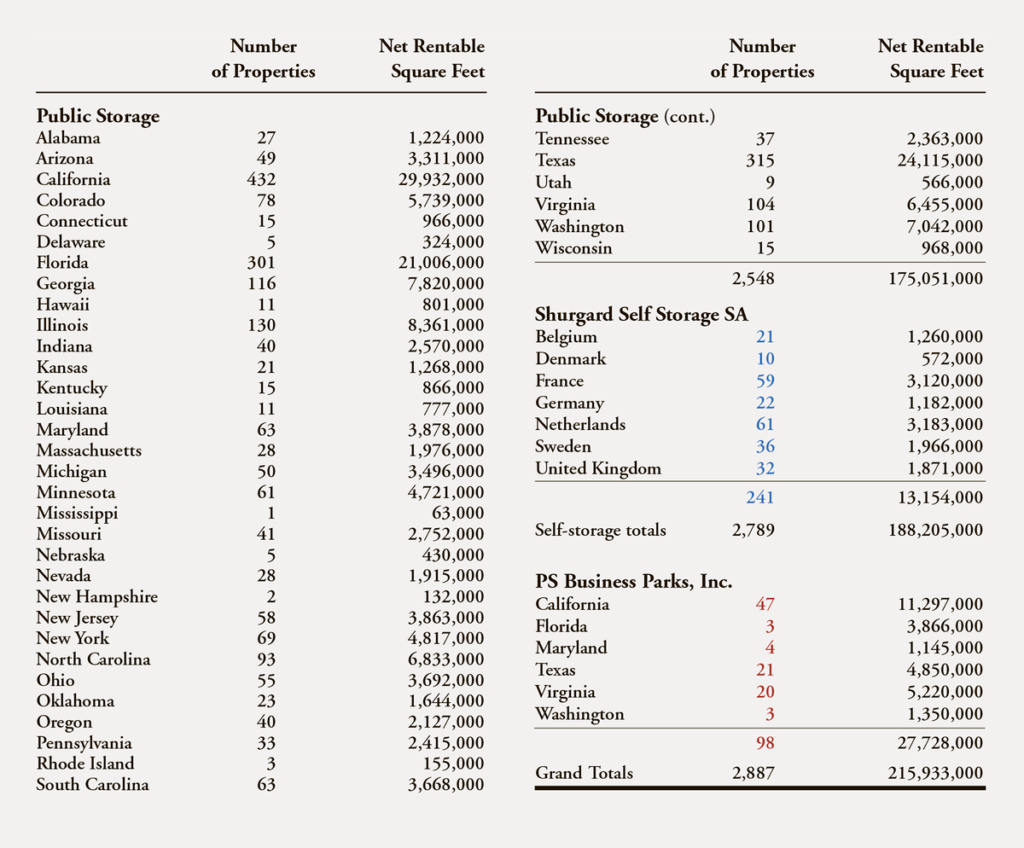

The company earns its main funds in the USA, however, she has assets in other states.

Annual revenue and profit of the company, billion dollars

| Revenue | Profit | Profit Margin | |

|---|---|---|---|

| 2017 | 2,67 | 1,42 | 53,21% |

| 2018 | 2,75 | 1,60 | 58,04% |

| 2019 | 2,85 | 1,40 | 49,04% |

| 2020 | 2,92 | 1,21 | 41,54% |

Revenue

2017

2,67

2018

2,75

2019

2,85

2020

2,92

Profit

2017

1,42

2018

1,60

2019

1,40

2020

1,21

Profit Margin

2017

53,21%

2018

58,04%

2019

49,04%

2020

41,54%

Reading between reporting lines

The U.S. storage market is approximately $40.73 billion a year.. Public Storage takes up not even half of it, but it costs much more - 51.7 billion. This makes one think about, that the company is disproportionately expensive.

The dividend yield of these stocks has been treading water for years.: since 2017, shareholders receive 8 $ per share per year, what constitutes 2,7% per annum.

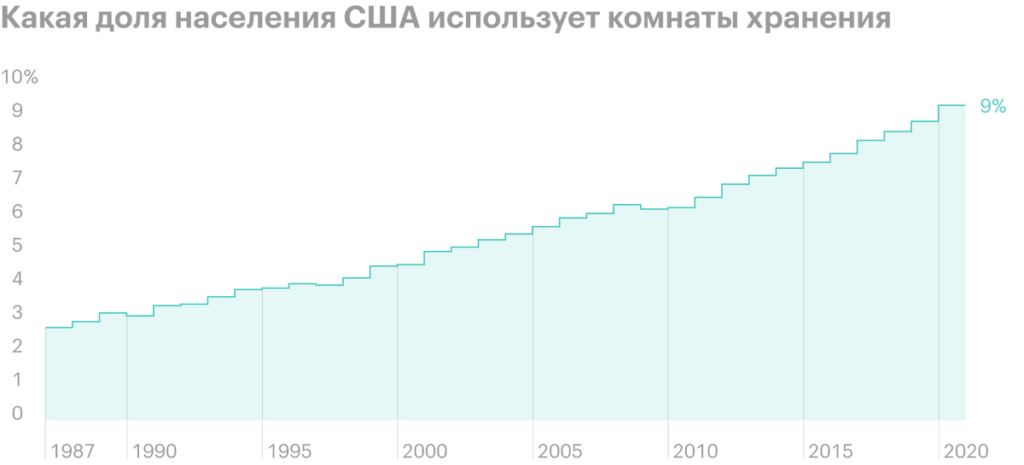

On the other hand, This yield is very good by today's standards.. And most importantly - it is stable, because it is a marginal and sustainable business. The market dynamics are positive here.: percentage of Americans, using the services of storage services, growing slowly.

The company is making the most of its premises. Plus, she has a fairly diversified portfolio of assets.. And in terms of a huge number of parameters, Public Storage is ahead of most of its competitors.. Actually, the fund's dividend yield is treading water precisely because, that the company was actively spending on business expansion. So for a long-term investment, Public Storage can be a very good option..

Storage market in the USA by number of sq.. feet for each company

| Public Storage | 9,4% |

| Extra Space Storage | 4,6% |

| Life Storage | 2,6% |

| National Storage Affiliate | 2,5% |

| CubeSmart | 2,0% |

| Rest of the market | 79,0% |

Public Storage

9,4%

Extra Space Storage

4,6%

Life Storage

2,6%

National Storage Affiliate

2,5%

CubeSmart

2,0%

Rest of the market

79,0%

Company performance in different quarters

| Share of employed sq.. feet | Rent per sq. foot per year, Dollars | |

|---|---|---|

| March 2020 | 92,7% | 17,88 |

| May 2020 | 94,0% | 17,42 |

| March 2021 | 96,0% | 18,06 |

| May 2021 | 96,5% | 18,54 |

Share of employed sq. feet

March 2020

92,7%

May 2020

94,0%

March 2021

96,0%

May 2021

96,5%

Rent per sq. foot per year, Dollars

March 2020

17,88

May 2020

17,42

March 2021

18,06

May 2021

18,54

Comparison of the growth in space of different companies, million sq. feet

| For 15 years | For 10 years | For 2 of the year | |

|---|---|---|---|

| Public Storage | 90 | 52 | 20 |

| Extra Space Storage | 52 | 42 | 6 |

| Life Storage | 32 | 21 | 2 |

| CubeSmart | 18 | 15 | 4 |

| National Storage Affiliates | — | — | 9 |

Public Storage

For 15 years

90

For 10 years

52

For 2 of the year

20

Extra Space Storage

For 15 years

52

For 10 years

42

For 2 of the year

6

Life Storage

For 15 years

32

For 10 years

21

For 2 of the year

2

CubeSmart

For 15 years

18

For 10 years

15

For 2 of the year

4

National Storage Affiliates

For 15 years

—

For 10 years

—

For 2 of the year

9

Revenue per sq.. feet from different companies by region in dollars

| Public Storage | Extra Space Storage | Life Storage | |

|---|---|---|---|

| Los Angeles — Riverside — Orange Country, THAT | 25,99 | 21,59 | 21,49 |

| San Francisco —Oakland — San Jose, THAT | 26,39 | 27,43 | — |

| New York — New Jersey — Long Island, NEW, NJ, PA | 25,67 | 23,78 | 22,80 |

| Seattle — Tacoma, WA | 19,40 | — | — |

| Washington — Baltimore, DC, MD, will, WV | 20,03 | 18,38 | — |

| Miami — Fort Lauderdale, FL | 19,65 | 17,91 | 17,87 |

| Chicago — Gary — Kenosha, The, IN, WI | 14,78 | 14,75 | 14,44 |

| Atlanta, GA | 12,89 | 12,30 | 12,33 |

| Dallas — Fort Worth, TX | 12,97 | 11,81 | 12,10 |

| Houston — Galveston — Brazoria, TX | 12,06 | 11,73 | 11,89 |

| Orlando, FL | 13,40 | 13,12 | 11,75 |

| Philadelphia —Wilmington — Atlantic City, PA, FROM, NJ | 17,14 | 16,00 | — |

| West Palm Beach, FL | 18,08 | — | — |

| Tampa — St.Petersburg, Clearwater, FL | 13,59 | 15,98 | 14,35 |

| Charlotte, NC | 10,55 | — | 11,86 |

Los Angele — Riverside — Orange Country, THAT

Public Storage

25,99

Extra Space Storage

21,59

Life Storage

21,49

San Francisco — Oakland — San Jose, THAT

Public Storage

26,39

Extra Space Storage

27,43

Life Storage

—

New York — New Jersey — Long Island, NEW, NJ, PA

Public Storage

25,67

Extra Space Storage

23,78

Life Storage

22,80

Seattle — Tacoma, WA

Public Storage

19,40

Extra Space Storage

—

Life Storage

—

Washington — Baltimore, DC, MD, will, WV

Public Storage

20,03

Extra Space Storage

18,38

Life Storage

—

Miami — Fort Lauderdale, FL

Public Storage

19,65

Extra Space Storage

17,91

Life Storage

17,87

Chicago — Gary — Kenosha, The, IN, WI

Public Storage

14,78

Extra Space Storage

14,75

Life Storage

14,44

Atlanta, GA

Public Storage

12,89

Extra Space Storage

12,30

Life Storage

12,33

Dallas — Fort Worth, TX

Public Storage

12,97

Extra Space Storage

11,81

Life Storage

12,10

Houston — Galveston — Brazoria, TX

Public Storage

12,06

Extra Space Storage

11,73

Life Storage

11,89

Orlando, FL

Public Storage

13,40

Extra Space Storage

13,12

Life Storage

11,75

Philadelphia — Wilmington — Atlantic City, PA, FROM, NJ

Public Storage

17,14

Extra Space Storage

16,00

Life Storage

—

West Palm Beach, FL

Public Storage

18,08

Extra Space Storage

—

Life Storage

—

Tampa — St.Petersburg, Clearwater, FL

Public Storage

13,59

Extra Space Storage

15,98

Life Storage

14,35

Charlotte, NC

Public Storage

10,55

Extra Space Storage

—

Life Storage

11,86

Operating margin of various companies as a percentage of revenue

| Public Storage | 75,9% |

| Extra Space Storage | 71,3% |

| National Storage Affiliates | 70,5% |

| CubeSmart | 70,1% |

| Life Storage | 66,8% |

Public Storage

75,9%

Extra Space Storage

71,3%

National Storage Affiliates

70,5%

CubeSmart

70,1%

Life Storage

66,8%

Comparing Public Storage to industry averages

| Public Storage | Industry averages | |

|---|---|---|

| Revenue per sq.. feet, Dollars | 16,40 | 14,05 |

| Operating income per square meter. feet, Dollars | 12,86 | 10,20 |

| Operating margin, percent of revenue | 76% | 70% |

Revenue per sq. feet, Dollars

Public Storage

16,40

Industry averages

14,05

Operating profit per sq. feet, Dollars

Public Storage

12,86

Industry averages

10,20

Operating margin, percent of revenue

Public Storage

76%

Industry averages

70%

The ratio of enterprise value to the consensus estimate of EBITDA for different companies

| Life Storage | 23,5X |

| CubeSmart | 24,4X |

| Public Storage | 24,7X |

| Extra Space | 26,2X |

| National Storage Affiliates | 29,2X |

Life Storage

23,5X

CubeSmart

24,4X

Public Storage

24,7X

Extra Space

26,2X

National Storage Affiliates

29,2X

ESG buns

The company is quite diligent and not without success positioning itself as a very progressive and environmentally friendly. This is a big bonus in our troubled times., when ethical-minded investors can start investing in these stocks because of the combination of reasonably attractive passive returns and following a progressive agenda.

Company employees, belonging to a specific group of the population

| Women | 69% |

| Women managers | 39% |

| Colored | 52% |

| Color managers | 32% |

| Generation X | 35% |

| Millennials | 40% |

| Generation Z | 15% |

| Boomers | 10% |

Women

69%

Women managers

39%

Colored

52%

Color managers

32%

Generation X

35%

Millennials

40%

Generation Z

15%

Boomers

10%

The environmental impact of the company's work

| Public Storage | Average performance of competitors | Percentage difference between companies | |

|---|---|---|---|

| Power consumption, kWh per sq. foot | 1,7515 | 14,0604 | −88% |

| Air emissions, million tons of CO2 equivalent per sq.. foot | 0,0006 | 0,0055 | −89% |

| Water consumption, kilogallons per square meter. foot | 0,0016 | 0,0262 | −94% |

| Waste, metrich. tons per sq.. foot | 0,0001 | 0,0007 | −86% |

Power consumption, kWh per sq. foot

Public Storage

1,7515

Average performance of competitors

14,0604

Percentage difference between companies

−88%

Air emissions, million tonnes of CO2 equivalent per sq. foot

Public Storage

0,0006

Average performance of competitors

0,0055

Percentage difference between companies

−89%

Water consumption, kilogallons per sq. foot

Public Storage

0,0016

Average performance of competitors

0,0262

Percentage difference between companies

−94%

Waste, metric tons per sq. foot

Public Storage

0,0001

Average performance of competitors

0,0007

Percentage difference between companies

−86%

Inflationary matters

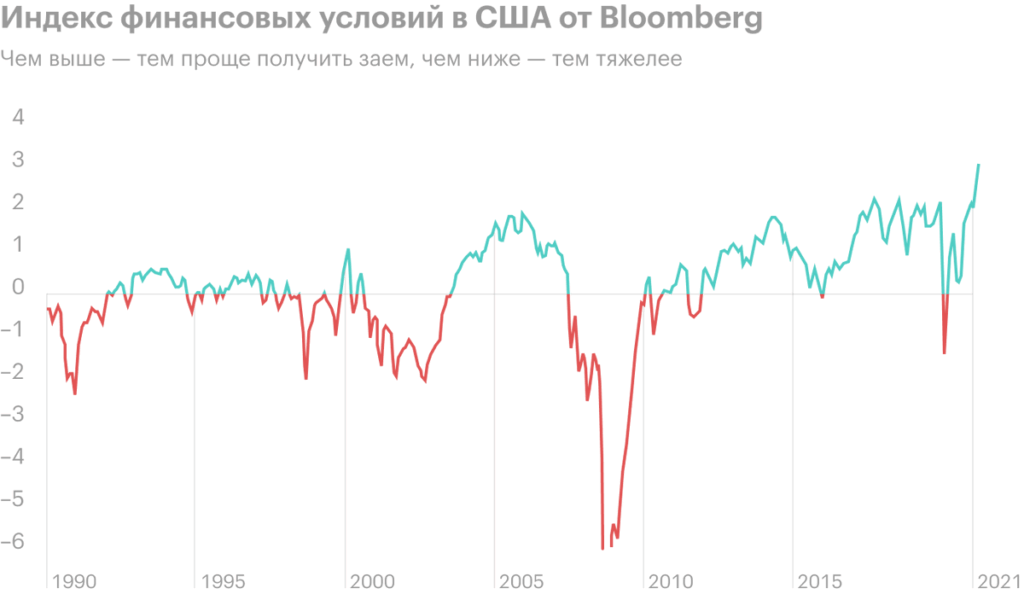

In the US, the time has come, when FED it's time to raise the key rate: inflation in the country has already risen. This can be a problem for a company for two reasons..

First: like many REITs, Public Storage is actively borrowing money. The total amount of the company's debts is 3.364 billion dollars with 159.6 million in the accounts. The growth of rates is equal to the rise in the cost of loans. US lending conditions are now extremely soft, and therefore any movement in the opposite direction is definitely not a plus for companies, who actively borrow money.

The second reason: rising rates will lead to an increase in bond yields. In this regard, the profitability 2,7% Public storage will look less attractive in the eyes of investors. So in this case, Public Storage shares may fall due to the exodus of passive income lovers into higher-yielding stocks.. Good news: no one has announced a rate hike yet, but it could come at any moment.

Resume

Public Storage is an interesting issuer, which shares can be taken, if you really want, "To make money work". However, problems should be kept in mind., which the company may face in the event of an increase in rates.