Violent advertising campaign funded by stock exchanges and professional participants is paying off.

According to the Ukrainian Association of Investment Business, on 1 January 2010 years in the country worked 985 Funds, whereas in 2004 year there were only 37. Management companies – OK – already 380, whereas in 2000 year there were only 45.

Net asset value, that is, the funds of the population and legal entities in the management of all Ukrainian unit investment funds are estimated at the level 82,5 billion hryvnia.

Moreover, on 1 January 2005 years in mutual funds were invested in total 1,9 billion hryvnia, то есть за пять лет инвестиции в stock market посредством ПИФов выросли в 42 Times! Not a bad result. What other sector of the economy in Ukraine has increased in size by 42 Times? Rhetorical question.

The industry of individual and collective investment is developing: people bring money to management companies, open brokerage accounts, buys shares.

And even scandals with the bankruptcy of a number of AMC, a fivefold fall in the market failed to discourage citizens from investing in the stock market. Need to mark, that the management of brokerage companies and mutual funds was insured: all investment agreements express risks, related to stock market trading.

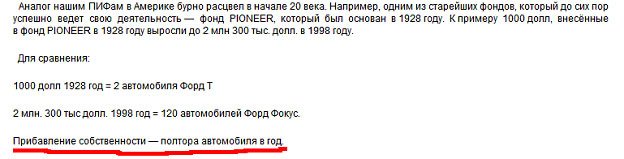

Дескать, asset value may decline, possible losses. However, what kind of investor would think about losses?, when he sees this text.

Who will refuse one and a half “Форд Фокусов” in year? By the way, according to sociologists, the level of financial literacy of Ukrainians is at a catastrophically low level. With such services, like ATM and plastic card, know how to use everything 30-40% граждан.

In this way, the field of activity for stock brokers and management companies is huge. 98% Ukrainians do not yet know about the pros and cons of investing in shares of Ukrainian and foreign companies, and they can continue to talk about “прибавлении” one and a half “Фокуса” in year.

The question arises: what are the advantages of investing?

The classic definition is: exchange investments – it is long term, больше года, investing in securities of public or private capital at home or abroad for the purpose of generating income.

There are two keywords here: “Long term” And “income generation”. Long-term investment means, that a person does not speculate, that is, short-term transactions, the risk of losing money for which is many times greater, and “income generation” – this is the purpose and essence of buying shares.

It is worth remembering here, how the mutual fund industry was born, which is now actively appealing to advertisements of management companies and brokers. Why the slogan “longevity is equal to income” works so effectively in the stock market?

If you do not take into account hoary antiquity, then the collective investment industry emerged and flourished in 1980 years in the USA. It was during this period that investments in stocks became truly massive..

Electronic exchange trading technologies, quotes in newspapers and magazines, telephone dealing with leading brokers, growth in the number of issuers – all this allowed every American housewife to get involved in investing.

Of course, it's not just about technology. The growing prosperity of the baby boomer generation also played a role., and advertising. However, this is not even the point. – a long period of growth in stock indices spoke for itself.

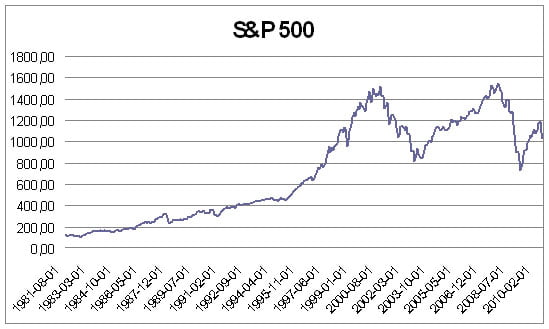

Broad Market Index S&P500 c 1980-2000 years grew eleven times, with 110 points to 1300. “Форды Фокусы” did triple every two years, and Americans felt the beauty of investing in their pocket. The apotheosis became, undoubtedly, dotcom bubble, burst in 2001 year.

Nevertheless, the system worked for twenty years in a row. Investors invested in stocks, shares rose in price, which attracted even more investors, which brought even more money. And so in a circle. Money was at the heart of this cycle, rather, their quantity and cost.

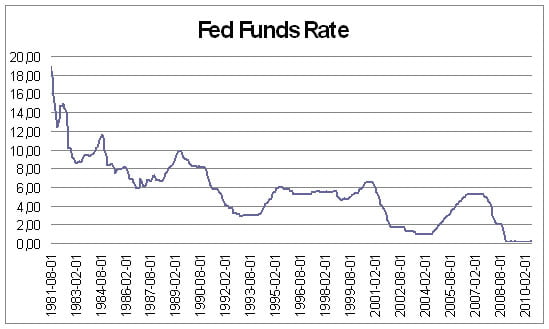

Как видно из графика процентной ставки FED, in 1981 year, the cost of capital in the United States was at its highest level in history – 19% per annum. Then the American monetary authorities began to consistently reduce the rate, bringing it down to today's zero values.

In other words, из года в год, except for a few short periods of rate hikes, borrowed capital in the USA became cheaper, loans became more and more affordable, up to that, that the use of leverage – purchase of shares for loans – became a massive phenomenon on American and European exchanges.

This is what ensured twenty years of growth in the stock market., the formation and flourishing of the mutual fund industry, massive influx of depositors.

It is easy to see the inverse correlation on the charts.: as soon as the US monetary authorities dared to raise the rate, stock market growth stopped, and the fall began. Wall Street aces pushed through another cycle of rate cuts, and growth in the stock market resumed.

It all worked until then, until the rates reach zero.

Already in the middle 2000 years owners and managers of multinational banks, analyzing the situation, understood, where the wind blows, and launched a new project to replace the collective investment industry.

If you can't make money on the rise in stock prices, you can earn on their fall. The so-called hedge funds appeared and became popular. The essence of their work – in the widespread use of financial derivatives, which allow you to earn both on growth, and on the fall of the market.

This is how the financial world entered an era of global volatility. – volatility, when the sharp rise, caused by politics “количественного смягчения” changes with an equally sharp drop. As it turned out, volatility can be successfully traded and earned on it, what hedge funds do.

Ukraine, normally, ended up on the sidelines of progress. While the civilized world is flying jet fighters – хеджевых фондах, domestic investors hobble in the rusty pennies of mutual funds. However, and mutual funds reached Kiev with a 25-year delay, and hedge funds – completely exotic for Ukraine.

Even 4% financially educated people don't understand, that global growth in stock exchanges is over forever. After that, how the fed dropped rates to zero, shares of companies around the world will never rise in price.

And if there is no such understanding, то управляющие компании и Brokers продолжат собирать свои комиссии за совершенно бессмысленное дело: long-term investing in stocks.