Restrictions will affect large companies, which store a large amount of user data, reports the Wall Street Journal. Beijing wants to introduce new rules before the end of the year, in the fourth quarter.

Last week, the agency responsible for cybersecurity has already approved two new requirements.. The first is to comply with national laws.. The second is to ensure data security in strategically important industries.: technologies, connection, finance, transport, energetics.

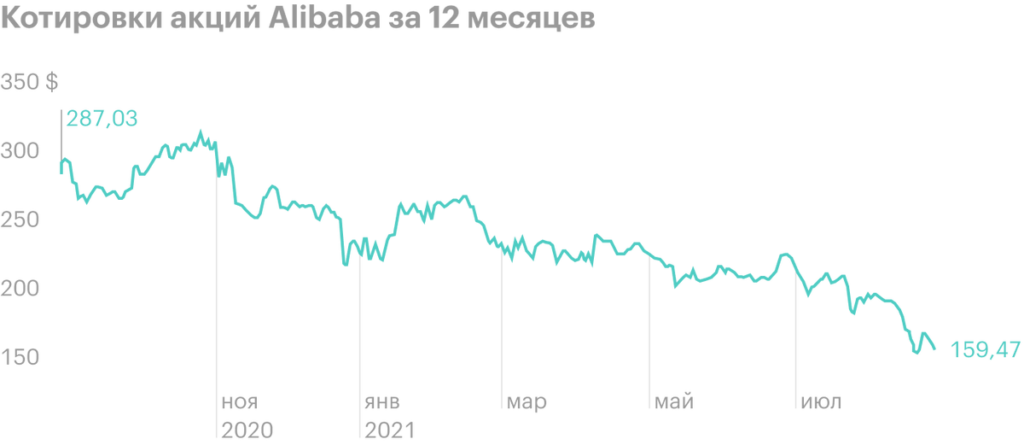

Now many Chinese companies, such as Alibaba or JD.com, enter the US stock exchange through offshore-registered subsidiaries. In this way, companies are out of the scope of national laws.. Now the government wants to close this loophole.

The American side makes similar demands. U.S. Securities and Exchange Commission Asks Chinese Companies to Notify Risks Before IPO, related to the ownership structure and possible intervention of regulators. And also follow American accounting standards. Otherwise, as reported in the commission, companies face delisting.

Professionals assess the prospects of Chinese companies differently. According to Mark Mobius, founder of Mobius Capital Partners, the actions of regulators allow investors to buy shares at low prices. “When companies, like Alibaba, fall on 30%, there is an opportunity to buy these companies, because the market reaction, maybe, was excessive ", Mobius said..

Ray Dalio has a similar position, which increased investment in China. Investors are wrong, when they call the actions of the Chinese authorities "anti-capitalist", says the managing director of Bridgewater Associates.

But Oxford economist George Magnus disagrees with Dalio.: "I think, Dalio is wrong. He has a big business in China., what else to say to him? So-called growth stocks will not and should not be traded as growth stocks., because they were politicized. Fall of Chinese stocks, which we have seen since February, sustainable. I do not think, that tech companies should be ranked as before ", Magnus added..