Hello, friends!

so, Let's see, what can we expect from currency wars in 2014 year. In this article we will try to understand, каким будет курс рубля 2014.

The situation in Russia is stable, although some consider such stability to be stagnation and degradation, but given the state of the global economy, it would be strange to expect prosperity, right? Nevertheless, the Ministry of Economy of the Russian Federation gives a positive forecast for the average annual ruble exchange rate., changing it from 33.9 to 33.4 ruble per dollar.

However, independent analysts predict less optimistic scenarios for the ruble.. Связано это с ростом импорта услуг на 20 billion dollars versus 2013 year, stagnation of oil and gas exports and a decrease in non-oil and gas exports by 9 billion. The balance of foreign trade in goods and services for 2013 год составило 177,3 billion dollars, что на 27,5 billion less than a year before. This has a negative effect on курс рубля 2014 of the year.

There is an increase in payments of investment income, процентов по обслуживанию внешнего долга. Based on the results of 2013 the balance of investment expenditures exceeded 60 billion. Dollars, and payments on them in the Russian Federation for the first time exceeded the bar in 100 billion dollars.

Important note, which directly affects the, каким будет курс рубля 2014.

Recently, information has been published in the media, that the Central Bank of Russia indicated that, that does not plan to maintain the ruble exchange rate in 2014 year. Very soon the Bank of Russia may abandon currency interventions, which will lead to a floating exchange rate. In my opinion, this may lead to increased volatility of the ruble against major currencies. — доллару, euros, фунту, franc and others. Так что россиянам следует быть готовым к такому сценарию.

Already with 13 January 2014 year, the Central Bank stopped foreign exchange interventions in order to, чтобы повысить гибкость курсообразования и перейти в 2015 year entirely on a floating exchange rate regime.

First Deputy Chairman of the Bank of Russia Ksenia Yudaeva said at a press conference, что ЦБ будет продолжать выходить из валютных интервенций и заниматься инфляцией.

That is, some analysts, based on these statements, draw conclusions about, that the dollar exchange rate 2014 year can reach 35 rubles. I think, that this is not the limit. Курс рубля 2014 year has every reason to decrease.

A deeper fall of the Russian ruble is very likely. Chief Economist of HSBC Bank Alexander Morozov sees the ruble against the dollar in the region 35,2 ruble., and Saxo Bank analysts — 36 rubles per dollar.

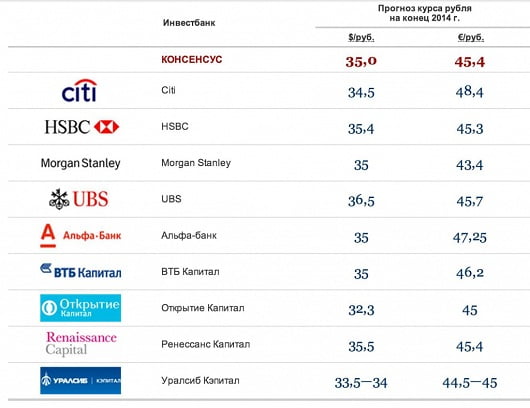

Let's see, what do leading analysts of some large banks think about the situation in the financial field of the Russian Federation.

Минэкономразвития РФ 33,9

Morgan Stanley 34

Alfa-Bank 35

HSBC 35,2

Saxo Bank 36

All in all, it makes sense to listen to the opinion of strategists and transfer part of the savings from rubles to dollars. The same applies to savings in euros., поскольку теже аналитики говорят о том, что курс евро на 2014 year (rather, his first half) will steadily decline. На графике ниже мжно видеть, what in 2012-2013 year, the ruble was quite stable in the corridor 27-34 ruble per dollar, and now the time has come, when the top bar, probably, will be broken.

I caught my eye and such information:

May God grant you health, at least until the next blog update