What taxes will you have to pay, investing in American stocks

From investment income, including investments in foreign securities, usually, have to pay taxes. How much do individual investors from Russia lose in taxes, playing on American securities through Russian brokers?

Income from investments in securities usually consists of two components - income from operations and fixed income (Dividends). The order of their taxation is different.

Transaction tax

Personal income tax is levied on income from transactions with foreign securities (personal income tax) according to Russian law, it is paid in Russia. The tax rate is 13%.

Tax on transactions in the Russian Federation is calculated using the FIFO method (FIFO — first in, first out). In this way, the first one sold is the first one bought stock. When calculating the financial result, the costs of commissions are deducted.

Lesion, received at the end of the year, can also be carried over to the following tax years.. This reduces future tax payments on transactions with securities.. But to exercise this right, you will have to fill out and submit your own tax return, attaching supporting documents (a statement of losses will provide broker). Lesion, received in the current tax period, can be carried forward into the future 10 years, following that tax period, in which it was received.

And does not matter, where the operations were carried out - on the "St. Petersburg Stock Exchange" (SPB) or on foreign exchanges through Russian brokers. With only one peculiarity - since foreign securities are denominated in the currency, in Russia, the income from their purchase and sale is calculated in ruble equivalent at the exchange rate of the Central Bank, valid on the second trading day after the date of the transaction (due to trading mode T + 2).

If you enter foreign markets or St. Petersburg through a Russian broker (conclude a brokerage agreement with him), then he becomes your tax agent, that is, it will be obliged to calculate and deduct tax from your income from securities transactions to the budget. But if you decide to become a client of a foreign intermediary and conclude a brokerage agreement with him directly, then you yourself will have to declare income and pay tax on them.

Foreign promotions, applying to SPB, can be purchased on an individual investment account (IIS), which means, tax benefits may apply to them - a deduction for the amount of the annual contribution up to 400 000 rub. or full exemption from taxation of income received on the account.

Tax on dividends

A different approach to taxes on income in the form of dividends. The rates apply to them, enshrined in an agreement on avoidance of double taxation between Russia and the United States, and this tax is paid to the US Internal Revenue Service (IRS).

Double taxation occurs then, when the investor is a resident of one country, but makes transactions with financial assets, who are registered in another country (being its non-resident). Then formally there is a need to pay tax in the country, where the issuer of the security is registered, and in the country of residence. It is to avoid such double taxation of income between some countries that the relevant treaties have been signed..

In the United States, the tax rate on dividends for individuals resident in the Russian Federation for almost all securities is 10%, but in some cases (REIT paper, allowing to invest in the real estate market) rate applies 30%. Yet 3% tax (in addition to 10%) the investor must transfer, submitting a declaration to the tax office.

A tax in this amount is levied on brokers, That, as well as FG BCS, provide individuals with direct access to US sites. The same applies to individuals., trading through SPB.

It is important to note, what if your broker enters American markets through a foreign broker, then he either needs the QI status (Qualified Intermediary), allowing your broker to calculate the necessary taxes on the income of their clients. Or between brokers there should be an exchange of information about, which clients and in what volume own shares, on which dividends came. If these conditions are not met, then dividends will be taxed at the rate, which applies to the jurisdiction of the broker, or at the highest possible rate (30%).

How to pay extra taxes on US stocks on the St. Petersburg Stock Exchange?

The default is 30% .0 If you signed the W8-BEN form, then you need to pay extra 3%, and if not signed, did not declare, then 30% ... and there is also a chance to receive a request from the tax office to pay more and 13%.

Brief instruction:

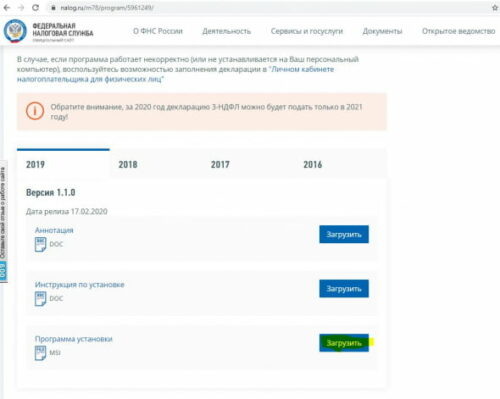

1. On the tax website we download the declaration program 2019 https://www.nalog.ru/rn77/program/5961249/:

2. Install on your computer.

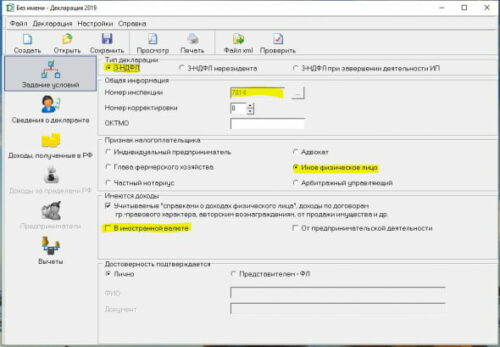

3. Launch and proceed to filling:

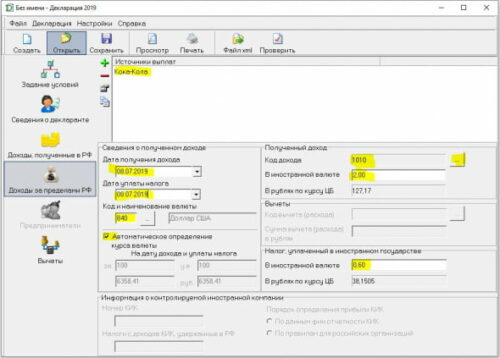

Be sure to check the box "In foreign currency"

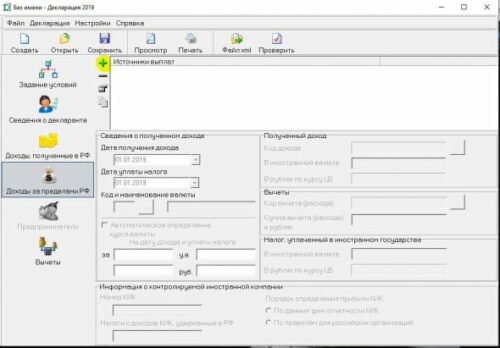

4. We proceed to filling in the data on dividends in the opened tab:

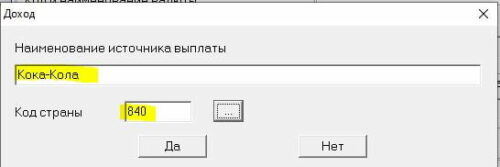

5. Click on “+” and fill in the data on the issuer

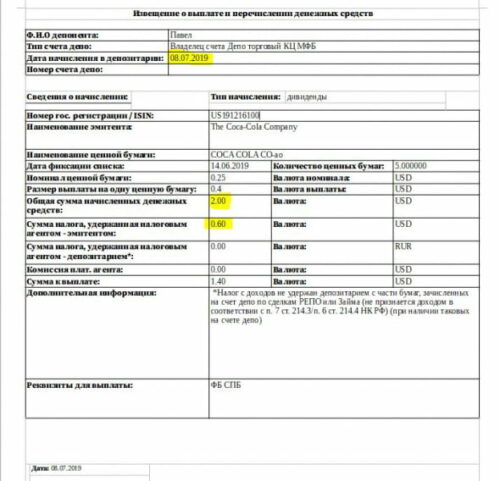

6. From reports, which the broker sends you, you need to take the following information:

I hope you haven't deleted them.!

7. We fill in the information from the brokerage report

We repeat the operation on the number of dividend accruals!

If you have deleted all broker reports, then you need to ask your depositary for a certificate of transfers. But she might be worth $$$

Frequently Asked Questions:

What tax is charged on dividends on American shares?

13%, if you sign Form W-8BEN.

30%, if not sign.

If I buy dollars on the exchange, and then I will withdraw them to the dollar card, need to pay tax?

Not, no need.

Why sign Form W-8BEN in your account?

Form W-8BEN must be signed, to save on taxes on US stock dividends. When you receive a dividend from a US company, USA deducts tax from you. If not sign the form, then they will withhold from the amount of dividends 30%.

The tax rate can be reduced, if you fill out Form W-8BEN. She will confirm, that you are not a US tax resident. Then the dividends will be written off 13%:

- 10% in favor of the USA - automatically;

- 3% in favor of Russia - you need to pay extra yourself.

You can download the W-8BEN form only in your personal account on the Tinkoff.ru website, there is no such function in the mobile application yet. If you want to download the tax form to your phone, open the link in a new tab in your mobile browser.

Form W-8BEN is valid 3 of the year. After that, you need to sign it again, if you want to lower the tax again.

The tax on income from the sale of shares after signing the form will remain the same - 13% in favor of Russia.

If you do not plan to receive a lot of dividends from foreign shares, you do not need to sign Form W-8BEN:

- US tax will automatically withhold 30% from your dividends on American securities;

- but you don't have to pay extra on your own 3% to the Russian tax.

Will I get a tax refund, already withheld at rate 30%, if i sign the form W8-BEN?

Not. Tax at a reduced rate will be withheld only on dividends, which will be paid after, how do you sign the form, upload it to your personal account, and the broker will check it - as a rule, it takes no more than two business days.

How long has a W8-BEN form been considered?

To 30 working days - this is due to, that in addition to the broker, the form is checked by the exchange. After the form is reviewed and accepted, in your personal account it will be written about the reduced tax.

If you bought shares for dividends, signed the form, and the closing of the register of shareholders occurred before the adoption of the form, tax will be withheld at full rate 30%.

How long is the dividend tax reduction valid after signing the W8-BEN form?

The signed form is valid 3 of the year. If you want to receive further tax reductions, will need to sign the form again.

The W8-BEN Agreement applies to all foreign stocks?

Not, there are two exceptions.

Foreign companies, registered outside the USA. Taxes on dividends on shares of such companies must be paid according to the laws of the country, in which they are released. For example, from dividends on Ferrari shares will be withheld 23% instead of 10+3%. Before, how to buy shares, check the tax policy of the issuing country. If they write off more 13%, then you do not need to pay anything in favor of the FTS.

Real estate investment funds. Or a REIT (Real Estate Investment Trust) – companies, who earn from construction, Renting, management and sale of real estate. To 100% REITs pay their profits to investors in the form of dividends even before the payment of income tax in the United States - therefore, in any case, they will be withheld from dividends on their shares 30% tax.

And if I made money on stocks from the London Stock Exchange, how will the tax be written off?

Depends on the source of income.

Sales income taxed 13% tax. The broker will deduct and pay this amount himself.

Income from dividends also taxed 13%. But the dividend amount will be credited to the account excluding tax. You will need to order a certificate of income from the broker, received from sources outside the Russian Federation, and pay the tax yourself.

This taxation applies to those shares, which are traded on the London Stock Exchange - LSE. That is, for GDR TCS Group (Tinkoff Bank Holder).

In what currency do I pay tax on foreign stocks and Eurobonds?

Always in rubles. Even if you received income in dollars, write off money from the ruble account, taking into account the course CB RF by currency on the dates of transactions.

If there is no money in the ruble account to write off the tax at the end of the year, send a notification or call, so that you replenish the account with rubles.

At the same time, you can refuse to replenish your account and pay the tax yourself through your personal account on the tax website or any service., which shows tax arrears.

The broker will transfer data on the debt to the tax office in March-April. You need to pay the debt for the last year before 1 December current.

What is the taxation for a coupon on Eurobonds??

13%. Tax agent for them broker, therefore tax will usually be debited automatically.

Do I need to pay tax, if I sold shares cheaper, than bought?

Yes, but only in one case, if you bought securities in foreign currency and the losses from the fall in their value were covered by an increase in the foreign exchange rate. Then in rubles when selling you will get more, what you spent when buying.

Income tax is calculated in rubles, even if you bought and sold securities from a dollar account without conversion. In this case, the course is taken to calculate CB on the dates of transactions.

The tax is rounded off and written off in rubles, no kopecks. To 49 kopecks rounding down, from 50 kopecks - in a large.

When the dollar was 50 R, you bought 1 share for 100 $. But when the dollar went up to 60 R, your share fell to 90 $ and you decided to sell it.

Here is how the tax will be calculated in this case: (sale amount − purchase commission − purchase amount − sale commission) × 13% = ((90 $ × 60 R) − (90 $ × 0,3% × 60 R) − (100 $ × 50 R) − (100 $ × 0,3% × 50 R)) × 13% = 48 R.