We are programmed to do so, to be idiot investors. But, what's worse, we don't get smarter because, that we read a lot, doing research and getting education.

In his book Thinking Fast and Slow, published in 2011 year, Nobel laureate in economics Daniel Kahneman showed, that even our knowledge of our own psychological weaknesses does not make us more effective investors. Furthermore – for the latest 30 years, the average annual profit of the average investor on the US stock exchanges amounted to only 3,7%. For comparison: annual profit of companies, included in the index S&P 500, over the same period amounted to 11,1%.

In many ways so “dim” indicators are explained by our own behavior. We are born with a desire to avoid risks. This leads to the fact, that we are giving up profitable opportunities, to avoid the likelihood of losses. Kahneman discovered, that the pain of loss is experienced in two, or even three times sharper, rather than the joy of making a profit.

Probably, this explains the fact, what's all 8% Australians are considered stock market the best place to place your savings, compared to 26%, who prefer real estate, And 33%, preferring cash. Stocks are less popular now, than in recent decades, despite, what is it in the long run – most profitable investment assets.

Fear of loss is compounded by the recent past. The global financial crisis is still fresh in the memory, therefore the stock market seems like a risky place to invest, despite a long history of consistent profitability.

Besides, we are too confident in our own abilities, what makes us trade more and more, instead of using the strategy “Install and forget” (set-and-forget strategy), which helps to reduce travel costs and reduce stress levels.

When we do manage to make money in the markets, we tend to attribute profits to our own “skills”, and write off losses to “bad luck”. It makes us believe, that we have more control over short-term investment results, than in reality.

We also have a tendency to, to follow popular trends. This herd mentality can cause bubbles in the markets, that harm both individuals, and whole countries.

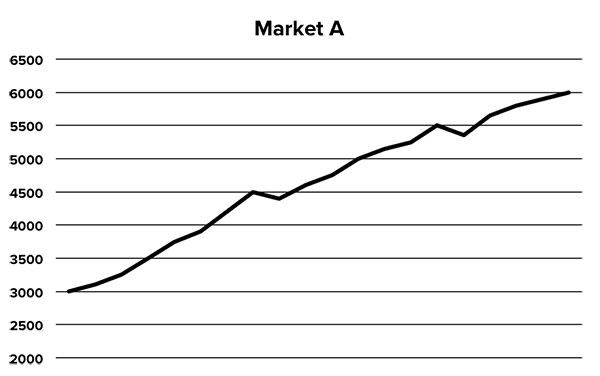

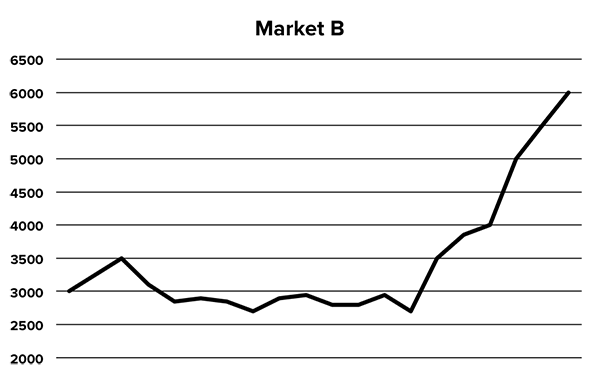

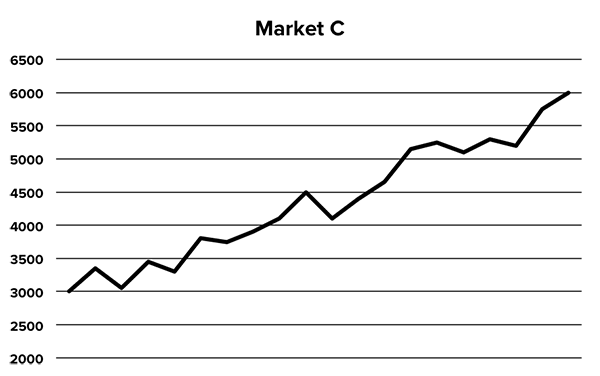

Look at three images, given below. Which of these 5-year markets would you like to invest in at different intervals each year?, if you are going “take out” your money no earlier than 5 years from now?

If you have made a choice in favor of market A, they ended up in the majority. Least of votes, usually, gets market B. but, surprisingly, it is market B that gives the highest profit, and market A – the smallest.

main reason, for which market B shows the best performance, is that, what “bumpy markets” actually work in your favor, because they give investors the opportunity to buy “on the groin”.

That's why, if you are going to invest in a measured and sustainable way, and do not plan to touch a significant part of the portfolio for many years, you can ignore short-term market movements and just stick to the chosen plan. History tells us, that investors are doing best then, when they invest in a well-diversified portfolio, wait out volatility and mitigate risks.

Next time, when you want to include financial news, to listen to speculations about investment, better switch to History channels, Sport или Discovery.

author: Chris Brycki, founder of Stockspot.

A source: (Australia). http://superinvestor.ru/archives/14124