The largest company in the healthcare sector Johnson & Johnson (NYSE: JNJ) published a report for the second quarter of 2021:

- revenue increased by 27,1%, up to $23.3 billion;

- operating sales excluding exchange rates increased by 23%;

- net profit increased by 73,1%, up to 6.3 billion;

- net margin increased from 19.8 to 26,9%;

- adjusted net income increased by 49%, up to 6.6 billion;

- adjusted net margin increased from 24.2 to 28,4%.

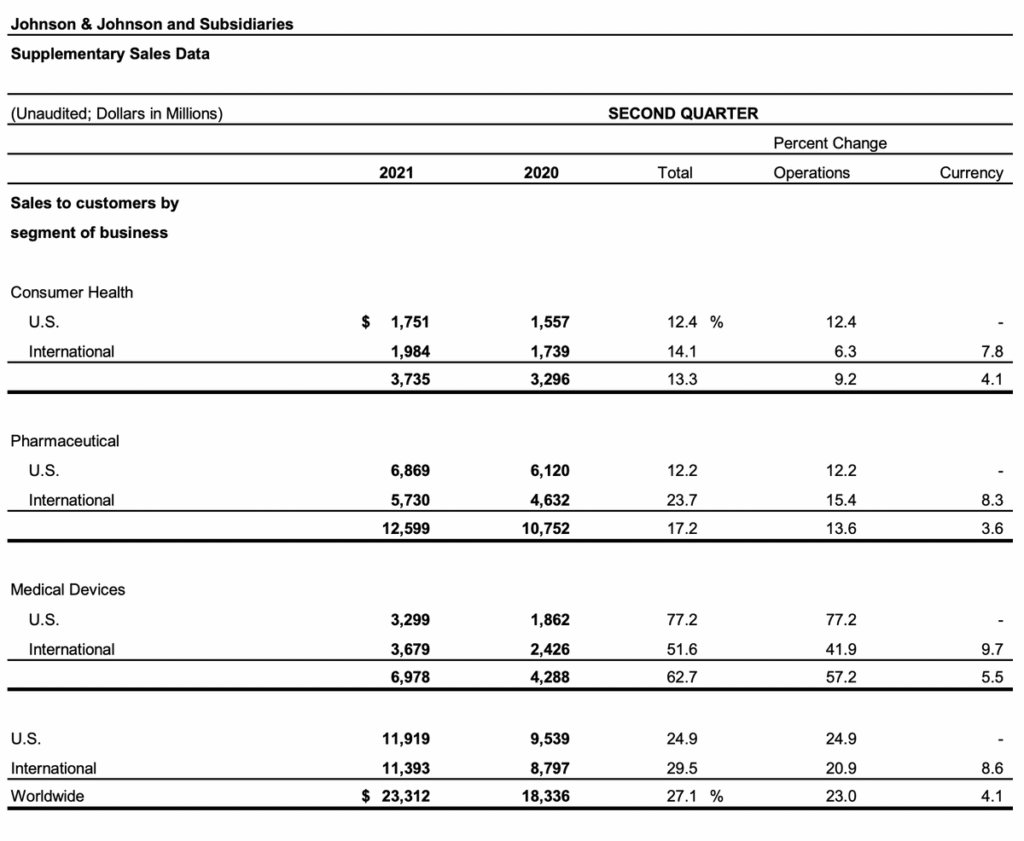

By region

The company divides sales by two regions: U.S. and other countries.

USA (U. S.) — 51%. Revenue increased by 24,9%, up to 11.9 billion.

Other countries (International) — 49%. Revenue increased by 29,5%, up to 11.4 billion. Of them 20,9% — operating sales, 8,6% - the influence of the exchange rate.

By segment

The company has three operating segments: consumer goods, pharmaceuticals and medical devices.

Consumer goods (Consumer Health) — 16%. Revenue increased by 13,3%, up to 3.7 billion. Consumer Healthcare Market Continues to Recover After COVID-19 Negative Impact. Increased sales of skin care products, cosmetics and over-the-counter drugs.

Pharmaceutics (Pharmaceutical) — 54%. Revenue increased by 17,2%, up to 12.6 billion. Sales of drugs for the treatment of psoriasis increased, myeloma and cancer.

Medical devices (Medical Devices) — 30%. Revenue increased by 62,7%, up to 7 billion. Sales in this segment grew the most. A year ago, in the midst of a pandemic, Medical centers refurbished to deal with coronavirus. Non-urgent operations postponed, so the demand for equipment fell. Now, when the number of new cases of COVID-19 infections decreased, medical facilities are returning to their daily operations.

Forecast

The company raised its expectations for 2021 revenue growth and adjusted EPS.

Revenue:

- It was: 9,7—10,9%, up to 90.6-91.6 billion;

- Became: 10,5—11,5%, up to 91.3-92.1 billion;

- including vaccine: 13,5—14,5%, up to 93.8-94.6 billion.

Adjusted net earnings per share:

- It was: 17,3—19,2%, to 9.42-9.57 $;

- including vaccine: 19,6—20,8%, to 9.6-9.7 $.

According to Johnson & Johnson, COVID-19 vaccine sales to be $ 2.5 billion. Excluding vaccine, core business could grow by 11%. It's a lot, because over the past five years, the company's revenue has grown on average by 3,4% in year.

Annual revenue of the company, million dollars

| 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|

| Revenue | 71 890 | 76 450 | 81 581 | 82 059 | 82 584 |

| The change | 2,6% | 6,3% | 6,7% | 0,6% | 0,6% |

Revenue

2016

71 890

2017

76 450

2018

81 581

2019

82 059

2020

82 584

The change

2016

2,6%

2017

6,3%

2018

6,7%

2019

0,6%

2020

0,6%

Legal fees

At the end of June Johnson & Johnson entered into a settlement agreement with the court of New York. The company agreed to pay 230-260 million compensation, to stay out of opioid proceedings. As they said in J&J, fine is part of a global agreement. In October 2020, the company promised to pay 5 billion in compensation, if the states and municipalities stop prosecuting her.

Half a million people have died from opioids in the US since 1999.. The government blamed drug manufacturers and distributors for everything, and the courts registered three thousand lawsuits. Later J&J, McKesson, Cardinal Health and AmerisourceBergen ordered to pay fines totaling $26 billion. If the authorities change their minds, the amount of compensation may grow.

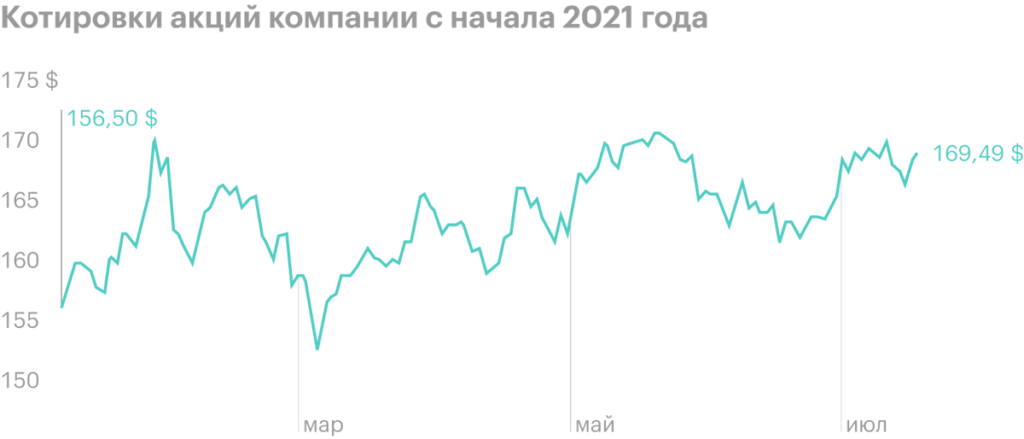

Shares and dividends

In the second quarter, the company's free cash flow was 8 billion. Of these, 2.8 billion, or 35%, spent on dividends. Johnson & Johnson 59 increases dividends for years in a row and is included in the list of dividend aristocrats. Годовая доходность — 2,5%.

Since the beginning of the year, the company's shares have grown by 8,3%, to 169,5 $. According to analysts' forecasts, in the following 12 months, securities can add another 10,6% and grow to 187,4 $.