28 April, another subsidiary of AFK Sistema, the timber holding Segezha Group, plans to conduct an IPO on the Moscow Exchange.

About company

Segezha Group (MCX: SGZH) is a large vertically integrated timber industry holding. Main directions of activity: paper production, Packaging, Plywood, Lumber.

The company's assets and representative offices are located in six regions of Russia and ten foreign countries. The history of the company began in 2014 year, when AFK Sistema bought Investlesprom. IN 2015 year, during the rebranding, the company acquired its current name. The company's business consists of four operating segments.

Paper and packaging. The company produces sack paper and parchment at its pulp and paper mills in the city of Segezha, Republic of Karelia, and in the city of Sokol, Vologda Region. Produces paper packaging for building materials, chemical and food industry products, paper bags and packages for retail consumers. Packaging is produced as in Russia, and in seven foreign countries: Germany, Denmark, The Netherlands, Of Italy, Czech republic, Turkey, Romania.

Forest resources and woodworking. The company harvests timber and produces lumber, pellets - fuel pellets, as well as a by-product of production - technological chips. Production is available in all regions of presence: the city of Lesosibirsk, Krasnoyarsk Territory, Segezhe, Falcon, as well as the city of Onega in the Arkhangelsk region and the city of Kostomuksha in the Republic of Karelia.

Plywood and boards. The company produces birch plywood at its Vyatka Plywood Mill in the city of Kirov, Kirov Region, and fibreboard (Fiberboard) in Lesosibirsk.

KDK and house kits. At the production site in the city of Sokol, the company produces glued wooden structures (CDC) and house kits, in particular CLT panels, they are multilayer glued wood panels, which are used for faster individual housing construction.

Production volumes

| Paper, thousand tons | Package, million pieces | Plywood, thousand m³ | Lumber, thousand m³ | CDC, thousand m³ | House kits, thousand m³ | |

|---|---|---|---|---|---|---|

| 2016 | 170 | 1270 | 92 | 912 | 23 | 30 |

| 2017 | 204 | 1191 | 95 | 894 | 44 | 18 |

| 2018 | 244 | 1284 | 120 | 931 | 51 | 26 |

| 2019 | 254 | 1238 | 182 | 1005 | 55 | 28 |

| 2020 | 289 | 1301 | 186 | 1217 | 38 | 19 |

One of the leaders in the global timber industry

In its information memorandum, Segezha cites data from industry research companies Fisher International and Vision Hunters.. According to these companies, Segezha is one of the leaders in the Russian and global timber industry in terms of production capacity in several segments at once:

- second place in the world and first in Russia in the production of sack paper;

- second place in the world and first in Russia in the production of paper bags and bags;

- first place in Russia in the production of sawn timber;

- fifth place in the world and third in Russia in the production of birch plywood;

- first place in Russia in the production of CDC and CLT panels.

At the same time, the company is very competitive in terms of production costs.. She is helped in this as a business model with vertical integration., and high availability of relatively cheap raw materials.

Russia is the largest country in the world by area with vast expanses, occupied by the forest, mostly valuable conifers. Segezha in use 8,1 million hectares of forest fund in long-term lease under contracts up to 49 years, and further 1,1 million hectares will be available under the Priority Investment Project Facility.

Segezha does not rest on the laurels of low production costs and is very actively expanding and modernizing production. 25 February, the company launched the first large-scale production of CLT panels in Russia in the city of Sokol, Vologda Region, builds a plywood plant in the city of Galich, Kostroma region, creates a new production of paper packaging in the city of Lobnya, Moscow Region, modernizes Segezha Pulp and Paper Mill, increases production capacity in Lesosibirsk. The plans also include the modernization of other plants of the group and very large-scale investments in the new plant "Segezha West", which can add from 850 thousand to 1,5 million tons of produced pulp and paper products per year.

The company also buys existing production facilities: at the beginning 2020 sawn lumber manufacturer Karelian Wood Company was bought from the Finnish company Pin Arctic Oy, located in the city of Kostomuksha in the Republic of Karelia.

Naturally, such large-scale investments are quite expensive for the company: the approved business plan for 2021-2025 assumes a capital expenditure of 23 billion rubles. And the total investment in Segezha West is estimated at 150 billion rubles. Since the establishment of the company, AFK Sistema has invested 49 billion rubles in the development of Segezha Group.

The cost of a cubic meter of material for the fourth quarter 2020 of the year

| Coniferous forest | Pilomateryls | |

|---|---|---|

| Segezha Group | 34 $ | 110 $ |

| USA | 60 $ | 195 $ |

| Canada | 65 $ | 215 $ |

| Sweden | 75 $ | 226 $ |

| Germany | 80 $ | 240 $ |

| Finland | 96 $ | 260 $ |

Cost per cubic meter of birch plywood for the fourth quarter 2020 of the year

| Segezha Group | 265 € |

| New Russian enterprises | 311 € |

| Old Russian enterprises | 348 € |

| Baltic companies | 450 € |

| Finnish enterprises | 472 € |

Forest volume by country, percent of global volume

| Russia | 20 |

| Brazil | 12 |

| Canada | 9 |

| USA | 8 |

| China | 5 |

Financial indicators

The company's revenue is constantly growing. More than half of the revenue comes from the paper and packaging operating segment, about a third - "forest resources and woodworking".

Segezha has excellent revenue diversification: products are sold in more than 100 countries of the world, the main part of the revenue is foreign exchange. Net income is quite volatile, but this is largely influenced by exchange rate differences. Net debt is growing at about the same pace, as well as revenue.

Financial performance of the company, billion rubles

| Revenue | Net profit | net debt | |

|---|---|---|---|

| 2016 | 42,8 | 1,7 | 23,9 |

| 2017 | 43,7 | 0,1 | 33,6 |

| 2018 | 57,9 | −0,02 | 38,5 |

| 2019 | 58,5 | 4,8 | 39,3 |

| 2020 | 69,0 | −1,3 | 49,2 |

| 2021 | 18,2 | 2,4 | 56,7 |

Share of foreign exchange earnings

| 2016 | 62,0% |

| 2017 | 71,6% |

| 2018 | 75,0% |

| 2019 | 73,9% |

| 2020 | 70,8% |

Structure of revenue by operating segments in 2020 year, billion rubles

| Paper and packaging | 35,7 |

| Forest resources and woodworking | 19,2 |

| Plywood and boards | 7,7 |

| Other | 6,5 |

Structure of revenue by regions in 2020 year

| Europe | 31,6% |

| Russia | 28,0% |

| Asia | 23,6% |

| Middle East and North Africa | 9,9% |

| Other | 6,9% |

Share capital

Prior to the IPO, AFK Sistema owns a huge share of shares, practically all the rest - with the top management of the company. After the IPO, AFK Sistema will remain the main shareholder with a controlling stake.

Shareholding structure before IPO

| Sistema JSFC | 96,8% |

| CEO Mikhail Shamolin | 2,9% |

| Chairman of the Board of Directors Ali Uzdenov | 0,22% |

| JSC "Region" | 0,08% |

Actions ahead of the IPO

In February, the company carried out an additional share issue, doubling the authorized capital, then approved the dividend policy, within which plans to pay dividends at least once a year. In 2021-2023, it is planned to pay 3-5.5 billion rubles a year, and with 2024 switch to paying dividends in the amount of 75-100% of adjusted free cash flow.

Segezha announced a preliminary price range of 7.75-10.25 R per share, at the same time plans to place new shares in the amount of 32,4% from previously placed ones and get at least 30 billion rubles. In this way, the company will be valued at 122.5-152.4 billion rubles.

Important, that the shares will be sold by the company itself, and the proceeds are planned to be used to invest in production and reduce the debt burden. Besides, AFK Sistema will have option for additional placement of secondary shares in the amount 15% from the initial offering of shares by the company.

Since the order book is completely covered even with the additional placement option, placement at the upper end of the price range can be expected.

Why stocks may go up after an IPO

Growing company with a good position in the industry. Segezha is actively increasing production, and with it the revenue grows.. Low costs, good diversification by country of sale, operating segments and leadership in many of them make the company stable in case of some local problems of individual countries and segments. And a significant percentage of foreign exchange earnings protects the company from the negative consequences of a possible devaluation of the ruble.

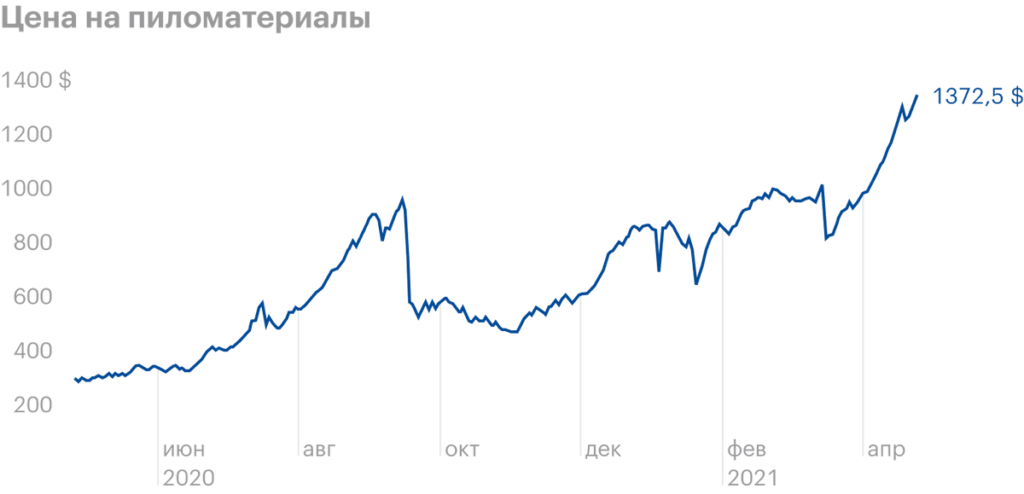

Good conjuncture and long-term trends. Segezha Benefits From Short-term Good Market Conditions - Rising Commodity Prices. Long-term plastic-free trends have also benefited more sustainable paper packaging., The growing popularity of online orders with delivery also played into the hands. Maybe, the company will also be helped by the introduction of 1 January 2022 a ban on the export of unprocessed timber from Russia, due to which prices may rise even more, and competitors will have to invest more in production.

ESG popularity. In recent years, many investors, including institutional, think about ethical investment, and this movement is gaining and gaining momentum. You can read more about ESG in the article by Mikhail Gorodilov.

Segezha should benefit from this, as it can interest investors with its success in this area: Forbes and RAEX-Europe included the company in their ratings as one of the leading environmentally responsible Russian companies. And Segezha does not stop there: 31 March the company approved the strategy and policy in the field of sustainable development, and announced in April, that its subsidiary in Denmark now consumes exclusively clean energy, made from the wind.

Dividends and dividend policy. The company has been paying dividends in recent years and plans to continue, also adopting a dividend policy. Given that, that the controlling shareholder, AFK Sistema, needs money to service its large debt, Segezha is unlikely to refuse to pay dividends.

Demand for different types of paper, million tons

| Multilayer flexible bag | Multilayer flat bag | Packaging craft | |

|---|---|---|---|

| 2015 | 2,6 | 1,5 | 7,5 |

| 2019 | 2,8 | 1,3 | 8,5 |

| 2025 | 3,4 | 1,4 | 10,9 |

Product Demand, million cubic meters

| Birch plywood | Lumber | |

|---|---|---|

| 2015 | 4,2 | 322 |

| 2020 | 5,0 | 364 |

| 2025 | 5,6 | 396 |

Dividends, billion rubles

| 2018 | 1,5 |

| 2019 | 3,8 |

| 2020 | 4,5 |

Why stocks may fall after an IPO

Not cheap estimate. There is some difficulty in comparing Segezha ratings with competitors: there are no public Russian companies in this area, and those foreign competitors, which are public, generally less diversified across operating segments.

Besides 2020 Segezha's year is unprofitable, so the multiplier P / E don't count. Let's try to compare the company with competitors by the multiplier P / S: у Mondi Group, world leader in paper and packaging, the value is 1,6, and from the American packaging manufacturer WestRock - 0,8, Segezha has 1.8-2.2. Looks at least expensive.

Big debt load. Large-scale investment in its development has a minus: Segezha has a big one, and by the standards of Russian public companies, even a rather large debt load. In recent years, she has been around 2,8 on the multiplier Net debt / OIBDA.

And debts must not only be repaid, but also serve: in recent years, Segezha takes about 3,5 billion rubles per year for interest expenses. Moreover, as in Russia, Inflation has also increased in the world - this puts on the agenda of world central banks the question of a possible increase in key rates, what, in its turn, can increase the cost of debt service. Truth, the company plans to reduce the debt burden at the expense of part of the money, attracted by IPO, - it can make the problem less acute.

Not everything is clear with dividends. If we take the estimates of the company itself in terms of the estimated capitalization and the amount of dividends in the coming years, then the dividend yield will be 2-4%, which is rather modest by Russian standards.

Cartoon Net debt / OIBDA

| 2016 | 2,7 |

| 2017 | 4,6 |

| 2018 | 2,9 |

| 2019 | 2,8 |

| 2020 | 2,8 |

| 2021 | 3,1 |

Inflation in Russia and the USA

| Russia | USA | |

|---|---|---|

| October 2020 | 3,99% | 1,2% |

| November 2020 | 4,42% | 1,2% |

| December 2020 | 4,91% | 1,4% |

| January 2021 | 5,19% | 1,4% |

| February 2021 | 5,67% | 1,7% |

| March 2021 | 5,79% | 2,6% |

Eventually

Segezha Group is a large dynamically developing timber industry holding. The company is well diversified by operating segments and markets. A significant share of the company's revenue in foreign currency, she is actively expanding production, trying to be on the wave of so popular now ESG, pays dividends.

All this makes the company quite interesting for investment., but an expensive appraisal and rather big debts must be taken into account by investors as for the final investment decision, and to find a possible suitable entry point.