GitLab is on the stock exchange this week (NASDAQ: GTLB). In this material we decided to look, whether it deserves the attention of investors.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

What do they earn

The main source of information about the company for us will be its registration prospectus.

GitLab is a web application for collaborative development. The company operates on a freemium model.: some of the functions are available for free, but more advanced versions cost money. Premium version costs 19 $ per month per user, and the coolest version of the application - Ultimate - costs 99 $ per month.

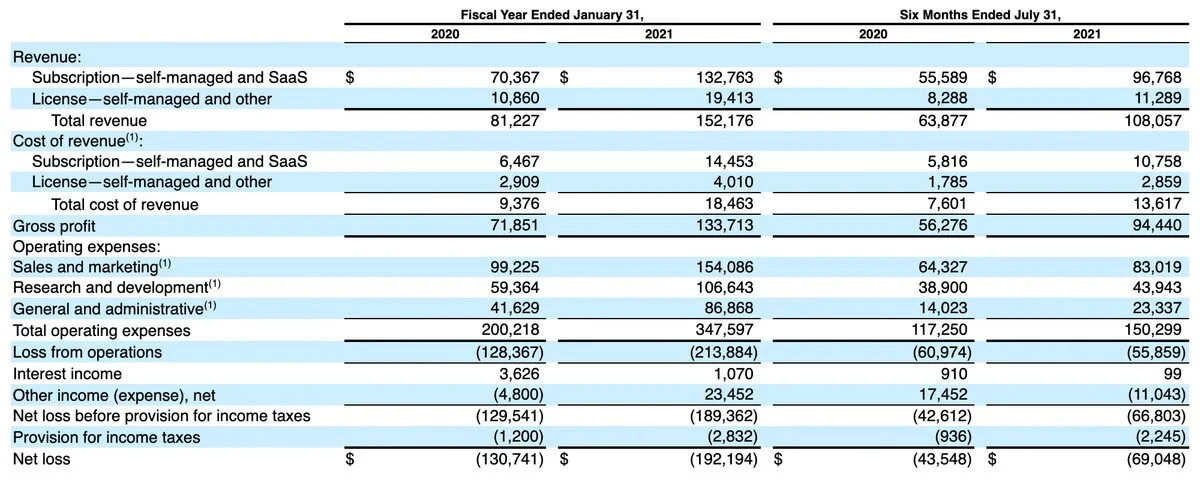

The company's revenue is divided into the following segments:

- Subscription - 89,55%. Regular customer fees for using the company's software. Segment gross margin — 88,89% from its proceeds.

- Licensing and more 10,45%. This is the sale of the rights to use the company's software to its customers.. It also includes revenue from professional services., which the company provides to its clients. Segment gross margin — 74,63% from its proceeds.

Clients come to the company from a variety of industries: business services - ContextLogic and Salesforce, finance - UBS, consulting - IHS Markit, defense - General Dynamics, industry - Rockwell Automation and Siemens, media - Pearson, telecommunications - T-Mobile, abstruse scientific institutions - CERN, cybersecurity - Fortinet and KnowBe4 and so on.

Revenue of the company by regions based on the results of the half-year:

- USA - 83,77%.

- Europe - 14,31%.

- Asian-Pacific area - 1,92%.

Among IT startups, profitability is considered a sin, which explains the chronic loss of GitLab: following the first 6 Months 2021 the total margin was -63.89% of revenue.

will take off?

There is some reason to hope for success as an IPO, and the company itself in the long run.

Gross margin is high. Let's start with this, that the company has a very high gross margin — 88%. The big plus of GitLab is the extremely high level of revenue retention.: he makes up 152% - this means, that from the existing user base it extracts so much money, that this allows her to more than compensate for the departure of paid subscribers. One day the moment will come, When can a company start cutting sales costs?, eating most of the money now, and turn a profit.

Perspectives. The company's business looks quite promising. GitLab is favored by several circumstances.

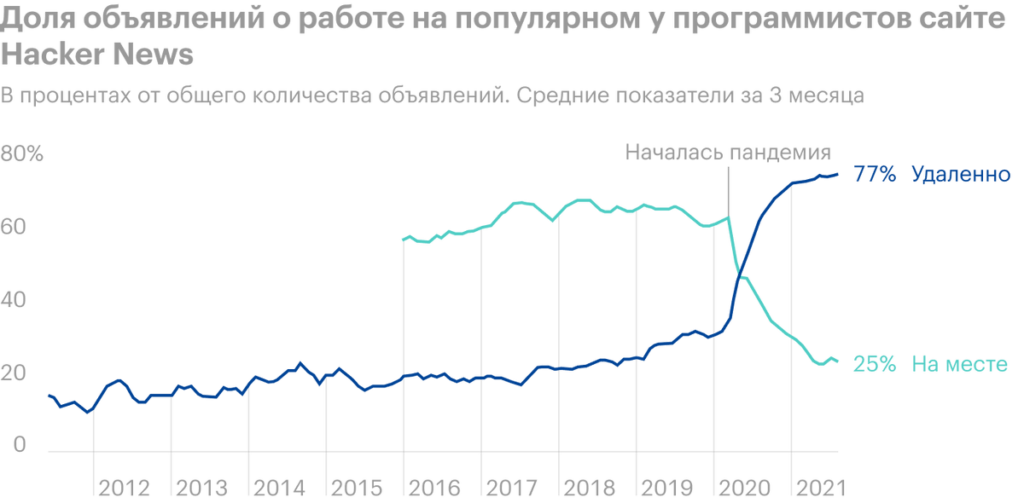

The rapid spread of remote work has sharply actualized the issue of transferring a significant part of the operations of various industries online - this allows us to hope for a load of programmers, who will actively use the company's software. In a sense, digitalization was actively going on even before the pandemic., but now this process is being accelerated by both companies, as well as states.

By the way,, from the very beginning of work, the entire GitLab staff has been working remotely - and, don't be unprofitable, I would even say, that GitLab exemplifies the benefits of digitalization.

We can also expect a significant increase in investments of various enterprises in IT: to improve the efficiency of your business. For example, in the real sector. Right now the conditions are right for that.: On the one side, companies have a lot of money and orders, on the other hand, the lack of resources and the high cost of labor force the corporate sector to look for long-term solutions. Basically, this will also apply to the service sector, where many businesses suffer from labor shortages.

For American enterprises, this will be a continuation of historical traditions.: investing in new equipment and technology for decades, they significantly increased productivity and the ability to get more out of available resources, happily avoiding the need to seriously increase wages.

GitLab itself offers examples in its prospectus of how, How its software is used by its customers across a wide range of industries. It should be noted, that all these examples boil down to, as a customer, using GitLab software, developed an application or their complex, which allowed him to squeeze more out of existing capacities.

So GitLab, let it not be too obvious, stands at the forefront of automation.

<p><img class="aligncenter" src="https://daytradergt.com/wp-content/uploads/2021/10/4e5cc8b3df88e86a841b00d47d697a38.png" alt="IPO GitLab: как устроен бизнес компании, стоит ли инвестировать в акции" /></p>

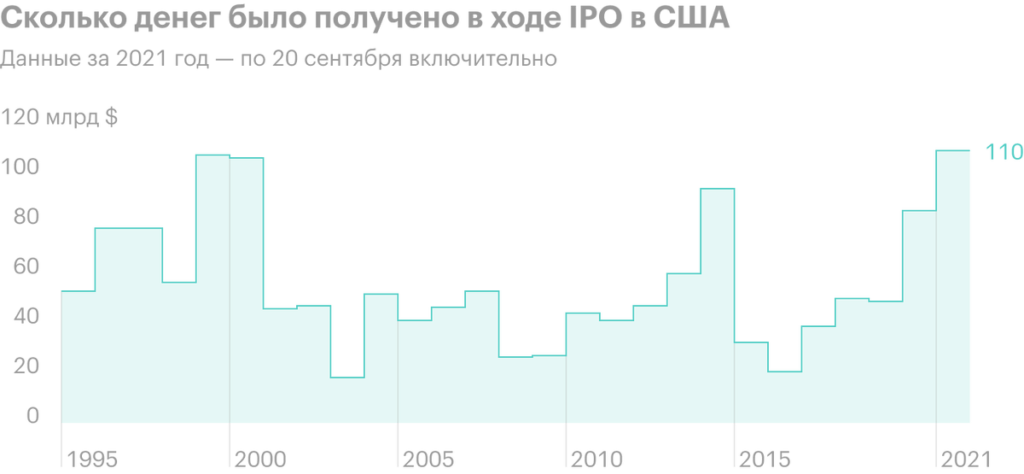

IPO, traditions and banks. The company conducts a traditional IPO, and its underwriters are Goldman Sachs, J. P. Morgan and other large banks. Considering, that now methods of entering the stock exchange bypassing banks like DPO are popular among companies, investment banks-underwriters are interested in, so that such a large IPO goes well and shares grow. This means, that they are probably already calling their customers, offering them a "promising emerging startup". Basically, now is a very good time to go public, as evidenced by the statistics on IPO in the US.

Won't take off?

<

p class=’paragraph’>But GitLab has weaknesses, which must be said.

well very overrated. With an expected share price in the range of 55-60 $ the company claims to capitalize about 9 billion dollars is about 41 annual revenue, which is unrealistically high even by the standards of the overvalued technology sector. Good, that the company is at least unprofitable: otherwise one would have to worry about her P / E!

GitLab itself estimates the size of its target market in the area 40 billion dollars. Occupying on it approximately 0,54%, the company already at the start claims to, to cost like 22,5% from him. Basically, this is a standard IT scheme, but in conjunction with the loss of the company, it seems to me, this predisposes to price volatility.

However, unprofitable and overvalued IT issuers Freshworks and Toast quite successfully performed at the IPO: their quotes have gone up. GitLab, as a company of similar size, may well achieve results at least not worse.

Avaricious users. It is also worth considering the possibility, that the gallant growth rate of GitLab's revenue will stumble over the company's transition to an alternative work system. Until recently, the company also had a third, the cheapest, "Bronze" subscription level - 4 $. In the first half of the year 2021 of the year "bronze" subscribers gave 11% GitLab revenue - and no guarantee, that they will all move to more expensive levels, instead of being satisfied with the free option. If GitLab Ceases to Show Brave Revenue Growth, then the shares will “roll like a sausage along Malaya Spasskaya”.

"To whom the mare is the bride". Every loss-making IT company hopes to find a Prince Charming, who will buy it, solving all financial problems. A similar company GitHub was bought by Microsoft in 2020 year over 7,5 billion dollars. I do not think, that someone will buy GitLab at a significant premium to its starting price. Although I wouldn't rule it out completely..

Unequal opportunities. Competition with the mentioned GitHub will slow down the transformation of the company into a profitable enterprise. Analysts usually point to the similarity of proposals, but I see the main problem, that behind GitHub stands a super-profitable and marginal Microsoft with practically bottomless pockets. Bill Gates Corporation can afford to spend money on GitHub extension.

There is nothing behind GitLab yet, except for her arrogance. Worst of all, I think, that GitLab will aggressively expand through both loans, and the issuance of new shares - the first is bad by default in anticipation of an increase in the price of loans, the second, in theory, may not affect quotes in the best way, especially if there is not enough demand for these shares.

Class struggle. The company will have 2 class of shares - A and B. Class A shares give a vote per share, Class B shares give 10 of votes. How do you understand, class B shares are owned by the current owners of the company and their very existence is arranged in order to, so that the owners of the company can dictate their will to other investors. Maybe, it will backfire: for example, the company may refuse to sell and decide to expand independently, up to bankruptcy.

Resume

The company looks prohibitively expensive. This, however, doesn't mean, that its IPO will fail: quite possible, that investors will buy into the bright cover and growth prospects. But I would only take these stocks after a fairly serious correction.. I understand, that such a correction may never happen, but take shares of a loss-making startup at the price of a normal one, I don't want a successful business. But I repeat, that the GitLab IPO may well be successful - and primarily due to the interest of underwriting banks.