Now we have a very speculative thought: take securities of the QuantumScape organization (NYSE: QS), who are engaged in R&D in the field of batteries for electric vehicles, to earn income on the hype in this area.

Growth potential and duration : thirty percent for 16 Months; 117% four years; 395% ten years.

Why stocks can go up: sick noise is organized around the topic of electric vehicles.

How do we act: we take at the moment 23,03 $.

No guarantees

If you want to be the first to know, did the investment work?, subscribe: how will it become clear, we will inform.

And what is there with the author's forecasts

What the company makes money on

On nothing. The company has no revenue. It is doing R&D in electric car charging and is threatening to make a solid-state battery., which will charge faster and last longer. Batteries are scheduled to start somewhere in 2025.

It makes no sense to analyze the company's financial statements from a monetary point of view.: only the scientific and techno side for those, who might be intrigued by this. The company can be considered unprofitable: it has no revenue from the sale of products and services and is engaged only in R&D.

Arguments in favor of the company

Fallen - buy. Since the peak in December 2020, the stock has lost about 80% prices. In other words, here you can take it just in the hope of a rebound. And why can you pin hopes on a rebound, we'll figure it out below.

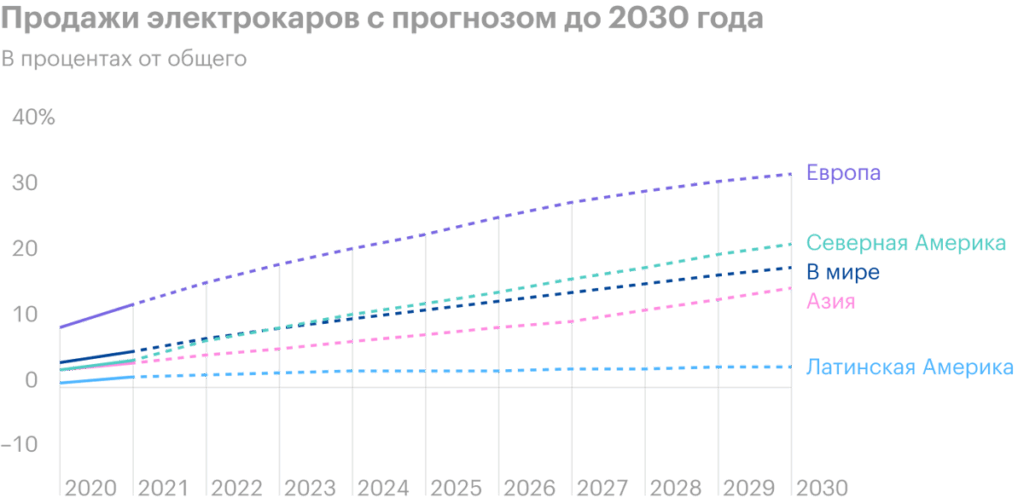

Exchange solipsism. Countries and big funds have made a sick noise about the electrification of transport. We studied this area in detail in the Tesla review.. QS here will definitely get quite the attention of financiers, as the company is located at the front edge of the development of this sector. After all, financiers see forecasts of growth in sales of electric vehicles in all regions of the world and their interest is automatically fixed on those companies., That, according to their beliefs, will have to earn income from these activities. Therefore, one can rely on, that QS prices will rise due to those, who thinks, that "this is a promising topic though".

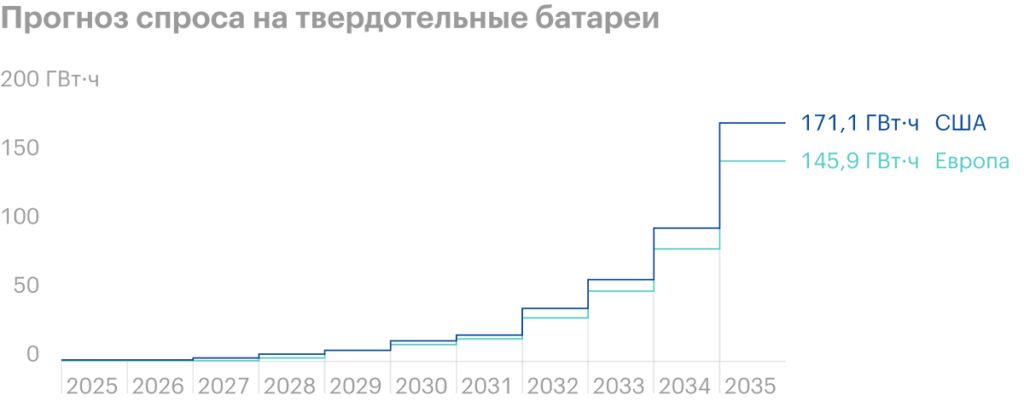

This is QuantumScape. If electric cars are considered more promising or one of the more promising sectors of the securities market, then R&D in the field of creating more efficient batteries is listed as a more promising direction for applying forces in the electric car environment. Solid state batteries, which is developing QS, are more productive than ordinary lithium-ion batteries, and they predict a huge future in terms of sales.

Big brothers and protectionism. One of the largest partners of QS is Volkswagen, which can serve as a definite indicator of interest in this area from the large automotive industry.

Taking into account, that almost all car factories, for example General Motors, increase investment in the creation of electric vehicles, QS may have big new partners, which will fuel interest in the company's prices. So far, the market opportunities for QS technology can only be estimated speculatively.: the company still has no sales. However, there is an aura of perspective - and that's enough.

If you look at the calculations of some financiers, they look presentable: if by 2030 the sales of electric vehicles will reach the trillion dollar mark per year, this would mean approximately $250 billion in battery sales.

With a likely market share of 10-15 percent, QS could theoretically generate EBITDA in the region of $5 billion per year., which in general will justify capitalization much higher than the current one. This is all, Certainly, according to these calculations, QS itself expects EBITDA in the region of $1.6 billion by 2028.

It seems to me, that even with the most modest estimates of revenue growth, the company could grow strongly over the next four years, just if she proves, that its technology is viable.

“We are talking about three-digit sums!» If you have read our thematic longread, you know that, what huge opportunities does the ESG lobby have. It can support QS quotes, pumping them up, to create a reputation for "cool" and "profitable" in this area. Pumping is needed until then, how will the proceeds appear there at all, - to attract private money into this area.

The question is not at all idle.: as calculated by the International Energy Agency, for a full-fledged transition of the world to an economy with minimization of harmful emissions, the volume of annual investments in the energy sector in order to transform it should grow from the current $2.3 trillion to $5 trillion as early as 2030. Against this background, a serious increase in the capitalization of QS is possible..

What can get in the way

QuantumScrape. QS is SPAC in origin. As we remember from the example of Lordstown Motors, in an electric car environment, this can be a signal, that the company can deceive shareholders about its real achievements.

Partnership with Volkswagen also means nothing. Electric car startup Nikola was supposed to become a partner of General Motors - but reports appeared in the press, that Nikola, maybe, engaged in defrauding investors and presented raw, unfinished technology as something ready for commercialization.

Noteworthy then, that General Motors learned about all this from the press - that is, the company simply did not study its potential partner. So that, may be, and Volkswagen did not bother much with the study of QS.

Important to consider, that QS costs nothing, except for promises. Research firm Scorpion Capital, which specializes in short companies, about which he publishes negative research, issued a report in April. In it, she accused QS management of exaggerating the company's R&D capabilities.. Simply put, according to Scorpion Capital experts, QS cannot create a battery, which advertises. Certainly, Scorpion Capital is a stakeholder, but, may be, they are right - no one can say for sure now.

Startup. The company won't start generating revenue until 2025.. That is, now it is eating up available resources and therefore is motivated to borrow money and issue new shares., what can affect the value of shares in the market. And in general, strictly speaking, the company may not live to see 2025, if for some reason it fails to survive to the stage of commercialization even with working technology. You need to be mentally prepared for this..

What's the bottom line?

You can take shares now by 23,03 $. And then a fan of possibilities opens up before us:

- wait, when will the stock be worth again 30 $, like this May. I think, that stocks can reach this level in the next 16 Months;

- wait for the price 50 $. Think, this level of action will be reached in the following 4 of the year;

- keep shares next 10 years, to reach the mark 114 $, who asked for them at the peak.

However, it must be understood, that this idea is very volatile, almost on par with bitcoin. This is a natural startup with all the pluses: the possibility of strong growth due to a technological breakthrough - and cons: real danger of fraud and bankruptcy.