Now we have a uniformly speculative thought: take stock of the logistics company Marten Transport (Nasdaq: MRTN), to earn income on increasing purchasing power for the transportation of goods in the United States.

Growth potential and duration : twelve percent for 14 Months.

Why stocks can go up: since in the USA the demand for transportation of goods, for what reason!

How do we act: take by 16,5 $.

No guarantees

And what is there with the author's forecasts

Because we do not try to build difficult models. The performance forecast in the article is the author's expectations. We indicate this forecast for guidance.. As with investing in general, readers decide for themselves, it is worth trusting the creator and focusing on the forecast or not.

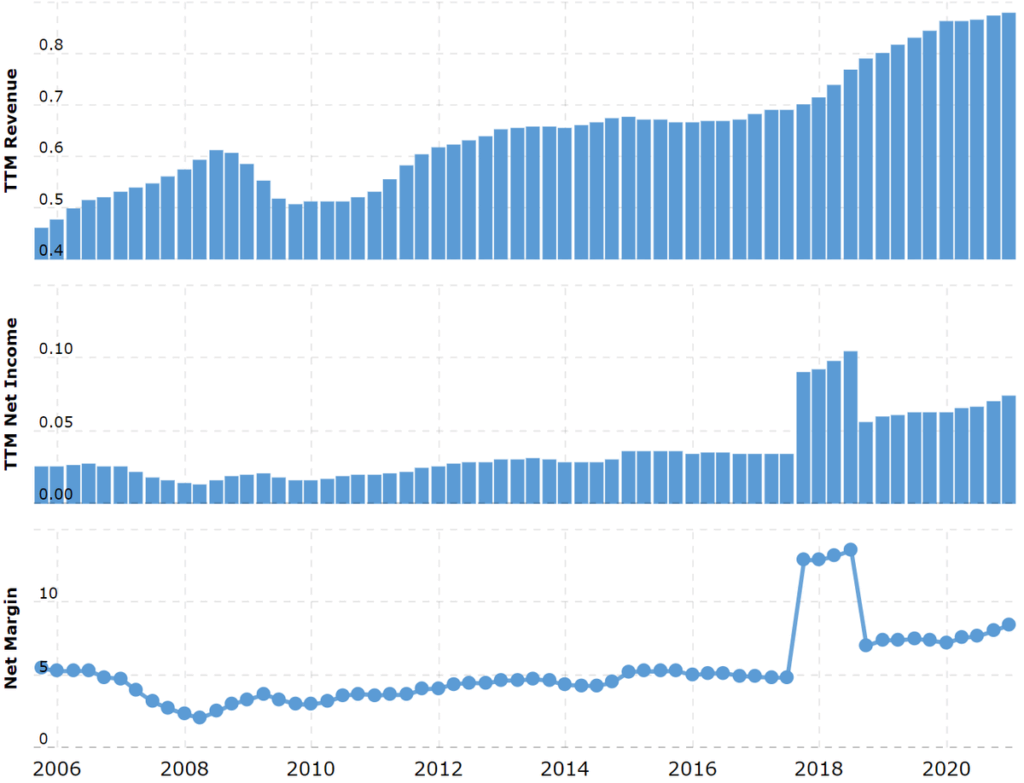

What the company makes money on

According to the Marten Transport report, revenue is divided into subsequent segments:

- Delivery of huge sizes of cargoes on trucks of the company - 43,36 %. The sector's operating margin is 10,5 % from its proceeds.

- Delivery of goods on order - 35,42 %. The sector's operating margin is 13,2 % from its proceeds.

- Intermodal transportation - 10,14 %. The sector's operating margin is 6,5 % from its proceeds.

- Intermediary services in the organization of cargo deliveries — 11,08. In this sector, Marten acts as a transport operator - it enters into agreements for the delivery of goods with third-party carriers in the interests of the client. The sector's operating margin is 7,2 % from its proceeds.

The goods transported by the company in the first 2 sectors are divided into those, that are sensitive to temperature, - fifty-eight percent of the total size - and for dry cargo - forty-two percent of the total size of 2 parts.

In fact, the company makes all the funds in the USA., but there are operations in Mexico and Canada with the participation of intermediaries. The proportion of these operations is so bullshit, that the report does not say anything definitive about this.

Arguments in favor of the company

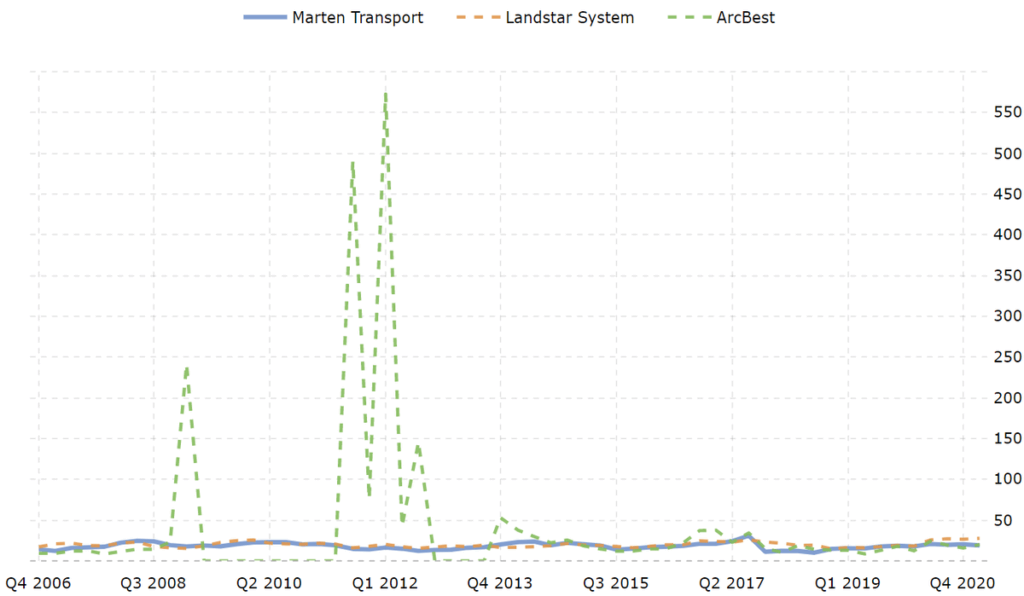

Need more ideas about logistics. Probably, Do you remember our cycle of investment ideas about cargo transportation?: Kirby, J. B. Hunt, Skirt, Schneider National, C. H. Robinson и Knight-Swift.

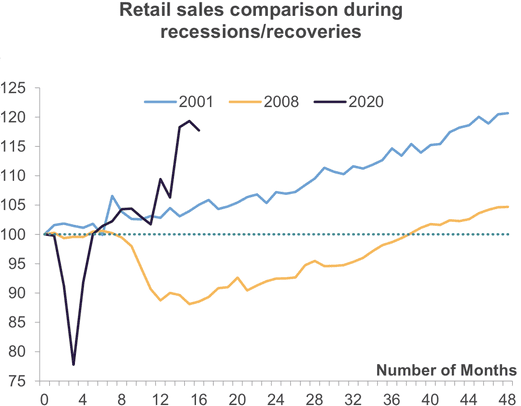

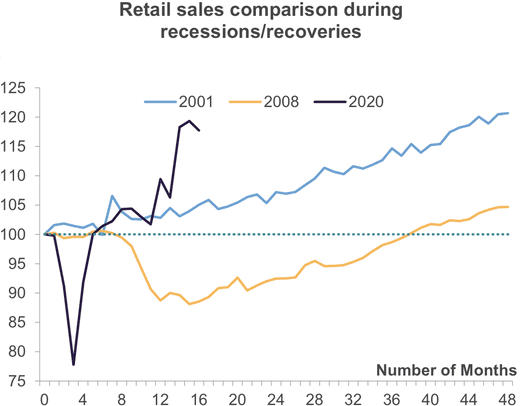

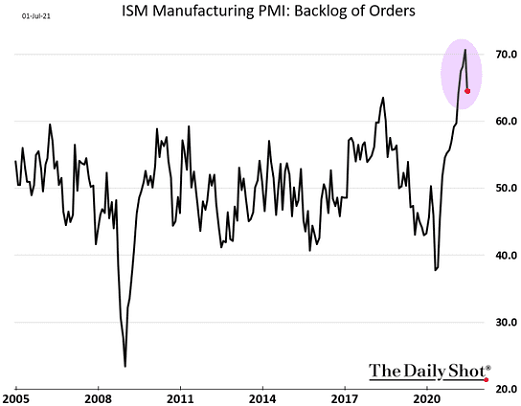

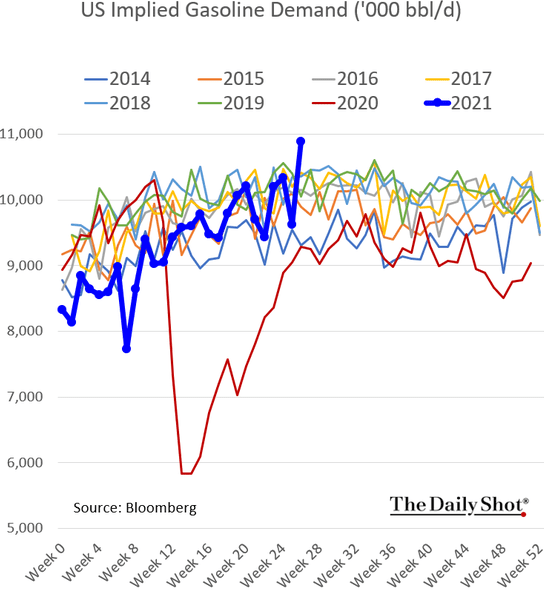

Consumers woke up after coronavirus hibernation and began to hyperactively spend on everything - what puzzled manufacturers, who were not ready for such a wave of orders. Production and consumption indicators are growing, but with the delivery time and the workload of supply chains, it’s a real disaster.

Shipping prices are on the rise. Large enterprises offer carriers big money for priority of their orders, why carrier prices are rising even more.

Basically, already that would be enough for Marten. But it's also worth remembering, that a significant share of the company's revenue comes from the transportation of goods, temperature sensitive. Although the report does not say anything specific, I think, that a significant part of the cargo there is food: this is confirmed by the description of the company in the online encyclopedia. If it is true, then Marten can count on a strong increase in orders from grocery retail: supermarkets have greatly increased the volume of orders for future products in anticipation of a strong increase in food prices.

|

|

|

|

|

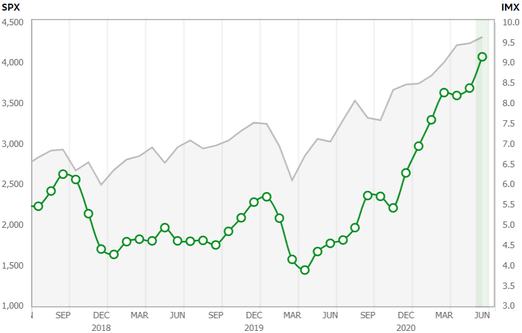

|

Price. The company is relatively inexpensive. P / E she has 19,02 - this is somewhat lower, than the closest competitors, and capitalization - 1,37 billion dollars. Together, these factors create opportunities for growth in quotations.. Firstly, stocks can easily be pumped by retail investors, because the "logistics sector, profitable ". And the mood of these investors is fighting. Small-cap stocks will find it easier to rise from current levels.

And secondly, the company may well be bought by someone larger. For example, it could be Knight-Swift, which is currently investing in expanding its business.

What can get in the way

Concentration. According to the report, the ten largest unnamed clients of the company give it 52% proceeds. The first five gives 43% proceeds, two customers — 35%, and the largest client gives 24% proceeds. This can be a problem, if relations with one of them change for the worse.

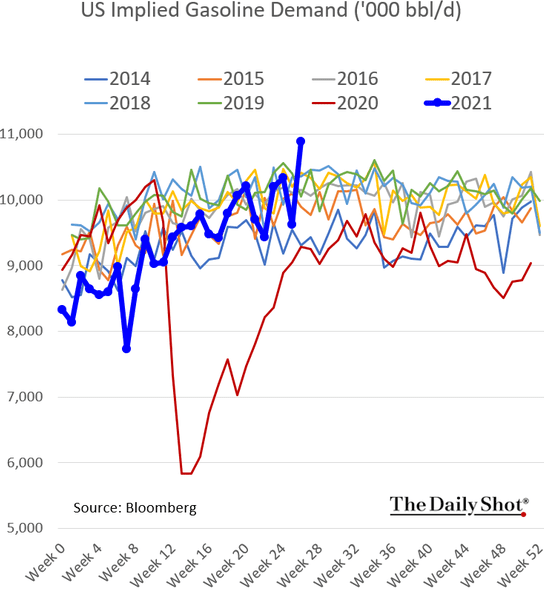

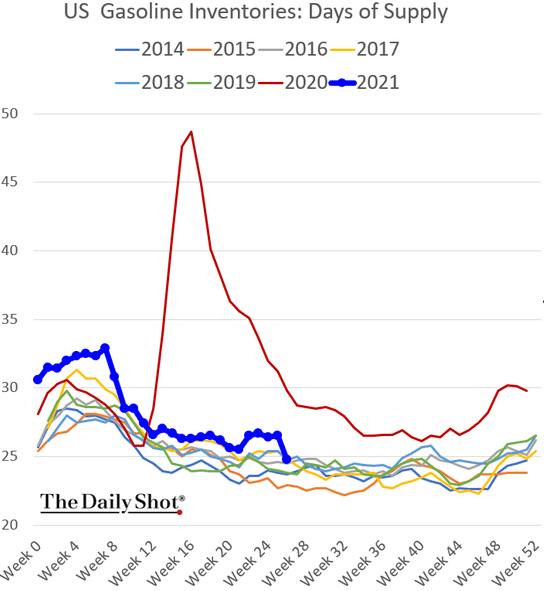

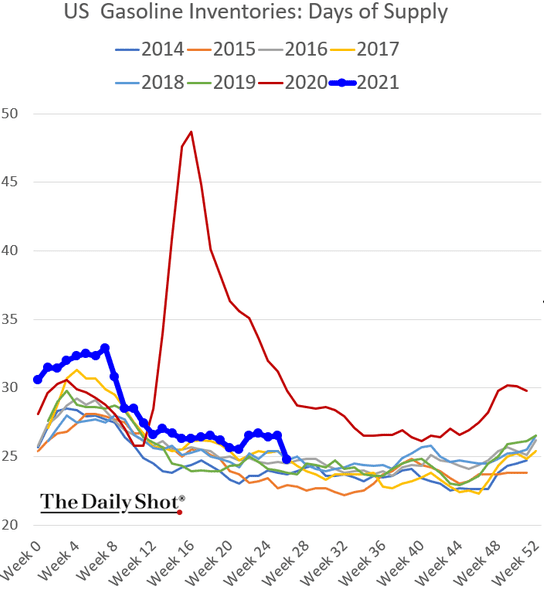

Expenses. The flip side of the growth in demand for cargo transportation is the growth in the costs of the carriers themselves. Need to pay more money to drivers, fuel costs may also rise. The latter is seen as the biggest problem due to the rapid growth in gasoline demand in the United States.. You need to be mentally prepared, that the growth of the company's revenue will be offset by the growth of expenses.

|

|

|

Dividends. The company pays 16 dividend cents per share per year, which gives approximately 0,96% per annum. It takes Marten about 13,2 million dollars a year is 18,8% from its profits over the past 12 Months. Basically, the money is not insanely large, and the company's accounting is not so bad: for 220.371 million dollars of debt, of which 97.851 million must be repaid during the year, she has 88.583 million in accounts and 93 mln of counterparties' debts. So that money, in theory, should be enough for everything.

But it is also worth considering, that the company has large investment needs in the renewal of fixed assets: an average of about 120 million per year, and this year 135 million. So if need be, then payments will be cut without any pity - with bad consequences for quotes.

What's the bottom line?

We take shares now by 16,5 $. Think, that with all the positives they will grow to 18,5 $ during the next 14 Months.