Growth Potential and Longevity Louisiana-Pacific : fifteen percent for 14 months excluding dividends.

Why stocks can go up: U.S. construction boom.

How do we act: take shares at the moment 57,8 $.

If you want to be the first to know, did the investment work?, subscribe: how will it become clear, we will inform.

Analysis, for example this and this, testify to, that the accuracy of the prophecies of motivated prices is not great. And it's acceptable: there are always a lot of surprises on the stock exchange and clear forecasts are rarely realized. If the state of affairs were reversed, then funds based on computer algorithms would perform better than humans, but no matter how annoying it may sound, they work worse.

Because we do not try to build difficult models. The performance forecast in the article is the author's expectations. We indicate this forecast for guidance.: as with investing in general, readers decide for themselves, it is worth trusting the creator and focusing on the forecast or not.

How does Louisiana-Pacific make money?

The company makes building materials from wood. In accordance with the annual report, her earnings are divided as follows:

- Wood siding - thirty-four percent. The sector's Adjusted EBITDA margin is twenty-six percent of its revenue.

- Oriented strand board - forty-four percent. The sector's Adjusted EBITDA margin is forty-three percent of its revenue.

- Engineered wood products - fourteen percent. Sector Adjusted EBITDA margin of six percent of its revenue.

- Implementations in South America - 5,7 %. The sector's Adjusted EBITDA margin is twenty-five percent of its revenue.

- The mysterious "other" 2,3 %. These are the installation services of frame structures, sale of unused tree species, also various small products and services. The sector is unprofitable: its adjusted EBITDA margin is −36.53 % from its proceeds.

The company's revenue by region is distributed as follows::

- USA - 74,54 %. Region operating margin — 25,07% from its proceeds.

- Canada - 19,76 %. Region operating margin — 7,77 % from its proceeds.

- South America - 5,7 %. Region operating margin — 18,91 % from its proceeds.

Arguments in favor of the company

Construction doesn't stop. The main argument here is the same, as in ideas for UFP and Boise: in the United States a strong growth in demand for real estate, and therefore manufacturers of building materials can count on an increase in orders.

Price. The company is inexpensive: P / E 8 and capitalization 5,91 billion dollars, which creates a good basis for pumping stocks. This can happen due to the influx of investors, who believe, that “construction is a promising topic, we must take manufacturers of building materials ". We've already figured it out, that construction is a really promising topic.

What can interfere with Louisiana-Pacific

Consider payouts. The company pays 0,64 $ dividend per share per year, at the current share price — 1,1% per annum. That's not enough income to, to attract payout enthusiasts to the promotions, but the company spends on this 68 million dollars per year - approximately 8,6% from its profits over the past 12 Months. Actually spending is not terribly big, and everything is decent with the company's accounting. On 930 million dollars in arrears, out of which 360 million needs to be repaid within a year, the company has enough money: 645 million in accounts and 264 mln of counterparties' debts.

It is unlikely that the company will reduce or eliminate dividends in the near future. But this possibility can never be completely ruled out., and you should be ready for it: stocks usually go down when payouts are cut.

The same cons, like colleagues. The rise in wood prices is not such a terrible minus, because the company has a pretty steep final margin, noticeably higher, than colleagues. So the increased cost of wood may not be reflected in the reporting too clearly.

Demand for building materials may fall due to a slowdown in consumer activity in the real estate market. In theory, a wild rise in home prices could hurt future sales - but that's not certain.. Building houses is still a very marginal business., even as house prices go down. So here we can see in the next six months, how much rising house prices can spoil the company's sales.

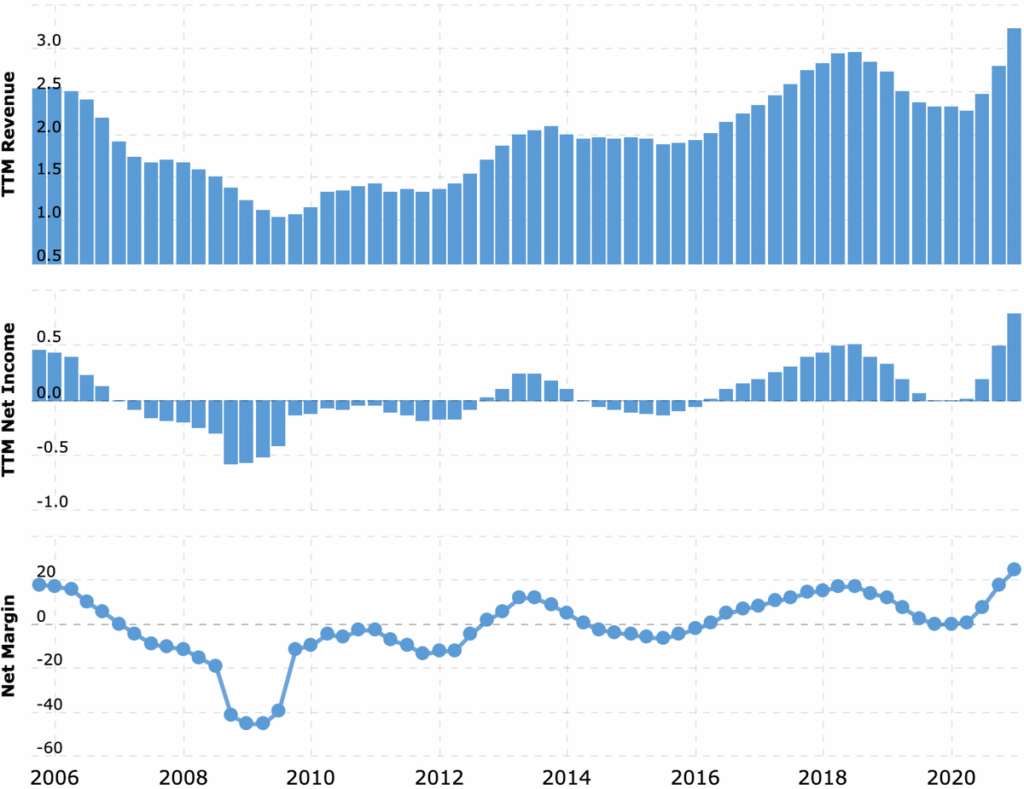

What's up with Louisiana-Pacific

You can take shares now on 57,8 $. Think, that during the next 14 months, we can expect stocks to rise to 67 $ per piece - noticeably less, what they cost back in May of this year.