Today we have a moderately speculative idea.: take shares of the recruitment agency Kforce (NASDAQ: KFRC), in order to capitalize on the growth in demand for his services.

Growth potential and validity: 12,5% behind 14 Months; 10% per year for 15 years. All excluding dividends.

Why stocks can go up: the company's services are in great demand.

How do we act: take now 63,09 $.

How the company makes money with Kforce

This is a recruiting agency, specializing in the financial and technology sectors. Kforce helps customers find the right candidates for money.

According to the annual report, by types of customers, revenue is divided as follows:

- technology sector — 75,1%. Everything, what is related to IT;

- finance - 24,9%. The company finds for customers specialists in the field of finance: from audit and accounting to tax and budgeting specialists. The company's customers are not only financial institutions, but also companies from such areas, like manufacturing and healthcare.

According to the types of hiring employees, the company's revenue looks like this:

- staff, who are hired for a fixed period, — 97%. These are usually the ones, who is hired to work on a specific project, without permanent employment. Usually, such employees are in the status of consultants. In the technology segment, they bring 98,4% Kforce revenue, and in financial 95,15%;

- employees in the company 3%. In the technology segment, these employees bring 1,6%, in the financial 4,85%.

I did not find any mention of foreign income in the report, so we will consider, that the company operates only in the USA.

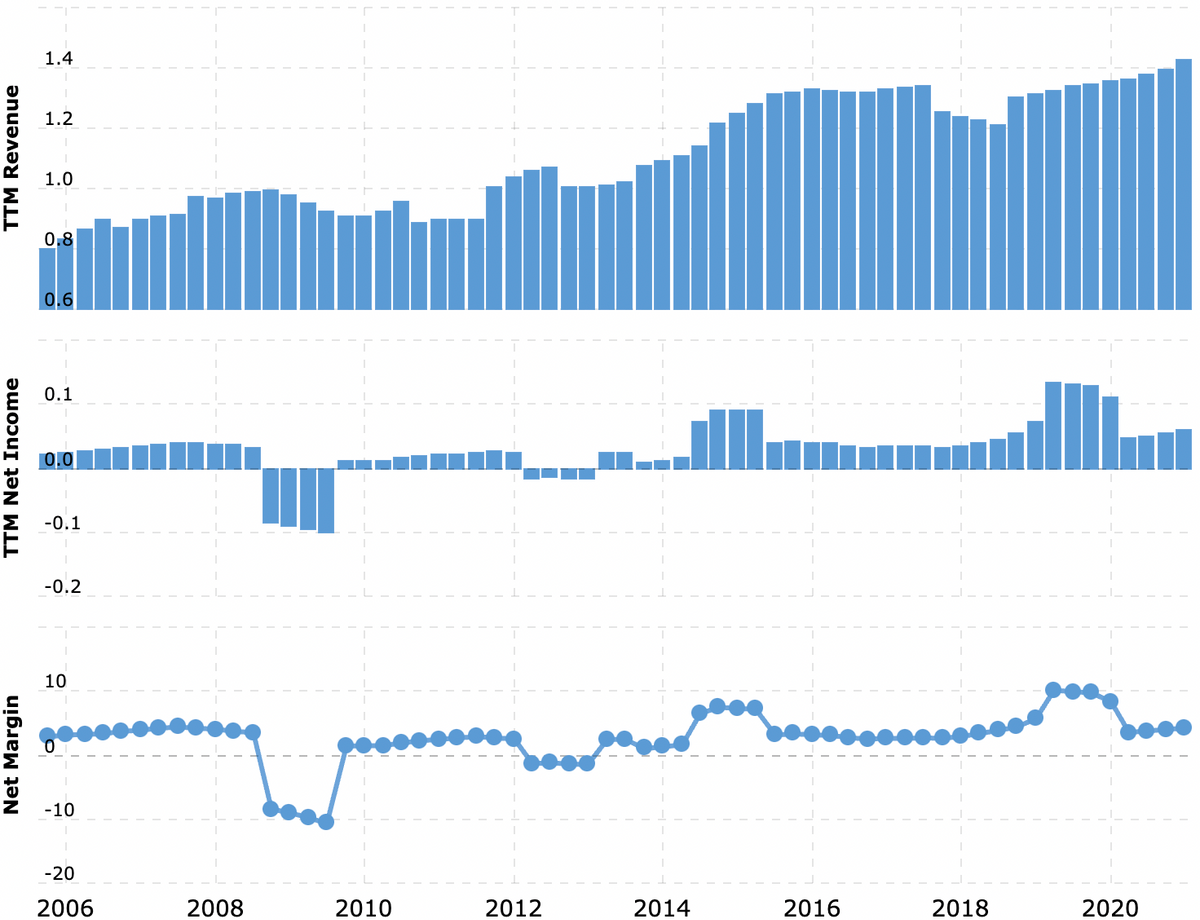

The Macrotrends chart has no data for the last quarter, which the company reported 3 august. It is also important to note, that profit growth in 2019 caused by the sale of one of the company's branches.

The case for Kforce

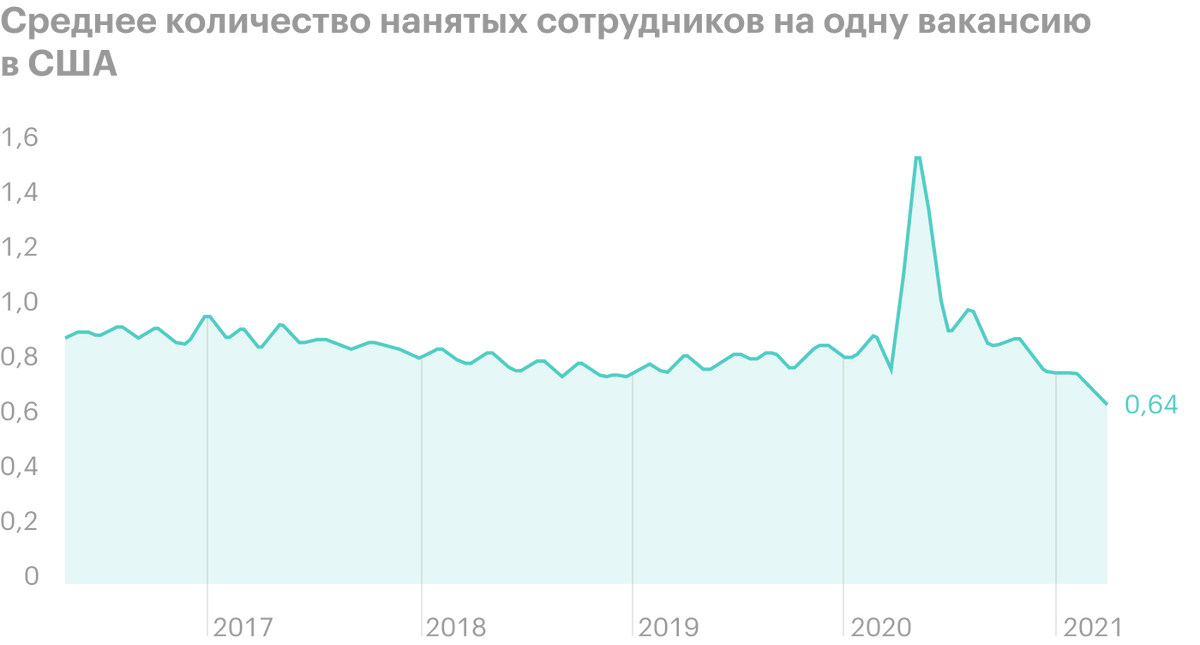

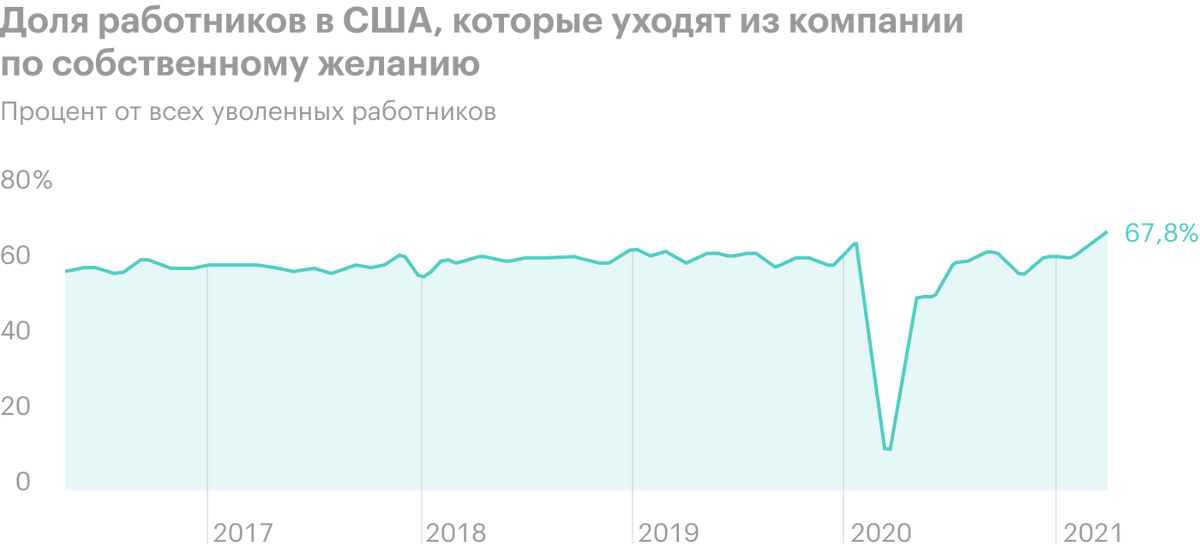

Demand. It is enough to open any fresh issue of the Daily Shot, to see, how demand for new workers is growing in the US. Yesterday Kforce released a good report: revenue increased by 17% compared to the same period 2020 and on 19,1% compared to the same period 2019. Profit more than doubled compared to 2020 year and for 31,7% compared to 2019, taking into account only the profit from the company's operations, excluding one-time income from the sale of one of the divisions.

So I would expect further improvement in the situation for the company: demand for its services in the current environment will grow. And since Kforce works primarily for IT companies, over which, seems to be, "the sun never sets", everything is going as well as possible.

Price. The company has a small capitalization in 1,38 billion dollars and a small P / E — 22,32. This will contribute to the growth of stock prices due to the influx of investors, looking for opportunities to earn "on the topic of employment growth".

Long term. The main money of the company comes from temporary or project workers. This is very good because of the shift in focus to piece work - we covered this story in our Upwork investment idea.. Moreover, Kforce specializes in meeting the needs of the main technology sector., infamous for the prohibitive cost of workers. Employers will be happy to reduce costs by hiring temporary specialists on a contract basis, working on the principle of "how stomped, so it fell".

So that, I think, Kforce has a great future. However, the same is true in the financial sector: anecdotal evidence from Business Insider's finance column points to excessive wage growth in the industry. So here, too, employers will use temporary hiring to cut costs..

Evaluation. According to company estimates, in 2021 year, its target market will be 39,5 billion dollars: 31,7 billion — solutions for technology companies and 7,8 billion — solutions in the world of finance. With their 1,43 billion dollars in revenue over the past 12 months Kforce takes 3,62% this market — but its capitalization is slightly less than its share in the target market. In other words, the company does not look overvalued - a rarity in the US, where the company can cost as 50% target market, taking less 1%. So there is a good room for quotes growth..

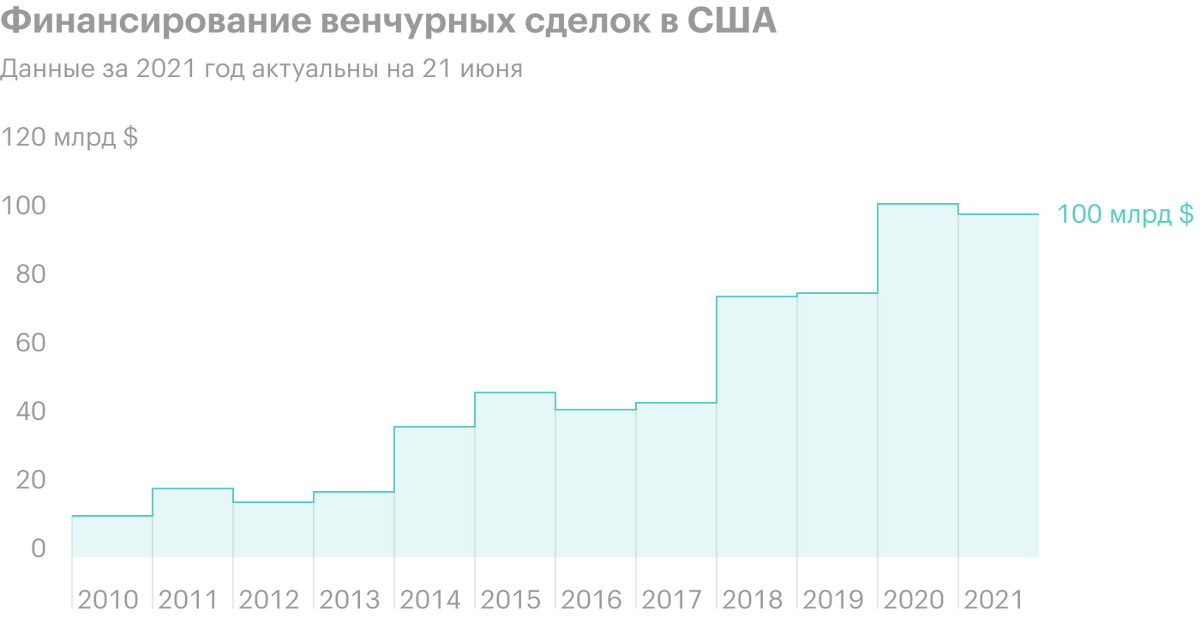

Can buy. All of the above advantages can lead to the purchase of a company by someone from the world of technology., considering Kforce's IT orientation. This is a perfectly reasonable assumption.: venture capital funding in the United States this year reached a mark of 100 billion dollars. This indicates that, that potential buyers of Kforce from the high-tech world have a lot of money. Accenture seems to be a very likely buyer of the company, but that's just speculation.

What can get in the way

Concentration. According to the annual report, 10 of the company's unnamed largest clients give it 28% proceeds. Changing relationships with one of them may affect Kforce reporting.

New quarantine. Orders from the financial sector may be hit hard by the repetition of quarantine. Actually, so it happened in 2020 year. This point should be kept in mind.

Substitution therapy. To a large extent, the company relies on the import of foreign specialists, who enter the United States on a special visa for highly skilled workers - H-1B. The meaning of the importation of such workers is, that they are cheaper than American specialists. In Silicon Valley, the dominance of encoders from the Russian Federation, India, PRC, and coders from Western Europe are also cheaper than American specialists. Any major impediment to the import of H-1B specialists could negatively affect the company's revenue.

Probability, that the organized actions of American coders will lead to restrictions on the importation of their competitors, small: IT professionals have a vanishingly small proportion of workers in trade unions. On the other hand, a post-pandemic world with an ever-changing landscape of bans and restrictions on flights from different countries can greatly increase the company's costs.. After the coronavirus, the world will become more like the novel "Michael Kohlhaas" by von Kleist with barriers at every turn - and this is not very good for the company's business, assuming the relative ease of movement of labor.

Dividends. Kforce pays 1,04 $ dividends per share per year - approximately 1,64% per annum. This takes the company 21,84 million dollars per year - approximately 36,4% from its profits over the past 12 Months. Basically, the company has enough money for everything, However, the possibility of cutbacks should be kept in mind..

Advance. Over the past 2 the stock rose by 84% and are now relatively expensive., when compared with the past 5 years. Although revenue and profit growth there was not as steep, to justify the price increase. So there is a chance, that Kforce shares will shake during the next stock market crash.

What's the bottom line?

Shares can be taken now by 63,09 $, then there are two options:

- wait for the price 71 $. Think, that we will reach this level in the next 14 Months;

- keep shares next 15 years, to see, how the company realizes its potential.