Today we have a moderately speculative idea.: take shares of industrial business II-VI (NASDAQ: IIVI), to capitalize on the industrial boom.

Growth potential and validity: 16% behind 15 Months; 11% per annum during 10 years.

Why stocks can go up: the world's industrial rise.

How do we act: we take shares now by 81,28 $.

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

The company name is actually Roman numerals 2 (II) And 6 (VI) - reference to the corresponding groups of elements of the periodic table.

II-VI manufactures complex electronics and provides services in this area: repair, maintenance, installation, tuning and optimization. Specialization II-VI - laser and photoelectronic equipment, with which it produces the ordered components.

According to the company's annual report, its revenue structure is as follows.

Photonic solutions — 65% of total revenue. These are transweavers, reconfigurable optical multiplexers and other complex technical solutions. Almost all revenue here is merchandise, 0,78% revenues are provided by services. Segment operating margin — 3,24% from its proceeds.

Composite semiconductors — 35%. These are wide-band semiconductors., optoelectronics and radio frequency devices, laser devices and systems and others. Most of the segment's revenue is provided by goods, 6,71% - services. Segment operating margin — 7,58% from its proceeds.

The company's clients are mainly manufacturing enterprises..

Structure of the company's revenue by demand

| Optical communications | 67% |

| Industry | 12% |

| Aerospace companies and defense industry | 7% |

| Consumer Electronics | 6% |

| Equipment for semiconductor production | 5% |

| Laboratory tests | 2% |

| Other | 1% |

Optical communications 67% Industry 12% Aerospace companies and defense industry 7% Consumer Electronics 6% Equipment for semiconductor production 5% Laboratory tests 2% Other 1%

Company revenue by regions

| USA | 60,18% |

| Hong Kong | 12,57% |

| Mainland China | 12,27% |

| Japan | 6,14% |

| Germany | 5,24% |

| Switzerland | 1,5% |

| Vietnam | 0,93% |

| Other countries | 1,17% |

USA 60,18% Hong Kong 12,57% Mainland China 12,27% Japan 6,14% Germany 5,24% Switzerland 1,5% Vietnam 0,93% Other countries 1,17%

Arguments in favor of the company

Strong business. The company makes a huge amount of complex electronics, and this is the most important element for modern civilization, built on technology.

The company had a losing period, but this was not related to its operational activities, and with extensive, multi-billion dollar acquisitions - practice, which the company continues to follow.

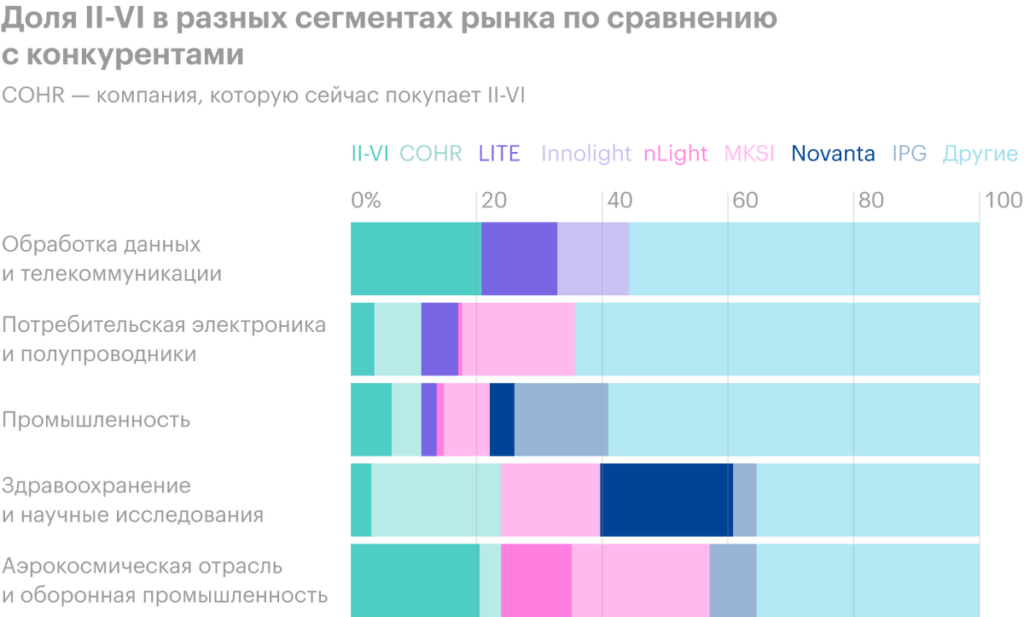

II-VI is one of the key players in its market, so i think, that the current rise in production in the United States and other countries will necessarily affect the accounts of II-VI in the best possible way.

Annual revenue, profit, final margin

| Revenue, billion $ | Net income, million $ | Profit Margin | |

|---|---|---|---|

| 2017 | 0,97205 | 95,27 | 9,80% |

| 2018 | 1,16 | 88,00 | 7,59% |

| 2019 | 1,36 | 107,52 | 7,89% |

| 2020 | 2,38 | −67,03 | −2,82% |

Revenue, billion $ 2017 0,97205 2018 1,16 2019 1,36 2020 2,38 Net income, million $ 2017 95,27 2018 88,00 2019 107,52 2020 −67,03 Profit Margin 2017 9,80% 2018 7,59% 2019 7,89% 2020 −2,82%

Quarterly revenue and profit, million dollars

| Revenue | Net income | Profit Margin | |

|---|---|---|---|

| 3 neighborhood 2020 | 627,04 | 5,92 | 0,94% |

| 4 neighborhood 2020 | 746,29 | 51,26 | 6,87% |

| 1 neighborhood 2021 | 728,08 | 46,27 | 6,35% |

| 2 neighborhood 2021 | 786,57 | 87,90 | 11,18% |

Revenue 3 neighborhood 2020 627,04 4 neighborhood 2020 746,29 1 neighborhood 2021 728,08 2 neighborhood 2021 786,57 Net income 3 neighborhood 2020 5,92 4 neighborhood 2020 51,26 1 neighborhood 2021 46,27 2 neighborhood 2021 87,90 Profit Margin 3 neighborhood 2020 0,94% 4 neighborhood 2020 6,87% 1 neighborhood 2021 6,35% 2 neighborhood 2021 11,18%

Earnings per share in dollars

| Expectation | Result | |

|---|---|---|

| 3 neighborhood 2020 | 0,14 | 0,47 |

| 4 neighborhood 2020 | 0,77 | 1,18 |

| 1 neighborhood 2021 | 0,54 | 0,84 |

| 2 neighborhood 2021 | 0,91 | 1,08 |

| 3 neighborhood 2021 | 0,88 | — |

Expectation 3 neighborhood 2020 0,14 4 neighborhood 2020 0,77 1 neighborhood 2021 0,54 2 neighborhood 2021 0,91 3 neighborhood 2021 0,88 Result 3 neighborhood 2020 0,47 4 neighborhood 2020 1,18 1 neighborhood 2021 0,84 2 neighborhood 2021 1,08 3 neighborhood 2021 —

What can get in the way

Accounting. II-VI debts for 2,41 billion dollars, of which a billion must be repaid within a year. And the amount of these debts will still grow after the purchase of Coherent for 7 billion dollars, but partners are involved in the deal, therefore, to the final debt II-VI this will add 4,9 billion. I do not think, that there are great risks of bankruptcy: it's sturdy, successful business, the company will borrow more money, - but still it is worth keeping in mind this moment.

What's the bottom line?

The company does not have the most modest price: P / E — 47,64, - but, taking into account the strong business fundamentals and the growth of the industry in the world, I think, that we can take a chance and take these shares by 81,28 $.

Then there are two options.:

- wait, when will the shares be worth 95 $, and sell. This will be noticeably less than the historical maximum in 99,5 $, reached in February this year. II-VI became involved in a confrontation with competitors for the purchase of Coherent and greatly increased the price of their offer. Stocks have fallen sharply because of this., because investors don't like, when companies spend a lot of money on mergers and acquisitions. But I think, that the market reaction was excessive, after all, these expenses will have to pay off: within niche II-VI this is a good buy. Therefore I would expect, that we will reach the specified level within the next 15 Months;

- keep shares next 10 years, to see, how the company will be able to take advantage of its position as a major niche player. This is the most preferred option., since in this case II-VI will not be affected by seasonal troubles. Although it is worth noting, that even the coronacrisis did not spoil her sales in 2020 year. The most likely source of problems for quotes in the medium term, I see the II-VI strategy for extensive spending on business expansion. On the other hand, in between 10 years is not scary, All these costs will pay off over time..