Today we have a moderately speculative idea.: take stock of industrial parts manufacturer IDEX (NYSE: IEX), to capitalize on the growth of his business.

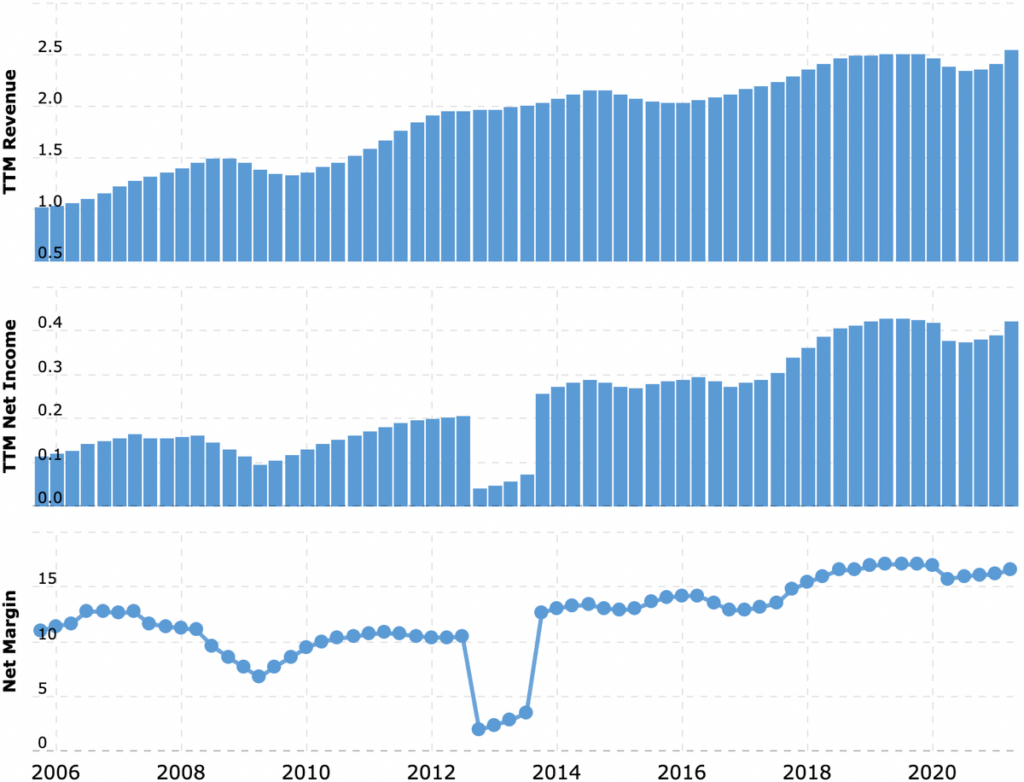

Growth potential and validity: 11,5% behind 14 months excluding dividends; 9% per annum during 10 years including dividends.

Why stocks can go up: the company's products were, is and will be in demand.

How do we act: we take shares on 219,1 $.

What the company makes money on

IDEX manufactures parts and provides services to the industry. There is a rather detailed presentation, according to which the revenue structure looks like this.

Measurement technology — 38%. The company makes pumps, counters and other equipment. Segment operating margin — 26,2% from its proceeds.

Technology Science and Health — 38%. It's pretty much the same, as in the segment above, but made to specifications, needed in R&D of various industries. Segment operating margin — 23% from its proceeds.

Fire safety and protection — 24%. Industrial Security Solutions. Segment operating margin — 25,6% from its proceeds.

Revenue of the company by industry:

- Industry - 16%.

- Fire safety and protection - 15%.

- Energy - 9%.

- Scientific research — 8%.

- Water supply - 7%.

- Analytical tools - 7%.

- Food and Pharmaceuticals — 7%.

- Automotive 6%.

- Chemical industry - 5%.

- Paints - 4%.

- Semiconductors — 4%.

- Agriculture - 4%.

- Other - 8%.

Company sales geography:

- USA - 50%.

- Europe - 24%.

- The rest of the world - 26%.

Arguments in favor of the company

Diversification. IDEX does not depend on the situation in any one industry: the company is little by little represented everywhere. This will protect her business from seasonal fluctuations in any of the industries..

Shaft of investments. Like other "valve manufacturers" like Emerson Electric and Parker-Hannifin, IDEX will be able to capitalize on both the current industrial boom, and the inevitable growth of companies' investments in equipment upgrades over the next 10 years.

Theoretical purchase opportunity. The company does not have a very large capitalization in 16,6 billion dollars and acceptable P / E — 39,92. So it is likely, that some big player will buy it.

What can get in the way

This has never happened - and here it is again. Increase in the cost of transportation, labor of workers and production raw materials will be no less a threat to the company's reporting, than for other industrial enterprises. Also, do not forget about the permanent possibility of a new quarantine., which will spoil the reporting even more than all the above problems, combined.

Passive threat. The company pays 2,16 $ dividend per share per year. The annual yield is 0,99% per annum, and dividend investors, these payments will not attract. At the same time, they spend 158 million dollars per year - 37,61% from the company's profits for the past 12 Months. Basically, all urgent debts of the company are covered by the money at its disposal and the amount of debts it has is not very large. So the threat of cutting payments with a subsequent drop in shares is very small here.. But still you should keep it in mind.

What's the bottom line?

Shares can be taken now by 219,1 $. And then there are two ways:

- wait, when will the shares start to cost 245 $. Think, that we will reach this level in the next 14 Months;

- keep shares next 10 years.

And traditionally: see the news section on the company's website, to dump shares after the news of payout cuts before, how this information will be processed in the market.