Today we have a moderately speculative idea.: take shares of ICON (NASDAQ: ICLR), engaged in R&D in the field of pharmaceuticals, in order to make money on the growth of expenses of pharmaceutical companies.

Growth potential and validity: 12% behind 14 Months; 10% per year for 15 years.

Why stocks can go up: pharmaceutical companies are forced to spend money on R&D.

How do we act: we take shares now by 270,17 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

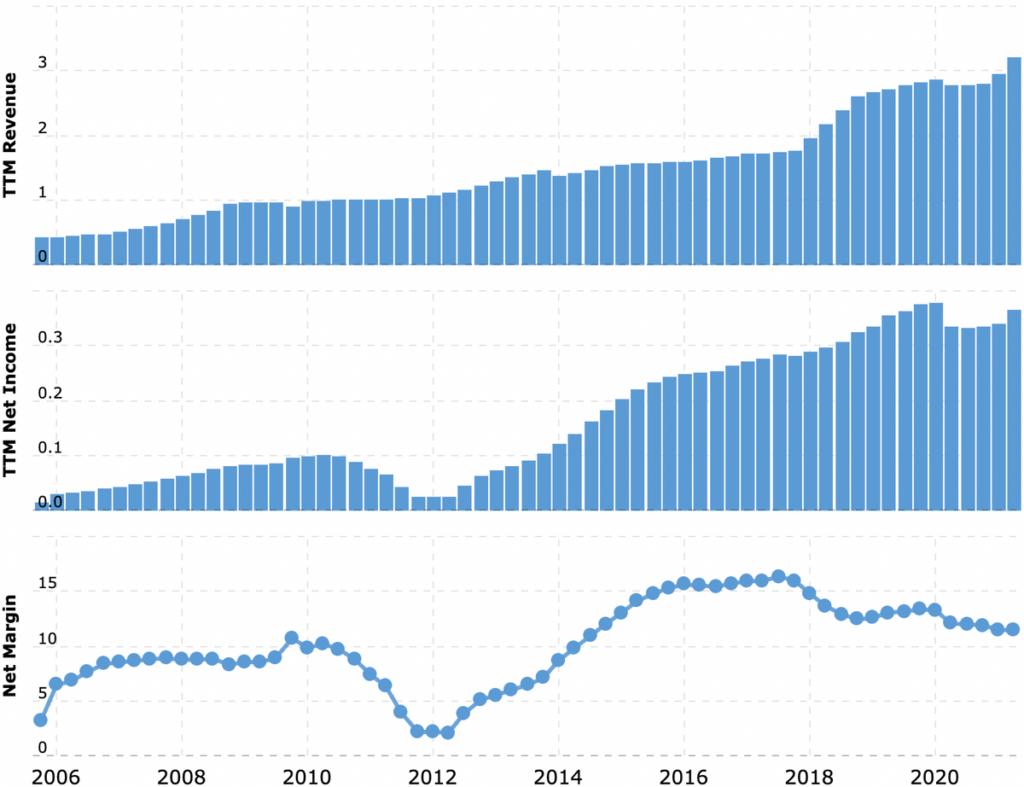

ICON provides R&D services to pharmaceutical companies: Test management, recruitment, consulting and services for laboratories. The company's annual report as a whole is not very useful.: segmentation there is no.

Revenue by country and region:

- USA - 33,1%.

- Europe - 57,1%.

- Other, unnamed regions — 9,8%.

Arguments in favor of the company

All clear. Like Catalent, the company will have to succeed simply by increasing pharmaceutical companies' R&D spending.. Pharmaceutical companies will spend infinitely much, as long as there is a modern system of patenting drugs with the expiration of the patent, after which competitors begin to produce analogues cheaply.. The full cycle of drug development with all trials can take 5-7 years and lead to failure.. So pharmaceutical companies are forced to constantly spend a lot of money on R&D.. And that's good for ICON..

More is better. ICON recently bought competitors PRA Health Sciences, this is not yet reported. Individually, ICON and PRA ranked fifth and sixth in their industry, respectively – and now the enlarged ICON will be in second or third place.. This will allow it to strengthen its negotiating position in relations with customers and increase margins in the long term..

Not so expensive. P / E at ICON — 39,5, which is a lot, but it doesn't yet reflect pra Health Sciences joins. U new, Single Company P / S will be in the area 3, which is quite inexpensive, a P / E — about 25. By the way,, competitors ICON from IQVIA P / E is 77.

Adaptability. Coronacrisis has become a problem for ICON: Trials and studies of many drugs have failed. But the company quickly got involved in various coronavirus research projects., so the final result is rather even. With a high probability of the emergence of new viruses, the ability of ICON to "change shoes in the air" will be a big plus for conservative investors..

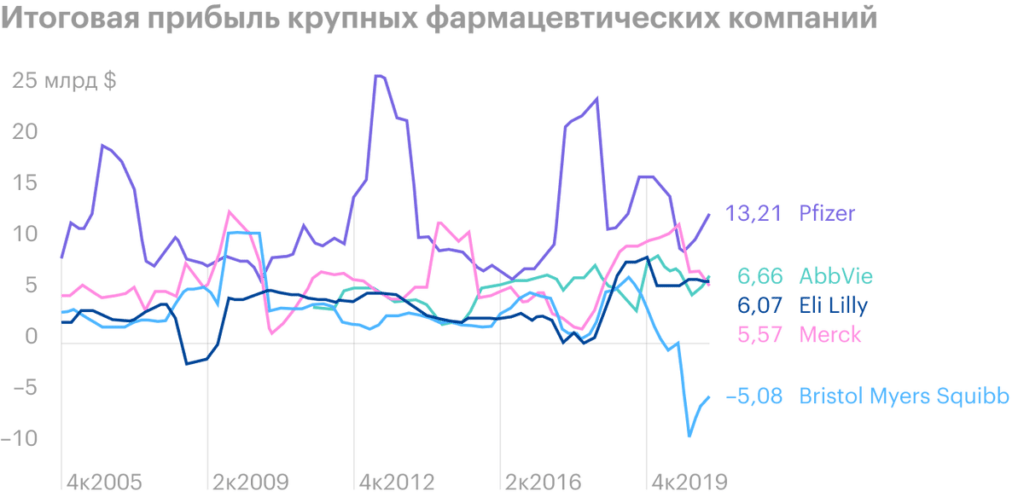

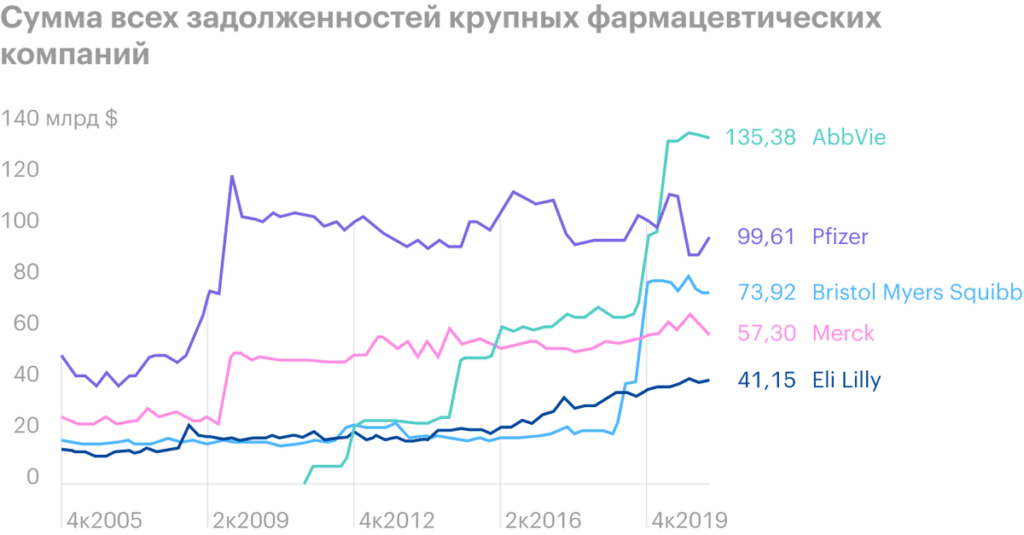

Can buy. The existence of pharmaceutical companies is the nightmarish wheel of samsara.. "Develop new drugs, while others are having fun, and one day you will develop more drugs, while others have fun. And then in the distant future, you will continue to develop drugs., while others have fun.". In general, the profits of pharmaceutical companies have been treading water for many years.. Jumps in profitability are replaced by rapid falls - thanks to the expiration of patents, — and the debt burden is growing, because shareholders ask for dividends, and R&D is becoming more expensive. Buying ICON would be a good option for some pharmaceutical holding company.: somewhat diversify your risks through a more stable and predictable business. So to speak, go from the category of gold diggers to the category of those, who earns on gold diggers.

What can get in the way

Concentration. According to the report, 39,1% the company's revenue falls on 5 unnamed customers. One of them gives 12,1% proceeds.

That's the reality.. Irish Registration Company. Irish registration is needed ICON, in the words of Pelevin, "within the framework of a charity event for tax evasion". Now taxes in Ireland, ICON pays the rate 12,5%, that is very little. Recently, Ireland was forced to raise the tax rate for corporations to 15%. So in the future, ICON expects higher taxes — and, in my opinion, investors have not yet put this risk in the current share price.

And yet expensive. Anyway, the company is now trading close to historical highs and is worth a lot. Stocks can shake.

Debts. To buy PRA, ICON borrowed a lot of money, so its debt burden will be very impressive.. What size it is now - it is difficult to say, since the company partially paid in shares, and partly with money at his disposal. But we can expect an increase in the amount of debt from the current 1.5 billion dollars to 7-8 billion. This, certainly, not very well in anticipation of the rise in the price of loans - and some investors such debt may scare away.

What's the bottom line?

We take shares now by 270,17 $. And then there are two options:

- stocks will rise to 303 $, exceeding historical highs. Think, we will reach this level in the next 14 Months;

- keep shares next 15 years.