Today we have a moderately speculative idea.: take stock of the German freight carrier Hapag-Lloyd (FROM: HLAG), in order to capitalize on the insane demand for container shipping.

Growth potential and validity: 12% during 15 months excluding dividends; 34% during 5 years excluding dividends; 7% per year for 15 years including dividends.

Why stocks can go up: the logistics sector is full of life "like a piece of moldy cheese on a hot summer day".

How do we act: we take shares now by 173,6 €.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

No guarantees

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

And what is there with the author's forecasts

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

So we're not trying to build complex models.. The profitability forecast in the article is the author's expectations. We specify this forecast for the landmark: as with the investment idea as a whole, readers decide for themselves, it is worth trusting the author and focusing on the forecast or not.

We love, appreciate,

Investment editorial office

What the company makes money on

The company is engaged in container cargo transportation, as well as their escort on land. The company's annual report is full of technical details on tonnage and other feet below the keel., so let's get it out of the way.

Company revenue by route:

- Atlantic — 17,23%.

- Transpacific transportation - 18,63%.

- Far East - 15,35%.

- Middle East — 8,46%.

- Transportation between different countries of Asia - 3,44%.

- Latin America — 22,41%.

- Europe - Mediterranean - Africa - 4,97%.

Company revenue by freight volume as a percentage of thousands of twenty-foot equivalents transported:

- Atlantic — 15,34%.

- Transpacific transportation - 15,63%.

- Far East - 19,31%.

- Middle East — 12,46%.

- Transportation between different countries of Asia - 7%.

- Latin America — 24,4%.

- Europe - Mediterranean - Africa - 5,86%.

Revenue from routes is not always proportional to the amount of cargo transported - the prices for different routes are different and can vary depending on a bunch of different factors: weather, political environment and so on.

Other 9,51% proceeds give other income, they are not distributed by region: penalties for violation of the terms of storage and transportation of goods by the owners of the goods, as well as a fee for occupying a place by a container during transportation.

The company's fleet consists of 250 water transport units: 116 ships owned by the company, or she rents them with the option to buy, and 134 Are chartered foreign ships.

Arguments in favor of the company

The logistics. Logistics traffic jams are constantly forming in the world now and the cost of delivering goods, coupled with their shortage, is growing.. This is logically reflected in the cost of delivery of HLAG cargo: now she is almost at 54% above, than a year ago.

The price of container transportation in the world is now extremely high. I would expect, that this state of affairs will last for some time: ports in China and USA are loaded, and the season of November and December holidays with the expected growth in demand has not even begun.

HLAG's business will benefit from an improved business environment, and its shares will benefit from investor interest in the beneficiaries of the logistics crisis. Moreover, the company is inexpensive in all major metrics.: P / S is approximately equal 2, a P / E — 9.

Reliability. According to the annual report, in 2020, despite all the coronavirus horrors, the volume of cargo transported by the company fell by only 1,6%. Scary coronavirus, obviously, decided to spare the freight, just like armies and governments, - so this industry can be considered conditionally resistant to violations, caused by the epidemiological situation. For a quarter, the effect can feel painful, but, as practice shows, in subsequent quarters, demand recovers rapidly.

Wrecked. The company pays 3,5 € dividend per share per year, which gives approximately 2% per annum. By European standards, this is a lot of money.. Given the positives with this business, a lot of fans of dividend yield can crowd into the company's shares - especially from among the Germans, suffering from negative deposit rates. However, there are subtleties here.

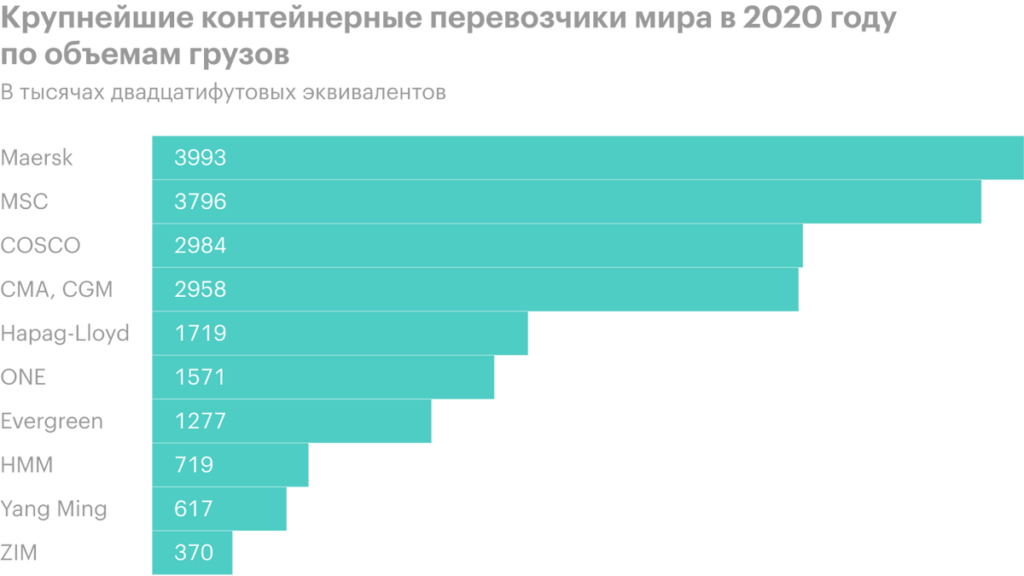

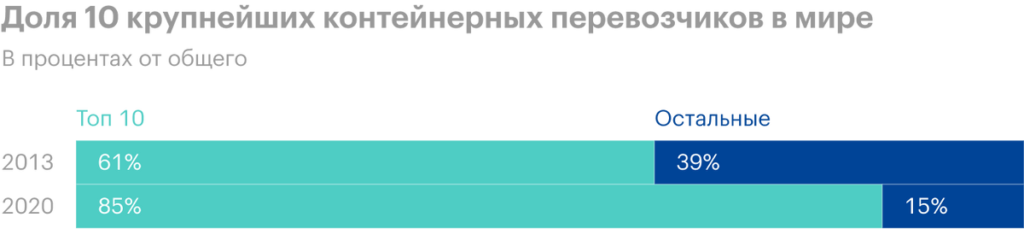

High probability of buying a company. According to the company's annual report, in the list 10 the largest container carriers HLAG is ranked fifth, far behind giants like Maersk and COSCO. At the same time, the sector tends to consolidate: if in 2013 10 largest companies occupied 61% container shipping market, then in 2020 they accounted for 85%. So HLAG may well be bought by a larger company..

What can get in the way

Wild card. According to the latest report, most of the company's shares are owned by large funds - and are in free float only 3,6% Shares, which is much less 10% - the minimum for many stocks. It's not much in general., and there may be problems with buying shares - so all hope for that, that stocks will rise due to the influx of German burghers, may not justify, if major shareholders do not sell their positions. However, I think, what, seeing great demand, many of the large holders decide to sell their shares.

"I am the sea!» A logistics crisis in the context of a pandemic and rising fuel prices can bring the company not only revenue growth, but also rising costs. Moreover, the epidemiological situation is constantly changing., and news about, what's on the ship - or worse, in the whole flotilla - HLAG there was an outbreak of the virus, can have a very negative impact on the quotes and lead to serious costs for HLAG.

You should also consider the likelihood of other force majeure: storms, port closures, accidents in ports, how it was in the Suez Canal this year. This is the Sea, everything happens here all the time.

Wrecked. The company spends 615 million euros per year on dividends, which is approximately 18% from her profits for the past 12 Months. During normal times, dividends are 50-65% of the company's profits.

The company's business looks quite stable, but still there is a possibility of cutting dividends due to force majeure. Moreover, the company has a large debt: according to the latest report, this is about 9 billion euros, of which approximately 4.7 billion must be repaid within a year.

Not much money at the disposal of the company: 2 billion in accounts and 2 billion debts of counterparties, - so that if necessary, payments can be cut. Dividends may also fall prey to cuts in the long run., if the company exceeds the original cost estimate for fleet renewal or business expansion.

However, this risk is very speculative: I think, that the abundance of large institutional investors among HLAG shareholders can help the company receive the necessary loan tranches if necessary.

What's the bottom line?

Shares can be taken now by 173,6 €. Then there are three options:

- wait for growth to 195 €. Think, we will reach this level in the next 15 Months;

- wait for stocks to return to their all-time highs, achieved in September this year - 232 €. Think, here you have to wait about 5 years;

- keep shares next 15 years, mostly for dividends.

Watch for news about the change in the situation with the payment of dividends, to quickly sell shares in the Russian Federation before they fall on the St. Petersburg stock exchange, pointless: we have a small time difference and stocks will already have time to fall in Germany.