Today we have a moderately speculative idea.: take stock in Graco Industrial (NYSE: GGG), to make money on the growth of this business.

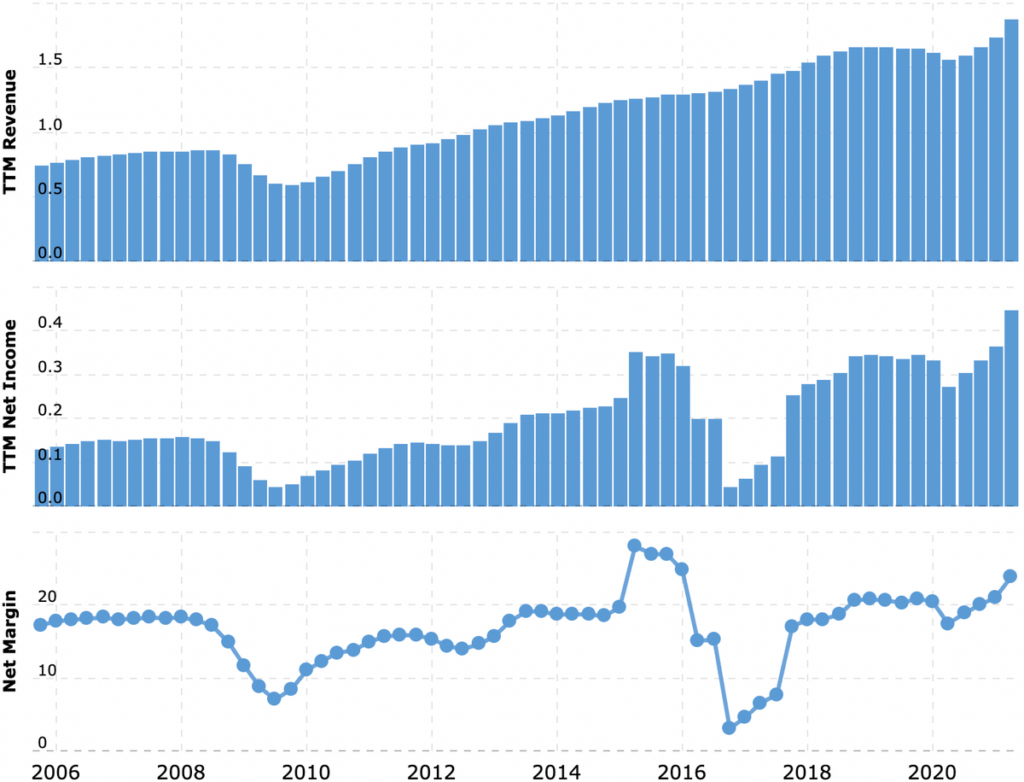

Growth potential and validity: 11% behind 14 months excluding dividends; 9% per year for 10 years.

Why stocks can go up: for the company's products, there is and will be a great demand.

How do we act: we take shares for 78,1 $.

When creating the material, sources were used, inaccessible to users from the Russian Federation. We hope, Do you know, what to do.

What the company makes money on

Graco manufactures fluid control equipment. According to the annual report, its revenue is divided as follows.

Industry — 41%. This is the application of liquids and coatings to various industrial products.. Segment operating margin — 33% from its proceeds.

Processes — 19,76%. Pumps, valves and other things for the distribution of liquids. Unlike the first segment, here we are talking about the movement of liquids - from oil and gas to milk and lubricants. Segment operating margin — 20% from its proceeds.

Coating — 39,24%. Wall paint sprayers - products are needed as professional builders, as well as artists. Segment operating margin — 25% from its proceeds.

Revenue by region:

- America - 60,39%. USA gives 53,51% from the entire revenue of the company;

- Europe, Middle East and Africa - 22,53%;

- Asian-Pacific area - 17,08%.

Arguments in favor of the company

Unity in difference. As a matter of fact, these are three different businesses: participation in the industrial production of goods, infrastructural or near-infrastructural works, construction. This is a big plus, as it allows to diversify the risks of the company. While the long-term outlook for all three segments is positive.

Industrial rise. The growth of industrial indicators in the US and the eurozone countries allows us to hope for an improvement in the company's financial performance in the near future.

Price. The company does not have a very large capitalization - 13,26 billion dollars, - and its P / E does not look very arrogant - 30. Therefore, in the medium term, there is a high probability that the company will be bought by some industrial holding..

What can get in the way

Wild card. The company's paint business could be its weak point. In the long run, this division, certainly, will enjoy great success: U.S. homes will age and cost more to repair and repaint. But during this year, the demand for the division's products may fall.: maybe, Consumers, tired of excessive real estate prices, stop driving demand for homes. A fall in demand will lead to a fall in prices and a decrease in the marginality of building houses., which will negatively affect the demand for paint application. Or will not affect: while this is a hypothesis. But we'll still take it into account..

Expenses. Logistics and rising cost of raw materials spoil the reporting of many industrial companies. By the way,, paint maker PPG recently adjusted its forecasts for this year to the downside just because of rising costs. So it is possible, that rising prices for everything will negatively affect Graco's reporting.

Dividends. The company pays 75 dividend cents per share per year, what does it take 124 million dollars is about 27,55% from its profits over the past 12 Months. Dividend yield is very small - 0,96% per annum, but there is always a threat of cutting or cutting dividends. Truth, in the case of Graco, it is minimal: enough money at her disposal for dividends, and to close all debts. And the threat of falling stocks due to cuts in payments is also small here.: dividends are unlikely to trigger a mass exodus of investors.

What's the bottom line?

We take shares now by 78,1 $. And then we have two ways:

- wait, when stocks exceed historic highs and begin to cost 87 $. Think, we will reach this level in the next 14 Months;

- hold shares 10 years, seeing the steady growth of this business.