Now we have a uniformly conservative thought: take stock of the bakery manufacturer Flowers Foods (NYSE: FLO), to earn income on the stability of this business.

Growth potential and duration : ten percent for 12 months excluding dividends; nine percent per annum for ten years, including dividends.

Why stocks can go up: it is measured, strong business with good income from securities.

How do we act: we take at the moment 24,38 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

The company is engaged in the creation of baking in its various types - from ordinary bread to rolls and snacks.. According to the report, revenue by type of product is divided as follows:

- The company's products for sale in retail chains - sixty-six percent.

- Products for their store brands - fourteen percent. Flowers Foods products, sold under the brand of retail chains.

- Not retail and other - twenty percent. Products for restaurants, vending machines and institutional customers.

Revenue is distributed across sales channels as follows::

- Hypermarkets and pharmacies - forty-two percent.

- Large stores and convenience stores - thirty-three percent.

- Catering - seventeen percent.

- Convenience stores - three percent.

- Other - five percent.

Based on the data in the report, can be solved, that the company has no sales outside the US. So let's think, that Flowers Foods products are only sold in America.

Arguments in favor of the company

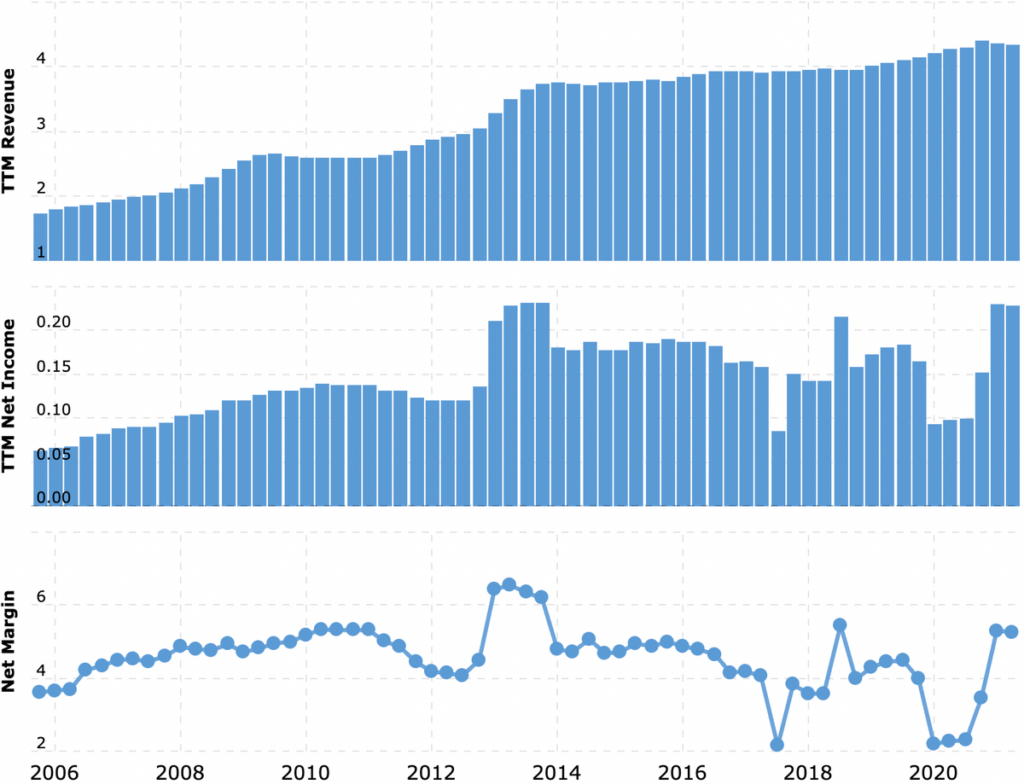

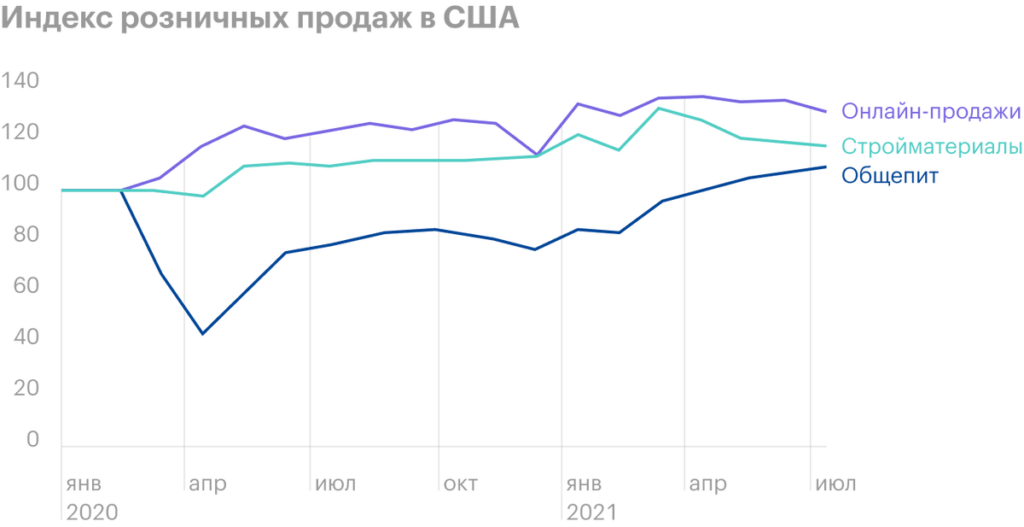

Medal for evenness. The company weathered the coronavirus spring 2020 well, but not without loss. The change in consumption patterns helped partly: people are spending more on food, - Some of the leadership has been on the best side.: online sales in the overall structure of revenue grew by almost 2,5 Times, reaching 9,6% in the overall revenue structure. Even the drop in sales in the catering industry did not spoil the big picture much.. All in all, the company performed at its best in the worst of circumstances.

Certainly, Right away, with the improvement of the situation, its sales dropped slightly - but, since it is necessary to compare with a period of abnormal demand, when everyone was preparing for the apocalypse, nothing terrible happened.

Shares can be taken now with the expectation of an influx of investors, wanting stability and predictability in an era of fear and coronavirus. Even if there is no new quarantine, then Flowers Foods objectively looks like a stable and strong business, Yes, and with dividends "for any weather", This already makes her stand out from the crowd.. If there is a new quarantine, then we already know, that the company will be fine. If quarantine doesn't happen, then we also know, that the company will be fine.

Catering is being restored. The company can count on an increase in the consumption of its products by catering establishments - let this moment be balanced by a slight decrease in the consumption of Flowers Foods products by retail customers.

Wrecked. The company pays 84 cent dividend per share per year, what gives 3,44% per annum - which is much more, how 1,32% averaged over S&P 500. This argument alone is enough, so that stocks rise due to the influx of payout lovers, who will pump quotes to the desired level.

What can get in the way

Concentration. According to the report, 10 the largest clients of the company give it 53,6% proceeds. The largest of them is Walmart with 21,2% proceeds. Changing relationships with one of the major customers may adversely affect reporting.

Conditionally expensive. According to company data, the volume of the bakery market - as fresh, and frozen - in the USA - 37.6 billion dollars. Flowers Foods ranks in this market 11,51%. At the same time, with its capitalization of 5.16 billion, the company costs 13,72% from your market.

Based on this, we can assume, that now the company is worth quite adequately and there are no visible reasons for the growth of quotations in the near future. P / E for the company is approximately 22,73 - it's not too high, but not too low. However, most investors don't pay much attention to this.

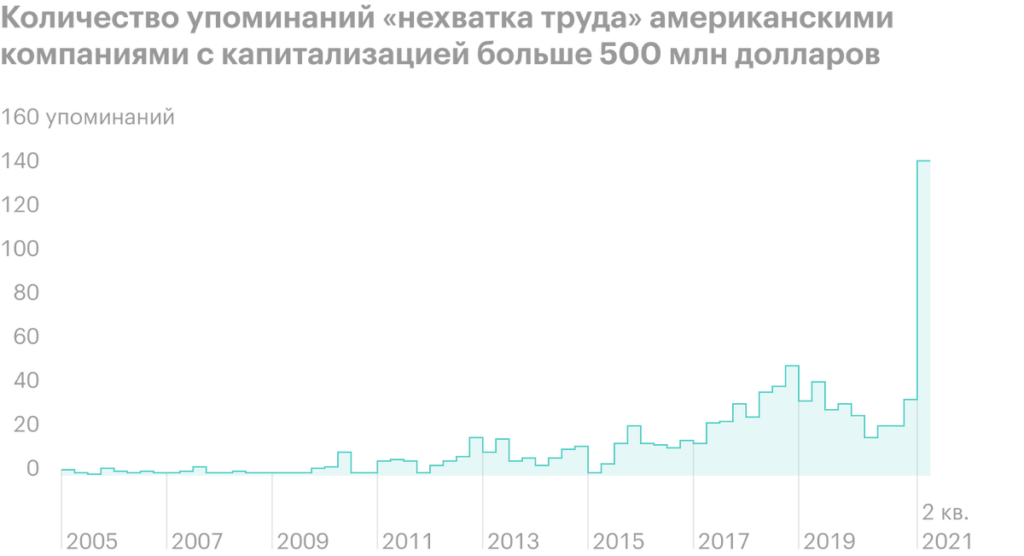

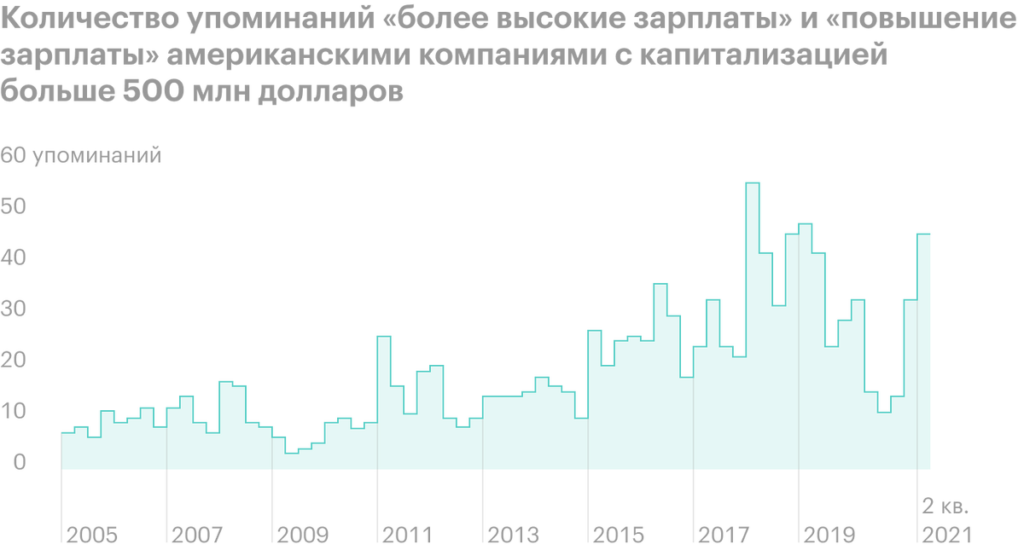

Materials in consumption. Wheat prices rose strongly this quarter. You should also keep in mind the rise in labor costs.: they make up 30,4% from the company's revenue. In conditions, when American companies complain about the rising cost of workers due to their shortage, Flowers Foods, too, could face a notable rise in labor costs. All in all, gotta be ready for that, that the increase in costs will spoil the company's reporting.

Wrecked. The company spends $178.92 million a year on dividend payments - 77,91% her profits over the past 12 Months. At the same time, the company has a debt amount of slightly more than 1.9 billion, of which 509.767 million must be repaid during the year. Basically, a lot of money at the disposal of the company: 292,27 million on accounts and 303.897 million debts of counterparties. While favorable loan conditions in the US will allow the company to collect debts at an acceptable interest rate in sufficient volumes. Furthermore, I even think, what if Flowers Foods decides to expand - and this is a very likely scenario, - then dividends, probably, will not cut - just take a large amount. But still, let's keep in mind the possibility of cutting payouts and falling shares because of this..

What's the bottom line?

Flowers Foods promotions can be taken now at 24,38 $. And then there are two options.:

- wait, when they exceed all-time highs and cost 27 $. Think, that we will reach this level in the next 12 Months. But, probably, it will happen much faster: the company's payouts are too attractive;

- keep shares next 10 years, receiving dividends.

But still, you should look at the news section on the company's website., to get rid of shares before, How will the market react to the news about the reduction in payments?.