Now we have a uniformly speculative thought with a conservative touch: take shares of the engineering business Emcor (NYSE: EME) with an eye on the growth of infrastructure investments in the United States.

Growth potential and duration : eleven percent in 12 months; nine percent per year for 15 years. All excluding dividends.

Why stocks can go up: U.S. real and imagined infrastructure investment on the rise.

How do we act: take shares at the moment 122,42 $.

Sources were used in the development of the material, hard-to-reach for users from Russia. Putting our hopes on, Do you understand, what to do.

What the company makes money on

Emcor provides clients with construction and maintenance services for infrastructure facilities.

In accordance with the annual report, the company's revenue is divided in the following way.

Construction site - sixty two percent. The company provides services for the design and construction of engineering structures of the widest range: power supply and lighting systems, voice communication and electronic computing systems, water supply systems and much more. The sector's operating margin is 8,4 % from its proceeds.

Service companies - twenty nine percent. Cleaning, technical and property service, advising. This sector is the only one, in which services are provided as in the USA, as well as in England. Operating margin of the American part of the sector — 5,4 % from US-acquired sector revenue, operating margin of the UK part of the sector — 4,8 % from UK-acquired sector revenue.

Industrial services - nine percent. In this sector, the company works primarily with companies from the oil and gas sector and petrochemical processing: Emcor serves the equipment of these companies. The segment's operating margin is −0.3% of its revenue, unprofitable segment. In fairness, I note, that the coronacrisis is to blame: in pre-war 2019 the operating margin of the segment was 4,1% from its proceeds.

95% revenue the company makes in the US, 5% - in other countries. In the report they speak, that virtually all overseas revenue is made in the UK.

Arguments in favor of the company

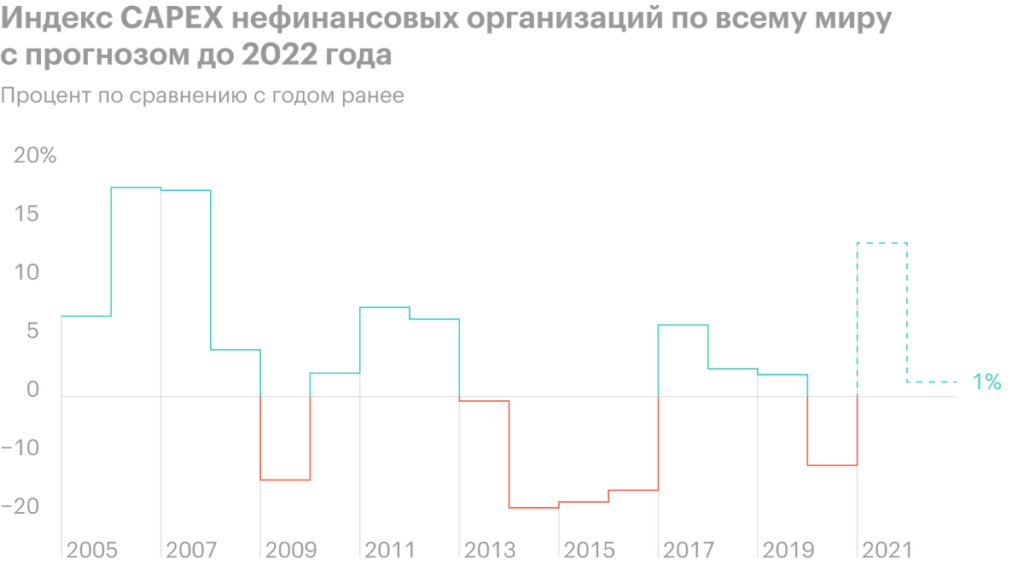

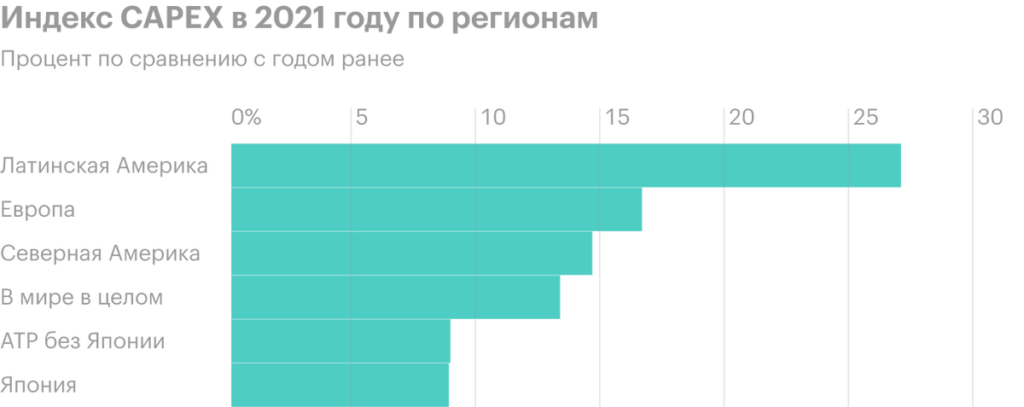

Natural growth. Emcor is a natural beneficiary of growth in capital renewal investment in the US this year. So I would expect good reporting from the company for at least a couple more quarters. But even without this there is no reason to believe, that the company's order volume may drop significantly: already built corporate infrastructure in the US requires constant maintenance and repair.

A bit of Biden, quite a bit. Emcor could also be the beneficiary of Biden's expected multibillion-dollar U.S. infrastructure investment package.. But even if this funding from the US government is not, Sufficient investment in infrastructure will be provided by the private sector over time. America will need an additional $5.7 trillion by 2039 just to support economic growth: the existing infrastructure is aging and needs renovation.

In this context, Emcor looks like a good investment option for the long term.. The company is inexpensive in relative and absolute terms: P / E — 20,83, capitalization - 6.83 billion dollars. Her business is characterized by a high level of stability.

What can get in the way

If there is no Biden. Over the past year, the company's shares rose by 78,4% - moreover, that the company had no visible success at this time. This is explained, certainly, speculative expectations of investors that, how will Emcor succeed if the US government adopts a massive spending program.

If Biden's package is not accepted for some reason, then the stock could be hit hard. On emotions, investors will get rid of these shares without looking back., that the company's business is already doing well.

Accounting. The company pays 52 cents in dividends per share per year, which is 0,42% per annum. It takes her 28.6 million dollars a year - almost 89,37% profit for the past 12 months.

According to the latest report, the company has debts of 3.041 billion dollars, of which 2.143 billion must be repaid within a year. Basically, money at her disposal should be enough for everything: 668,9 million on accounts and 2.1 billion debts of counterparties. But you should still be prepared to cut payments.. However, it is unlikely that the company's shareholders are shaking so much because of these payments - therefore, a strong drop in the event of a cancellation of dividends can not be expected. Another thing, that in the long run, when rates rise and loans rise in price, big debt will become a problem.

There is America - there is Emcor. The whole idea is based on the idea of the USA as a country, where businesses have long planning horizons, and the state does not suffer from loss of control. Therefore, you should keep in mind, that the entire business of Emcor depends on the predictability of the situation in the United States.

What's the bottom line?

Shares can be taken now by 122,42 $, then there are two options:

- wait, when stocks exceed historic highs and begin to cost 136 $. Think, that we will reach this level in the next 12 months;

- hold the stock for the next 15 years with a view to gradually increasing investment in US infrastructure.