Now we have a uniformly speculative thought: take stock of the Dollar Tree retail chain (Nasdaq: DLTR), to earn income from the savings of American buyers.

Growth potential and duration : ten percent for 15 Months; eight percent a year for fifteen years.

Why stocks can go up: the US population will be depleted, and the company will be able to earn on this.

How do we act: we take stocks at the moment.

No guarantees

If you want to be the first to know, did the investment work?, subscribe: how will it become clear, we will inform.

And what is there with the author's forecasts

What the company makes money on

This is a chain of cheap stores, what is in the title: most of the products are sold at cost 1 $. The range of prices in the store in general from 1 to 10 $ for the product.

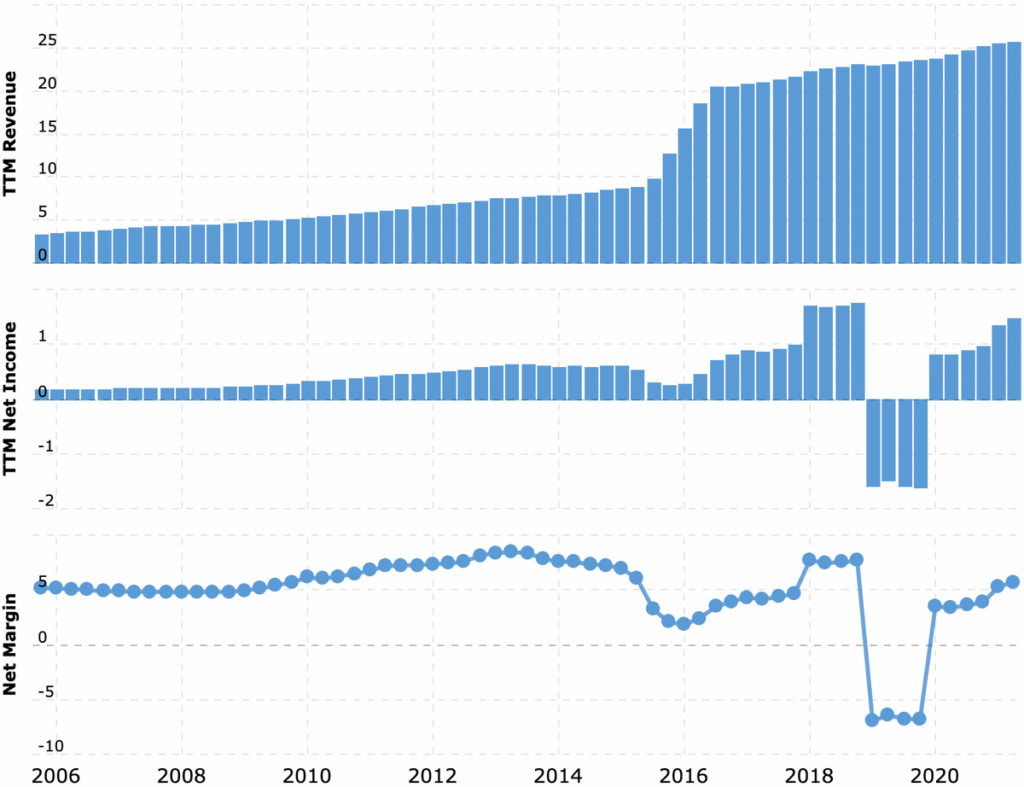

Revenue of the company, according to the report, divided into two networks.

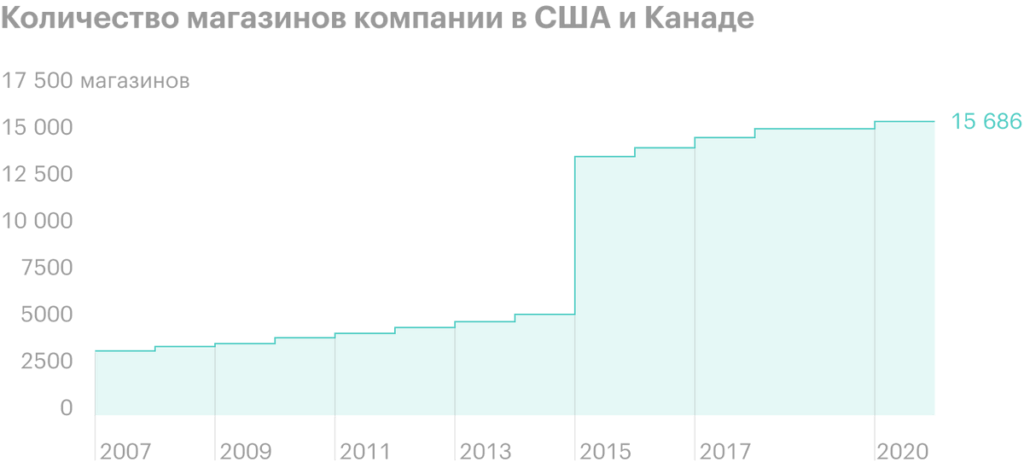

Dollar Tree - fifty two percent. The company's operating income is 12,04% of the sector's revenue. This is a network of 7805 stores. Sector revenue is divided into the following types of products:

- Consumed products - 48,3 %. Food and drink, cardboard and chemical products for the home, medicines and personal care products.

- Miscellaneous - 46,7 %. Toys, cutlery, presents, party decorations, postcards.

- Seasonal products - five percent. Products for different holidays.

Family Dollar - Forty-eight percent. It is practically the same, what and dollar tree, but the range is wider. The company's operating income is 5,35 % of the sector's revenue. This is a network of 7880 stores. Sector revenue is divided into the following types of products:

- Consumed products - 76,5 %. Same, as Dollar Tree in the same category, also diapers, products for animals and products for cars.

- Home Products — 8,8 %. This bed linen and decor elements.

- Clothes and devices 5,6 %.

- Seasonal products and electronics - 9,1 %. Products for the holidays, cheap prepaid phones, toys, school supplies.

The company makes almost all sales in the USA.. There are a couple of stores in Canada, but their share in the overall revenue structure of Dollar Tree is nonsense.

Arguments in favor of the company

Living worse and worse. The growth in consumption and employment after the removal of quarantine in the United States should not hide the fact from consumers, that life in the States and without the still unfinished corona crisis was not sugar, what we wrote about in ideas for Dollar General and Ollie’s Bargain Outlet. The overall trajectory of the economy for the mass of consumers there was extremely negative.: wages grew much slower than real estate prices, medication and education.

Now, added to this is the permanent threat of loss of income due to the state of emergency and the forced closure of the economy.. But even without sudden force majeure, life in the USA is not so good.: The middle class in the US has been shrinking even without the pandemic, and the coronacrisis dealt just one more blow. Therefore, one can expect, that Dollar Tree will be able to capitalize on the tragedy of the primitive consumption in the United States: I'm sure, that American consumers will save more in the future, which will increase sales in such stores.

Cheap in every way. The company has a rather small P / E — 16,28, so at least for this reason enough investors should be recruited into these shares, looking for cheap efficient businesses, and Dollar Tree is just like that.

What can get in the way

Logistics. According to the report, the company is almost 40% purchases of goods outside the United States. With rising global freight prices and a rather tense situation with logistics services, shareholders should be wary, that higher logistics costs will spoil the reporting of this business.

Duty. The company has a huge amount of debt: 13,639 billion, of which 3.9 billion must be repaid within a year. But the company does not have much money in its accounts - 1.473 billion.

I have no doubt, that Dollar Tree will be able to borrow the necessary amount to cover the debt, but you need to understand, that the company's debt burden will only grow further, as it competes with Dollar General for market share and constantly opens new stores. Dollar Tree plans to open 600 more new stores and renovate 1,250 old stores in 2021. Therefore, such an amount of debt cannot but disturb.

Off season. Now in the US, consumption and wages are rising, so there is a risk, that in a short distance these actions will not perform well, because Americans will temporarily start going to more expensive stores. This, however, is not monstrous, insurmountable obstacle - rather an argument in favor of investing in these stocks for a longer period. But the company's latest report shows, that she is doing well with sales even in a situation with an improvement in consumer sentiment. So that, maybe, I play it safe.

What's the bottom line?

We take stock now. And then two options:

- wait for the price increase and sell for 111 $. I believe, that we can achieve this result in the following 15 Months;

- we hold the following shares 15 years. Think, that during this time the company will be able to fully capitalize on the impoverishment of the American proletariat. May be, across 5 years, having reached a certain level of income, she will introduce dividends, what will attract additional investors to the shares.