Buy shares of the company of the retail chain Big Lots (NYSE : BIG), to get income from the deteriorating economic situation in the USA.

Buy shares of the company of the retail chain Big Lots (NYSE : BIG), to get income from the deteriorating economic situation in the USA.

Growth potential and duration : eleven percent for 16 Months; ten percent a year for fifteen years. All excluding dividends.

Why stocks can go up: the long-term business environment for the company turns out to be more than positive.

How do we act: take shares at the moment 66,2 $.

What is Big Lots on ( NYSE : BIG )

This is a chain of stores for cheap products. According to company report, its revenue is divided into subsequent segments:

- Furniture — twenty-eight percent.

- Home Products — 16,9 %. This category includes: curtains, decorative textiles, carpets, floor coverings, bedding.

- Consumables - fifteen percent. This is cosmetics, medications, plastic, products of the chemical industry and for animals.

- Seasonal products — 13,2 %. It's a decoration for the festivities., furniture for the street and gazebos.

- Food — 12,9 %.

- Electronics, toys and devices — 7,1 %.

- Home products with hard surfaces — 6,9 %. This is a small household appliance, products for food making and cleaning.

1408 the company's stores are unevenly distributed across different states: most of all in California — 150, Texas — 112, Florida — 104 and Ohio - 98. These states account for thirty-three percent of the company's revenue., the least — one store each — in North Dakota and Minnesota. The company operates only in the USA.

Annual revenue in billions and profit of the company in million dollars

| Revenue | Profit | Margin | |

|---|---|---|---|

| 2017 | 5,26 | 189,83 | 3,61 % |

| 2018 | 5,24 | 156,89 | 3,00% |

| 2019 | 5,32 | 242,46 | 4,55 % |

| 2020 | 6,20 | 629,19 | 10,15 % |

Quarterly revenue in billions and company profit in million dollars

| Revenue | Profit | Margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 1,64 | 451,97 | 27,49 % |

| 3 neighborhood 2020 | 1,38 | 29,91 | 2,17 % |

| 4 neighborhood 2020 | 1,74 | 97,99 | 5,64 % |

| 1 neighborhood 2021 | 1,63 | 94,56 | 5,82 % |

Arguments for Big Lots ( NYSE : BIG )

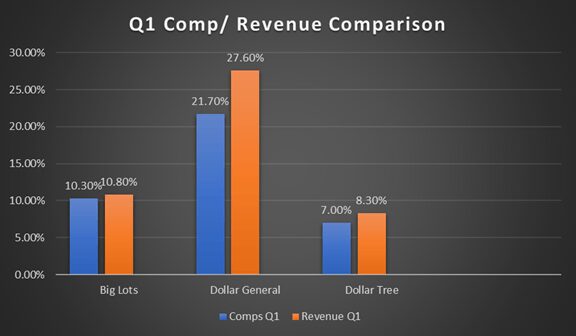

Conjuncture. The main arguments in favor of the company have already been voiced in the ideas for Dollar General and Ollie's Bargain Outlet: life in America without the coronavirus was gradually deteriorating., and the coronavirus has given this process an additional boost.. Certainly, there will be seasonal improvements, when life becomes more or less normal, but in the long run, wage growth has not kept pace with inflation, and the work itself is becoming increasingly unstable., and employment is no longer guaranteed to anyone.

Talk about a shrinking middle class began long before the pandemic, well, with the coronacrisis, things will be even worse.. I'm waiting, that the process of pauperization of the American consumer will force many Americans to switch to budget consumption, which will have a positive impact on sales of chains like Big Lots.

Plot on the real estate boom in the United States. A significant share of the company's revenue is things for home improvement.. Given the growth in home sales in the US, this is an argument in favor of, that the company's stores will be purchased for the arrangement of new housing. Wild prices for houses and building materials in the US here will even be a plus.: home buyers will be motivated to save on the interior of the house, since it doesn't work on the houses themselves.

Cheapness. The company has a very low P / E - in the area 8, - she looks cheap even against the background of her colleagues from the field of cheap stores. This can catch up with a bunch of investors in the stock., which will increase quotes and may lead to the purchase of the company by someone larger. For example, the buyer may be the same Dollar General.

What can hinder the Big Lots company ( NYSE : BIG )

Rentals. If you read our titanic longread about the American real estate market, then you already know, that there is a huge demand for land in the U.S.. And that's the problem: according to the report, from 1408 company stores only 50 belong to her, for other Big Lots rents space. In this regard, the company's shareholders should be prepared to do so., that the rental price will rise. And this will affect the reporting of Big Lots not in the best way..

Better is longer. Now in the US there is an economic recovery and wages seem to be growing again, after falling hard. In this regard, consumers may mistakenly decide, that you do not need to save, and will be spent in more expensive stores on more expensive goods.

So, in the last quarter, against the background of the recovery of consumption in the US, sales of Dollar General, albeit insignificantly, but still decreased. The same could theoretically happen to Big Lots this season.. It's more of an argument in favor of holding Big Lots shares for a long time.. The probability of a decline in sales is more of a theorizing, so far the company is doing great: according to the latest report, in the last quarter, sales fell only in the categories of consumables and food, but they don't give most of the sales, while the rest of the segments showed significant growth.

Payouts. Big Lots Paying 1,2 $ per share per year. With the current stock price, it turns out to be somewhere 1,74% per annum. The company takes about 50 million dollars a year. Basically, it's only about 10% from the Big Lots profit for the last 12 Months. But it may well cut payouts for the noble purpose of investing in opening new stores and renovating existing ones.. Fortunately, she has already planned the corresponding spending this year at the level 210 million dollars. It is also worth remembering about 2,769 million dollars in arrears, out of which 1,049 billion needs to be closed within a year.

The company does not have much money at its disposal - 613,329 million in accounts, so it is quite logical to sacrifice dividends here for the sake of business development. Basically, it wouldn't be so scary, if investors, after cutting payments, did not sell off shares of companies.

What's the bottom line?

We take shares now by 66,2 $. And then there are two options.:

- we wait, when they grow up to 74 $, - this should happen in the following 16 Months. This is a perfectly reasonable option., taking into account all the positive aspects with the company;

- keep shares next 15 years. This is the most preferred option., because in a long time the company will be able to realize its full potential.