Today we have a moderately speculative idea.: take stock of industrial business Corning (NYSE: GLW), to capitalize on the industrial boom in the US.

Growth potential and validity: 13% behind 15 months excluding dividends.

Why stocks can go up: there is a demand for the company's products.

How do we act: take stock now.

The idea was proposed by our reader Andrey Sergeev in the comments to the idea on Teradata. Suggest your ideas in the comments.

Our reflections are based on the analysis of the company's business and the personal experience of our investors, but remember: not a fact, that the investment idea will work like this, as we expect. Everything, what we write, are forecasts and hypotheses, not a call to action. To rely on our reflections or not – it's up to you.

If you want to be the first to know, did the investment work?, subscribe: as soon as it becomes known, we will inform.

Research, like this and this, talk about, that the accuracy of target price predictions is low. And that's ok: there are always too many surprises on the stock exchange and accurate forecasts are rarely realized. If the situation were reversed, then funds based on computer algorithms would show results better than people, but alas, they work worse.

What the company makes money on

The company produces goods from ceramics and glass, as well as components for complex equipment. According to the annual report, The company's revenue is distributed as follows.

Display Technologies — 28% proceeds. Substrates, which are used when creating TV screens, Notebooks, Tablets. Final segment margin — 22,6% from its proceeds.

Optical communications — 31% proceeds. Fiber optic cables and other. Final segment margin — 10,27% from its proceeds.

Special materials — 16% proceeds. Glass, ceramics and crystals for industry. Here, the company's products are used to produce a huge range of products - from glasses and components for the aerospace industry to consumer electronics and radiation protection.. Final segment margin — 22,45% from its proceeds.

Environmental Technologies — 12% proceeds. Ceramic Substrates and Filters for Controlling Emissions in Engines. Final segment margin — 14,37% from its proceeds.

Scientific research — 9% from proceeds. These are consumables and devices for laboratories. Final segment margin — 13,92% from its proceeds.

Everything else — 4% from proceeds. These are various investments of the company in such areas., as pharmaceuticals and automotive glass production. The segment is deeply unprofitable: losses on 46% more revenue.

Revenue by country and region

| USA | 29,79% |

| Canada | 2,39% |

| Mexico | 0,65% |

| Japan | 4,4% |

| Taiwan | 7,74% |

| China | 32,6% |

| South Korea | 6,53% |

| Other Asia-Pacific countries | 2,96% |

| Germany | 3,3% |

| Other European countries | 7,31% |

| Other countries and regions | 2,33% |

Arguments in favor of the company

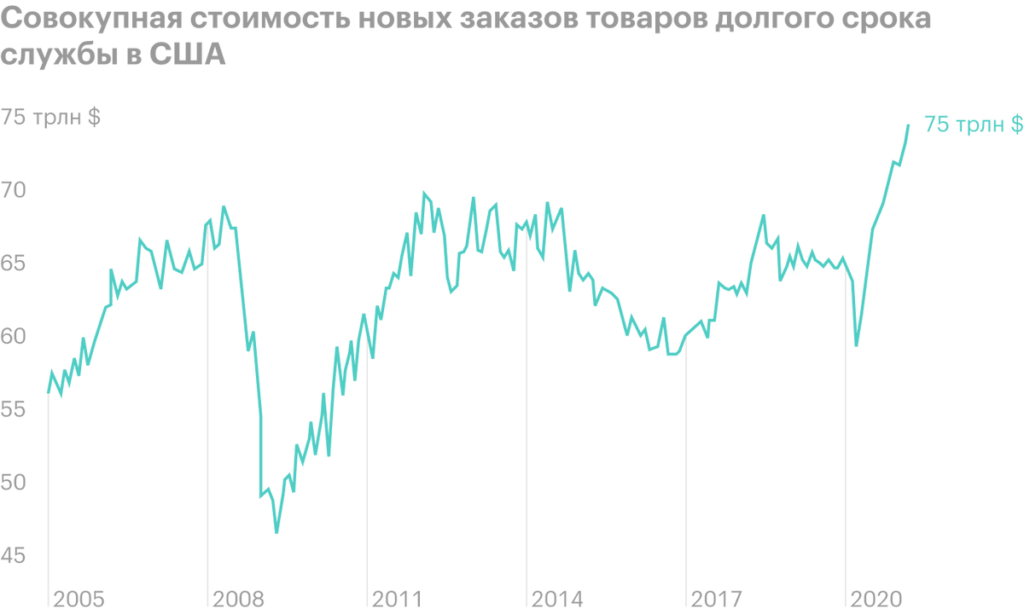

Good, maybe even better. For a neighborhood, ended 31 Martha, the company has shown excellent growth in revenue and profit, and in all segments. Since then, the main production figures in the US, and in other regions, increased or remained at the same high level. So what can we expect here?, that the company will do very well this quarter.

Payouts. The company pays 0,96 dollars per share per year, with the current value of the shares it turns out 2,22% per annum. In the case of Corning, we see a good dividend yield for the current blessing times., which can attract many lovers of passive income into stocks - which will contribute to the growth of quotes. Moreover, the business environment is not bad for the company., and therefore there is a real prospect of increasing payments.

What can get in the way

High concentration. According to the annual report, the company has a fairly high concentration of sales. In the Display Technology segment, four customers provide 74% selling, in the segment "Optical communications" one client gives 11% proceeds, in "Special Materials" three clients account for 65% selling, at Environmental Technologies, three clients give 74% proceeds, in Scientific Research, two clients give 39% selling.

A change in relationship with one of the major clients can negatively affect the company's results.

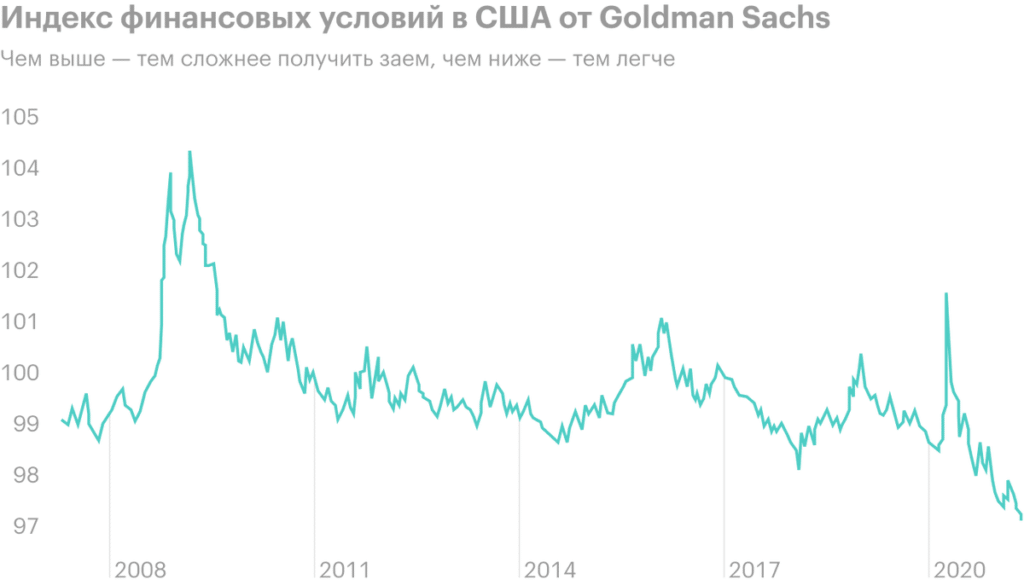

Payouts. On "trash" the company takes about 862 million dollars a year. Basically, it's a little less 40% company profits, but suddenly she decides to expand production? In addition, she has a very high level of indebtedness - 16,585 billion dollars, out of which 3,513 billion needs to be repaid within a year. Money from Corning, basically, enough for everything: 2,868 billion in accounts plus 1,9 billion of counterparties' debts, and the conditions for obtaining loans in the USA are now very soft. But you still need to keep in mind the possibility of the company cutting payments for higher goals., which can lead to price drops.

What's the bottom line?

We take shares now by 43,12 $ for pike. Think, taking into account all the positive aspects, we can well expect the growth of shares to 49 $ per piece for the next 15 Months.