Now we have a very speculative thought: take shares of the technical company ContextLogic (Nasdaq: WISH), to generate income on the speculative growth of these stocks after a powerful fall.

Growth potential and duration : thirty two percent in 20 months; 145% for 8 years.

Why stocks can go up: they fell very much, and the online commerce sector, in which company does he work, seems promising to almost everyone.

How do we act: we take at the moment 9,78 $.

No guarantees

And what is there with the author's forecasts

Because we do not try to build difficult models. The performance forecast in the article is the author's expectations. We indicate this forecast for guidance.. As with investing in general, readers decide for themselves, it is worth trusting the creator and focusing on the forecast or not.

What the company makes money on

The company owns the online commerce platform Wish, aimed at users of mobile devices with Android and iOS operating systems: ninety percent of site activity happens in the company's phone app.

In accordance with the annual report of the company, its revenue is divided into two sectors:

- Marketplace - 79,77 %. The company earns, providing sellers with access to the Wish Internet resource. ContextLogic collects its own percentage from operations, takes funds for promoting products - this gives 9,86 % sector revenue — and provides other services.

- Logistics - 20,23 %. In this sector, the company provides merchants with the service of sending the product to the buyer..

In the report, the geographical section is given only by the market area. Geographically, the company's revenue is divided in the following way:

- Europe - forty-six percent.

- North America - forty percent. USA gives 33.6 % from the entire revenue of the company.

- South America - five percent.

- Other, unspecified regions - nine percent.

The company is unprofitable.

Annual revenue and profit, million dollars

| Revenue | Profit | Income margin | |

|---|---|---|---|

| 2017 | 303,37 | 24,02 | 7,92 % |

| 2018 | 289,47 | −4,89 | −1,69 % |

| 2019 | 280,66 | −31,55 | −11,24 % |

| 2020 | 443,88 | −1,51 | −0,34 % |

2017

Revenue

303,37

Profit

24,02

Income margin

7,92 %

2018

Revenue

289,47

Profit

−4,89

Income margin

−1,69 %

2019

Revenue

280,66

Profit

−31,55

Income margin

−11,24 %

2020

Revenue

443,88

Profit

−1,51

Income margin

−0,34 %

Quarterly revenue and profit, million dollars

| Revenue | Profit | Income margin | |

|---|---|---|---|

| 2 kV. 2020 | 118,93 | 1,57 | 1,32 % |

| 3 kV. 2020 | 117,41 | 1,39 | 1,18 % |

| 4 kV. 2020 | 119,73 | −3,49 | −2,91 % |

| 1 kV. 2021 | 144,80 | −2,72 | −1,88 % |

2 kV. 2020

Revenue

118,93

Profit

1,57

Income margin

1,32 %

3 kV. 2020

Revenue

117,41

Profit

1,39

Income margin

1,18 %

4 kV. 2020

Revenue

119,73

Profit

−3,49

Profit Margin

−2,91%

1 kV. 2021

Revenue

144,80

Profit

−2,72

Profit Margin

−1,88%

Arguments in favor of the company

Fell hard. The company recently went public, in December 2020, and is now trading below 24 $ - prices, with which the shares were placed during the IPO. That is, you can take shares just in anticipation of a rebound.

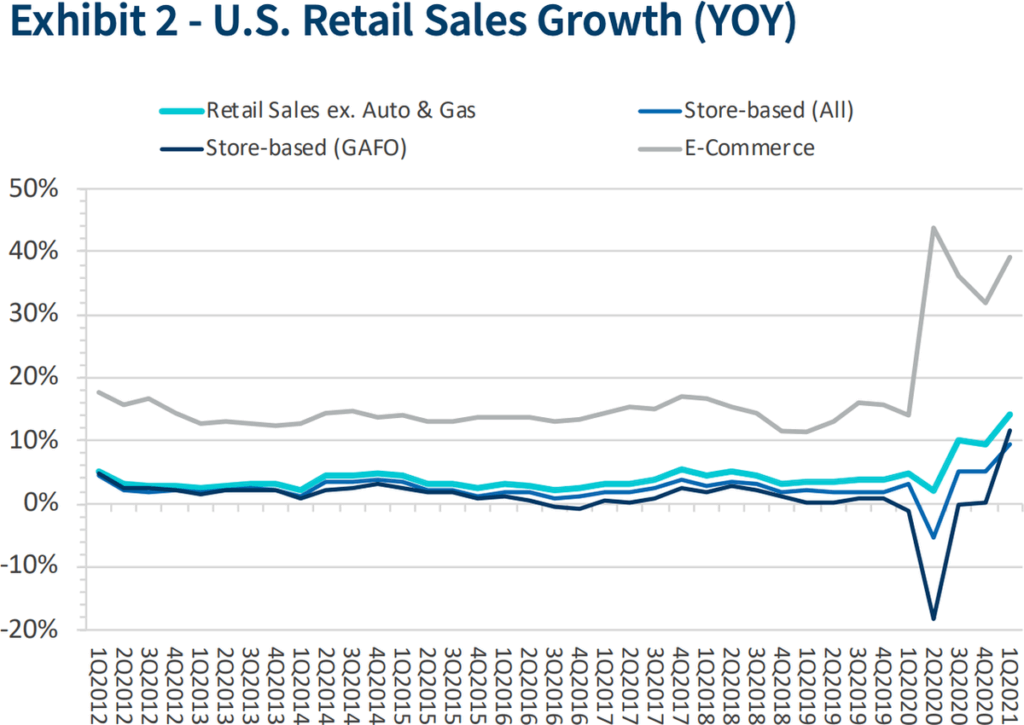

Promising sector. In the US, online commerce is experiencing strong growth. The coronavirus crisis contributed to this in part., but in general, the growth trend of e-commerce was before. However, the pandemic experience will give consumers an added incentive to shop more online: as polls show, many consumers plan to use more online channels even after the end of the pandemic. I believe, that this result can be safely extrapolated to the whole world as a whole. In other countries, online commerce growth forecasts are also very brave..

ContextLogic is at the forefront here, as a representative of the sub-segment of mobile commerce, which is growing even faster than online commerce in general: the average annual growth rate here until 2024 will be 25.5% per year. All this together will contribute to the growth of the company's revenue at an above-average rate..

The company's shares can count on an influx of retail investors. ContextLogic looks like a 'promising start-up' due to its revenue growth rate and mobile focus. Moreover, the average retail investor now expects unrealistic average annual growth rates - around 15%, and such results in theory can be obtained only in "fast-growing promising businesses". So I think, that ContextLogic shares will be pumped by a crowd of retail investors. Moreover, the capitalization of the company is not very large - $ 6.05 billion.

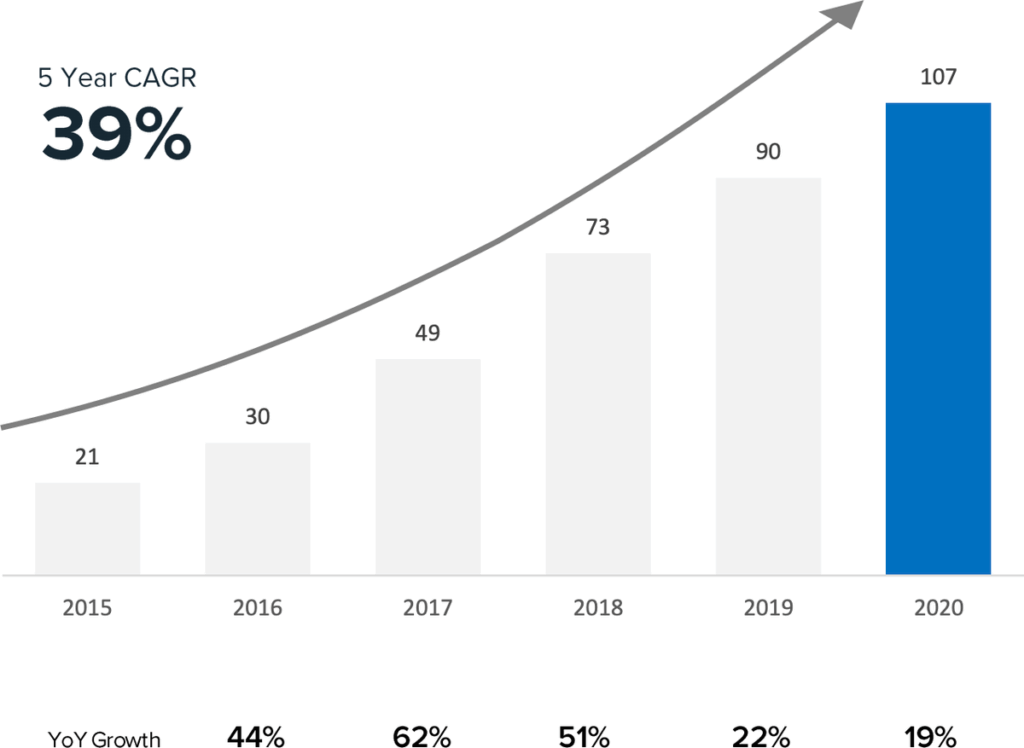

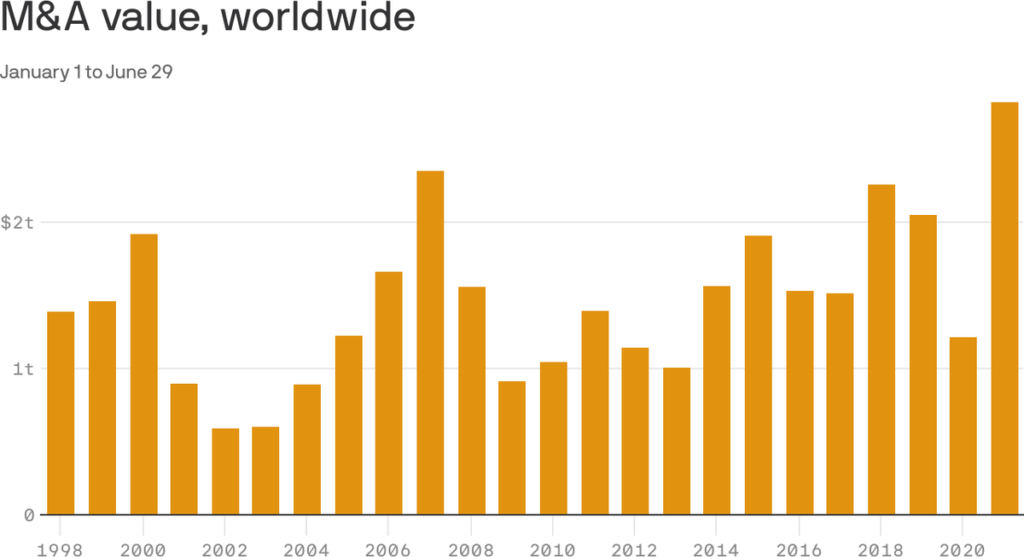

Good buy. The company may well be bought by someone larger. This will be within the logic of the M&A wave in 2021, and the capitalization of the company has fallen sharply. In terms of the sum of its advantages, ContextLogic may be of interest to a major player, who wants to develop in the field of online commerce: 107 million monthly users, 550 thousands of merchants working on the platform, presence in 100 more than countries and work with more than 50 thousand local contractors in these countries. In absolute numbers, the company does not look completely overvalued and may even serve its customer well.: The company's target market is everything, what is related to online commerce, i.e. $3.4 trillion in annual revenue, where 63% of activity is on mobile devices.

ContextLogic consistently brags about topics in all of its presentations and reports., what a smart and learning platform, which effectively analyzes shopping habits and gives users something, what do they want to buy. There are statements, that 70% of sales on the company's platform occur without search at all: the buyer takes something, what the main page offers him. This factor can serve as an additional argument in favor of someone buying a company..

I won't be too surprised, if the buyer of the company becomes Amazon, who with perseverance, worthy of a better use, develops low-margin online retail segment due to the main profitable cloud computing division.

What is the average annual return investors expect over long distances

| Individual investors | Professional Investors | Difference | |

|---|---|---|---|

| Argentina, Uruguay | 15,0% | 5,5% | 173% |

| Australia | 14,4% | 6,0% | 140% |

| Canada | 11,2% | 5,1% | 120% |

| Chile | 16,4% | 6,0% | 173% |

| Colombia, Peru | 16,6% | 5,3% | 213% |

| France | 12,1% | 4,7% | 157% |

| Germany | 10,7% | 4,9% | 118% |

| Hong Kong | 13,6% | 5,2% | 162% |

| Italy | 11,6% | 3,8% | 205% |

| Mexico | 16,2% | 4,6% | 252% |

| Singapore | 13,4% | 5,2% | 158% |

| Spain | 15,3% | 6,9% | 122% |

| Switzerland | 13,4% | 5,1% | 163% |

| United Kingdom | 14,1% | 4,6% | 207% |

| USA | 17,5% | 6,7% | 161% |

Argentina, Uruguay

Individual investors

15,0%

Professional Investors

5,5%

Difference

173%

Australia

Individual investors

14,4%

Professional Investors

6,0%

Difference

140%

Canada

Individual investors

11,2%

Professional Investors

5,1%

Difference

120%

Chile

Individual investors

16,4%

Professional Investors

6,0%

Difference

173%

Colombia, Peru

Individual investors

16,6%

Professional Investors

5,3%

Difference

213%

France

Individual investors

12,1%

Professional Investors

4,7%

Difference

157%

Germany

Individual investors

10,7%

Professional Investors

4,9%

Difference

118%

Hong Kong

Individual investors

13,6%

Professional Investors

5,2%

Difference

162%

Italy

Individual investors

11,6%

Professional Investors

3,8%

Difference

205%

Mexico

Individual investors

16,2%

Professional Investors

4,6%

Difference

252%

Singapore

Individual investors

13,4%

Professional Investors

5,2%

Difference

158%

Spain

Individual investors

15,3%

Professional Investors

6,9%

Difference

122%

Switzerland

Individual investors

13,4%

Professional Investors

5,1%

Difference

163%

United Kingdom

Individual investors

14,1%

Professional Investors

4,6%

Difference

207%

USA

Individual investors

17,5%

Professional Investors

6,7%

Difference

161%

What can get in the way

"Oh, China… » Most of the sellers from the company's platform are located in China. A whole bunch of problems are possible here - from purely logistical to political ones.. For example, China will begin to actively press entrepreneurs working on the ContextLogic platform. China is a land of opportunity, including the scariest.

"Who got in the temple - that is now the sand". The company is unprofitable - and therefore, by definition, volatile. This is especially important now, when rates hike looms, what makes loss-making companies usually bad, since the cost of loans is becoming more expensive for them.

Moreover, there is a very high probability, that the company will be unprofitable for a very long time and, maybe, even always: online commerce is generally not a very profitable business, since logistics and related costs eat up most of the profit there.

The company's unprofitability will motivate the company's management to engage in an additional issue of shares - which may negatively affect the quotes. Well, unprofitability is always a very likely risk of bankruptcy..

Might be a scam, but that's not for sure.. The CFO recently left the company, and a lawsuit from one of the investors appeared on the horizon, in which the company's management is accused of misrepresenting ContextLogic's operational metrics and defrauding shareholders. How this story will develop further is unclear.. But you should still keep this point in mind..

What's the bottom line?

We take shares now by 9,78 $. And then two options:

- I think, that over the next 20 months the stock will rise to 13 $ apiece due to the speculative influx of investors in them;

- hold shares for the next 8 years in anticipation of, what will they go back to 24 $, that is the price, on which they were placed during the IPO. Maybe, the company will become the new Etsy.

It seems to me, that the option to buy the company is more or less equally likely in both cases. Well, in any case, the idea turns out to be very volatile, and worth investing in, only if you are mentally prepared to lose this money.