<img class="aligncenter" src="/wp-content/uploads/2021/08/investideja-agilent-technologies-potomunbspchto-spros-slishkom-silen-8b06789.png" alt="Инвестидея: Agilent Technologies, потому что спрос слишком силен" />

Today we have a moderately speculative idea.: take stock of Agilent, a medical R&D manufacturer (NYSE: A), to capitalize on the growth of their sales.

Growth potential and validity: 14% behind 15 Months; 10% per year for 10 years.

Why stocks can go up: demand for the company's products is strong.

How do we act: we take shares on 156,54 $.

<h2 class='subheading'>Без гарантий</h2> <p class='paragraph'>Наши размышления основаны на анализе бизнеса компании и личном опыте наших инвесторов, но помните: не факт, что инвестидея сработает так, как мы ожидаем. Все, что мы пишем, — это прогнозы и гипотезы, а не призыв к действию. Полагаться на наши размышления или нет — решать вам.</p><p class='paragraph'>Если хотите первыми узнавать, сработала ли инвестидея, подпишитесь на Т—Ж в «Телеграме»: как только это станет известно, мы сообщим.</p><br /><h2 class='subheading'>И что там с прогнозами автора</h2><p class='paragraph'>Исследования, например вот это и вот это, говорят о том, что точность предсказаний целевых цен невелика. И это нормально: на бирже всегда слишком много неожиданностей и точные прогнозы реализовываются редко. Если бы ситуация была обратная, то фонды на основе компьютерных алгоритмов показывали бы результаты лучше людей, но увы, работают они хуже.</p><p class='paragraph'>Поэтому мы не пытаемся строить сложные модели. Прогноз доходности в статье — это ожидания автора. Этот прогноз мы указываем для ориентира: как и с инвестидеей в целом, читатели решают сами, стоит доверять автору и ориентироваться на прогноз или нет.</p><p class='paragraph'>Любим, ценим,<br />Инвестредакция</p>

What the company makes money on

The company produces instruments and consumables for scientific research and applied chemistry., and also provides services in these areas.

According to the annual report, The company's revenue is divided into the following segments:

- scientific research and their applied application — 44,8%. Tools and software for research at the cellular and molecular level.

Segment operating margin — 22,9% from its proceeds;

- diagnostics and genomics — 19,61%. ON, Ingredients, tools and consumables for scientific testing. Segment operating margin — 18,3% from its proceeds;

- Agilent CrossLab — 35,57%. Segment for the provision of services and supplies of consumables to ensure the operation of the entire laboratory. Segment operating margin — 27,2% from its proceeds.

The company's revenue is also split as follows:

- products - 75%. Segment gross margin — 55% from its proceeds;

- services - 25%. Segment gross margin — 47,5% from its proceeds.

Revenue structure by end users:

- pharmaceuticals and biotech — 32,85%;

- chemistry and energy — 21,61%;

- diagnostics and clinical trials — 14,74;

- food industry 9,68%;

- government and academic institutions 9,85%;

- environment and materials research — 11,27%.

Revenue by region is divided as follows:

- America - 36,86%;

- Europe - 27%;

- Asian-Pacific area - 36,14%.

Unfortunately, the breakdown of revenue by country is not given in the report.

<img class="aligncenter" src="/wp-content/uploads/2021/08/investideja-agilent-technologies-potomunbspchto-spros-slishkom-silen-c74b467.png" alt="Инвестидея: Agilent Technologies, потому что спрос слишком силен" /></p>

Arguments in favor of the company

Things are good, and it will get even better. In the short and long term, I see a positive for the company. Medical research gives her the main money, and this is a good basis for business, because pharmaceutical companies are like a squirrel on a wheel: forced to constantly run forward. Their patents expire over time, and they are motivated to invest big money in R&D, to create new drugs and patent them.

They don't count as expenses., because, When does a drug patent expire?, their incomes start to drop seriously: competitors begin to produce cheap analogs. They constantly need to be engaged in the creation of new drugs: just "the clock is ticking". And you have to spend a lot, because you never know, what drug can reach the stage of commercialization. So the medical part of the Agilent business can count on good demand, while the world patent system works like this, how it works, and pharmaceutical companies have an incentive to spend on development.

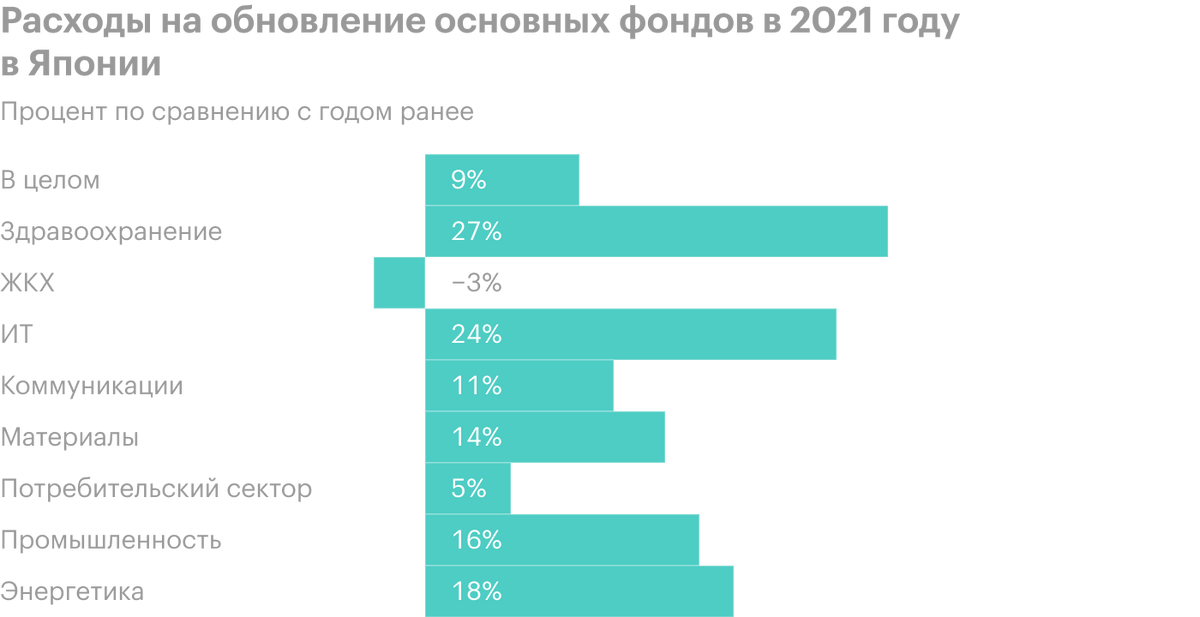

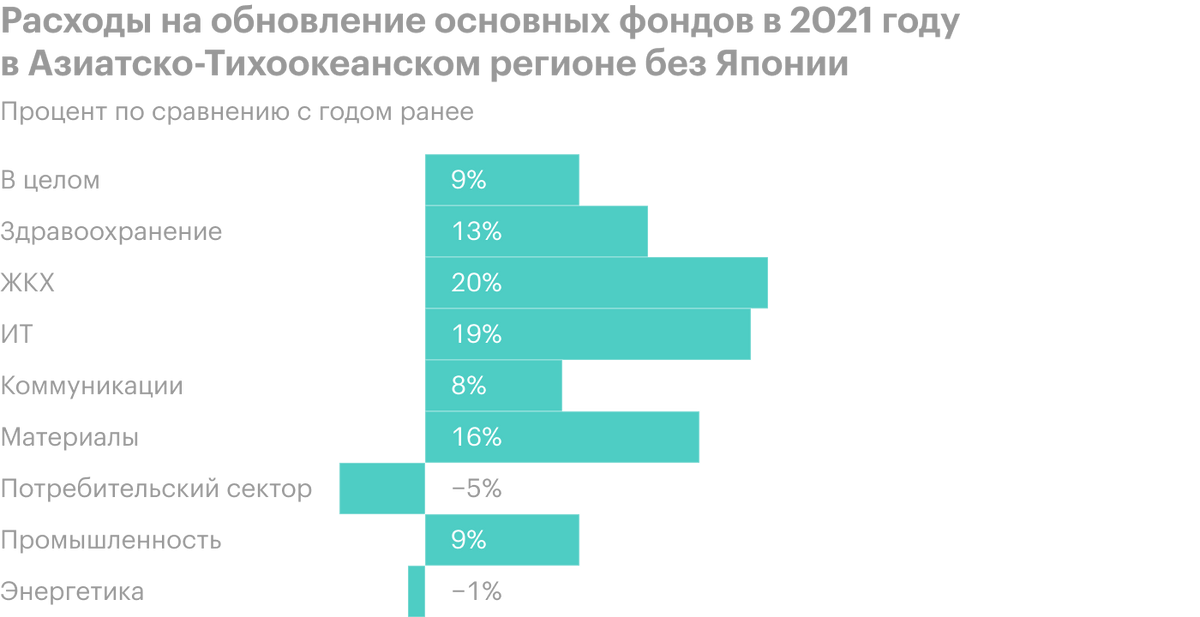

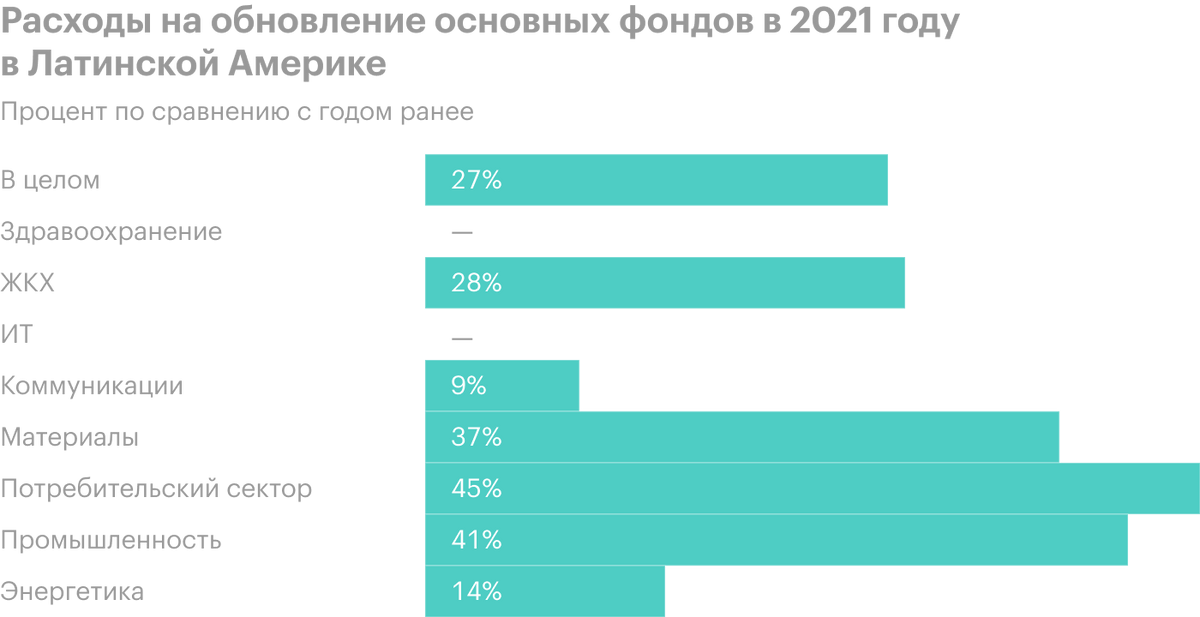

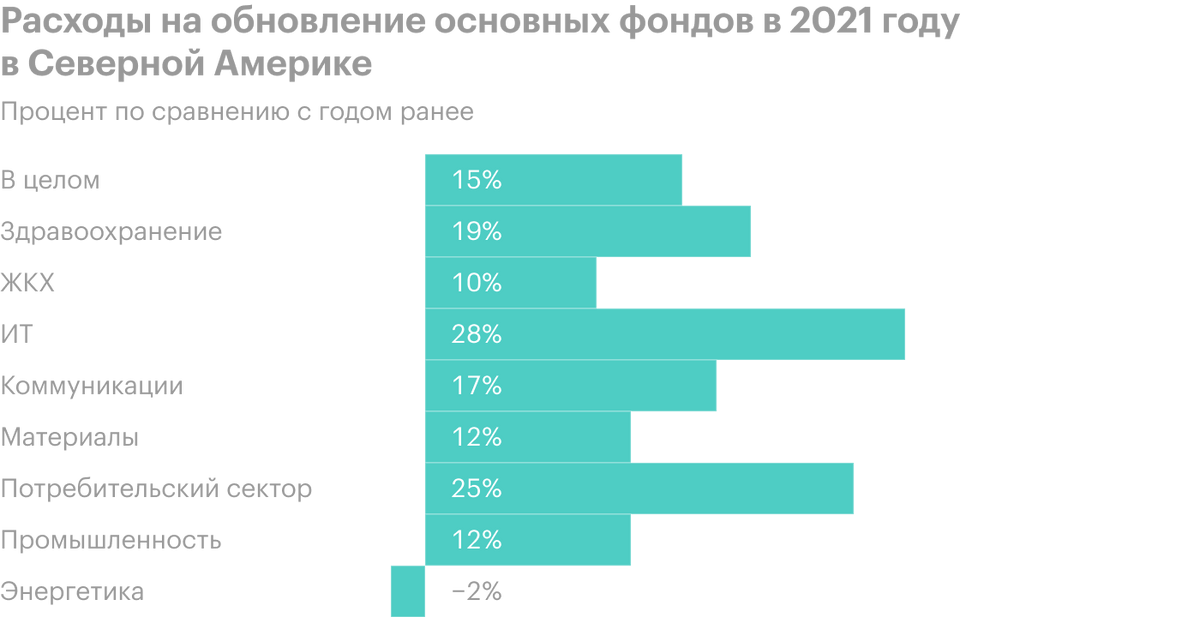

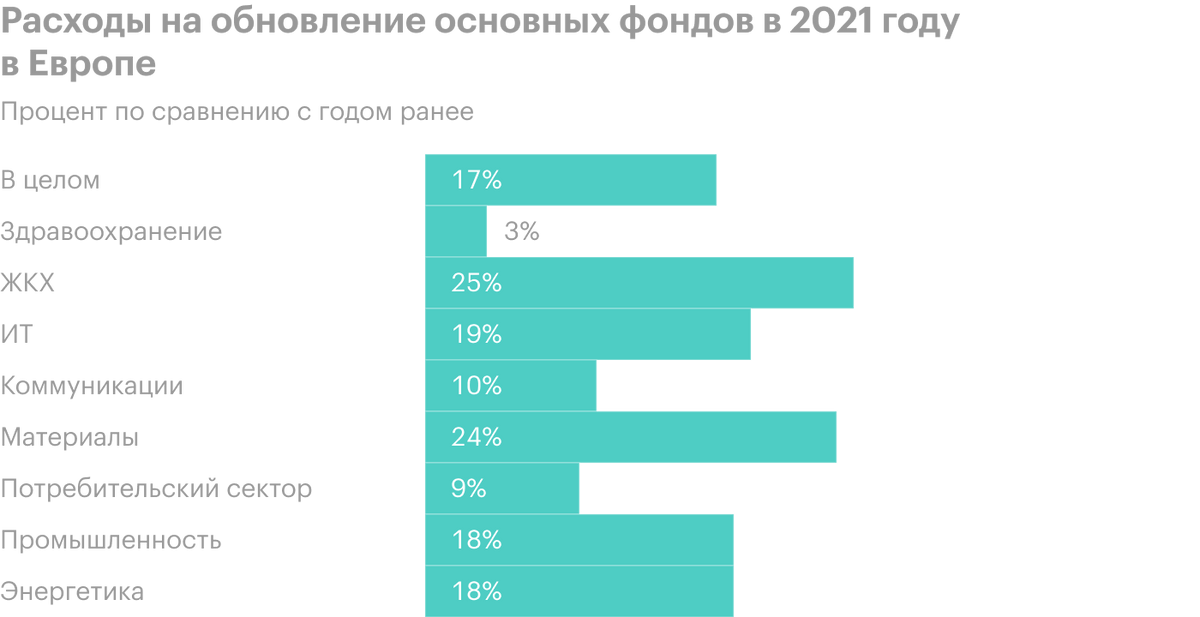

For Agilent's Non-Medical Customers in Chemistry and Energy, for example, - this is where Agilent can be the beneficiary of the current increase in the costs of industrial companies around the world for the renewal of fixed assets.

Purchase argument. In theory, the company could well be bought by someone bigger. Certainly, Agilent's current capitalization of $47.5 billion limits the buyer base to the largest medical companies. But, taking into account the profitability and marginality of Agilent, its purchase by someone is quite a probable outcome. Danaher is a likely buyer, who does not adhere to a strategy of inaction, based on quarterly results. Or maybe, the buyer will be Thermo Fisher Scientific.

What can get in the way

A little about the pandemic. The coronavirus crisis increased the revenue of some segments of the company and reduced the revenue of others, but the final picture is still positive for Agilent. The increase in the incidence now may slightly spoil the sales of the company directly.

Over 47% long-term assets of the company are located far outside the United States, raw materials and spare parts have to be bought all over the world, And, finally, export provides the main revenue. Considering Agilent's Global Operations, Coronavirus-driven logistical crisis could hurt company earnings this year.

Accounting. The company pays 0,77 $ dividend per share per year, which gives a very small profit - 0,5% per annum. The company spends $236 million a year on this - a little more 25% from its profits over the past 12 Months. Wherein, according to the latest report, Agilent has a large amount of debt - 5.588 billion, of which 1.758 billion must be repaid within a year. The company has enough money to cover all urgent debts: 1,38 billion in accounts and 1.075 billion debts of counterparties.

Pay cuts and high debt are not good right now, as rates are expected to rise and borrowing prices to rise. So there is a chance, that investors will exit heavily indebted stocks.

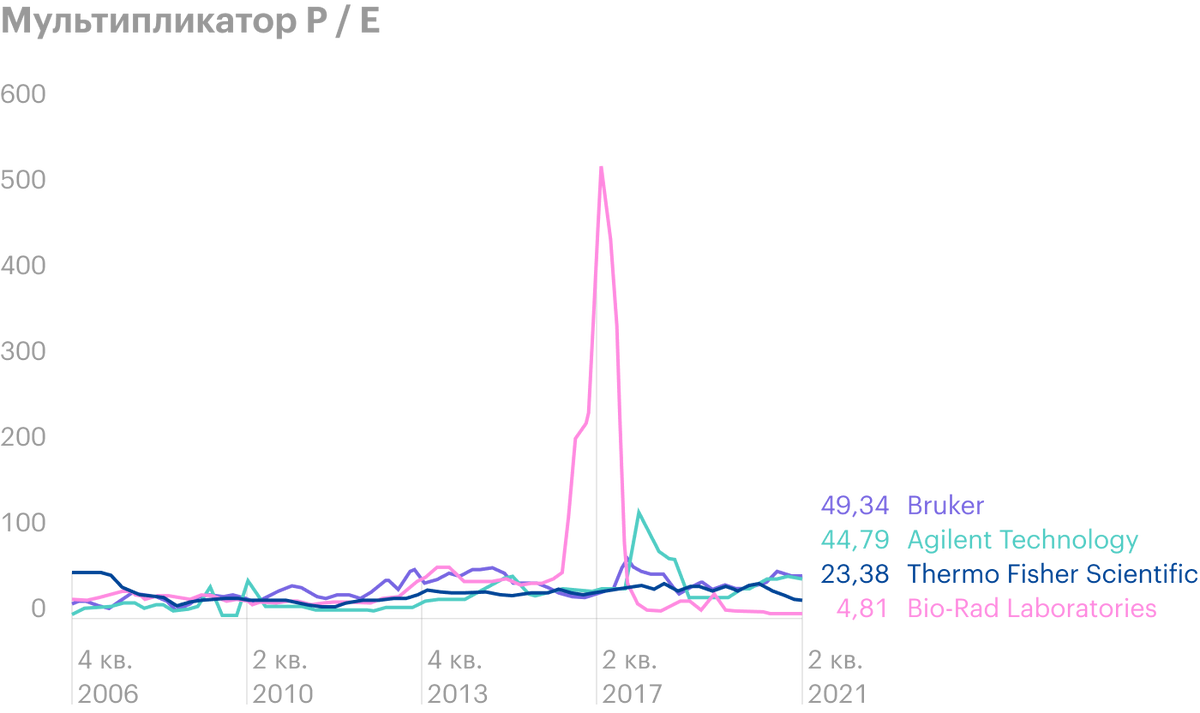

Price. Agilent P / E under 50, and compared to similar companies, it does not look cheap. I do not think, that it will scare off a potential buyer, but quotes can storm. Moreover, stocks are now at historical highs..

The buying argument works the other way around. Agilent itself may decide to buy one of the smaller competitors. From a business standpoint, there is nothing wrong with that., but stocks from such news may fall, insofar as, probably, companies will have to expand on borrowed money, and its debt load is already so high.

What's the bottom line?

<

p class=’paragraph’>Shares can be taken now by 156,54 $, and then there are two options:

- wait for the price 179 $ and sell. Think, that we will reach this level in the next 15 Months;

- keep shares next 10 years, to see, how the company will become Microsoft in the field of medical R&D.

I see the option of buying a company equally likely in both scenarios., as the Agilent buyer also understands, that low rates now are gift fate, And, maybe, decides to borrow a large amount to buy Agilent in the near future - while there is such an opportunity and loans have not risen in price.