BioXcel Therapeutics (Nasdaq: BTAI) — biotech start-up from the United States of America, whose drugs are in clinical trials. The company focuses on the introduction of artificial intelligence for the development of pharmaceuticals in the fields of neurology and immuno-oncology. Business is primarily aimed at the United States market.

Where did the funds come from?

At the moment, the business does not earn anything and attracts funds by issuing new shares - it earns mainly from additional issues. The last $100 million additional placement took place in June 2021.

At the same time, BioXcel has every reason to generate revenue in the coming years.: one of the developments is on the final stretch for approval by the U.S. Food and Drug Administration (FDA) and can get it in less than six months.

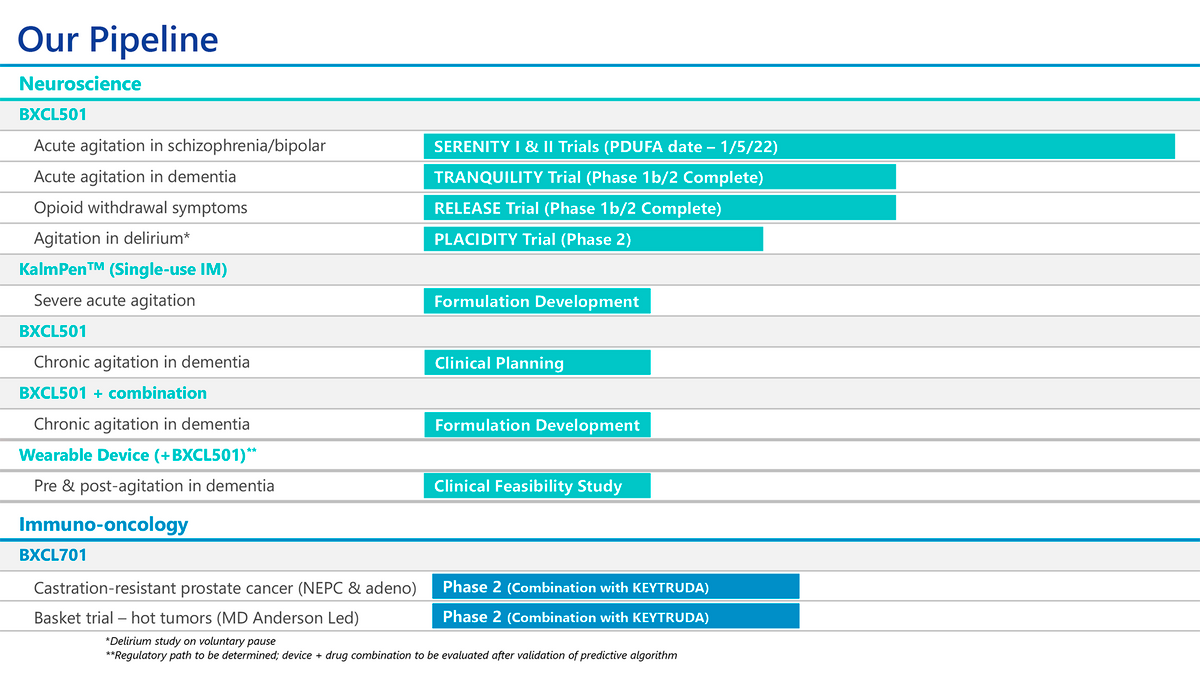

Preparations and stages of their development

BioXcel Therapeutics has two flagship products.

BXCL501 - a product closer to official recognition and commercialization to prevent agitation attacks, in other words, states of intense restlessness and sensual excitement, in which a person cannot control himself.

5 January 2022, the FDA will review the application for the introduction of drugs for patients with schizophrenia and bipolar disorder. The company is actively reviewing the introduction of BXCL501 in patients with dementia and delirium, also plans to introduce it for the treatment of withdrawal syndrome, which was caused by the use of opioids.

BXCL701 - product, stimulating?? immune response to fight aggressive forms of prostate cancer and other tumors.

Besides, the company is working on KalmPen for the treatment of severe agitation and is planning a wearable device to be used in combination with the BXCL501- and post-surgical period in patients with dementia.

What's wrong

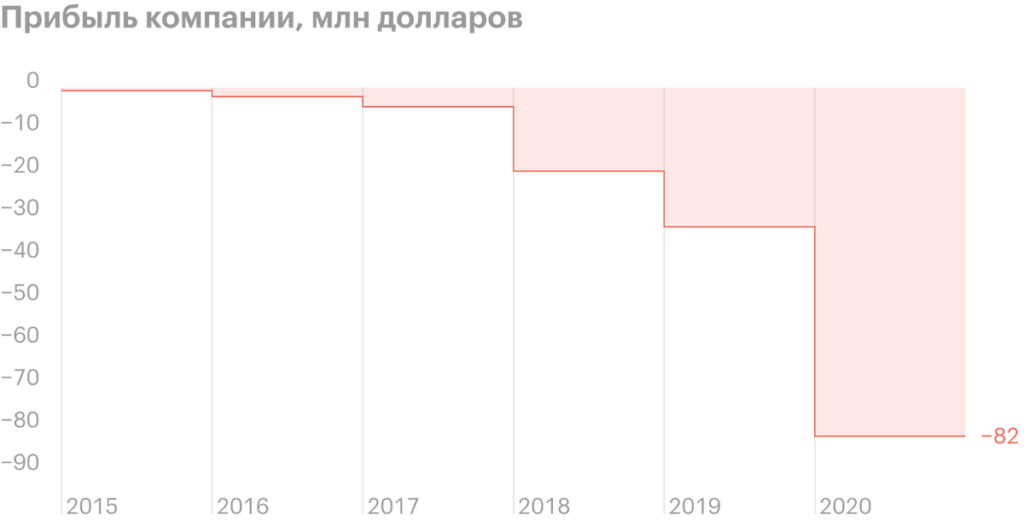

At this stage of development, the company has no profit from its own developments, and it raises all the money for research through additional issues of new shares. As a result, diluted earnings are 4,07 $ per share.

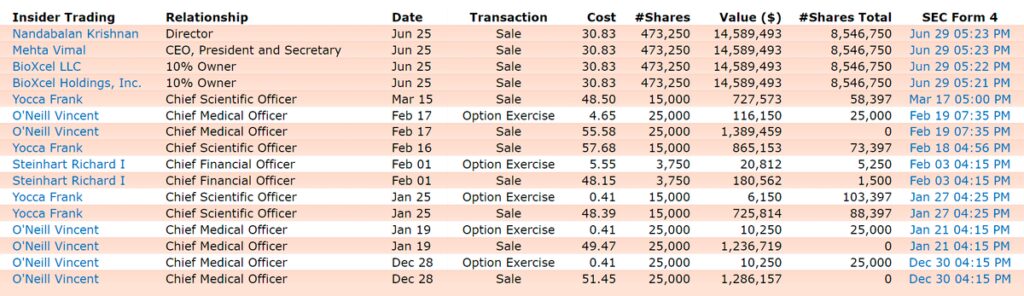

Losses are growing: over 5 years, the negative value of profit increased from 640 thousand to 82 million dollars. Insiders are not encouraging either.: all 2021 they sell shares of their employer.

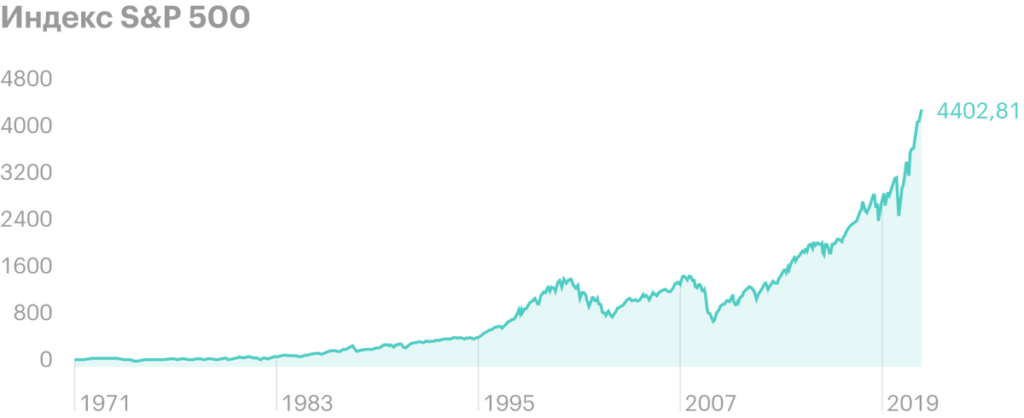

Indirectly, an additional risk factor is the general market situation.: major US indices are still storming new heights, but this growth can't last forever. Businesses, who earn nothing, will be under significant pressure in the event of investor panic and sell-off during the correction - because of this, BioXcel shares could fall significantly in price.

What good

Among colleagues in the biotechnology sector, BioXcel Therapeutics stands out for its innovative approach: in development, the company focuses on its own artificial intelligence platform. It works with big data and analyzes a huge number of promising, and drugs rejected by the FDA for the applicability of their dosages or individual chemical components for the purposes BioXcel researchers need. A clear advantage of this method is the ability to use and develop some of the previously started developments and their components - instead of creating a new product from scratch..

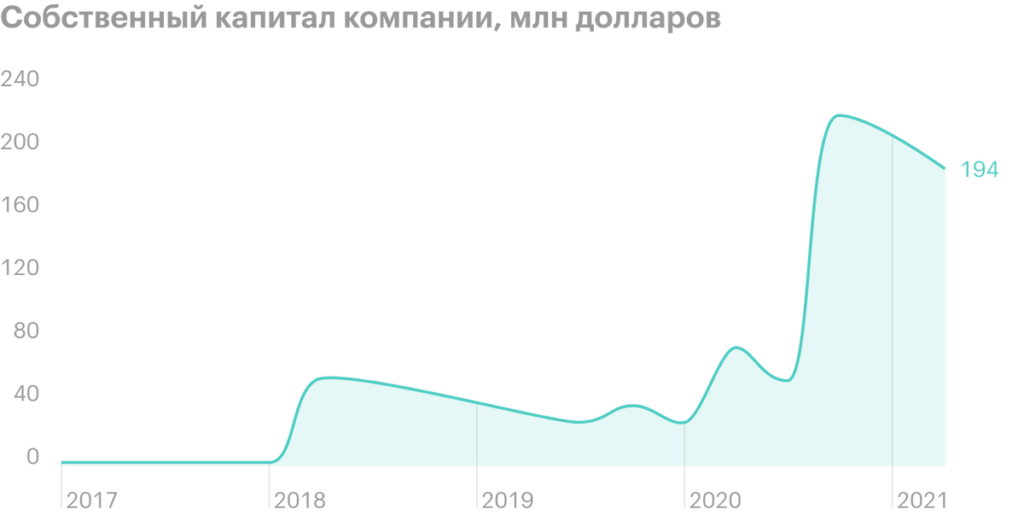

The company also has a strong position: 194 million dollars in account, she has no debts - she is not threatened with bankruptcy in the coming years.

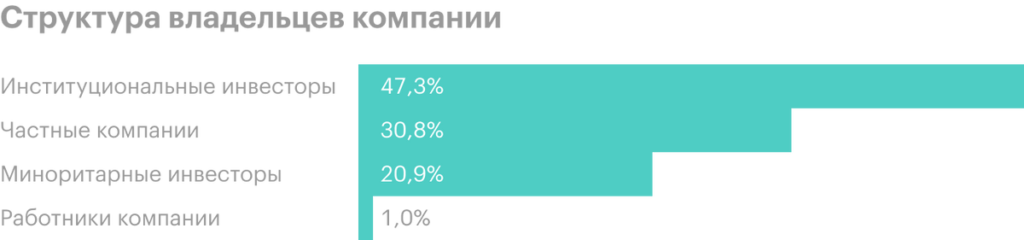

There are institutional investors among the shareholders, whose significant share in the total number is 47,3%. Of the most famous names here you can see State Street, BlackRock и The Vanguard Group. The interest of large players in a business with a modest capitalization of less than a billion dollars plays into the hands of the company and acts as an additional positive marker for its potential investors.

Analysts are bullish about the future of the company and seem to be competing, who will give BioXcel Therapeutics the highest target price: growth forecasts range from 200 to 470%.

Share Price Predictions

| Analyst | Recommendation | Forecast |

|---|---|---|

| UBS | Buy | $88 (+260,66%) |

| H.C. Wainwright | Buy | $140 (+473,77%) |

| Truist Financial | Buy | $125 (+412,3%) |

| Berenberg Bank | Buy | $75 (+207,38%) |

| Canaccord Genuity | Buy | $95 (+289,34%) |

| Merrill Lynch | Buy | $83 (+240,16%) |

| Jefferies | Buy | $86 (+252,46%) |

What's the bottom line?

BioXcel Therapeutics is an extremely risky investment. The company has a modest capitalization and solid losses, but at the same time, it is predicted to have significant growth and commercial success. As is often the case with biotech startups, the success of investments in this case is associated with faith, that its developments will "shoot". If the FDA approves the first drug in early 2022, it's quite likely, that business is waiting for rapid growth. Otherwise, there is a high probability, that stocks will significantly lose in price even relative to the current low levels.