Original taken from in

I am often asked and reproached for, that I ignore the human factor in the market. Supposedly it is people who move prices on the stock exchange., and the eternal struggle of bulls and bears is precisely the reason for the movement of markets. In underdeveloped weakly liquid thin markets, this can still be, but on effective platforms you can safely forget about such postulates. Eurodollar, for example, – it is a very mature and well-established market: I compare this to a train, which follows its given route, and the people in it – they are secondary. Their actions have no effect on this train.. Roughly speaking, they all try to catch on to the price movement, the market dumps someone, and gives someone a ride. As I have already repeated many times, no large participants even need to specifically force someone to stand in positions in one direction or the other – everything will happen by itself.

запостил "video на выходные", wherein Gerchik зачитывает истории краха его учеников-лудоманов на бирже. There is absolutely nothing surprising in this., and there can be no other result for his students. Gerchik's methods, In Maitreya, Rezvyakov and other near-market rabble – they are a priori ineffective. It is simply impossible for many to make money on them., but for those, у кого это получается – extremely difficult. The profit factor of the latter will hardly exceed 1.5 – 1.75, which is close to the randomness of the results. That is why on the & quot; courses" such comrades always devote a lot of time to psychology, conspiracy theories, etc.. and so on. When you don't have REAL knowledge, then the only way to describe the process under study is – it's making up stories. Who about psychology, who about the 'doll', who about support-resistances, etc.. and so on. People used to believe in gods, into giants and dragons, Right away – in conspiracy theory and so on: mysticism always appears there, where there is no deep scientific understanding of the processes.

One simple thing to understand – there is always a scientific explanation for any phenomenon. If someone tries to convince you otherwise – it means he does not understand the issue. Точка. And then the development of the researcher or stops, and he will forever be stuck in his trivial view of the object under study, or evolves into a scientific approach in its activities. For thousands of years, people have described the World from the standpoint of Euclidean geometry, while in the middle 20 century Benoit Mandelbrot did not solve the riddle of fractals. Thousands of technical analysts believe in strong hand theory, until they look at the results of mathematical algorithms for advanced participants. The latter are able to ignore not only the behavioral factors of bidders, но даже и сам schedule prices, which for the vast majority of stock traders is the only source of information.

One simple thing to understand – there is always a scientific explanation for any phenomenon. If someone tries to convince you otherwise – it means he does not understand the issue. Точка. And then the development of the researcher or stops, and he will forever be stuck in his trivial view of the object under study, or evolves into a scientific approach in its activities. For thousands of years, people have described the World from the standpoint of Euclidean geometry, while in the middle 20 century Benoit Mandelbrot did not solve the riddle of fractals. Thousands of technical analysts believe in strong hand theory, until they look at the results of mathematical algorithms for advanced participants. The latter are able to ignore not only the behavioral factors of bidders, но даже и сам schedule prices, which for the vast majority of stock traders is the only source of information.

Do you know why methods, like PA, VSA or patterns, so popular with traders? Yes, because they (methods) have no clear structural logic – they can always be interpreted subjectively. In the minds of adepts, you can always change the `` system input" to `` erroneous '', write off everything to psychology, inexperience, etc., be known as a `` guru '', teaching youngsters primitive things, draw channels with a smart look every time in a different way, etc.. and so on. It is from this that on smartlabs people constantly argue about questions like `` and in which direction is the trend now?", `` is this already a reversal or just a correction?" etc. А теперь представьте, that you have discarded all unnecessary, and created a model, wherein the red light comes on – and now you are only selling, and then green lights up, and you only buy. No need for training immediately, it becomes impossible to change the system input to a non-system one, and there is no point in talking about psychology at all. Obviously, whatever Gerchik has, Neither Maitrade has any similar mathematically verified model and is close.

This creates a paradoxical situation, when EVERYONE in Runet is fenced off from the notorious crowd, and at the same time use the same methods. The most interesting thing happens, when in the thread of discussion to like & quot; gurus" a bearded programmer comes in, And… proposes to formalize their approach. This is where it becomes obvious, that there is really no `` system ''" our experts" No, they start to deny, that their method is not formalized, that they will trade better by intuition, or blame everything on unwillingness to share secrets. Immediately I assure you – there are no secrets there, all their methods are very common. Better at once throw away all this primitive nonsense, and do real research work.

As for human behavior, and trying to dig in that direction, trying to take into account a huge variety of factors, I hope the very first video at the top of this article will convince you, that it is not at all necessary. I will repeat myself again, if we are dealing with a complex (chaotic) system of interactions, then you need to use the appropriate methods of probability functions, narrowing the multidimensional vector of research to common basic properties of the system. The biggest mistake those, who fails on the stock exchange, is, that they are not focusing their efforts on this task (not looking for the alpha itself), but deal with secondary issues – psychology, Discipline, fight against windmills and other. What's the use of that, what, having lost an apartment on the market, now you vowed to always put feet, – if you just guess buy now or sell. Stop guessing, and get busy, and then you won't have to write plaintive letters to Gerchik, who is the same gambling addict, like you, also earns on you)

Better to spend your money, time and effort to learn really worthwhile things – quantitative methods of analysis. In the previous article, I gave a link to Taleb's new book – worth reading. You can also search for information on Financial modeling, Financial engeneering, Financial econometrics and other things. Believe, after that, all the nonsense of Maitrade or Gerchik will seem like attempts by the ancient aborigines to convince you that, that the sun – this is god, and you must try not to anger him, otherwise he will send an evil dragon to Earth, and a giant will come out from under the water, and it is necessary to have fortitude in order not to go crazy with their anger. All in all, discard all unnecessary, and do math – find the code. Try to scientifically explain, why when the auger shaft rotates manual grinder in the opposite direction in the reflection of the mirror, meat is not pushed up, but still passes through the bars. Does the mirror show a real picture of the World, or projects something else? Does the graph reflect the molecular structure of its essence?, or just superficial? What methods can describe the whole process? How to predict it? All these questions do not require philosophizing., but meticulous research.

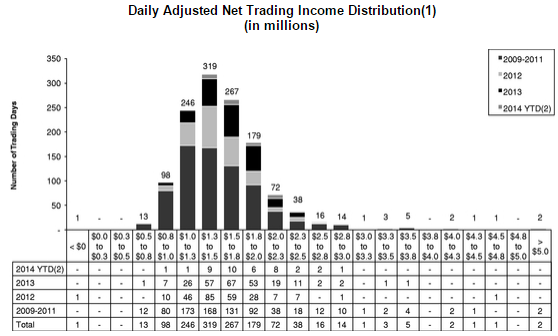

As an example, I will give the results of the activities of one of the algorithmic funds – companies , one of the high-frequency market makers in many of the most liquid markets in the World. IN 2014 year company one more year without a single losing day, and for the last 6 years, the firm had only one unprofitable day. Here EDGAR US Securities Commission (SEC) there is an underwriter prospectus for preparing the company for an IPO. Virtu algorithms generate more 51% profitable deals, where the share of the unprofitable is no more than 24%, and the rest are around zero. At the same time, the company's net profit – about a quarter of a billion dollars.

As an example, I will give the results of the activities of one of the algorithmic funds – companies , one of the high-frequency market makers in many of the most liquid markets in the World. IN 2014 year company one more year without a single losing day, and for the last 6 years, the firm had only one unprofitable day. Here EDGAR US Securities Commission (SEC) there is an underwriter prospectus for preparing the company for an IPO. Virtu algorithms generate more 51% profitable deals, where the share of the unprofitable is no more than 24%, and the rest are around zero. At the same time, the company's net profit – about a quarter of a billion dollars.

Also, the guys from their Virtu became the object of research of the SEC after the mention of their 1277 profitable days from 1278 in the acclaimed book by Michael Lewis . Думаю нужно автору Books еще рассказать об отсутствии убыточных месяцев торговли некого товарища Герчика)) Interesting, whether the SEC is interested in them or not?) Can check the Wall Street legend" на инсайд)) Unprofitable months, or rather their absence – this is absolutely normal, this is how it should be for those who trade `` according to the system '', but Gerchik does not stumble already 20 years) But for some reason, neither Alfa-Direct is bragging about his outstanding talents as a manager., nor Finam. Paradox))

Also, the guys from their Virtu became the object of research of the SEC after the mention of their 1277 profitable days from 1278 in the acclaimed book by Michael Lewis . Думаю нужно автору Books еще рассказать об отсутствии убыточных месяцев торговли некого товарища Герчика)) Interesting, whether the SEC is interested in them or not?) Can check the Wall Street legend" на инсайд)) Unprofitable months, or rather their absence – this is absolutely normal, this is how it should be for those who trade `` according to the system '', but Gerchik does not stumble already 20 years) But for some reason, neither Alfa-Direct is bragging about his outstanding talents as a manager., nor Finam. Paradox))

Why is the example of such a company, how , интересен? Yes, just because, that similar results on 210 stock exchanges in 30 countries of the World with a similar result mean the ability to generate a UNIVERSAL CODE of the structure of exchange fluctuations. This is what you need to strive for in your research activities.. Naturally, that each asset will always have different volatility, price step, other specifications, etc., and it is necessary to separately calculate and recalculate the control coefficients of the algorithms, but if it makes money, then it's worth doing.

All in all, summarizing the above, Note, what knowledge, paradigms and mental abilities of domestic & quot; traders" so far from potential research opportunities, that are not even worth attention. Using quantitative methods and building robust mathematical models, trading on the stock exchange turns from a painful and dangerous pastime into a highly profitable business.

P.S. To popularize science among those, who is just taking the path of quantitative assessment methods, I offer my alternative version of the `` video for the weekend" – bbc movie 2011 of the year & quot; The Secret Code of Life & quot;. For those, who has not seen – excellent illustration of the mathematical order in nature. Much more useful than Gerchikov's whining of gamblers. Happy viewing.

1 series – The numbers – .

2 series – Shapes –

3 series – Predictions –