Soros earned $1 billion in 1992, by placing a bet against the pound sterling, forcing the UK government to remove the peg from the basket of European currencies. He was also the largest financial investor, participating in a failed attempt to resist the election for a second presidential term of George W. Bush.

Soros earned $1 billion in 1992, by placing a bet against the pound sterling, forcing the UK government to remove the peg from the basket of European currencies. He was also the largest financial investor, participating in a failed attempt to resist the election for a second presidential term of George W. Bush.

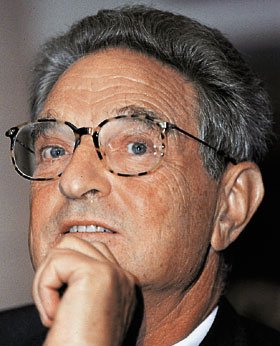

George Soros, at that time Gjord Schwartz, was born 12 august 1930 years in the city of Budapest in the family of Tivadar Schwartz and Erzebet Sutz. His father was a lawyer, a writer, founder of a literary magazine, and also held one of the key posts in the Jewish community of Budapest.

In the 1930s, with the coming to power of the Nazis, the situation of the family began to deteriorate significantly. IN 1936 year they changed their last name Schwartz to Hungarian Soros (“Shorosh” more Hungarian).

When George was 17, he decided to leave Budapest, choosing several destinations for travel: first – to Moscow, second – in London. Father dissuaded his son from going to Moscow, and George went to the capital of Britain. Arriving in London, George settled with distant relatives, who at one time his father helped to leave occupied Hungary. “At first I had a very hard time in England, - Soros recalls. - I was often malnourished, I even somehow envied the cat on the street, because she ate herring”. IN 1949 year George entered the London School of Economics, which he successfully graduated after three years. During all this time, he changed many jobs.. He was in a haberdashery factory, then worked as a traveling salesman, after the waiter in the restaurant, apple picker, train station porter, but throughout all his searches he did not give up the hope of getting a job at the bank. Even then, he kept personal bookkeeping for his few finances.. “I started with a weekly budget in 4 pound, then I tried to meet the amount less 4 Pounds, and in my diary I kept a record of my income and expenses” - remembers the future billionaire.

After graduating from the London School of Economics, George Soros was promoted to an investment company, where he worked and trained in the arbitration department, which was located near the London Stock Exchange. IN 1956 Soros received an offer to work in a small New York brokerage firm, owned by the father of his London friend. With 1956 Soros worked for three years in the field of international arbitration, buying securities in one market and selling them in another. With 1959 on 1963 George spent a year in analytical work at Wetheim & Co.

Having moved to America, George Soros started investing, working mainly with the capital of their friends and acquaintances, and after a while began to bring them a good profit. He set himself an ambitious task – earn half a million dollars on investments, since this amount, in his opinion, it should have been enough for him, to devote yourself to your other strong hobby – pursuing philosophies.

IN 1967 year George Soros, working at Arnhold & S.Bleichroeder, managed to convince management to establish an offshore investment fund, First Eagle, which he began to manage. IN 1969 year, the company, together with George Soros, established another fund, this time hedge fund Double Eagle, which was also entrusted to manage Soros. When regulators limited Soros' ability to manage funds, he left his high posts and in 1970 year, together with Jim Rogers, he founded the famous Quantum Foundation. The fund carried out speculative transactions with securities, as a result of which its profitability in the first 10 years of its existence was 3365%. It is to this foundation that Soros mainly owes his fortune., which currently has 11 billion. USD.

George Soros conducted risky transactions using loans, acting in most cases contrary to existing investment norms, based on more reliable methods.

Soros became world famous thanks to truly the largest currency speculation. IN “black Wednesday”, this is what it became customary to call that day, 16 September 1992 years, Soros opened a short position on the pound sterling with a volume of more than $10 billion, while earning more than $1,1 billion. As a result of Soros's operations, the Bank of England was forced to carry out a massive foreign exchange intervention and, in the end, withdraw the pound sterling from the mechanism for regulating the exchange rates of European countries, which led to an instant drop in the pound against major currencies. From that moment on, Soros began to be referred to in the press as “human, which brought down the Bank of England”.

Funds today, founded by George Soros, operate in more, how 50 countries. Their goal is to build and maintain open society institutions in countries, where do they operate. According to the most rough estimates, George Soros charitable foundations network spends about $400 million. to support projects in the field of education, health care, civil society development and other areas.

In his books, Soros used a number of developments of the so-called “theories of market reflexivity”, which he successfully applied in the stock exchange game. According to this theory, traders make decisions about buying and selling securities, based on future price expectations, and since expectations – psychological category, they can have a certain informational impact. At the same time, the moods and expectations of individual market participants are reflected in the nature of market operations., which can distort the impact of fundamental factors on the market.

Nowadays, George Soros actively speaks to journalists, participates in economic forums.

In January 2008 at the World Economic Forum in Davos, Soros predicted, that the aftermath of the US mortgage crisis will lead to the end of the dollar's status as the world's reserve currency. “The current crisis is not just a recession, following the real estate boom, this – basically the end of a 60-year period of ongoing credit expansion, based on the characteristics of the dollar as a world reserve currency. Now the rest of the world is more and more reluctant to accumulate dollars.. The share of the dollar in global foreign exchange reserves fell to a minimum, as demand for US assets declined after the collapse of the US real estate market. The American currency fell by 11 interest against the euro and 13 percent versus yen last year. The dollar has been down in five of the past six years. Since the 1980s, we have had faith in the magic of the market, and the authorities were so successful, that they began to believe in this firmness of the market. This has gone too far. ".