Deleveraging is often presented as a loan repayment at the expense of consumption. When current numbers contradict this view, it is concluded that, that there is no reduction in the debt burden, which means, and don't scare us here with your balance sheet recession.

The friend already had thoughts about this.. Briefly, then the total amount of the loan is reduced due to write-offs.

Well, in general, Yes. How it should be different? The consumer balance is cleared in two ways:

“Is there truly deleveraging or are charge-offs removing a lot of balances?”

and so and so. there is not much difference at the macro level.

Deleveridge (deleverage) – the process of reducing leverage, ie. the level of debt load. Have an opinion, that deleveraging is the main reason for long-term (Decades) cyclical decline in economic activity.

Deleveraging can be achieved 3 Ways:

- repayment of debts by the entity

- increase in the equity capital of a subject

- write-off of an entity's debt by a creditor.

Subjects in this case can be:

-

- ordinary consumer

- company or bank

- state

I.e term deleveraging can be applied to the widest range of subjects - from a person, to the whole state.

Views:

Inflationary deleveraging:

- Germany 1920s

- Latin America 1980s

Deflationary deleveraging:

- Great Depression of the USA 1930s

- Japan in the 1990s

The experience of Sweden and Finland (90-is): deleveraging is divided into 2 Phase:

- Households, financial institutions and companies have been reducing debt for several years. This is accompanied by weak GDP growth and growth in public debt..

- Economic growth is recovering, the state reduces for many years.

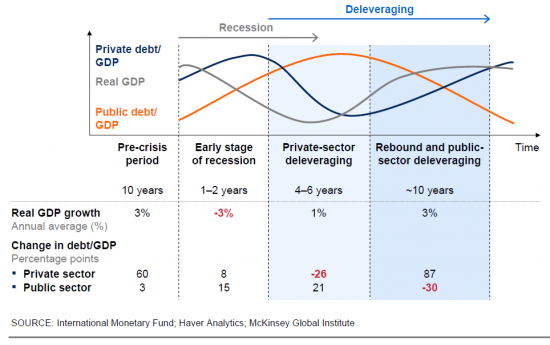

Typical phases and their characteristics during the deleveraging period:

Historical scale of deleveraging in terms of household debt to GDP%

This experience shows 6 recovery indicators:

- stabilization of the financial sector and growth of lending volumes

- structural reforms carried out

- a robust plan to reduce the budget deficit has been developed

- export growth

- recovery of private investment

- stabilization of the housing market + revival of the construction sector

Deleveridge – this is the reverse process of leverage, what the prefix is talking about “where-“. Based on clear financial definitions, then leverage (English. – leverage) – this is the ratio of the company's borrowed funds to its own funds.

If you go into the field of macroeconomics, then leverage is called, as it were, the level of debt load of the population, Business, people in general. It is also the process of building up debt.. Say “high leverage” – means, meaning, what a lot of debts. Or “you have leverage” – loan accumulation process, lending growth.

So here's the deleveraging – this is the reverse of leverage, that is, it is a reduction in the debt burden, slowdown in lending.

The fact, that in the existing concept, economic growth is ensured by the growth of lending. The entire modern economy is built on loans. Therefore, leverage is considered a positive process..

Deleveraging is considered a negative process – there is a decline in growth.

Another thing, that there must be some balance. The growth of debt burden makes the whole system unstable. Therefore, the crisis happened 2008 of the year. Then lending reached its ceiling.

Deleveraging in the American economy has been written extensively in 2013 year.

At the end of September, the Z.1 Flow of Funds report for the second quarter was released. Updated the numbers and added several important points to the description of the deleveraging process after the appearance video by Ray Dalio “How the Economic Machine Works?” . I'll start with the theoretical part, then I will present updated charts and numbers, at the end I will summarize.

so, according to Ray Dalio's concept, there are three main forces, stimulating the economy:

1. Productivity growth (long-term period, blue line)

2. Short-term credit cycle (5-10 years, green Line)

3. Long-term credit cycle (75-100 years, red line)

Short-term and long-term cycles exist, because there is a loan.

The main difference between the crisis 2008 years from previous economic cyclical downturns (within a short-term credit cycle) in the USA is, that the real estate market crash triggered a self-sustaining deleveraging process, which marked the end of a long-term credit cycle.

The last time a similar phenomenon occurred in the American economy was during the Great Depression of the 1930s.. And the latest prime example on a global scale (to 2008 of the year) is Japan, who never recovered from the effects of deleveraging, after the collapse of the national real estate market (and the asset market in general) late 1980s.

In terms of short-term and long-term credit cycle, it is also important to distinguish between the concepts Recession (contraction of the economy within a short-term business cycle) and economic Depression (shrinking economy, deleveraging). How to deal with recessions is well known for the reason, that they happen often enough (short cycle usually lasts 5-10 years). While depression and deleveraging remain poorly understood processes and are extremely rare in a historical context.

Recession represents a slowdown in the economy due to a reduction in the growth rate of private sector debt, often arising from the tightening of monetary policy by the central bank (usually for the purpose of fighting inflation during an economic boom). The recession usually ends, when the central bank undertakes a series of interest rate cuts to stimulate demand for goods / services and credit growth, which finances this demand. Low rates allow: 1) reduce the cost of debt service, 2) raise stock prices, bonds and real estate through the effect of an increase in the level of net present value from discounting expected cash flows at lower rates. This has a positive effect on the well-being of households and increases the level of consumption..

Deleveridge is the process of reducing the debt burden (debt and payments on this debt in relation to income) within a long-term credit cycle. Long-term credit cycle arises, when debts grow faster, than income. This cycle ends, when the cost of servicing the debt becomes prohibitive for the borrower.

At the same time, it is impossible to support the economy with monetary policy instruments, because. interest rates during deleveraging, usually, go down to zero. Depression is the phase of economic contraction in the deleveraging process. Depression happens, when the process of reducing the growth rate of private sector debt cannot be prevented through lowering the cost of money by the central bank. In times of depression: 1) a large number of borrowers do not have enough funds to pay off obligations, 2) traditional monetary policy is ineffective in reducing debt service costs and stimulating credit growth.

With deleveraging, the debt burden simply becomes unbearable for the borrower and cannot be weakened by lowering interest rates. Lenders understand, that debts have grown too much and the borrower is unlikely to be able to repay loans. The borrower cannot pay off the debt, and his collateral, whose value was inadequately inflated during the credit boom, lost the price. The debt situation puts such pressure on borrowers, that they don't even want to take new loans. Lenders stop lending, and borrowers - borrow. The economy seems to be losing its creditworthiness, as a single person.

so, what to do with deleveraging? The fact, that the debt load is too high and needs to be somehow reduced. This can be done 4 Ways:

1. Reduced spending

2. Debt reduction (Restructuring, cancellation of part of the debt)

3. Redistribution of goods

4. "Printed" Machine

The preponderance of the first two processes leads to deflationary deleveridge., an advantage in the direction of the last two – to inflationary deleverage. Let's consider all the methods in detail:

1. Cutting costs

Deleveraging starts with a drastic reduction in spending, or the introduction of austerity (austerity measures). Borrowers stop borrowing and start paying off old debts. Seems, that it should lead to debt reduction, but it's not: you have to understand, that one person's expenses are another person's income. Under austerity, revenues decline faster, how debt is reduced. All this leads to deflationary processes. Enterprises start to lay off staff, the unemployment rate rises, etc..

2. Debt restructuring

Many borrowers are unable to pay off their debts. In this case, the obligations of the borrower are the assets of the lender. When the borrower fails to meet its obligations to repay debt to banks, panic begins. People stop believing in banks, and start taking their deposits. Worst case cans burst, defaults begin at enterprises, etc.. All this leads to a severe economic depression. In order not to bring the situation to the brink, lenders often follow the path of restructuring the borrower's debt in the hope of returning at least some part of the funds issued in loans (this may be a decrease in rates on previously issued loans, prolongation of the loan term, partial write-off, etc.). Anyway, revenues are falling again faster than debt, leading to a deflationary scenario.

3. Redistribution of goods

In a crisis, the government collects fewer taxes, but forced to spend more - it is necessary to pay unemployment benefits and launch programs to stimulate the economy.

As spending increases, the budget deficit grows, which needs to be financed somehow. But where to get the money? You can borrow, either raise taxes. Understandably, that the rise in the level of taxes in the economy, depressed, will be disastrous. But taxes can be raised for the rich, ie. redistribute wealth from haves to have-nots. Usually, at such moments, acute social protests and general hatred of the general population for the rich arise. In the 1930s, when Germany was in a state of deleveraging, the situation got out of control and Hitler came to power.

4. “Printed” machine

To prevent the destructive consequences of depression, urgent action is needed.. In conditions, when interest rates are already at zero, the option of salvation is the "printing" press of the central bank. Printing money - inflationary scenario. Printed money is for purchase only: 1. Financial assets ( what causes their prices to rise and has a beneficial effect on the well-being of those, who has these financial assets) 2. Government debt, which the, as we already noted, reaches its peak during deleveraging (support for the unemployed, stimulating economic programs).

In this way, central bank and government need full coordination. The government must be confident, what's behind the counterparty, which, if necessary, will redeem all issued debt. US Treasury long-term bond buyback program FED USA named QE. The purchase of government securities by the central bank is called monetization of the government debt..

The correct balancing of the above four options for mitigating deleverage, coupled with coordinated actions of the government and the central bank, lead to a "beautiful" deleverage (beautiful deleveraging), in which debts decrease in relation to income, economic growth is positive, and inflation is not a headache for monetary authorities.

According to Ray Dalio's concept, in addition to "beautiful deleveraging" there are also options:

– “ugly deflationary deleveraging” ("Ugly deflationary deleveraging") - period of economic depression, when the central bank “printed” not enough money, there are serious deflationary risks, and nominal interest rates are higher than the growth rate of nominal GDP.

– “ugly inflationary deleveraging” ("Ugly inflationary deleveraging"), when the "printing" press gets out of control, far outweighs deflationary forces, creating the risk of hyperinflation. In countries with reserve currencies (like USA) can occur with too long stimulation in order to overcome the "deflationary deleveraging".

Depression usually ends, when central banks "print" money in the process of monetizing public debt in volumes, that offset the deflationary depressive effects of debt reduction and austerity measures. Actually, the American economy has been quite successfully balancing on the brink of "beautiful" deleveraging in recent years.

You can often hear the question: and why with such volumes of printed dollars there are no Inflation? No inflation, as the printed dollars go to offset the fall in lending. The main thing is expenses. Every dollar spent, paid in money, gives the same effect, what is the dollar spent, paid as a loan. Printing money, the central bank can compensate for the disappearance of credit by increasing the amount of available money. *Vadim has a great post on inflation. (Endeavour) .

Depression usually ends, when central banks "print" money in the process of monetizing public debt in volumes, that offset the deflationary depressive effects of debt reduction and austerity measures. Actually, the American economy has been quite successfully balancing on the brink of "beautiful" deleveraging in recent years.

To change the direction of economic development in the right direction, the central bank needs not so much to fuel income growth, how much to ensure income growth, exceeding interest payments on accumulated debt. This means, that income should grow faster than debt.

The main thing is not to get carried away with the printing press., so as not to provoke uncontrolled inflation, how it happened in the 1920s in Germany. If we manage to balance the actions of the government and the central bank, then economic growth will start albeit slowly, but expand, and the debt load - to decrease. This will be the key to the least painful “beautiful” deleveraging.

Usually, the process of reducing the debt burden within the framework of deleveraging lasts 10 years. This period is often referred to as the “lost” decade..

Deleveridge more American

To fully understand the process of deleveraging in the United States, it is necessary to analyze the structure and changes in the balances of the main economic entities of the United States., which are published quarterly in the Z.1 “Flow of Funds Accounts” of the Federal Reserve System (FED) (latest data for June 2013 G.).

The graphs show the process of deleveraging in various sectors of the US economy. Good visibility, how the government began to actively replace the falling demand of the private sector through a significant expansion of public debt: since July 2008 years to July 2013 household debt decreased by $0,91 trillion, financial sector - on $3,07 trillion, non-financial corporate sector grew by $1,51 trillion, governments - on $6,14 trillion.

Household Deleveraging

American households hit the hardest. And this is not surprising - the real estate portfolio is 20% all household assets (70% – financial assets), and mortgage loans – more 70% all obligations. Assets depreciated during the crisis, but debts remained - wealth fell. Deleveraging started, which can be called “mortgage” deleveraging. Let me remind you, what consumer spending forms 70% US GDP.

The deleveraging process is precisely the reduction in the volume of mortgage loans - over the past five years, their volume has decreased by 12,3% (-$1,32 trillion) to $9,34 trillion. Consumer loans during this period showed an increase of 13,7% (+$0,36 trillion) to $2,8 trillion, but could not cover the mortgage deleveraging in any way. The total volume of household liabilities over this period of time decreased by 6,3%, (-$0,88 trillion) to $13,2 tlrn. It is shrinking to this day.

The ratio of the volume of mortgage debt to the volume of the real estate portfolio of US households remained at the level of 40% in 1991-2006 years. Between the end 2006 in the middle 2008 of the year, when real estate prices fell, while mortgage debt was still expanding, this ratio skyrocketed to 63%. Then the process of “mortgage” deleveraging began and after five years the ratio of mortgage debt to real estate portfolio was reduced to 50%.

As I mentioned above, deleveraging is the process of reducing the debt burden – debt and payments on this debt in relation to income. Deleveraging begins, when the cost of servicing the debt becomes prohibitive for the borrower.

In this way, an extremely valuable indicator is the ratio of interest expenses on debt servicing to the level of disposable income of households. As you can see on the chart, when debt service costs from disposable income of U.S. households reached 14%, the deleveraging process has started. The same level was reached in the early 1930s, when the country was on the brink of the Great Depression. History Repeats Itself. Today, the ratio of interest expenses on debt servicing to the level of disposable income is close to the lowest historical levels..

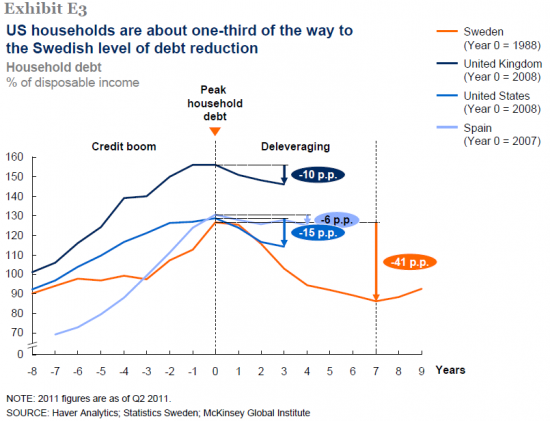

In December 2007 years, US household debt exceeded the level in 130% of their disposable income. Under the weight of long time (ie. already spent future income), households could no longer increase consumption. In the process of deleveraging by June 2013 year the volume of debt to disposable income decreased to 104%, but by historical standards it also remains high.

Despite a significant reduction in debt from 130% to 104% from household disposable income, it is impossible to say unequivocally that, that the deleveraging is close to completion. Income and debt are unevenly distributed in the US economy, because. most of it is concentrated in the sector of middle and low income households. Just look at the Gini coefficient.

That being said, it is important to note, that in conditions of real negative interest rates, it is primarily the borrowers of capital that benefit, because. debt service costs are reduced faster, how income from owning assets grows.

With the onset of the crisis 2008 years, “expensive” household debt began to be replaced by cheaper government debt, which allows to solve only the current problems of the economy in the process of deleveraging the private sector, but creates big problems in the future. National debt – it is actually also a debt, which households should serve, this is worth understanding when trying to assess long-term prospects. At some point, the state may increase the budget deficit and increase debt, to help households, but in the long run, households will still have to pay for it.

As noted above, in the conditions of “beautiful” deleveraging, the income growth rate exceeds the debt growth rate.

Instead of a conclusion

Today, the US economy is moving along the path of "beautiful" deleveraging (“beautiful delevereging”), when the volume of public debt monetization outweighs the deflationary effects of reducing the level of debt burden of economic entities, and especially households. This creates the basis for, to keep the growth rate of nominal GDP above the level of nominal interest rates.

Despite, that traditional methods of monetary policy during deleveraging do not work, US FRS from the very beginning of the acute phase of the crisis 2008 Makes every possible effort through the use of non-traditional instruments to fulfil its dual mandate of ensuring price stability at full employment.. Almost five years after the start of the financial crisis, we can talk about, that the Fed managed to prevent deflation and indirectly influence the economic recovery.

If only in 2008 year for economic agents (no matter debtors or creditors) would not be behind that, who will provide the money, то fire sales (forced emergency sale of assets) would reach significant proportions, collateral would change hands and be sold at a significant discount, thereby twisting the deflationary spiral. FED, considering the negative experience of the Great Depression of the 1930s, just offered the system so much money, how much was needed to regain control over the money supply and inflationary processes in the economy.

Besides, The Fed has managed to significantly reduce the cost of money, creating a favorable basis for the stock market. Household financial assets account for almost 70% of the total volume of assets. The recovery of American household wealth to pre-crisis levels was largely driven by growth in financial markets..

In order to replace the falling demand of the private sector during the time of deleveraging, the government begins to increase the debt burden and widen the budget deficit. In these conditions, it is extremely important for the financial authorities to have an agent behind their back, which is guaranteed to buy back new issues of debt obligations. This agent is the Fed, monetizing public debt under quantitative easing programs (QE), and as a result became the largest holder of the US government debt.

However, monetary policy instruments can only partially smooth out the deleveraging process.. The link between the central bank and government action is very important., that the fed did everything, what he could do. Today the ball is on the side of politicians, Democrats and Republicans, which since 2008 years in practice have not been able to prove their sincere desire and focus on solving the structural problems of the American economy. Half-hearted decisions are made, negotiations on the most important bills are constantly disrupted (по fiscal cliff, the ceiling of the national debt, etc.), paramount. All this delays the deleveraging process and negatively affects the US economy..

Nevertheless, household deleveraging, most affected during the crisis 2008 of the year, passed its equator. The "fighting" power of the American authorities today is aimed at restoring the real estate market. Real estate is the largest household asset, mortgages - the largest liability. The essence of deleveraging lies precisely in the mortgage segment. The big positive shifts in the US real estate market took place in 2012 year (largely influenced by the Fed's “Twist” program).

A positive scenario suggests, that the deleveraging of households will be completed by the middle 2015 years and the economy will enter the stage of natural recovery, as before based on credit. At the same time, the Fed is planning an exit from the policy of zero interest rates.. But there are many questions and difficulties along the way..

P.S. Three essential rules from Ray Dalio:

1. Not allowing debt to grow faster than income, because. debt burden will ruin you over time

2. Prevent revenue from growing faster than productivity levels, because. this will lead to a loss of competitiveness

3. Do everything you can to improve your productivity.