Depositary receipt (English. Depositary Receipt) – document, certifying, that the securities have been deposited with a custodian bank (custody) in the country of the issuer of the shares in the name of the depositary bank, and giving the right to its owner to enjoy the benefits of these securities. Except for the difference due to a change in the exchange rate, the price of these receipts changes point to point with a change in the price of the underlying securities, except when, when the participation of foreign investors is limited in the local market.

Depositary receipt (English. Depositary Receipt) – document, certifying, that the securities have been deposited with a custodian bank (custody) in the country of the issuer of the shares in the name of the depositary bank, and giving the right to its owner to enjoy the benefits of these securities. Except for the difference due to a change in the exchange rate, the price of these receipts changes point to point with a change in the price of the underlying securities, except when, when the participation of foreign investors is limited in the local market.

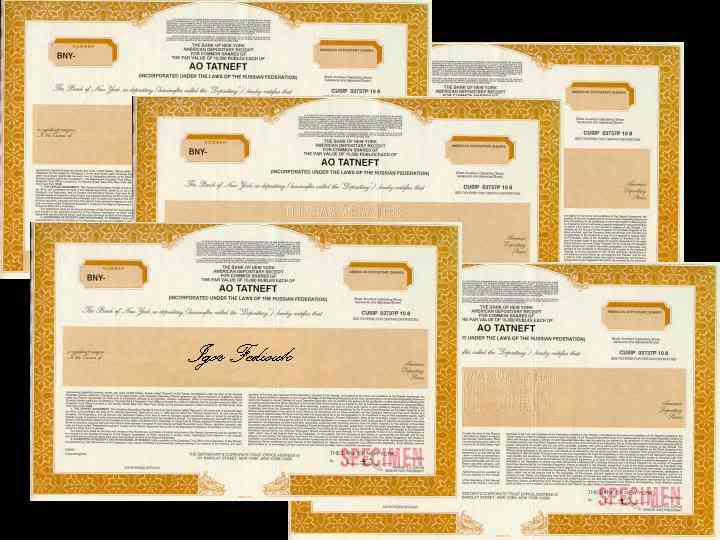

The most famous types of depositary receipts – American depositary receipts (ADR – American Depositary Receipt) and global depositary receipts (GDR – Global Depositary Receipt). ADRs are issued for circulation in the US markets (although they also apply to European), GDR – for circulation on European markets.

IN 2007 year, the concept of a Russian depositary receipt appeared in Russian legislation (DDR).

In the end 2010 years appeared Ukrainian depositary receipts. Their appearance is associated with the expansion of stock market instruments. There is no demand for UDR yet and is not expected. There is still no point in simply placing foreign companies in Ukraine.

Based on materials And .