Chargeback- this is a procedure for protesting a payment, made from a bank card. Simply put - the ability to return your payment. From English, « chargeback »Literally and translated: "Chargeback".

Materiel

The service for challenging transactions is called "chargeback". You can dispute an erroneous write-off or operation, which the client refused.

The contract with any bank specifies the terms, during which you need to contact the bank, to challenge the operation. Most often, this period is no more than 60 days are 30 days from the date of discharge, which reflected the operation. If you contact the bank through 61 a day or more, then the chargeback can be refused.

In Tinkoff Bank, this requirement is spelled out and looks like this:

The timing of the challenge varies depending on the situation. The general rule is one: the bank will take time. If you dispute the operation, the bank may request additional information. If you refuse a service or purchase, the bank may ask to provide confirmation of such a refusal.

It can happen like this, that you are sitting at home, and you unexpectedly receive a notification about a completed purchase or withdrawal of funds. I recommend checking first, whether you did not perform this operation exactly. It happens, that the message about the write-off of money comes after a while. For example, I sometimes buy apps in Epstor. Messages about the write-off of payment for these purchases always come to me after a certain period of time - a week, or even two. At first I'm scared., that this is some kind of mistake, and then I understand, that she really confirmed such a purchase.

If you understand, that absolutely did not make a payment, block the card and contact the bank. If the operation was performed by scammers, this will help to avoid even greater losses. If it is some kind of failure on the side of the bank, money will be returned soon. Usually such issues are resolved within a few hours and do not even need to go anywhere..

Situations with such write-offs may vary, for example:

- money was written off by your bank;

- the money was written off by the acquiring bank;

- scammers worked.

Depending on the type of operation, to be challenged, the term and procedure for the refund will depend.

Since you did not talk about fraudulent activities in your letter, we will consider the first two cases.

If the money was mistakenly written off by your bank

If the write-off was for some service of your bank - for example,, charged for SMS notifications about all operations, although you have them disabled, – you just need to contact your bank. Sometimes a simple call is enough for this.. Experts will check the information, and if the service is indeed disabled, you will receive a refund within a day.

On the side of banks, sometimes failures can occur, due to which amounts are debited without explanation. The procedure is similar: contact the bank, specialist will fix the appeal, will explain the situation - and the money will be returned. Usually such issues are resolved within 24 hours..

The money was written off by the acquiring bank

If the failure occurred on the side of the acquiring bank, refunds may take longer.

Here it is important not to confuse a failure in the acquiring bank and money., stolen by fraudsters. For instance, if you are in Moscow, and on your card passed the operation in Rio de Janeiro - most likely, this is the work of scammers. Here you will need to apply not only to the bank, but also to the police. How to try to return money from a stolen card, we have already told.

If at the time of purchase you repeatedly wrote off money for the same service, contact your bank. In some cases, a call may be sufficient, and in others an application may be required: it all depends on the internal procedures of the bank. Everything, this is where your actions end, and we can only wait.

Your appeal will be recorded and your bank will contact the acquiring bank. If the information about the error is confirmed , you will be refunded. But this may take more than one day..

A friend of mine once paid for the subway fare, and he was charged five times. He went to his bank., and the money was returned: confirmed failure on the side of another bank, who made a payment from the metro.

Erroneous challenge

If, when checking the information, it turns out, that it was you who performed the operation, the money will not be returned to you and may still be charged a fine for an erroneously disputed operation. Usually it is 1000-1500 rubles and is prescribed in your contract with the bank:

Chargeback (chargeback)

Chargeback (English. chargeback) – the process of bank disputing the card transaction, produced by the holder at the point of sale (online store). More often the procedure is initiated by the cardholder. But in some cases, the initiator may be a bank. For example, if the operation took place on a non-existent card.

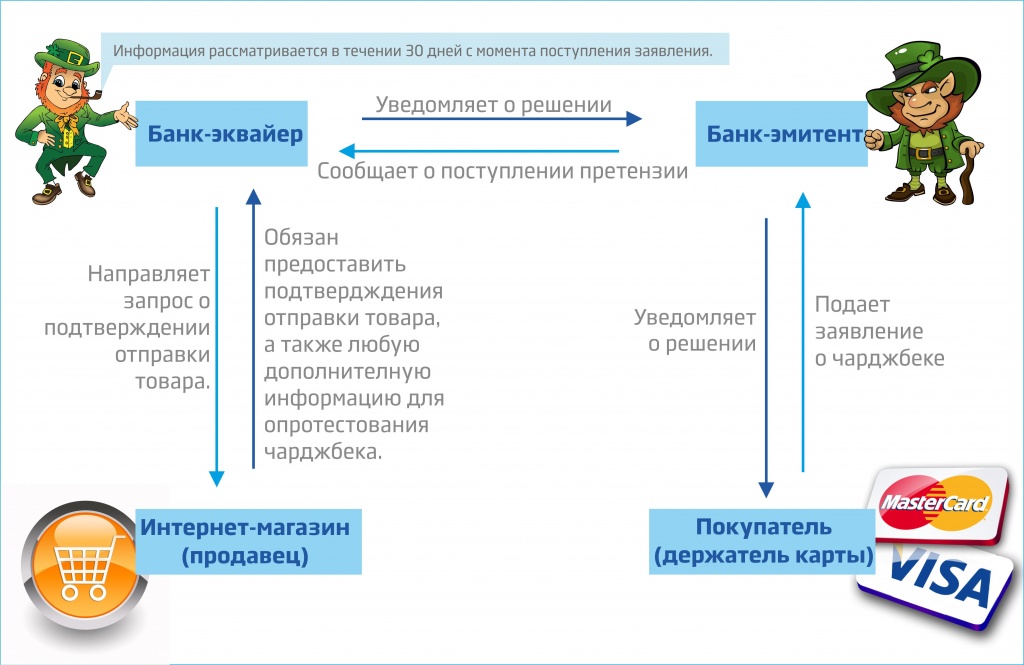

The procedure is as follows. The cardholder submits a corresponding application to the issuing bank, which indicates the reason, why does he think the transaction is invalid or fraudulent, and encloses all the documents available for this operation (Checks, Account, Correspondence). Further, the credit organization conducts an investigation and, if the applicant is correct, writes off the protested amount of payment from the outlet and returns it to the payer, that is, the chargeback occurs at the expense of the outlet.

The reasons, by which it is possible to initiate a chargeback:

– the seller did not make a refund;

– the card was double debited;

– the operation was made in the amount, different from the purchase price;

– incorrect date and time of the operation;

– the signature on the card and on the invoice differ;

– money for the purchase was debited from the card, which the cardholder did not commit;

– money has been debited from the account, but the buyer has not received the product or service;

– the buyer is not satisfied with the product or service, for example, in fact, the product is different from, what was promised earlier by the seller, or the services were not provided in full;

– the customer has received a product or service, but paid in a different way (Cash, from another card, etc.. P.);

– the seller refused to accept the goods back.

How to make a chargeback

Any Visa cardholder can apply for a refund, Mastercard or Mir, regardless of, which bank issued this card.

If you do the chargeback correctly, then the chance of getting your money back becomes high enough. but, for this it is important to take into account all the nuances.

Formally, it is possible to make a chargeback within 540 days from the date of payment. Wherein, the greatest chances of getting their money back from those, who applies as soon as possible. For the company, the cheater was still working.

To start the return procedure, you need to come to the bank, from whose card you paid and write an application for chargeback. In large banks, you can simply ask a consultant for a sample of such a statement..

It is important to submit documents to the bank, which will confirm, that the company really owes you money. Understandably, that any bank is an intermediary between the payer and the recipient. So that, he cannot return the money without reason.

I will emphasize, that the bank itself is not able to determine, are your claims substantiated. He needs proof.

There is a great risk without supporting documents, that the bank will simply refuse to consider the case. BUT, if later you apply again, then the bank will simply refer to the already existing refusal decision.

For instance, Sberbank almost always pays attention in its answers, that the payer himself must try to resolve the issue of the refund with the company. AND, only then you should contact the bank. By providing evidence, what was the fact of deception.

Chargeback application

Chargeback application is simple enough. Actually, you only need to describe the circumstances of the payment and indicate the facts, Confirming, that the recipient of the money did not fulfill his part of the transaction.

I will note, that the application can be submitted not only in the office, but also via the Internet. The same Sberbank, like many other banks, accepts applications online in the feedback section on his website.

An application for a chargeback can be submitted at the office of the bank with which card you made the payment. In the application for chargeback, it is very important to indicate the reason, on which you demand a refund.

What could be the reasons:

- The product or service does not match the description. For example, we bought a TV, did you get a radio;

- Unauthorized transaction. I.e, someone made a payment from our card without our knowledge;

- The service or product is not provided in full. For instance, we ordered two sets of wheels, but only one came;

- Double deduction of the amount from the account. It happens, that the payment is made twice. Usually, this is a consequence of a technical error and the money can be easily returned;

- The buyer did not receive the product or service. This is the most common reason for chargebacks..

Any supporting documents can be used as evidence., as well as photo and video recordings.

For example, if the wrong product arrived, then you can attach a sales contract, delivery notes and product photos, which show, what did not come at all, what did they agree on.

If you cheated broker or investment company, then you can attach a contract, account statements, screenshots of your personal account and even correspondence with employees of this company. The main thing is to prove convincingly, that the service was not provided as it should. Here is the most detailed example of such a statement..

The field of that, how do you apply for a chargeback, the bank will register it and send it for examination to Visa and Mastercard. AND, Further, if there are no technical errors, to refute the accusations and substantiate their position, the defendant is given thirty days.

If your position is confirmed, then the money is returned to the card in full.

Chargeback Visa

International payment system Visa is very popular in Russia, Ukraine and other European countries. Most bank cards are issued with the "Visa" chip. Respectively, most payments, and therefore chargebacks are made on Visa cards.

Visa cardholders are encouraged to apply for a chargeback within the first 180 days from the date of the disputed payment.

Full regulations for consideration of applications for Visa chargeback are available on the website of the payment system. but, only the English version of the document is available.

chargeback MasterCard

Today Mastercard cards are also highly popular.. More often, such cards are issued for students and employees of budgetary institutions. Many electronic payment systems also work with Mastercard. For example, Yandex.Money offers its customers cards of this type.

Besides, very common Maestro cards. Actually, these cards also refer to MasterCard.

Visa cardholders are encouraged to apply for a chargeback within the first 120 days from the date of the disputed payment.

Full regulations for consideration of applications for chargeback MasterCard are available on the website of the payment system. Truth, I only found the English version of the document.

Chargeback Sberbank

Sberbank is the largest bank in Russia. Actually, not even just the largest bank, but, recently also the largest company, which is priced more expensive than Gazprom or Rosneft.

The vast majority of cards in our country are issued by Sberbank. That's why, and most applications for chargeback are submitted to Sberbank.

How to apply for a chargeback to Sberbank? There is an official comment of the bank on this matter.:

It is necessary to submit a written application on the disputed operation on the form of the established form to the bank's subdivision, by attaching a free-form statement to it stating the reasons for challenging the operation and the circumstances of its implementation. A statement about a disputed transaction can be sent by fax to the Contact Center of Sberbank of Russia; indicate your card number in the message, Your full name and contact phone number, as well as the location of the operation (country, city), trade and service point name, card number, Date, transaction amount and currency, reason for challenging. If the operation is contested, perfect on the internet, you must also fill out an additional application.

You can download the application form here at this link from the blog or in the "help service" section of the Sberbank website.

An important feature of the chargeback in Sberbank is the shortened deadline for accepting applications. There is ample evidence of this, that Sberbank really accepts applications for chargeback only in the first 60 days from the date of payment.

If you apply later, the application can and will be accepted., but it is not a fact to consider it in the bank, what will. So,, and it won't even get into the payment system. You are welcome, consider this moment.

What is a chargeback and how to deal with it

Any business tries to minimize its risks. This is especially true in the b2c sector, because the legislation introduces a strict framework, protecting consumer rights. But there are factors, which cannot be eliminated, and chargeback is one of them.

The definition and order of the chargeback seems simple for those, who has known him for a long time, and are obscure to those, who first encountered this. Let's try to analyze this process in as much detail as possible..

so, the consumer has the right, within a certain period of time, to contact his bank and protest the transaction. After that, the process of interaction between the payer's and the recipient's bank is launched.. As a result, a decision is made on the return of funds for a disputable operation - this is the chargeback. This procedure is not so simple., and not always the decision is made in favor of the consumer.

Such an opportunity for the consumer is provided by the rules of the VISA and MasterCard payment systems.. For example, according to chapter 9 the rules of the VISA payment system for carrying out transactions on the territory of the Russian Federation, payment system participants are obliged to offer mutual assistance and cooperation to other participants in resolving disputes between their clients. This rule obliges banks to consider disputed cases., and not deny them.

The refund procedure for disputed transactions is described in the VISA rules as follows:

- A client - an individual applies to the issuing bank with a statement challenging the operation.

- The issuer sends an application to the payment system.

- The payment system through the acquiring bank sends this application to the merchant.

- The company reviews the application and sends the result of the consideration to the acquiring bank.

The decision on the application is not made by the court or by a state body, a bank. At the same time, the right to appeal the decision by the issuing bank is not provided., accepted by the trade and service enterprise.

There is a list of reasons, at which chargeback is applicable, but in some cases this can be interpreted broadly.

Chargeback can be initiated by the payer in the following cases:

- The seller did not carry out a refund.

- There was a double write-off on the card.

- The operation was performed for the amount, different from the purchase price.

- Incorrect date and time of the operation.

- Signature on the card and on the invoice are different.

- Money was debited for the purchase, which the cardholder did not commit.

- The money has been debited from the account, but the buyer has not received the product or service.

- Buyer is not satisfied with the product or service: for example, the product is different from that, what was promised earlier by the seller, or services are not provided in full.

- The customer received the product or service, but paid in a different way (Cash, from another card, etc.. P.).

- The seller refused to accept the goods back.

Features of this procedure:

- The right to object is limited 45 Days.

- The procedure is not fixed by law, but only by the rules of payment systems. As a matter of fact, it exists as a superstructure over regulations. Every bank, prescribes the use of chargeback in the contract, while embedding it in legal relations.

The implementation of this operation is the right of the bank, which complies with the requirements of Federal Law No. 161-FZ "On the National Payment System". The unconditional obligation of the bank to make a chargeback is also not provided for by the Regulations of the Central Bank of the Russian Federation "On the issue of payment cards and on operations, committed with their use ", Regulations for the Issue and Servicing of Credit Cards of Sberbank of Russia, Rules for the accrual of funds MasterCard and Visa.

At the same time, it was repeatedly noted in judicial acts, that the investigation is the right of the issuing bank, not his duty. The bank is only obliged to accept the client's application and in the event, if the basis for the reverse accrual of funds is determined, that is, if the operation is recognized as controversial, send a request to the receiving bank (cm. Decision in case no. 2-1136/2017 [2-18991/2016] from 09.02.2017. Vologda City Court (Vologodskaya Oblast).

Over the past few years, enough judicial practice has appeared to consider the legality of the chargeback procedure and the peculiarities of its application depending on the business..

Can the payee not return the money to the bank?

When the bank made a decision to satisfy the application, the payee has an unconditional right to reimburse the amount to the bank. However, many people mistakenly think, that they did not give the bank permission to write off these amounts and since the bank itself satisfied the claim, let him pay for it. But before insisting on such a position, you need to look into the contract of settlement and cash services.

So, in one of the legal disputes, when the payee tried to challenge the debiting of the amount, the court referred to the agreement with the bank, which states the following: "The fact of crediting / transferring funds in favor of the company on the basis of a check received from the company (document / report of the electronic terminal), issued during the operation, is not an unconditional recognition of the validity of the operation ". As a result, the company pledged to unconditionally reimburse the bank for fines and other deductions imposed by payment systems., related to her activities (cm. Decision in case No. А40-5029 / 2017 dated 30.06.2017. AS g. Moscow).

It is worth noting, that there is an exception to this rule - electronic money transfer. In accordance with h. 15 Art. 7 Federal Law "On the National Payment System" the transfer of electronic funds becomes irrevocable and final after the operator takes action, prescribed by law. This is confirmed by judicial practice., which recognizes the refusal to return legitimate (cm. Decision in case no. 2-1865/2017 from 08.08.2017. Oktyabrsky District Court. Penza (Penza Oblast).

When the chargeback doesn't work

Terms of payment systems and judicial practice have developed rules, in which the procedure does not apply.

Firstly, if the client was not initially promised a guaranteed profit. It's like, for example, about payments for activities, which is related to trading / stock market games (cm. Determination in case No. 11-203/2031 from 04.08.2017. Kirovsky District Court. Yekaterinburg (Sverdlovsk region).

Secondly, if payments are related to the purchase of travel products from a travel agent and the obligations are fulfilled by him. The courts in such cases indicate, that you can not impose a duty on an agent, as it is contrary to the legislation on tourism activities (cm. Determination in case No. 33-3102/2016 from 18.10.2016. Kursk Regional Court). In practice, this rule is not always observed., and travel agents often have to defend their position in court.

How to minimize risks

If the consumer is deprived of the right to apply for a chargeback, it is impossible, then there is an opportunity to minimize the risk of satisfaction of claims. To do this, you need:

1. In the contract with the consumer, provide for the procedure for the provision of services (transfer of goods), and also the moment, in which the obligations to the consumer are fulfilled. It will be possible to refer to the fulfillment of these points in case of claims.

2. Have documents, confirming the fulfillment of obligations. Often the bank makes a decision in favor of the consumer simply because, that the seller did not keep the act of acceptance and transfer of the goods and cannot provide anything in confirmation of his good faith.

If the company is an agent, then you need to have documents, confirming the transfer of funds to the proper addressee.

3. Upon receipt of a claim, it is imperative to draw up a written response and attach all available documentary evidence.

4. If decisions are not in your favor, try to appeal it - there are examples of positive court decisions.

We hope, our explanation will help you overcome your fear of chargeback. And if you receive a similar request from the bank, you can protect yourself. As you can see, for this you need to follow only four rules.. It is only important to observe them everywhere for all clients..

About chargeback in simple words

Charjbek (from English. chargeback - return (back) Payment (charge)) Is a procedure for protesting a transaction through a bank. In some cases, it can be an alternative to long altercations with the seller and litigation., in others - generally the only way to get your money back.

And immediately an important clarification - the use of a chargeback is possible only if, that the payment was made using the bank card details: her numbers, CVV etc. In other words, chargeback is possible in those cases, when the buyer directly enters the card details when making a payment (most calculations on the Internet), "Passes" the card through the terminal (when buying in a real store) etc. Making transactions through an online bank or mobile bank may exclude the possibility of accessing a chargeback, since in this case the payment system is not always involved. In such cases, you can refer to the mechanisms, stipulated by the Law on the National Payment System, But that is another story.

Below are the most common situations, in which you can use the chargeback procedure:

1) the paid product was not delivered and the seller does not want to voluntarily return the money or in every possible way delays this moment;

2) the goods have been delivered, however, not at all the same, which was ordered - for example, instead of iPhone 7 Chinese counterpart arrived; the service provided was significantly different from the paid service - for example, instead of an individual sightseeing tour by car throughout the city, tourists walked around the administration building;

3) the consumer faced outright fraud, when I bought something on the site, and later it turned out, that he disappeared, and with it the transferred money, and even incomprehensible, who to complain to;

4) to whom to make a claim for undelivered goods or undelivered services, known, however, there is an understanding, that even in the presence of a positive court decision from such a company or an individual entrepreneur, you will not look for anything - this often happens with mass consumer appeals with demands to return money due to the closure of the organization (for example, fitness club);

5) the seller changed the transaction amount at the last moment, and more was debited from the card, than you need;

6) money was debited several times for the same purchase (tour operators talk about this very often, cautioning guests against shopping from local vendors);

7) all kinds of fraudulent schemes using the card.

To initiate the chargeback procedure, you must contact the bank, who issued the card, with an application for the return of funds and the attachment of relevant evidence. Then it remains to wait for the decision.

In general, the picture is as follows. but, as in any other area, there are many nuances here. Let's figure it out together. The above concise description I wanted to give, so that everyone looking at this page understands, what a useful thing a chargeback, and read this article to the end. People wave their hand so often, faced with unfair behavior of entrepreneurs, not wanting to waste energy and emotions on showdowns, or just stumped in the fight for their rights. Not worth it, because it's about your own money. Chardjbek is a lifesaver in many situations..

2. Dealing with the participants in the chargeback procedure

Rarely does anyone think about, what exactly happens when making a purchase from the point of view of a money transfer. For the consumer, only the fact is important, that a certain amount was debited from the account. However, to understand the nuances of a chargeback, you need to dig deeper and look into the financial jungle., if only for that, to navigate the subject composition of persons, who take part in the procedure in question.

so, by choosing a product, the buyer places an order with payment by credit card. This request goes to the acquiring bank, with which the seller has an agreement. The acquiring bank forwards the request to the issuing bank, issuing and servicing the buyer's card, to check the sufficiency of funds for the purchase. If the answer is positive, the acquiring bank informs the seller of the result, makes calculations with him, and the latter transfers the goods / provides services to the buyer. It looks schematically as follows:

In reality, several more actors are involved in this process.: payment system operating centers, payment clearing centers, settlement centers, etc.. All of them provide interaction between the issuing bank and the acquiring bank.. However, since they are not directly related to the chargeback procedure, let's leave these details aside.

3. Chardjbek from a legal point of view

Despite the amazing opportunities, given by this option, many have not even heard of her. And those, who heard, cannot find the primary sources, which you can refer to when contacting the bank. The fact, that there is no official document in Russian, governing this procedure.

And here it is worth explaining right away: chargeback is not a product of the legislation of the Russian Federation, and the obligations of banks to payment systems. And in Visa, и у MasterCard (the most common payment systems) the internal rules stipulate the possibility of a chargeback. Accordingly, for all banks, who work with these payment systems, the requirement to accept from an individual an application for disputing the transaction and its consideration applies.

3.1. Charjbek with Visa

From Russian-speaking official sources, information about the chargeback in its most general form can be found in the Visa payment system rules for operations in the Russian Federation. (PPSV), Approved 1 January 2018 of the year [1].

Here is the diagram, which is contained there:

So on it the official explanations on the chargeback in Russian end, which creates a considerable barrier for persons, do not speak foreign languages. It is written in PPSV: "Conditions and requirements for the procedure for the return of disputed transactions, as well as the procedure for re-presentation for payment are set out in Visa Basic Rules and Rules for Visa Products and Services. Below is the general refund process for a disputed transaction ". Only here are the Basic rules of Visa in Russian in the public domain.. Think, this approach is very beneficial for Russian banks. No information - no complaints. Or, at least, it is very easy to "deploy" people when contacting.

Well,, we know english, turn to sources in foreign languages. First of all, these are the very Basic Rules of Visa and the Rules for Visa Products and Services from 14.04.2018 (Visa Core Rules and Visa Product and Service Rules) [2] (next - Basic Rules (WHOP)). Let's go through the main points.

Firstly, Visa sets a minimum amount for a number of reasons, which can be returned under the chargeback procedure. It differs slightly depending on the reason for the return, but the most common milestone is 25 Dollars.

Secondly, there are certain time limits, and they, yet again, depend on the specific reason for challenging the transaction. In most cases, this period is 120 days. And here I want to make a remark: in almost all Russian Internet sources and literature, dedicated to chargeback, for Visa the deadline is 180 days. Where did this discrepancy come from?, I don't know. Looked at foreign sites - there too 120. I tend to trust official documents.

An equally important point is how long to count from. And again for each foundation its own line. As a general rule - from the date of the transaction. But on a number of occasions since that day, when the cardholder last expected to receive a product or service. Moreover, there is a blocking limit in 540 days from the date of the transaction, after which challenge is impossible under any circumstances, even respectful.

And here is a summary table with a full list of grounds and terms for a chargeback within the Visa payment system (Attention: below is a table on the previously valid rules, you can get acquainted with the current version ):

| Code | Base in English | Foundation in Russian | Time limit for challenging (days) |

| 30 | Services Not Provided or Merchandise Not Received | The service was not provided or the goods were not received | 120 |

| 41 | Cancelled Recurring Transaction | Canceled periodic transaction | 120 |

| 53 | Not as Described or Defective Merchandise | The product does not match the description or is damaged | 120 |

| 57 | Fraudulent Multiple Transactions | Multiple fraudulent transactions | 120 |

| 62 | Counterfeit Transaction | Counterfeit card operation | 120 |

| 70 | Card Recovery Bulletin or Exception File | List of blocked or withdrawn cards | 75 |

| 71 | Declined Authorization | Denied authorization | 75 |

| 72 | No Authorization | Lack of authorization | 75 |

| 73 | Expired Card | Card expired | 75 |

| 74 | Late Presentment | Late presentation for payment | 120 |

| 75 | Transaction Not Recognized | Transaction not recognized | 120 |

| 76 | Incorrect Currency or Transaction Code or Domestic Transaction Processing Violation | Invalid currency or transaction code or internal violation of transaction processing | 120 |

| 77 | Non-Matching Account Number | Invalid account number | 75 |

| 78 | Service Code Violation | Damage to the card validity confirmation code | 75 |

| 80 | Incorrect Transaction Amount or Account Number | Invalid transaction number or account number | 120 |

| 81 | Fraud – Card-Present Environment | Card fraud | 120 |

| 82 | Duplicate Processing | Reprocessing | 120 |

| 83 | Fraud – Card-Absent Environment | Fraud without using a card | 120 |

| 85 | Credit Not Processed | Loan not processed | 120 |

| 86 | Paid by Other Means | Paid in another way | 120 |

| 90 | Non-Receipt of Cash or Load Transaction Value at ATM or Load Device | Failure to receive payment, failure to download the payment value in an ATM or device for replenishing the balance on downloaded cards | 120 |

| 93 | Visa Fraud Monitoring Program | Visa Fraud Monitoring Program | 120 |

3.2. Chargeback with MasterCard

Russian-language sources, regulating chargeback in the MasterCard payment system, none at all. However, there is a Chargeback Guide (Chargeback Guide) [3] in English.

MasterCard describes the dispute procedure differently., rather than Visa. If the latter prioritizes the owner of the bank card as the initiator of the process, then MasterCard presents the material from the perspective of business processes, resulting in the following chain:

If the controversial issue has not been resolved, that thing over 45 days can be referred to MasterCard arbitration, whose decision is binding and final for the parties. However, this provides for the possibility of appeal during 45 days from the date of the award.

As when using the Visa payment system, the time limit for challenging the transaction is, usually, 120 days. The minimum payment amount is not specified. But the list of reasons varies., although there are quite a few coincidences in essence.

And again I present to your attention the pivot table.:

| Code | Base in English | Foundation in Russian | Time limit for challenging (days) |

| 4807 | Warning Bulletin File | Invoices file, suspended | 45 |

| 4808 | Authorization-Related Chargeback | Challenging, authorization related | 90 |

| 4812 | Account Number Not On File | Account number not in file | 45 |

| 4831 | Transaction Amount Differs | Transaction amount differs | 120 |

| 4834 | Point-of-Interaction Error | Data processing error | 120 |

| 4837 | No Cardholder Authorization | Cardholder authorization is missing | 120 |

| 4840 | Fraudulent Processing of Transactions | Fraudulent transaction processing | 120 |

| 4841 | Cancelled Recurring or Digital Goods Transaction | Canceled recurring or digital item purchase transaction | 120 |

| 4842 | Late Presentment | Late provision | 120 |

| 4846 | Correct Transaction Currency Code Not Provided | The correct transaction currency code was not provided | 120 |

| 4849 | Questionable Merchant Activity | Questionable seller activity | 120 |

| 4850 | Installment Billing Dispute | Dispute over payment of the next installment | 120 |

| 4853 | Cardholder Dispute | Challenge by the cardholder | 120 |

| 4855 | Goods or Services not Provided | No products or services provided | 120 |

| 4859 | Addendum, No-show, or ATM Dispute | Supplementary agreement, non-appearance or dispute at an ATM | 120 |

| 4860 | Credit Not Processed | Loan not processed | 120 |

| 4863 | Cardholder Does Not Recognize — Potential Fraud | Cardholder not identified - possible fraud | 120 |

| 4870 | Chip Liability Shift | Transfer of responsibility for operations with chip cards | 120 |

| 4871 | Chip/PIN Liability Shift | Transfer of responsibility for operations with chip cards / PIN code | 120 |

The above codes and reasons are for Dual Message System. There is also Single Message System. They differ in the order of banking operations. But for our purposes - namely, studying the chargeback from the perspective of the consumer, who wants to get his money back, - it is not so important. I make a reservation for the curious, That, maybe, want to dig deeper and see the MasterCard Chargeback Guide for more information.

First of all, the consumer should pay attention to the code 4853. The Guide explains, that the chargeback on this basis can be carried out in the following cases:

- product does not meet the description, was delivered damaged, cannot be used for its intended purpose, and also if the seller does not comply with the terms and conditions of the contract;

- goods were not delivered, services not provided;

- loan not processed;

- the purchase procedure has not been completed;

- etc.

Actual code 4853 the MasterCard includes those grounds, which are allocated separately in the Visa payment system.

3.3. Disputes with the WORLD

Since now the MIR payment system is gaining strength within the Russian market (PSM), let's turn to the regulation of the chargeback in it. Dispute Resolution Issues (it is this terminology that is used in the regulatory documents of the PSM) dedicated to a separate Appendix 6 to the Rules of the payment system "MIR" "Procedure for resolving disputes" from 01.10.2015 G. [5].

As in previous cases, the dispute cycle can include several stages.. The first is an attempt to independently resolve the issue between the participants in the transaction.. The second is the transfer of the dispute for resolution to the operator of the PSM if it is impossible to reach agreement.

PSM provides the following grounds for challenging transactions:

| Code | Foundation | Time limit for challenging (days) |

| 4501 | Request for copies of documents not executed / executed incorrectly | 30 |

| 4508 | Violation of authorization procedures | 60 |

| 4580 | Violation of transaction processing procedures | 60 / 120 |

| 4555 | Purchased goods not delivered / services not provided / work not completed | 120, but not more 360 |

| 4590 | The cash was not dispensed by the self-service device in whole or in part | 120 |

| 4554 | Purchased goods / work / services are paid in a different way | 120 |

| 4560 | Credit operation not processed | 120, but not more 540 |

| 4537 | Unauthorized operation | 120 |

In the event that the reason for the dispute does not fall under any of the current codes, the issuing bank has the right to initiate the procedure for considering a complaint for violation of the MIR Rules (a similar opportunity exists within the MasterCard payment system and is called Compliance Procedure). The time limits for this procedure are 90 days from the date the violation was discovered, but not more 360 days from the date the transaction was processed.

Note: if you want to deal with the chargeback in more detail, I recommend that you first of all refer to the Procedure for resolving disputes in the WORLD, since the information is presented there quite systematically and consistently. Certainly, each payment system has its own rules, however the basics are similar.

3.4. Examples

Now let's turn to examples, so that the information presented above fits better in your head.

Suppose, the buyer ordered the headphones in the online store for 1100 rubles, by paying with a Visa card. Been waiting for them for a month, but they never showed up. A week later, he began to attack the seller with questions about the delivery time. Not getting an answer, applied to the bank for a chargeback. What should be the answer? Correct, positive. Limitations on the amount for the challenging code 30 not installed.

Another example. Family bought airline tickets 1 February for the flight Moscow - Antalya, which was supposed to take place 20 august. However, a week before departure, the buyer received a notification from the airline, what tickets, purchased from the same company, invalid. Is it possible in this case to initiate the chargeback procedure? Yes, can. Despite, what with 1 February (date of purchase) much more has passed 120 days, in this situation, it is necessary to take the day as the starting point, when the consumer was informed that, that the service will not be provided.

One more example. A person purchased an annual fitness club membership. However, after two months the club closed.. Repeated appeals to the administration were unsuccessful, and a lot of time was spent on them. The buyer realized the failure of his attempts only six months later., ie. order has passed since the purchase 240 days. Does it make sense to appeal to the bank to dispute the transaction at this stage? Undoubtedly, It has. In this case, the 120-day period can be counted from the last date, when the cardholder could expect the service to be rendered, ie. the last day of the subscription. At the same time, there are no obstacles to contacting the bank before the expiration of the specified period., since the service has already ceased to be provided, which is also a violation.

The husband withdrawn money from the wife's card of the MIR payment system at an ATM at her request. However, instead of the requested 50 000 rubles, the machine only issued 20 000 rubles. Can a wife initiate a dispute? Maybe, certainly, only satisfaction will she be denied, since the transaction was not performed by the cardholder, which is a violation of one of the mandatory conditions. Yes, information about this has not been given anywhere above, and you couldn't know the correct answer. However, this example was included specifically in order to, to demonstrate the need to carefully read all the conditions of the chargeback before contacting the bank. It is impossible to consider all the nuances within the framework of this article - then you would have to rewrite hundreds of pages of regulatory documents of payment systems, which does not meet the purpose of the current work. Just remember this, if you are faced with the need to dispute the transaction .

4. Charjbek: algorithm of actions

so, there is reason to demand a chargeback. Timeline met. What is the algorithm of actions?

Step # 1. Receive confirmation of an attempt to resolve the issue with the recipient of funds.

The fact, that chargeback is considered by payment systems as a straw, grabbed by a drowning man. In other words, this is an extreme measure. Although in the Procedure for resolving disputes in the WORLD, this provision is rather dispositive in nature. However, I believe, in practice, confirmation of an attempt to resolve the issue with the seller will still be required.

E-mail letters to the seller with a screenshot of the site can serve as such confirmation., where such an address will be indicated as a contact, receipts from the mail about sending regular letters or claims, copy of the claim itself, seller responses, printout of calls, etc..

Step # 2. Apply to the bank.

And this is sometimes quite problematic to do due to a number of circumstances..

Firstly, not only ordinary consumers do not know about chargeback, but often, Unfortunately, and bank employees. Here I can advise you to use the phrase "disputing the transaction" instead of the word "chargeback" in your speech. If things are really bad, you will have to conduct an educational program on your own - you can print and take this article with you.

Secondly, for some reason banks try not to accept such applications. I can only guess, that it is a banal unwillingness to burden oneself with additional work. The bank does not bear any losses in case of satisfaction of the application. All costs are borne by the seller: and commission for processing the request, and the penalty for refusing voluntary satisfaction (if it came to the operator of the payment system), And, Certainly, the refund amount itself. If the company has ceased to exist, then the money is paid by the acquiring bank, however, all these losses are more than covered by the commission, which he charges from the seller under the contract. Here the situation is similar to insurance.

Thirdly, sometimes they try with all their might to convince the client of the futility of the attempt. However, if you are sure that there is a reason and that the deadlines are met, stand on your own. Make sure that, so that the application is registered and you are given a number or other requisite, by which you can track the progress of the case.

How exactly to apply? There are various ways. Each bank may have its own requirements. On the Sberbank website, for example, contains the following information:

«2.10. What to do, if when servicing a card at an ATM, the bank or at the point of sale the requested amount, the product or service was not provided (including partially), and the spending limit on the card has decreased?

You should contact the subdivision of Sberbank of Russia at the place where the card account is maintained to fill out an Application for a disputed transaction or contact the Bank's Contact Center by phone or by sending a message describing the situation by fax or by e-mail [email protected], attaching, in the presence of, a copy of the correspondence with the outlet and a copy of the receipts. Indicate in the message: Name, name, patronymic (totally); number, month, year of birth; city, where is the card open; recent 4 card number digits; Date, transaction amount; merchant / bank name; whether a request was made to the bank; Your phone number indicating the desired call time. "[4].

Making an application over the phone is a very tempting option in terms of saving time, however I do not recommend it. The fact, that such a method does not allow evidence to be attached, which significantly reduces the chances of a positive solution to the issue. And one try will already be used up. Better to go to the bank branch and ask for a form to fill out, if it is approved by the bank. If not, then the application is made in free form. The main thing is to indicate your last name there, First and middle name, card number / Account, date and amount of the transaction, grounds, on which you want to challenge it, and your contact details.

Step # 3. Provide evidence.

This must be done in parallel with step No. 2, or rather, even at the same time. Even though it's not about a trial, however, the evidence-backed claim will weigh much more, than unsubstantiated.

Truth, a reservation should be made, that evidence is not always required - it all depends on the basis of the dispute. For example, MasterCard's ChargeBerk Guide explains, that proof is always needed when challenging a transaction by codes 4837, 4840, 4053-4855, 4859, 4870, 4871; sometimes - by codes 4831, 4841, 4846, 4850, 4860, 4863 (with. 31-32 Manuals). However, please note, what controversy, initiated by the cardholder (code 4853), which we are most interested in, always require an evidence base.

What can serve as evidence? Almost everything, what is associated with the transaction and subsequent communication with the seller: Checks, receipts, screenshots, correspondence, automatic checkout messages, processing it, sending in delivery, etc..

For example, wrong item delivered, which was paid. In this case, you will need to provide a receipt for payment, where the name of the product or its article will probably be contained, screenshot from the site with the description and characteristics of the product, photo of the received product, Documents, confirming the appeal to the seller in order to resolve the issue that has arisen (Step # 1). Learn more about, how to receive goods by mail, see. article "».

Step # 4. Wait for an answer.

The processing time of the appeal may vary. On average it is 1-2 months. What happens at this time? Having received the application, the issuing bank sends a request to the acquiring bank. He, in turn, addresses it to the seller.. The seller has a month to do that, to present your objections on the merits of the claim. If they are absent or the seller agrees with the submitted claim, the applicant receives his money back. If the service was partially provided, then only part of the amount is refundable, proportional to the number of non-rendered services.

If a refusal came, then it is necessary to carefully analyze his reasons - he must be motivated. Often, the refusal is due to a violation of the deadlines for filing a claim, which is not always true. Some banks set their own time frames for challenging transactions - for example, 30 or 45 days from the date of the transaction. It is unacceptable, because it contradicts the provisions of payment systems, which are not subject to correction by their participants. In p. 7 Art. 20 FZ from 27.06.2011 No. 161-FZ "On the National Payment System", that the participants of the payment system join the rules of the payment system only by accepting them as a whole.

Another possible option is a formal approach to deadlines.. As written above, the time limit for challenging in most cases is 120 days from the date of the transaction. However, there are exceptions to this rule. (continuing service or deferred performance). Many banks do not take them into account.. There are two ways out: or immediately, when drawing up an application, describe in detail this moment, or take it into account when re-applying.

If the refusal is due to counter-arguments of the recipient of funds, then you need to assess their legitimacy and contestability. If it is possible to refute by providing additional evidence, they must be collected and attached to the repeated statement..

5. Court or chargeback?

It depends on many factors.. Let's compare on a number of parameters.

| Parameter | Court | Charjbek |

| Financial costs of initiating the procedure | Absent. Consumers are exempt from paying state. court fees (if the value of the claim does not exceed 1 million. rub.) | Absent. But if the case is referred to the IPU arbitration and the decision is not in your favor, then a duty is levied 500 dollars for each transaction. |

| Complexity of paperwork | The statement of claim must meet the requirements, presented by the Code of Civil Procedure of the Russian Federation. There are also certain requirements for evidence.. | The application is drawn up in free form or according to the sample, approved by the bank, does not require references to regulatory legal acts. More loyal attitude to the admissibility of this or that evidence. |

| Opportunity to get advice from a representative of the organization | The probability of going to zero is not the responsibility of the court staff. | Maybe, however the question is, how qualified assistance will be provided. |

| Politeness in handling | Well… | Formal communication style. |

| Time spent on handling | Unpredictable. Sometimes you can wait for meetings for three to four hours, and sometimes everything is on schedule. | Depends on the queue at the bank. |

| Terms of consideration of the case | 3-4 months including enforcement proceedings (if without appeal). | 1-2 months, if the first attempt is successful. |

| The need to contact a lawyer | If you have time to understand the laws and go to court, you can get by. But on the other hand, when contacting a lawyer, many disadvantages disappear., mentioned above. | On the first call, you can get by. In case of refusal, it is better to contact. |

| Reimbursement of expenses for a lawyer | Recovered from the defendant in case of a positive decision on the case. | Not refundable. |

| Total amount | Paid amount

+ penalty + interest for using someone else's money + penalty for refusal of voluntary satisfaction + moral injury In general, the amount will be in 2-3 times more than paid. |

No more paid. |

| The prospect of receiving funds with a positive decision on the case | Depends on the specific situation. If the company is "abandoned" or all the money is withdrawn from its current account, then the money will not be received. | 100% will be returned |

| Ability to use a second procedure after a failure in the first | Maybe | Maybe |

I would start from the following: if there is no need to get money as soon as possible, the company is "live" and everything is in order with the evidence base, I would go to court - this way you can get more money, thereby punishing the seller for stubbornness and dishonest behavior. But this is just my opinion and by no means a call to do this.. Everyone chooses that, what is closer to him.

6. Chargeback for withdrawal of funds from the broker

When I wrote this article almost a year ago, didn’t even imagine, that chargeback can be applied in the brokerage industry. To be completely honest, I did not even know about the existence of such sites, and even more so about, that for the most part it is a fake, toy for pumping money from people. But what can I say - I was not going to work in the direction of chargeback at all, but just wanted to tell people about this tool. And the topic turned out to be very popular, and c 90% of cases they call with questions about withdrawing funds from dishonest brokers.

Well,, I share another piece of information.

Withdrawing funds from a broker with MasterCard

In April 2017 of the year MasterCard introduced the following rule:

Chargebacks are available to the issuer for transactions in which any value is purchased for gambling, investment or similar purposes. However, issuers have no chargeback rights related to the use of these chips or value, unspent chips, or withdrawal of such value, or on any winnings, gains or losses resulting from the use of such chips or value.

You can find it on page. 44 Chargeback Guide. The point is the following: chargeback can be used for transactions, as a result of which some resources were acquired for gambling, investment or other similar purposes. However, it is not applicable in situations, related to challenging the use of this money, their withdrawal or disputes regarding winnings, losses, etc..

Let me explain with a simple example. If you bought a deck of cards from an online store, but they didn't deliver it to you, then you can dispute such a transaction, as a deck of cards is just a tool for gambling. If, as a result of playing poker with this deck, the partner refuses to give you the money won, MasterCard will not understand this..

What are the loopholes? Dispute a transaction on the basis of non-provision of service (code 4853).

1. If in the agreement with the broker, the user agreement on his website or elsewhere contains a detailed procedure for withdrawing funds and it is not respected, you can try to declare non-provision of services. Controversial approach. In general, the general restriction from p.. 44 Chargeback Guide. But I heard from the bank employees, that positive decisions were. I have not yet come across principals, who would also have a MasterCard, and a well-written output scheme.

2. It happens, that brokers block access to your personal account - in this case, you can also appeal to the non-provision of the service.

3. A time-consuming option to prove - there was no brokerage at all. This is just about, that most of the companies in this market are scammers and have no entry into the Forex market at all. Accordingly, the MasterCard restriction is not applicable in this case.. Now all applications in this area are in the process - I cannot share the results yet, but I will definitely tell you, how will the answer come from arbitration.

Update (21.03.2018): ready to share great news: we won arbitration in the MasterCard IPS in the third direction! Works!

Summing up the prospects for challenging transactions to transfer money to a trading account within the framework of the IPS MasterCard, I'll say this: if you really want to try, then you can. Especially if a large amount of money has "hung". But be clear about the fact, that there can be no guarantees of success here. The options above are just looking for opportunities in an attempt to help. I definitely do not recommend trusting companies, who will promise a quick solution to the issue thanks to their connections, experience and something else there. Unfortunately, Parasites, cashing in on someone else's grief, a lot divorced.

There is another interesting option, but I'll tell you about it below.

Withdrawal of funds from the broker with Visa

Attention! 14 April 2018 G. new Visa chargeback rules have been published. Codes, the grounds and timing have undergone significant adjustments. As soon as possible, the text of the article in this part will be brought in accordance with the current rules.. The relevance of the information below is still in question, since it was prepared according to the previous edition.

Good news for Visa cardholders - with 14 October 2017 of the year Visa protests transactions, recipients of money for which they refuse to withdraw funds to cardholders:

Effective for Transactions completed on or after 14 October 2017 Investment products or services, (for example: binary options orforeign exchange trading), where the Merchant refuses to allow the Cardholder to withdraw available balances.

It's on the page 612 Visa Core Rules. In this case, the protest must be carried out using the code 53.

If the transaction was carried out before this date, then the outcome is controversial. Some banks consider, that since the right to chargeback with respect to withdrawal was secured only with 14 October, then earlier translations should be refused.

Loophole: an application for a chargeback must be submitted by code 30 - failure to provide services (and 53 Is a mismatch with the description). The rest of the logic is the same, as for MasterCard.

Refusal to initiate a chargeback

It also happens, that the bank generally refuses to accept an application for a chargeback. Either accepts it, but does nothing. In this case, you can make a claim directly to the bank..

Algorithm of actions:

1. Document everything. If the bank refuses to accept, demand a written waiver. If it is not given, send the documents by post with a list of attachments.. The same with silence - if your calls and letters are not responded, write a formal request requesting clarification.

2. File a claim against the bank in court in connection with violation of consumer protection legislation. The fact, that according to the Law on the National Payment System, the bank is obliged to accept the rules of such completely and unconditionally. In this way, issuing Visa and MasterCard, the bank is obliged to provide all procedures, provided by these payment systems, including protesting transactions.

Within the framework of this proceeding, it will be possible to demand the amount of the transaction from the bank, which he prevented from returning, forfeit, fine, moral injury, as well as legal costs.

I will warn you right away - judicial practice on this issue has absolutely not developed. It is my personal conviction that everything depends on the particular judge.. Some follow the formal path - the Russian legislation does not contain the concept of “chargeback”, means, requirements are not subject to satisfaction. Others prepare brilliant motivations, where the entire logical chain is reproduced in detail. Certainly, it may not be about the judges, and in plaintiffs and representatives. I can't judge this - I share only that picture, I am watching. well, certainly, need to understand, that the claim itself must be justified.

Update 14.11.2018 G.: there is a decision on a claim against the bank for refusing to initiate a chargeback procedure under the Mastercard MPS, despite, that he was provided with evidence that, that the company is not a broker, - denial of satisfaction. We will appeal, I will inform you about the news. But at the moment so.

Update 04.12.2018: rejection of a similar claim under the IPS Visa. The principal also intends to appeal. So far, the motivation is not ready in any case., therefore, I cannot say about the reason for the refusal. I will inform, as it becomes known, follow the news.

Since there are a lot of requests for refunds from brokers, I will give several comments at once:

1. Time. The return procedure is long. The broker never voluntarily agrees to return the money within the first round of chargeback. Respectively, followed by another, least, one stage. In this way, the story lasts at least six months.

2. Perspectives. According to the stories, I cannot assess the prospects. In most cases, people have one idea of how, what they were promised and what happened, but according to the evidence base, the picture is completely different. We go to the bank or court with the latter. Respectively, make any assessment of the storytelling situation at least unprofessionally. Another thing, what is a list of basic questions, which I ask everyone, since some answers to them immediately exclude the possibility of further action. In this case, it makes no sense for you to pay for an assessment of prospects or other services..

3. Warranty. Guarantees of a positive outcome with a positive assessment of the prospects too, Unfortunately, No. An important role in the implementation of the chargeback is played by the issuing bank. For example, this is not the first time we have encountered, that VTB violates all deadlines for sending replies to its clients, as a result, the possibility of applying to arbitration by the IPU. The fact, that the time limit for filing an application for pre-arbitration / arbitration is calculated from the moment the acquiring bank gives a response, rather than receiving this response by the cardholder. Respectively, in such cases, it remains only to sue the issuing bank - additional costs, additional time.

4. Competitors / partners. I can't say anything about other companies, engaged in chargeback. We work with those, who contacted us, within that concept, which we think is correct. Unfortunately, did not hear positive reviews from the first hand.

Thank you for your patience in reading this material., really hope, that he was helpful. My big request is to share it, you are welcome. With friends, Friends, colleagues - anyone. I never asked for anything like this (you can see in other articles). It doesn't give me anything (because we don't do it anymore). It's just that so few people know about the chargeback., and situations, in which he may be needed and help - a lot. Let's raise the level of legal culture together and help each other to fight for their rights. For those, who understands information better by ear, I recommend to watch video .

The article has been prepared taking into account the revision of regulatory documents, operating on 10.05.2017 G.

Updating: 15.05.2018 G.

P.S. Dear Readers, 27.08.2018 G. my team and I decided to stop doing chargeback, therefore, it no longer makes sense to contact us for support of cases in this category.

I will explain the reason for this refusal.

We want to focus on cases with a strong legal bias. This article was originally written solely to disseminate information about the chargeback.. We began to deal with this issue in practice due to the huge number of requests. However, they consume too much time.. Furthermore, I emphasize once again - we are lawyers. With chargeback, a good understanding of the functioning of the securities market is very often required.. Precisely from a financial point of view. Find a qualified professional, on which we could rely, during this time we could not.

In conclusion, I want to thank everyone, who entrusted us with their affairs. Our team did everything, what was in our power, and always tried to give an objective assessment of the situation in order to avoid incurring additional expenses by the principals.

For those, who are only in search of a solution to their question, I'll say this: we have no one, Unfortunately, recommend you. We don't know the company, which would act according to our algorithm. We cannot vouch for others. I definitely do not advise you to believe those, who promises a quick solution to the issue through connections, channels, etc., just transfer money. Also, do not get fooled by calls from supposedly employees of foreign banks., where is your money and you only need to pay a commission for their withdrawal.

And the last: don't be afraid to try. If the cost of a chargeback specialist is too much for you, try to submit the documents yourself. No form exists. You can simply state the situation on paper and send it in a valuable letter with a list of investments to the legal address of the bank. Why is that? The fact, that many people on the ground have never heard of the word "chargeback". As a result, people are simply denied the application.. The message received by the central office and the registered message will certainly be considered., and it will be answered.

And the very last: as far as possible, I will still try to update the information in the article, so that people have a reliable source of information, however promise it on 100%, Unfortunately, I can't. As a parting gift, we shot a video on the topic: . Happy viewing!

Sources of:

[1] VISA official website (Russia) // URL: https://www.visa.com.ru/content/dam/VCOM/regional/cemea/russia/media-kits/documents/VPSORR-01.01.18.pdf (date of the application: 20.05.2018).

[2] VISA official website (USA) // URL: https://usa.visa.com/dam/VCOM/download/about-visa/visa-rules-public.pdf (date of the application: 20.05.2018).

[3] Official website of MasterCard // URL: https://www.google.ru / url?h=t&rct=j&q=&esrc=s&source=web&cd=1&ved = 0ahUKEwimmtf4-5LbAhWGCJoKHQnxBIsQFggxMAA&url=https://www.mastercard.us/content/dam/mccom/en-us/documents/rules/chargeback-guide.pdf&usg = AOvVaw0817bXiUsROV2VovS08AVb (date of the application: 20.05.2018).

[4] Frequently asked Questions // Sberbank official website. URL: (date of the application: 09.05.2017).

[5] Official site of the national payment card "MIR" // URL: (date of the application: 09.05.2017).

© Maya Sablina, 2016–2019