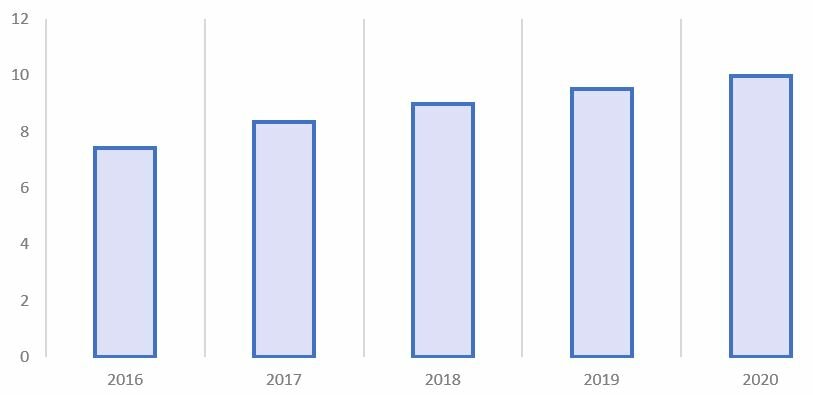

Good for everyone, not counting its owners of shares Over the recent period, there has been a real explosive growth in investments - due to the general covid isolation, brokers had to significantly improve their remote services for clients, including - to facilitate the opening and service of brokerage accounts, conducting operations with securities. This entailed something, that a huge number of newbie financiers appeared on the exchange. Some of them are determined to chase fashion promotions like Tesla and Virgin Galactic., someone got "under the hand" during events like the crackdown on GameStop shares. More advanced financiers might think about, how to get income on the general investment boom. It immediately recalls the times of the gold rush: not many of the gold diggers have found gold, but almost all businessmen, who traded in shovels, made a fortune. Such "shovel dealers" during the investment boom, Certainly, are exchanges and brokers. Prior to that, the pages of the Open Journal published a review of global exchanges and evaluated their investment attractiveness. In this article we will analyze, how presentable is the brokerage industry for a financier, taking Interactive Brokers as an example (IBKR). This foreign broker is more popular among Russian financiers, besides, its shares are traded on the St. Petersburg Stock Exchange. Interactive Brokers Past Cash Performance Summary 5 years is shown in the figure below. Rice. 1. Charts based on EDGAR data. Дивидендная история и график акции …

Interactive Brokers through the eyes of a financier Read more