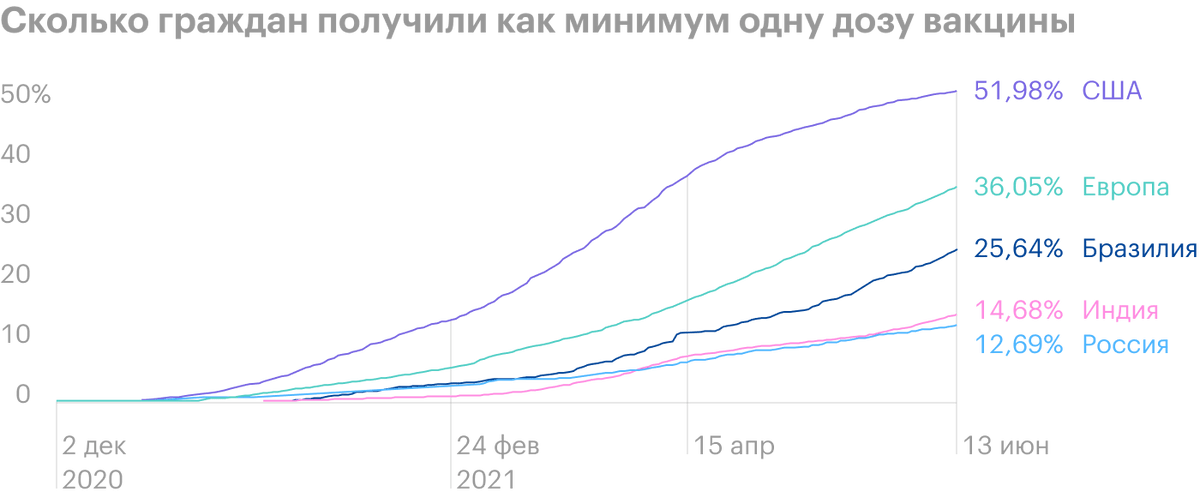

CEO of monetary American Express (NYSE: AXP) Steve Squarie in a conversation with CNBC said, that Americans began to use credit cards more often for travel and catering. These industries are recovering, as the number of vaccinated people increases, and restrictions are eased.

“In May, the amount of booked trips was eighty-five percent of May figures 2019 of the year. We believe, that US travel consumer activity will recover fully by the end of the year, and in the world as a whole - eighty percent of the level 2019 of the year", - Squery said.

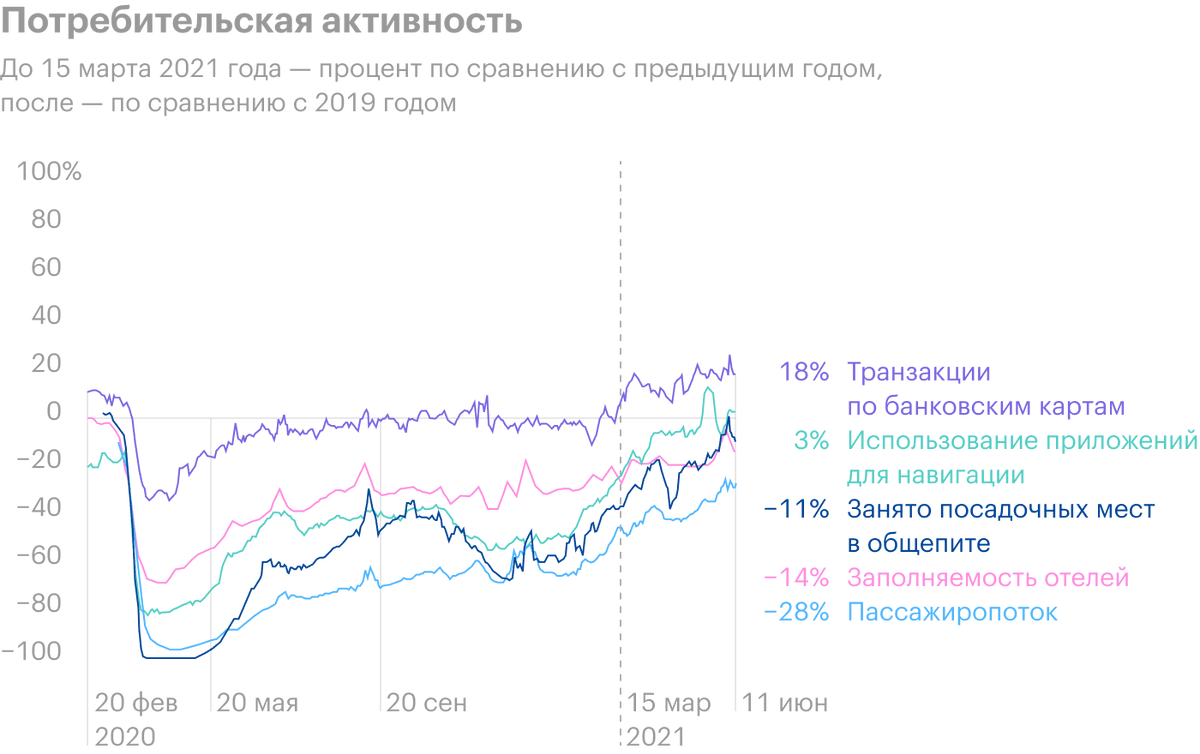

According to the US Transportation Security Administration, last Friday, 11 June, passed through airport checkpoints 2 million people. This is the highest number of passengers since March 2020 of the year, amounting to seventy-four percent of the flow of passengers on the same day in 2019 year.

Yet, according to Squarie, users began to spend heavily in restaurants: May spending recovered to eighty-five percent of May figures 2019 of the year. "Millennial spending, who really spend a lot in restaurants, in April were 130% from the level of April 2019 of the year. We believe, that this trend will continue ", - also said the head of American Express.

According to experts, shares of the Chipotle Mexican Grill restaurant chain have more growth potential in the industry. The company's securities are currently traded at 1391 $, twelve percent below the maximum. Experts expect, what's next 12 months, securities can rise by twenty-four percent, to 1723 $.

Chipotle increased the price of its meals by four percent in June. At the end of the month, the company will raise the wages of workers to 15 $ per hour, Therefore, future costs are included in the cost of the final product.. The entire restaurant industry is facing a labor shortage right now., because the Americans, government-backed, are reluctant to get out of the “non-working day mode”.

Yesterday, 14 June, analysts at investment bank Raymond James raised the target for Chipotle shares to 1800 $. The bank considers, that higher food prices will have a positive effect on the company's financial results: “The price increase creates significant upside potential in the second half of the year and confirms our earnings per share estimate for 2022 year" – American Express (NYSE: AXP)

Companies from S&P 500, working in the catering industry

| Ticker | Since the beginning of the year | From the annual maximum | Growth potential | |

|---|---|---|---|---|

| McDonald’s | MCD | 10% | −1% | 9% |

| Starbucks | SBUX | 5% | −5% | 11% |

| Chipotle Mexican Grill | CMG | 0% | −12% | 24% |

| Yum! Brands | YUM | 9% | −4% | 3% |

| Darden Restaurants | DRI | 15% | −8% | 13% |

| Domino’s Pizza | DPZ | 17% | −1% | −2% |

Companies from S&P 500, working in the travel industry

| Ticker | Since the beginning of the year | From the annual maximum | Growth potential | |

|---|---|---|---|---|

| Booking | BKNG | 3% | −8% | 10% |

| Carnival | CCL | 33% | −9% | −3% |

| Expedia | EXPE | 28% | −10% | 14% |

| Royal Caribbean | RCL | 18% | −11% | 6% |

| Norwegian Cruise Line | NCLH | 22% | −10% | 0% |