26 May company Amazon (NASDAQ: AMZN) announced the purchase of the MGM film studio for $ 8.45 billion. The MGM library has more than 4 thousand films and 17 thousand TV shows. Film studios own such franchises, how "james bond", "Rocky", RoboCop, Pink Panther, Vikings, «Fargo».

If the regulator approves the deal, MGM acquisition will allow Amazon to expand its Prime Video library and compete with Netflix, Disney, HBO Max and other streaming services. In April, Amazon CEO Jeff Bezos said, that 175 million people used Prime Video in 2020, and the volume of views in hours increased by 70%.

From a financial point of view, the new acquisition for 8.45 billion will not be a problem for Amazon. The company now has 73 billion cash and cash equivalents, and its free cash flow is growing by 60% in the last three years. A large supply of money and a huge audience allow you to enter new markets and impose an unequal struggle on competitors. In the US, Amazon has become called the nightmare of American business, also invented term "amazoned" - to fail because, that the company entered your market.

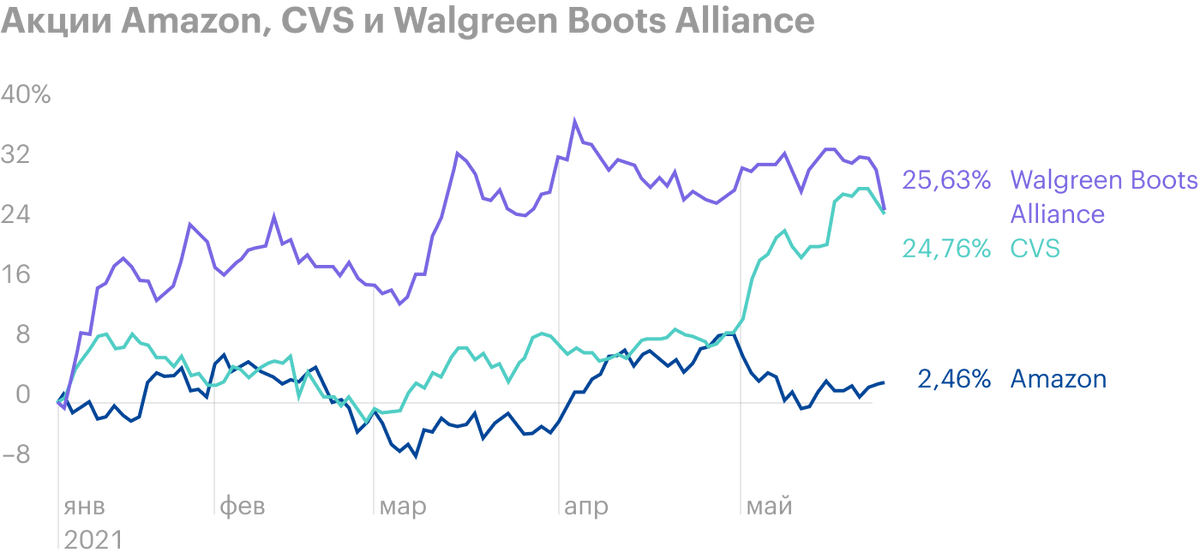

So, in June 2017, shares of Walmart retailers, Target and Kroger fell by more than 10% following Amazon's announcement to buy Whole Foods supermarket chain; in November 2020, the company launched online drug sales, while shares of drugstore chains CVS and Walgreens Boots Alliance fell by 7 And 10%. Six months later, Amazon again turned its attention to the pharmaceutical industry.

Rumor has it, the company is considering the possibility of launching a network of pharmacies, which may be located separately or inside Whole Foods stores. The first pharmacies may open in a year. Amazon has not yet commented on the rumors, but CVS shares and Walgreen Boots Alliance 26 may have already fallen on 1,5 And 4%. Since the beginning of the year, securities of pharmacy chains have added 25%.