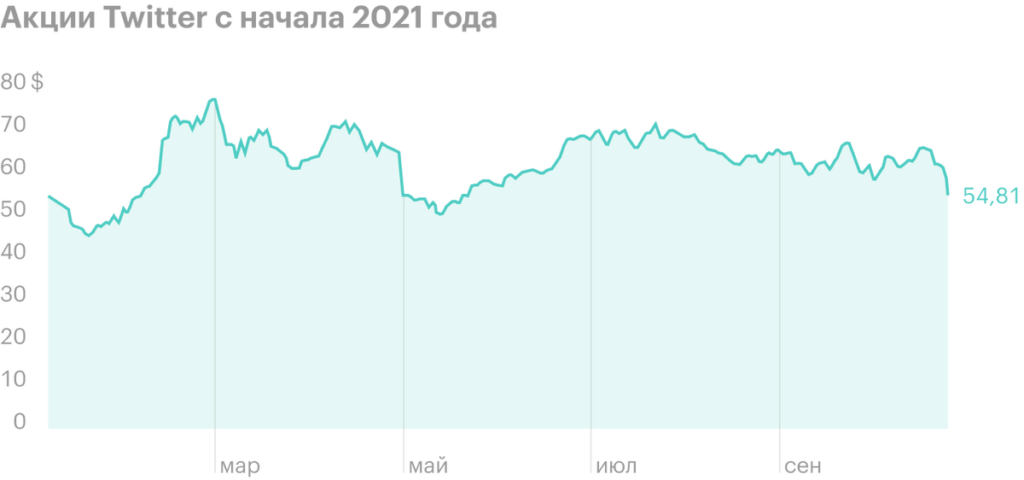

Social network Twitter reported for the third quarter of 2021. Analysts called the growth in the number of paid users weak. TWTR shares fell by 11%, to 55 $, and capitalization - from 49 up to $ 44 billion.

Experts don't believe

The total number of daily active social network users monetized increased to 211 million - by 3% block to block and on 13% year to year. Compared to 2020, the base of such users in the United States has grown by 4%, up to 37 million, in other countries - by 15%, up to 174 million.

In February, Twitter set a goal: Reach 315 million paying users and double revenue by the end of 2023. After the report for the quarter, the investment company KeyBanc Capital Markets said, that Twitter won't do the job, and lowered the target for social media shares by 11%, with 81 to 70 $.

User growth has slowed for other social networks as well.. One reason is the high base effect.. Last year, during quarantine, people began to spend more time online, including on Twitter.

Number of daily active Twitter users monetized, million people

| 2018 | 126 (+9%) |

| 2019 | 152 (+21%) |

| 2020 | 192 (+27%) |

| 1к2021 | 199 (+20%) |

| 2к2021 | 206 (11%) |

| 3к2021 | 211 (13%) |

126 (+9%)

Users too

In the third quarter, Twitter's revenue grew by 37%, to $1.3 billion. Advertising revenue, the company's core business, grew by 41%, up to 1.1 billion. For comparison: Facebook ad revenue increased by 33%, and Google - on 43%.

Twitter lost $537M in the quarter as it paid out $766M to shareholders, who filed a class action lawsuit. Company executives were accused of, that they exaggerate, when they talk about the number of users of the platform. Investors said, that they were misled, and went to court. A month ago, Twitter agreed to pay the plaintiffs $ 810 million.

A little more about iOS

Twitter spoke out about Apple's new privacy policy, which does not allow tracking user preferences. Since last Friday, when the quarterly report was published by Snap, changes in iOS - the main topic, when it comes to advertising-earning services.

According to management, iOS changes don't affect Twitter's ad revenue as much, as was expected. According to company forecasts, revenue in the fourth quarter will amount to 1.5-1.6 billion - by 20% more compared to last year, which is in line with the consensus forecast.

Analysts fear Twitter more than Twitter itself. Investment companies called the privacy situation in iOS uncertain and lowered the target for shares of TWTR just in case.

Since the beginning of the year, Twitter shares have lagged noticeably behind the broad market index S.&P 500: 0 against 23%.

Targets of investment companies on shares of Twitter

| MKM | 83 $ ➝ 77 $ |

| BMO | 70 $ ➝ 65 $ |

| Jefferies | 80 $ ➝ 70 $ |

| Cowen | 64 $ ➝ 67 $ |

| KeyCorp | 81 $ ➝ 70 $ |

| Canaccord | 78 $ ➝ 72 $ |

| Barclays | 60 $ ➝ 64 $ |

| Piper Sandler | 76 $ ➝ 70 $ |

83 $ ➝ 77 $