According to Vanda Research, behind 5 trading days, with 17 on 24 august, retail financiers have purchased securities of organizations from China in a total amount of more than $ 400 million. Alibaba stock purchases increased by 270%, and JD.com - on 170% in relation to the previous month.

At the beginning of the week, 23 august, Alibaba shares were the most popular in the US. Pfizer Stock Purchase Size, 2-oh the fame of the company, hit twice less.

Over the past weeks, Chinese regulators have restricted the work of companies from various industries for various reasons., from technology and media to education and games. The largest companies suffered, similar as Alibaba, DiDi, Tencent and others.

For a certain number of days, while financiers were intensively buying out sagging companies, акции Pinduoduo и Baidu прибавили 25 and nine percent. Shares of online trading company JD.com have increased by seventeen percent over the corresponding time period.. At the beginning of the week, the company presented a report on sales growth by 26,2 %.

However, the dangers of investing in organizations from China still remain.. And not only from China. Not so long ago there was information, that the US Securities and Exchange Commission (SEC) will introduce new requirements for companies, who wish to list on US exchanges. Now companies will have to open their structure in more detail and inform about all risks., related to the actions of Chinese regulators.

24 August in conversation Bloomberg SEC chief Gary Gensler said, that organizations from China must begin to comply with all requirements, including financial statements, until 2024. Otherwise, companies face delisting. "The clock is ticking", Gensler added..

According to Vanda Research, Demand for Chinese papers will soon fall. Partly because, that retail investors are again interested in "meme" stocks. Since the beginning of the week, for no apparent reason, the securities of GameStop and AMC Entertainment have risen by 23 And 25%.

“Demand for manufacturers of vaccines and semiconductors, such as Nvidia and AMD, has grown significantly. Demand for "meme" stocks also rose, which intensified competition for retail money", — said in Vanda Research.

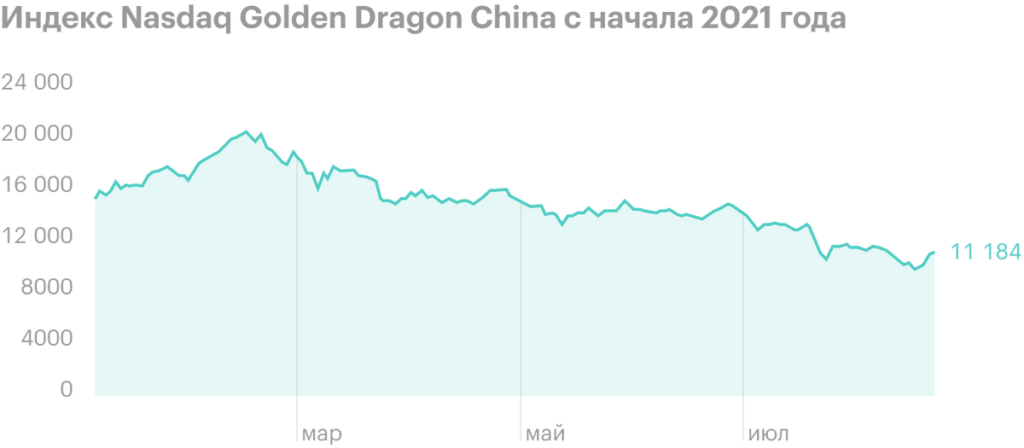

Despite little recovery, index Nasdaq Golden Dragon China, which includes large Chinese companies listed on the US exchange, still in a deep drawdown. The index is currently at 46% below February highs.

Volume of retail purchases since 17 on 24 august

| Ticker | The change | |

|---|---|---|

| Alibaba | BABA | 270% |

| Pinduoduo | PDD | 200% |

| JD.com | JD | 170% |

| Baidu | START | 161% |