Home Depot Tool and Building Materials Retailer (NYSE: HD) released the 2Q 2021 cash report:

- revenue increased by 8,1 %, up to $41.1 billion;

- operating profit increased by 9,4 %, up to 6.6 billion;

- net profit increased by eleven percent, up to 4.8 billion.

“I am proud of our employees, continuing?? focus on our customer service. As a result of their efforts, for the first time in the history of the company, quarterly sales reached the milestone of $40 billion.”, - said the head of the firm Craig Menard.

Compared to the previous year, US like-for-like sales increased by 3,4 %, and total comparable sales by four and a half percent. This is less than the expectations of specialists, forecaster?? like-for-like sales growth 5,4 %.

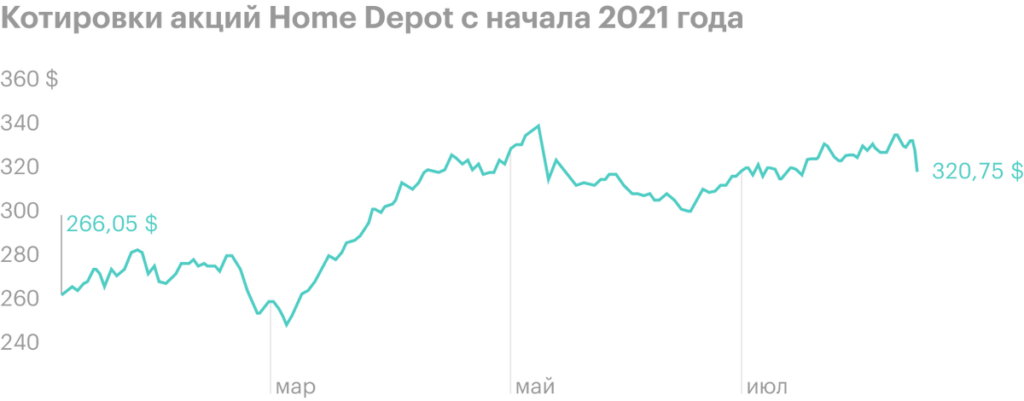

After the release of the report, Home Depot shares fell to 4,3 %, to 321 $. Lowe's Trading Company Shares (NYSE: LOW), which will report this week, also fell on 5,8 %, to 182 $.

Like others, Home Depot faces inflationary pressures. Gross Margin Falls 1% in Q2. The company raised prices and partly reduced costs. The average check increased by 11,3 %, but the number of client transactions fell by 5,8 %.

Home Depot is hard to overshadow last year's performance, stavš?? success for the company. In 2019, the company's revenue increased by two percent, but in 2020 already twenty percent. During the period of quarantine measures, users spent more on home improvement: materials, tools and equipment. The increase in the housing market and incentives from the country also added Home Depot buyers.

People are now spending more time outside the home as vaccinations progress.. From the other side, the number of infections with new strains of COVID-19 is growing. While the company's management does not give forecasts of future sales.

Since the beginning of the year, Home Depot securities have added 22%. In index S&P 500 similar result - 20%. Over the past five years, Home Depot has increased its quarterly dividend by 2,4 Times. Годовая доходность — 2%.

Home Depot operating results in the second quarter

| 2020 | 2021 | The change | |

|---|---|---|---|

| Transaction | 511,5 million | 481,7 million | −5,8% |

| Average check | 74,12 $ | 82,48 $ | 11,3% |

| Sales per square foot | 629,38 $ | 663,05 $ | 5,3% |