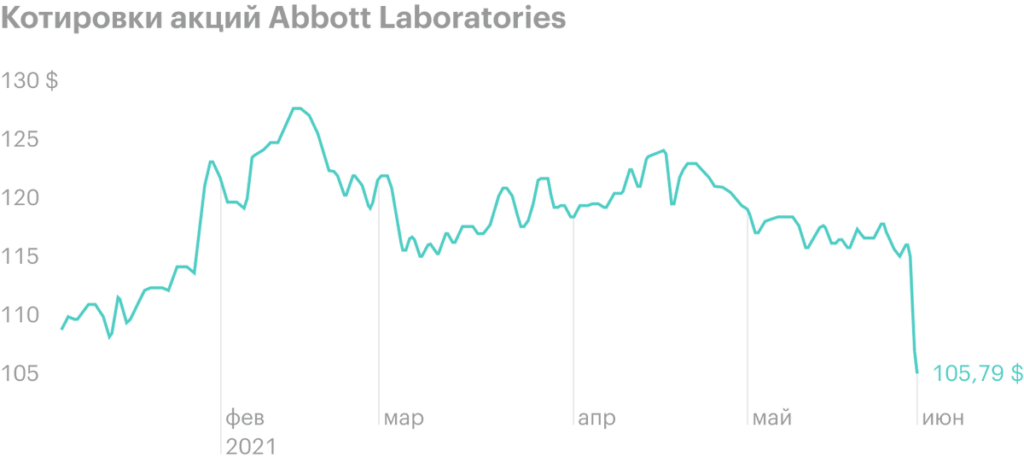

1 June medical giant Abbott Laboratories (NYSE: ABT) reported a sharp drop in demand for coronavirus diagnostics. The company downgraded its forecast for adjusted net income per share from 5 up to 4.3-4.5 $. Abbott shares fell by 9,3%.

Demand for diagnostics has fallen due to a decrease in the number of diseases in many countries, vaccination of the population, as well as recommendations from US health authorities. They say, that vaccinated people do not need to be tested, if they have no symptoms of the disease.

“We are seeing a rapid decline in demand for COVID-19 diagnostics and expect, that this trend will continue. The rest of our business segments are growing, and the product line remains productive.”, Robert Ford said, head Abbott.

Since the start of the pandemic, Abbott has developed 12 different tests for coronavirus, including the popular BinaxNow - a 15-minute express test worth 5 $ and the size of a credit card. In the first quarter 2021 the company earned record 10,5 billion dollars, out of which 2,2 billion were sales of tests for COVID-19.

The drop in demand for diagnostic tools is palpable, but not fatal for Abbott: the company's business is well diversified. As the quarantine is lifted, hospitals return to elective operations, and sales of medical devices are recovering. Freestyle Libre Diabetes Device Sales Continue to Grow at Double Digits.

Yesterday, Abbott Laboratories didn't just announce revisions to its revenue and profit expectations., but also acted as a kind of mouthpiece for all companies, who received super-profits from test sales. These companies are at risk of falling sales in the near future., and their financials may fall short of analysts' expectations.

Companies producing tests for COVID-19

| Ticker | The fall 1 June | |

|---|---|---|

| Abbott Laboratories | ABT | −9,31% |

| Thermo Fisher Scientific | TMO | −4,79% |

| Laboratory | LH | −3,91% |

| Quest Diagnostics | DGX | −3,34% |

| PerkinElmer | PKI | −2,28% |

| Hologic | HOLX | −2,71% |

| Quidel | QDEL | −7,43% |