Development of a video communication platform Zoom (Nasdaq: ZM) announced the acquisition of cloud service provider Five9 (Nasdaq: FIVN) for $14.7 billion. Entering a New Market Will Accelerate Zoom's Long-Term Growth and Help Grow Corporate Share. Five9 will become an operating division of Zoom in the first half of 2022, if the owners of Five9 shares and the regulator approve the deal.

What Five9 does

Five9 - provider of cloudy software for contact centers. The company provides a set of applications, helping?? communicate with customers via chat, Social, by email, voice communication and other channels. To quickly deploy a contact center anywhere, Five9 customers are satisfied with the headset, computer and network connection.

According to the agreement, for each security, Five9 holders will receive 0.5533 Zoom shares. Zoom shares on Friday closed at 361,97 $, because the holders of Five9 securities can hope for 200,28 $ per share. Five9 papers cost 177,6 $, so the shareholder premium is thirteen percent.

Zoom plans

According to Zoom, future deal will help companies to cross-sell their own goods. Five9 will also complement the Zoom Phone platform - a cloudy phone system, offering?? digital alternative to ordinary voice communication. The entire market for cloud services for Zoom contact centers is estimated at $ 24 billion.

“In the main company they talk with customers through the contact center, and we believe, that this acquisition will help make it a leading platform for customer collaboration.”, - said the head of Zoom Eric Yuan.

“Companies spend significant resources every year on contact centers, but still can't provide smooth customer service. Five9 has always helped make it easier for businesses to solve this problem and begin to interact more effectively with their customers.. Joining forces with Zoom will give Five9 customers access to the best solutions, in particular Zoom Phone, that will enable them to achieve real results for their business.”, added Five9 CEO Rowan Trollope.

Financial results

Zoom's revenue tripled last quarter, up to a billion dollars. The number of clients with more than ten employees has grown by 87%, up to 497 thousand. The number of large clients grew by 160%, to 1999. The company is waiting, that in fiscal 2022, revenue will grow by 50%, up to 4 billion dollars. At the end of April, Zoom had 4.7 billion in cash and equivalents with a total debt of 0.1 billion.

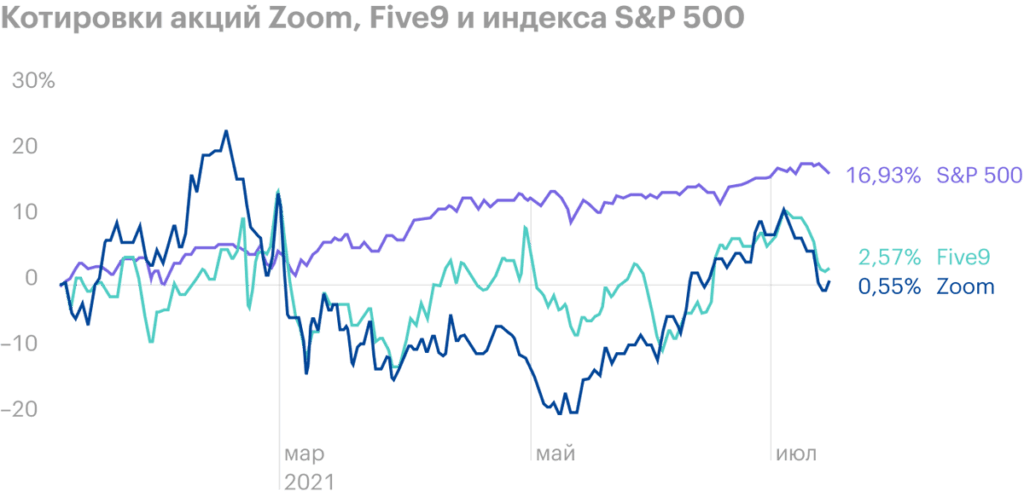

Zoom capitalization is $ 105 billion, or 32 annual revenues. In five years, the company's securities have grown by 484%, and from the beginning of the year - on 1%. Zoom shares are traded on 39% below the October high at 589 $.

Capitalization of Five9 — 12 billion dollars. The company is worth 25 annual proceeds and has no profit. Five9 shares are up by 1371%, and from the beginning of the year - on 3%. Securities are traded on 12% below the maximum.

Zoom Financials for Three Fiscal Years, million dollars

| 2019 | 2020 | 2021 | |

|---|---|---|---|

| Revenue | 331 | 663 | 2651 |

| Operating profit | 6 | 13 | 660 |

Revenue

2019

331

2020

663

2021

2651

Operating profit

2019

6

2020

13

2021

660

Five9 financial results for three financial years, million dollars

| 2018 | 2019 | 2020 | |

|---|---|---|---|

| Revenue | 258 | 328 | 435 |

| Operating profit | 7 | 3 | −12 |

Revenue

2018

258

2019

328

2020

435

Operating profit

2018

7

2019

3

2020

−12