"Russian aquaculture" (MCX: AQUA) — the largest player in Russia in the segment of commercial fish farming — aquaculture. The company breeds trout in the lakes of the Republic of Karelia and Atlantic salmon in the Barents Sea.

6 April "Russian Aquaculture" published the financial performance of the business for 2020 year. In them, the company reflected a decrease in revenue and profit year-on-year, as well as an increase in net debt by 51% behind 12 Months.

In spite of this, market quotes in April 2021 years were near historic highs. I suggest you figure it out, why the main financial indicators fell, but prices have risen.

Position in the industry

Aquaculture in Russia belongs to the agricultural sector. Thanks to this, the company, fish growers, have the following bonuses:

- State subsidies.

- Lending at a preferential rate.

- Freedom from taxation on profits from the sale of agricultural products.

Russian Aquaculture does not pay tax profit is a serious competitive advantage in comparison with foreign manufacturers.

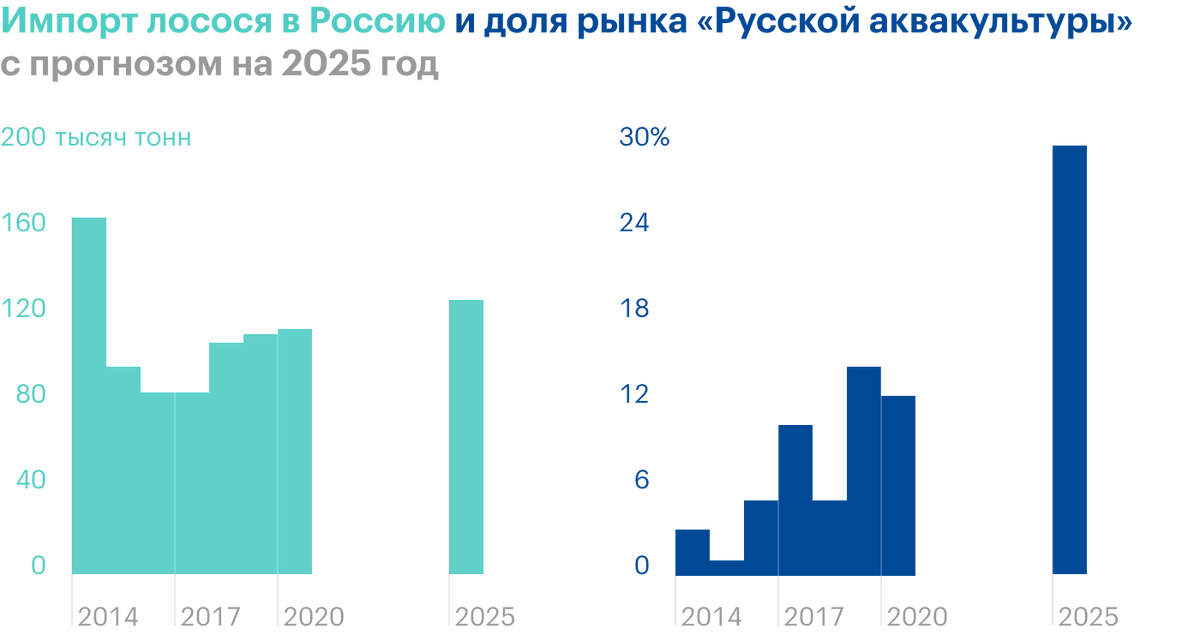

The main share of the Russian salmon market is occupied by imports from Norway, Chile and from the Faroe Islands. "Russian aquaculture" c 2020 took only 12%, but the management plans to increase the stake to 26% to 2025 year.

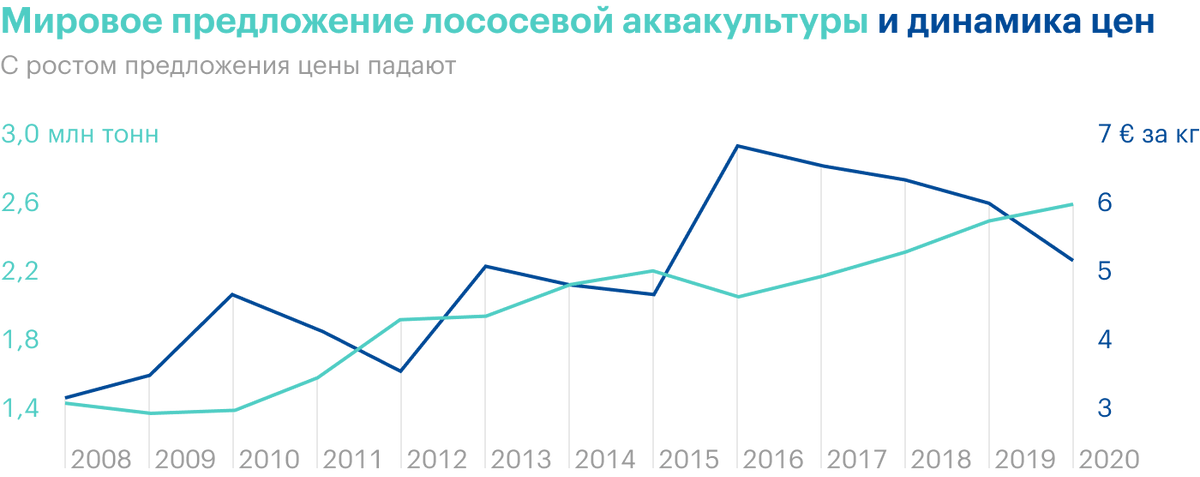

Global production and sales of salmon aquaculture are growing with 2016 of the year, and prices are going down, what speaks about oversupply in the market.

Based on the results of 2020 year, the cost of salmon fell to a five-year low amid the crisis and lower incomes of the population. The fact, that fresh salmon meat is a delicacy and expensive, therefore, its main consumers are people with incomes above average.

Last year, many restaurants suspended work due to restrictive measures amid the coronavirus pandemic., which also hit the demand for red fish.

Against this background, the sales volume of "Russian Aquaculture" fell by 9% year to year - before 15,5 thousands of tons. Part of the drop in sales was due to the cold spring and summer. Fish in ponds gained weight more slowly. As a result, the company moved part of the face to 2021 year, because of which the volume of fish in reservoirs at the end of last year reached a record.

According to the company on 31 December 2020 of the year, the volume of living biomass in water increased by 74% year to year - before 28,2 thousands of tons. This is a good start for growth in sales in 2021 year.

The strategy of "Russian Aquaculture" is aimed at increasing fish production by 2025 year before 35 thousand tons and strengthening of vertical business integration. Under this program in 2020 year the company acquired 2 fish breeding grounds and agreed to purchase a fish processing plant in Murmansk.

Operating indicators of "Russian Aquaculture", thousand tons

| Volume of sales | Biomass of fish in water | |

|---|---|---|

| 2016 | 5,3 | 10,6 |

| 2017 | 10,2 | 5,0 |

| 2018 | 6,5 | 17,2 |

| 2019 | 17 | 16,2 |

| 2020 | 15,5 | 28,2 |

Financial indicators

Revenue. Due to a decrease in sales volumes, the revenue of Russian Aquaculture fell by 5% year to year - before 8,3 billion rubles. 59% revenue comes from the sale of salmon, and almost 39,8% - trout. The company also sells small volumes of red caviar and other products., they account for 1,2% proceeds.

Cost of sales. Despite falling revenue, cost of sales increased by 3% year to year - before 5 billion rubles. This is due to an increase in the cost of materials and raw materials., which are used in the production of fish. All food and fry are imported to Russia from other countries, therefore, the devaluation of the ruble affects the cost of production.

According to the company's international reporting rules, who are aquaculture, obliged to revalue farmed fish at current market prices. As a result, the profit from the revaluation of biological assets decreased from 0,7 to 0,5 billion rubles year-on-year. This profit is for the future., as long as the fish is not sold in certain volumes at settlement prices.

Business expenses rose to 47% year on year due to increased transportation costs. At the same time, management costs were reduced by 2% by reducing the cost of travel and corporate events amid restrictive measures due to coronavirus.

The biggest risks for the company are biological. Disease and mass pestilence of fish in water bodies can bring down the operating and financial indicators of the company, as it already happened in 2015 year. Therefore, "Russian Aquaculture" insures biological risks, And, if part of the fish dies, the company is paid insurance. Based on the results of 2020 years, insurance indemnities in favor of "Russian Aquaculture" amounted to more than 0,2 billion rubles. Still almost 0,4 billion rubles of revenues the company received as a result of inventory of biological assets. Was, that there are more fish in the water, than originally intended.

As a result, the company's operating profit fell by 7% year to year - before 3,3 billion rubles.

"Russian aquaculture" on 3% reduced net finance costs, because it reduced interest payments on loans and borrowings. The company also made a profit from exchange rate differences in the amount of 51 million rubles - against a loss in 47 million rubles last year.

The company's net profit fell by 4% year to year - before 3,1 billion rubles.

Dynamics of the main financial indicators of "Russian Aquaculture", billion rubles

| Revenue | Operating profit | Net profit | |

|---|---|---|---|

| 2016 | 2,5 | 2,6 | 3,9 |

| 2017 | 5 | 0,5 | 0,4 |

| 2018 | 3,2 | 2,5 | 2,3 |

| 2019 | 8,8 | 3,6 | 3,3 |

| 2020 | 8,3 | 3,3 | 3,1 |

Debts

For 2020 year Russian Aquaculture has invested more than 1,8 billion rubles in its development. Amid the purchase of assets and a record amount of fish in the water, the holding's net debt for 12 months grew by 51% - to 6,1 billion rubles, what has become the maximum of recent years.

Against the backdrop of debt growth and a decrease in adjusted EBITDA, the level of debt burden by the “net debt” multiplier / Adjusted EBITDA "for the year increased from 1,2 to 1,8.

Debt indicators of "Russian Aquaculture", billion rubles

| net debt | net debt / adjusted EBITDA | |

|---|---|---|

| 2016 | 3,2 | 3,1x |

| 2017 | 0,7 | 0,4x |

| 2018 | 3,7 | 3,8x |

| 2019 | 4 | 1,2x |

| 2020 | 6,1 | 1,8x |

Dividends

IN 2020 year management for the first time in 10 years paid dividends to shareholders. Payouts based on the results 1 half 2020 years were 5 P per share.

The dividend policy of Russian Aquaculture states, that the company can pay dividends at least once a year if there is profit under RAS and if the net debt ratio / Adjusted EBITDA "is less than 3,5.

23 April, the board of directors of Russian Aquaculture recommended 2 half a year to pay 5 P per ordinary share - 1,7% per annum to the market price as of the news release date. Taking into account interim payments, the total amount of dividends for the past year may be 10 P per share.

What's the bottom line?

The past year was not easy for the domestic producer of red fish. Demand for seafood in Russia has declined amid the closure of restaurants and falling incomes of the population. Because of the cold water in the reservoirs of Russian Aquaculture, the fish did not gain weight fast enough, what impacted the performance of the business.

As a result: decrease in sales volumes, revenues and profits against the backdrop of rising costs due to the devaluation of the ruble. At the same time, the company continues its investment program and for the first time in 10 years paid dividends, because of what the net debt has grown.

On 2021 year perspectives of "Russian Aquaculture" are optimistic. The epidemiological situation is normalizing against the backdrop of mass vaccination, which means, the risks of repeated closure of catering establishments are also reduced. At the same time, the company has record biological reserves, which will contribute to the growth of sales volumes against the backdrop of economic recovery and the purchasing power of the population.