Teladoc (NYSE: TDOC) - American site, on which clients are provided with services in the field of telemedicine. The company shows a good level of improvement, but the limitations of the format do not allow this sector to be considered truly promising.. And this is not good news for the owners of the company's shares..

What happens here

Readers have been asking us for a long time to start sorting out the financial statements and business foundations of foreign issuers.. Offer in the comments of the company, analysis of which you would like to read.

Year thereafter

In the past year, we have already carefully analyzed the company's business. Let's take a look, what has changed since then. Telemedicine is not dead, despite the lifting of the quarantine: the company continued to increase the number of paid signers even after the large-scale quarantine was lifted.

Teladoc's revenue is growing at a good pace so far. But there was no income, and it doesn't. Worse than that: the company's loss per share is steadily worse than experts' expectations. In the end - albeit even later, than we thought, - the organization's securities fell to the mark 140 $, which we have designated as a valid entry point.

Monetary characteristics of the company, million dollars

| 1 neighborhood 2020 | 1 neighborhood 2021 | Percentage difference | |

|---|---|---|---|

| Subscription | 137 | 388 | 183% |

| Fee for infrequent visits | 44 | 54 | twenty four percent |

| US revenue | 151 | 416 | 175% |

| International revenue | 29 | 38 | twenty nine percent |

Number of site visits, thousands of people

| USA | Interstate | |

|---|---|---|

| 1 neighborhood 2020 | 1613 | 432 |

| 2 neighborhood 2020 | 2302 | 453 |

| 3 neighborhood 2020 | 2390 | 445 |

| 4 neighborhood 2020 | 2515 | 440 |

| 1 neighborhood 2021 | 2723 | 467 |

Company quarterly revenue and profit, million dollars

| Revenue | Unsullied income | Income margin | |

|---|---|---|---|

| 2 neighborhood 2020 | 241,03 | −25,68 | −10,66 % |

| 3 neighborhood 2020 | 288,81 | −35,88 | −12,42 % |

| 4 neighborhood 2020 | 383,32 | −393,97 | −102,78 % |

| 1 neighborhood 2021 | 453,68 | −199,65 | −44,01% |

Revenue 2 neighborhood 2020 241,03 3 neighborhood 2020 288,81 4 neighborhood 2020 383,32 1 neighborhood 2021 453,68 Unsullied income 2 neighborhood 2020 −25,68 3 neighborhood 2020 −35,88 4 neighborhood 2020 −393,97 1 neighborhood 2021 −199,65 Profit Margin 2 neighborhood 2020 −10,66% 3 neighborhood 2020 −12,42% 4 neighborhood 2020 −102,78% 1 neighborhood 2021 −44,01%

Earnings per share in dollars

| Current | Forecast | |

|---|---|---|

| 2 neighborhood 2020 | −0,34 | −0,24 |

| 3 neighborhood 2020 | −0,43 | −0,32 |

| 4 neighborhood 2020 | −3,07 | −0,26 |

| 1 neighborhood 2021 | −1,31 | −0,54 |

| 2 neighborhood 2021 | — | −0,51 |

What's next

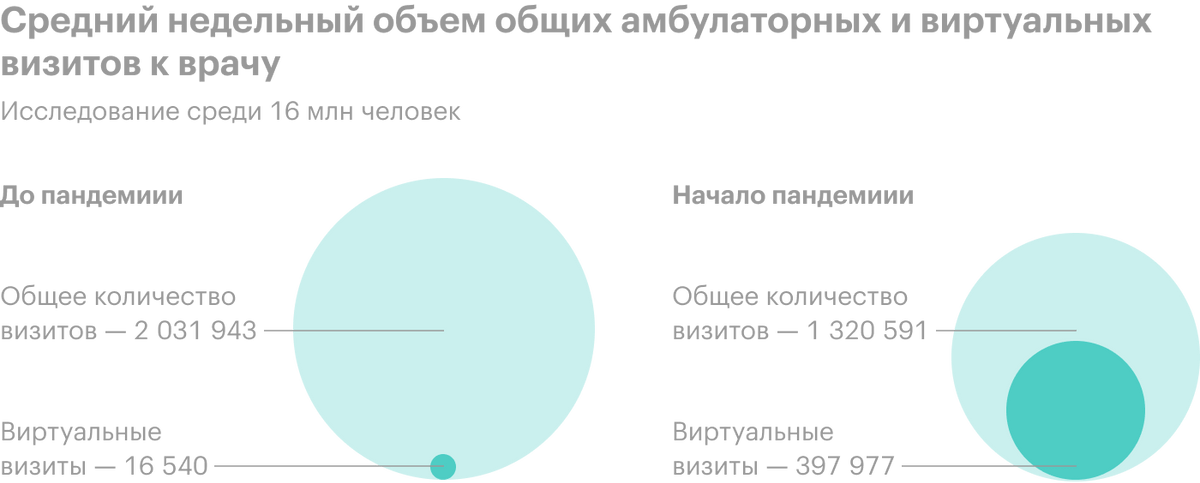

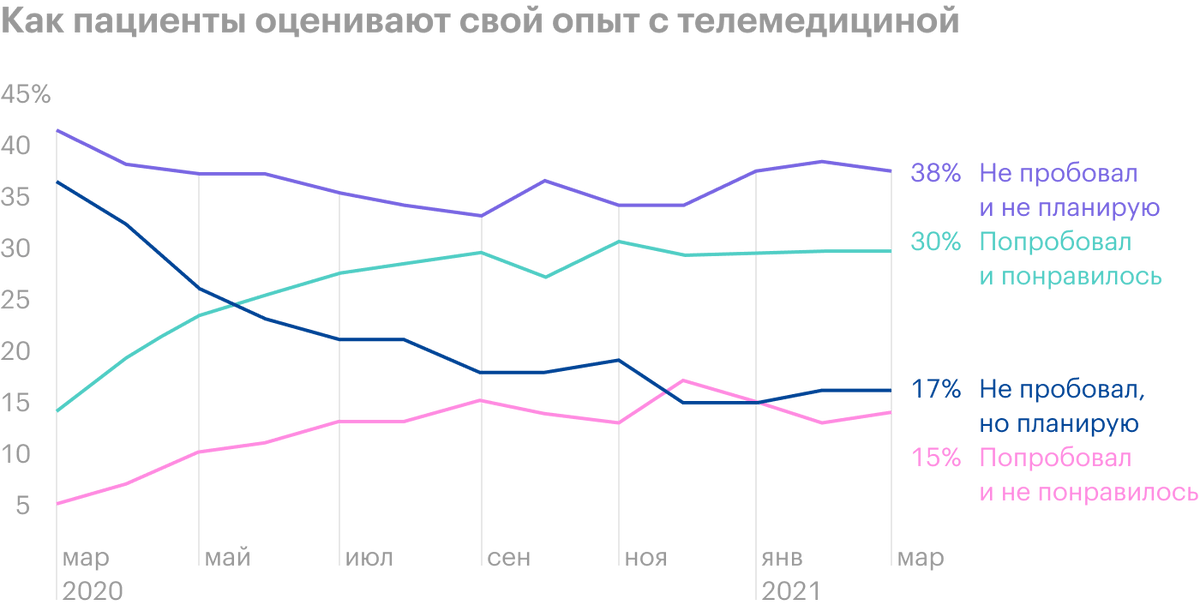

The closure of many hospitals and the inaccessibility of specialists during the pandemic led to a surge in the popularity of telemedicine. Many patients even still go to the doctors by telecom., despite the availability of physical visits.

But the further introduction of telemedicine met with resistance from both doctors, and patients. The first is not satisfied with the problem with payment: many insurance companies pay doctors much less for virtual visits, than for physical, - as well as technical difficulties. Many are not satisfied with the quality of service: many diseases are very difficult to diagnose remotely.

From the patient's point of view, telemedicine is still a niche solution, which is only suitable for a very limited range of situations.

You can say, that more than a year of telemedicine experiment showed mixed results: On the one side, telemedicine has taken a significant market share from conventional hospitals, On the other hand, there are acute problems, hindering the wider adoption of this method of work.

Large-scale population vaccination program could greatly reduce the attractiveness of online doctor visits, after all, visiting public places no longer looks like a foray into the front line for consumers. In this regard, the growth of Teladoc indicators may gradually slow down. And considering the unprofitability of this company, I would not wish anyone to become a long-term investor there.

However, the management of the company, aware of the problematic and limited format, will try to expand the business by buying competitors. It is hard to say, How will shareholders react to this?. On the one side, this will negatively affect the accounting of the company, on the other hand, investors may take this news positively as a sign of, that the company can increase margins and move closer to profitability.

Remote visits to doctors as a percentage of the total

| Psychiatry | 95% |

| Endocrinology | 89% |

| Infectious diseases | 78% |

| Pain complaints | 74% |

| Gastroenterology | 73% |

| First aid | 51% |

| Oncology | 50% |

| Cardiovascular diseases | 49% |

| Neurology | 46% |

| Dermatology | 28% |

| Gynecology | 28% |

| Surgery | 27% |

| Orthopedics | 14% |

| Ophthalmology | 2% |

Type of assistance, which doctors would prefer to provide after the pandemic virtually

| Chronic disease treatment | 73% |

| Medical Care | 64% |

| Help with patient care | 60% |

| Preventive assistance | 53% |

| Help after hospitalization | 48% |

| Special care | 45% |

| Psychological help | 41% |

| Emergency assistance | 40% |

| Other | 10% |

Barriers to Continued Use of Telemedicine Among Physicians

| Low or no monetary compensation | 73 % |

| Technical barriers from patients | 64 % |

| Various responsibilities | 33 % |

| Integration with electronic patient records | 30 % |

| Integration with existing technologies | 28 % |

| Specialized telemedicine processes | 26 % |

| Lack of technical support | 25 % |

| Dissatisfaction with technology | 23 % |

| The cost of implementing and maintaining technology | 21 % |

| Low patient engagement | 18 % |

| Licensing Issues | 18 % |

| Other | 6 % |

| I don't see any problem | 4 % |

How patient use of telemedicine will change after the pandemic

| Will use, when they see fit | 44% |

| Will enjoy, but not so often | 14% |

| Stop using | 17% |

| Not sure | 25% |

The main problems of telemedicine according to patients

| They don't see a problem | 14% |

| Technical problems | 10% |

| Medical problems | 43% |

| Administrative problems | 5% |

| Problems in communication | 18% |

| Other | 9% |

Resume

In our previous investment idea for Teladoc, we set a limit for the rebound of stocks in the area 180 $ - due to the promising aura of this field of activity, as well as other positive things, which collectively will allow stocks to bounce after such a strong drop.

It is still relevant, especially in view of the fall of shares by 50% in 2021, the possibility of buying a company by one of the major players in the field of medicine for the sake of integration into an existing business. But here's to invest in these stocks, based on the belief that, that "this is a promising sector", I wouldn't.

The telemedicine sector turned out to be not particularly promising over time. And the further, the more obvious the limitations of this area, which will hinder the further growth of the company. And given the, that Teladoc is unprofitable, it's a problem: because all unprofitable startups, working "in a promising field", can at least hope so, that sooner or later quantitative growth will turn into qualitative. But Teladoc's quantitative growth threatens to be interrupted in the near future, along with the disappointment of patients and doctors in the work of telemedicine.

The only thing, what can give a second wind to the company's business, is a repetition of the hard quarantine of the spring sample 2020. Not excluding the high probability of this scenario, still note, what if a company needs such cataclysms to stimulate business, it's a so-so company.